Author | Wu Blockchain

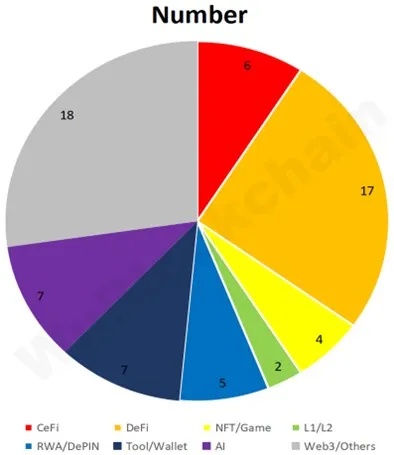

According to RootData statistics, there were 66 publicly disclosed venture capital projects in Crypto VC in June 2025, a 3.1% increase from May 2025 (64 projects), and a 37.1% decrease from June 2024 (105 projects). The number of small-scale financing continues to decline. Note: As not all financing is announced in the same month, the above statistical figures may increase in the future. The number of projects in each track is as follows:

Among them, CeFi accounts for about 9.1%, DeFi accounts for about 25.8%, NFT/GameFi accounts for about 6.1%, L1/L2 accounts for about 3%, RWA/DePIN accounts for about 7.6%, Tool/Wallet accounts for about 10.6%, and AI accounts for about 10.6%.

The total financing amount in June 2025 was $2.846 billion, a 27.9% decrease from May 2025 ($3.95 billion), and a 274% increase from June 2024 ($761 million). The top 10 financing rounds are as follows:

Circle sold 34 million shares at approximately $31 per share, raising about $1.1 billion for the company. Therefore, the company's market value may reach $6.9 billion, with a fully diluted valuation of $8.1 billion. At the end of the month, Circle also submitted an application to the Office of the Comptroller of the Currency (OCC) to establish a federal trust bank called "First National Digital Currency Bank, N.A."

Nasdaq-listed Nano Labs signed a convertible note subscription agreement with multiple investors, planning to issue convertible notes with a total principal amount of $500 million. Initially, they plan to purchase $1 billion worth of BNB and plan to hold 5% to 10% of BNB circulation in the long term. The initial conversion price is set at $20 per share, and during the note's term, holders can choose to convert the notes into the company's Class A common stock.

Bitcoin mining company BitMine Immersion Technologies signed a private placement agreement to buy and sell 55,555,556 common shares at $4.50 per share. The company stated in the announcement that the total financing for this transaction is approximately $250 million (excluding fees), to be used to launch its Ethereum vault. The round was led by MOZAYYX, with participation from Founders Fund, Pantera, FalconX, Republic Digital, Kraken, Galaxy Digital, DCG, Diametric Capital, Occam Crest Management, and Thomas Lee. The transaction is expected to be completed on Thursday, subject to conditions such as NYSE American's approval of the supplemental listing application.

Prediction market platform Kalshi raised $185 million in a funding round, valuing the company at $2 billion. The round was led by Paradigm, a crypto-focused investor, with participation from Sequoia, Multicoin, Neo, Bond Capital, and other investment firms. Kalshi's latest financing comes as its main competitor Polymarket is reportedly completing a $200 million round at a $1 billion valuation. A key difference between the two is that Kalshi is federally regulated and approved to operate in the US, while Polymarket is not.

Canton network developer Digital Asset announced the completion of a $135 million strategic financing round, led by DRW Venture Capital and Tradeweb Markets, with participation from BNP Paribas, Circle Ventures, Citadel Securities, DTCC, and others. Canton is a privacy blockchain for institutions, supporting configurable privacy and real-world asset (RWA) on-chain applications. The new round of financing will be used to expand asset types and network ecosystem.

The crypto asset company World Liberty Financial, supported by former US President Trump and his family, reported that Aqua1 Foundation, a UAE-based company, purchased $100 million worth of platform governance Token WLFI. Aqua1 stated that the transaction focuses on RWA and StableCoin. This acquisition makes Aqua1 a larger WLFI holder than Justin Sun, who invested $30 million in the project in November.

Eigen Labs announced the launch of EigenCloud platform, aimed at providing blockchain-level trust assurance for Web2 and Web3 applications. The platform is based on EigenLayer's re-staking protocol, integrating data availability, general computing, and dispute resolution functions. Additionally, a16z crypto purchased EIGEN for $70 million, continuing its investment layout after the $100 million Series B financing in February 2024.

Crypto startup Zama announced the completion of a $57 million Series B financing round, led by Blockchange Ventures and Pantera Capital, with a total financing of over $150 million and a valuation exceeding $1 billion, becoming the first unicorn focused on Fully Homomorphic Encryption (FHE). Zama is advancing the technology's application in blockchain and AI scenarios, with its protocol supporting developers in building encrypted dApps without deep cryptography background.

Web3 security company Hypernative completed a $40 million Series B financing round, led by Ten Eleven Ventures and Ballistic Ventures, with participation from StepStone Group, Boldstart Ventures, and IBI Tech Fund. Previously, Hypernative completed a $16 million Series A financing in September 2024.

a16z announced leading the $33 million seed round for AI model evaluation platform Yupp. Yupp aims to enhance transparency and participation in AI model training and evaluation through on-chain incentive mechanisms. Users can compare and vote on multiple model outputs, generate signed preference data for model optimization, and receive rewards. Team members come from institutions like Twitter, Google, and Coinbase.