Written by: KarenZ, Foresight News

This article was first published on July 1st

Updated on July 4th: YZi Labs announced investment in Digital Asset.

On June 24th, Digital Asset, the developer of the privacy-focused blockchain Canton, completed a $135 million Series E funding round, led by DRW Venture Capital and Tradeweb Markets. The investment lineup includes heavyweight players from traditional finance and crypto, including BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Virtu Financial, Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain Capital, QCP, Republic Digital, 7RIDGE, and Virtu Financial.

Digital Asset stated that this funding round will accelerate the deployment of institutions and DeFi on Canton Network and integration with RWA, further consolidating its broad deployment across diverse asset classes such as bonds, money market funds, alternative funds, commodities, repos, mortgages, life insurance, and annuities.

Notably, Digital Asset has been established for 11 years and has raised a total of over $400 million. So, what exactly are Digital Asset and Canton Network? What are the characteristics of their core technology? Why have they attracted the attention and adoption of many traditional financial institutions? What is the background of the core team? Additionally, what is Canton's current momentum, and where is it heading?

Company Positioning and Development

Founded in 2014 and headquartered in New York, Digital Asset is committed to unlocking the potential of cryptocurrency and the continuous integration of DeFi with traditional finance. Its core products include Canton Network and the DAML smart contract language, which together form an institutional-level blockchain infrastructure. Digital Asset's total funding has exceeded $400 million.

Canton Network is an open-source privacy Layer1 blockchain designed specifically for financial institutions and enterprise applications. Canton achieves cross-application interoperability through the DAML language and Canton protocol, supporting multi-subnet atomic transactions, while providing privacy protection, independent scalability, and compliance.

[Rest of the text remains the same]

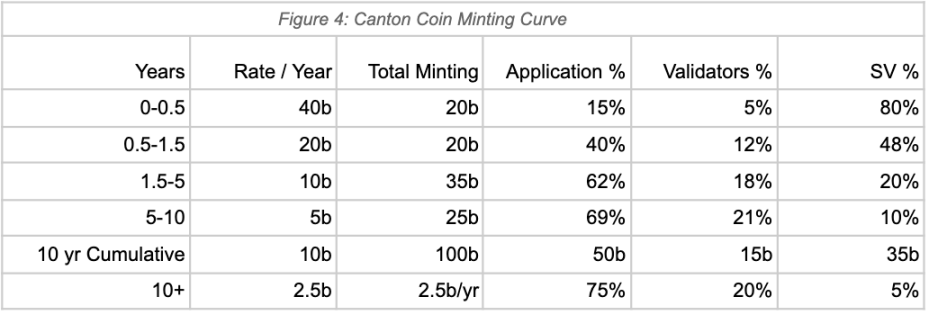

It is worth emphasizing that validators and super validators (composed of a validator and a Canton synchronizer node, participating in global synchronization) obtain Canton Coin minting rights by running nodes and maintaining network security. Early super validators receive a higher proportion of token allocation to encourage network launch. Additionally, application providers can earn Canton Coin by providing services to users. "Featured Apps" (requiring super validator voting) can enjoy up to 100 times the minting rewards compared to burning volume (early ecosystem incentive), while non-featured apps can mint at most 80% of fees into Canton Coin.

Canton Coin has a fair launch, with no pre-mining or pre-sale. In the first 10 years of Global Synchronizer operation, the total minting of Canton Coin is 100 billion, with an allocation ratio of 50% for infrastructure providers and 50% for application providers. After ten years, the annual minting will drop to 2.5 billion, gradually tilting towards application providers. Its economic model dynamically adjusts the supply to ensure long-term token value stability.

Source:Canton Coin Whitepaper

From Pilot to Handling $4 Trillion RWA

Canton is suitable for scenarios requiring high privacy and high concurrency, such as finance, and has successfully supported on-chain and trading of multiple asset classes. For example: bonds, money market funds, repurchase agreements, etc.

The participants announced when Canton was disclosed in May 2023 include 3Homes, ASX, BNP Paribas, Broadridge, Capgemini, Cboe Global Markets, Cumberland, Deloitte, Deutsche Börse Group, Digital Asset, DRW, Eleox, EquiLend, FinClear, Gambyl, Goldman Sachs, IntellectEU, Liberty City Ventures, Microsoft, Moody's, Paxos, Right Pedal LendOS, S&P Global, SBI Digital Asset Holdings, The Digital Dollar Project, Umbrage, Versana, VERT Capital, Xpansiv, and Zinnia.

In March 2024, Canton completed a comprehensive blockchain pilot. This pilot project provided participants with distributed ledger applications for asset tokenization, fund registration, digital cash, repurchase, securities lending, and margin management transactions, all of which can be interoperable through the Canton Network testnet. This pilot brought together 15 asset management companies, 13 banks, 4 custodians, 3 exchanges, and 1 financial market infrastructure provider. BNY Mellon, Broadridge, DRW, EquiLend, Goldman Sachs, Oliver Wyman, and Paxos provided market expertise for the working group throughout the project. Other pilot participants include: abrdn, Baymarkets, BNP Paribas, BOK Financial, Cboe Global Markets, Commerzbank, DTCC, Fiùtur, Generali Investments, Harvest Fund Management, IEX, Nomura, Northern Trust, Pirum, Standard Chartered Bank, State Street, Visa, and Wellington Management, with Deloitte as an observer and Microsoft as a support partner.

According to Digital Asset, since the Canton Network mainnet went live, the ecosystem participants have exceeded 400+, with tokenized RWA scale surpassing $4 trillion and monthly transaction volume reaching $2 trillion.

According to the latest report from RedStone, over half of digital bond issuances since 2022 have been executed through Canton applications. HSBC Orion, Goldman Sachs Digital Asset Platform (GS DAP), BNP Paribas Neobonds, and Broadridge's DLR have all developed using Canton technology. In January this year, Circle stated when acquiring Hashnote, the USYC issuer incubated by Cumberland Labs, that it also plans to provide native USDC support on the Canton Network, enabling private transactions and USDC and USYC usage in TradFi markets.

Summary

Canton Network fills the gaps in existing public chains, combining smart contract functionality with privacy features, providing a viable solution for traditional asset on-chain. Canton enables financial institutions to achieve asset on-chain while retaining control through "selective decentralization" design. This architecture makes it an ideal springboard for traditional financial institutions' digital transformation. For financial institutions seeking digital transformation but limited by existing system rigidity, Canton offers a progressive on-chain path and is poised to become a hub connecting traditional finance and decentralized finance.