DeFi Development has just increased its total holdings to more than 2 million SOL, worth about $406 million, affirming its position as one of the ecosystem's largest "public whales".

DeFi Development Raises Treasury to Over 2 Million SOL. Photo: Invezz

DeFi Development Raises Treasury to Over 2 Million SOL. Photo: Invezz

DeFi Development Corp. (DFDV) - formerly Janover - continues to strengthen its Solana treasury. According to an announcement on September 4, the company has just purchased an additional 196,141 SOL at an Medium price of $202.76 per coin, bringing the total amount to 2,027,817 SOL , worth approximately $406 million at current prices.

1/ Achievement Unlocked: 2 Million $ SOL ✅

— DeFi Dev Corp. (DFDV) (@defidevcorp) September 4, 2025

Today, we announce the acquisition of 196,141 SOL at an avg. price of $202.76, bringing total Treasury holdings to 2,027,817 SOL.

This latest purchase marks an +11% increase from our prior acquisition announced on August 28, 2025. 🧵 pic.twitter.com/31YUMpvZOw

This reserve is not only held long-term, but also Staking across multiple validators , including validators operated by the company itself, to generate additional profits from the Solana system through Staking rewards and fees from the delegated Staking .

Core Valuation Metrics

As of the time of writing, DeFi Development has 25,573,702 shares outstanding, each of which indirectly represents 0.0793 SOL, or approximately $16.70 per share. This is a key metric - “SOL per Share” (SPS) - used by investors to value the company’s SOL reserve, directly reflecting the stock’s exposure to the Solana asset.

The figure does not include warrants from the recent Capital offering. If warrants are included, the total number of shares adjusted would be around 31.4 million, reducing SPS. However, the company stressed that SPS will not fall below 0.0675 SOL/share, the pre- Capital offering threshold, thanks to plans to use the remaining cash to buy more SOL.

At the end of August, DeFi Development completed a $125 million share and warrant issuance at $12.50 per share and warrant, including cash and locked SOL . This is seen as a move to increase the net asset value (NAV) per share and strengthen the SPS, as the amount of SOL purchased is at a discount to the market.

“Treasury Accelerator”

Not stopping in the US, DeFi Development has just expanded its operations to the UK through the acquisition of 45% of Cykel AI (listed on LSE), rebranding as DFDV UK, the first international bridge in the Treasury Accelerator strategy. The company also revealed that it has 5 other Treasury funds, emphasizing its ambition to become a global Solana treasury consortium.

To strengthen its image in the eyes of institutional investors, DeFi Development will host the SOLID: Solana Investor Day event in New York on November 5, 2025.

The program is expected to include:

Analysis of Solana 's competitive advantages and long-term vision (price target up to $10,000/ SOL);

Discuss directly with Solana Foundation and top builders;

Transparent presentation of SPS compound strategy;

Community exchange.

In addition to taking care of the Solana treasury, DeFi Development's core business remains an AI-powered online platform that provides data and subscription software to the commercial real estate industry.

At press time, Solana price was down 2.6% to $202.90 after the historic “Alpenglow” upgrade . Meanwhile, DFDV shares plunged 7.6% to $15.21 in the latest trading session. The move reflects skepticism from the market, especially as The Information reported that Nasdaq is tightening its oversight of companies that raise Capital solely to buy crypto — a notable risk for the crypto treasury ( DAT ) model that DeFi Development is pursuing.

The Big Picture

Currently, a series of listed companies have started building Solana treasuries, most notablyUpexi and DeFi Development with holdings of approximately 2 million SOL each. In addition, names such as SOL Strategies , Classover , Torrent Capital or SOL Global also participate on a smaller scale, contributing to legitimizing this trend.

Notably, Bit Mining , Sharps Technology , the three giants Galaxy - Jump - Multicoin and Pantera Capital are also raising billions of dollars to accumulate SOL.

The crypto Capital picture is reminiscent of the time when MicroStrategy pioneered Bitcoin, opening a new asset class for businesses but at the same time tying stock value to crypto market fluctuations. However, the crypto treasury model, although seen as a “boom”, can also be a “time bomb” , due to the high risks related to group interests, conflicts of interest, and the ability to turn shareholder money into leverage to price private Token of the board of directors.

Evidence

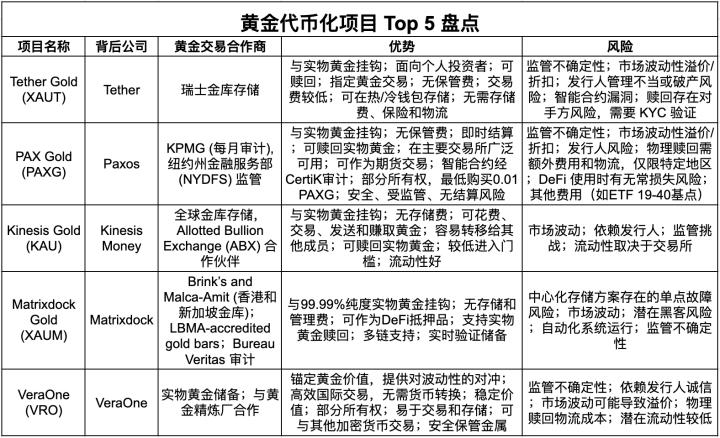

SOL price movement over the past month, CoinGecko screenshot as of 10:30 AM on 05/09/2025

SOL price movement over the past month, CoinGecko screenshot as of 10:30 AM on 05/09/2025

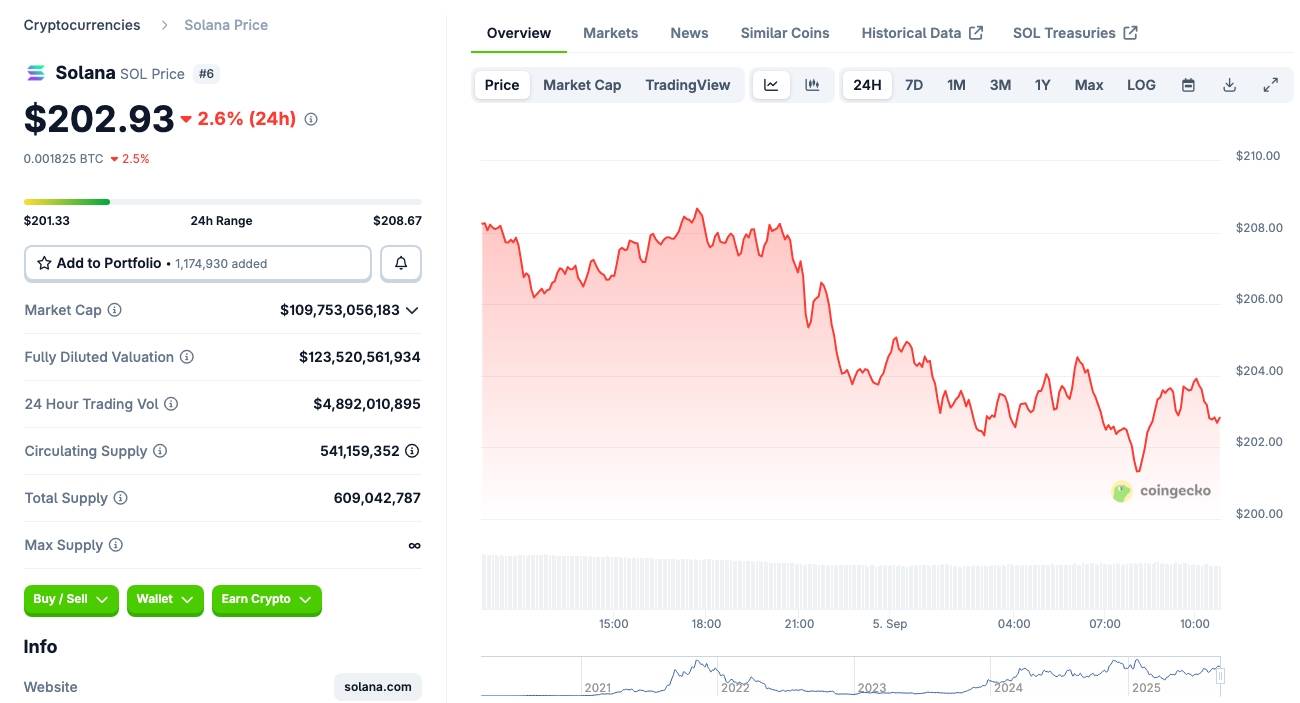

DDC stock price movements in the latest trading session, image captured by Google Finance at 10:30 AM on September 5, 2025

DDC stock price movements in the latest trading session, image captured by Google Finance at 10:30 AM on September 5, 2025

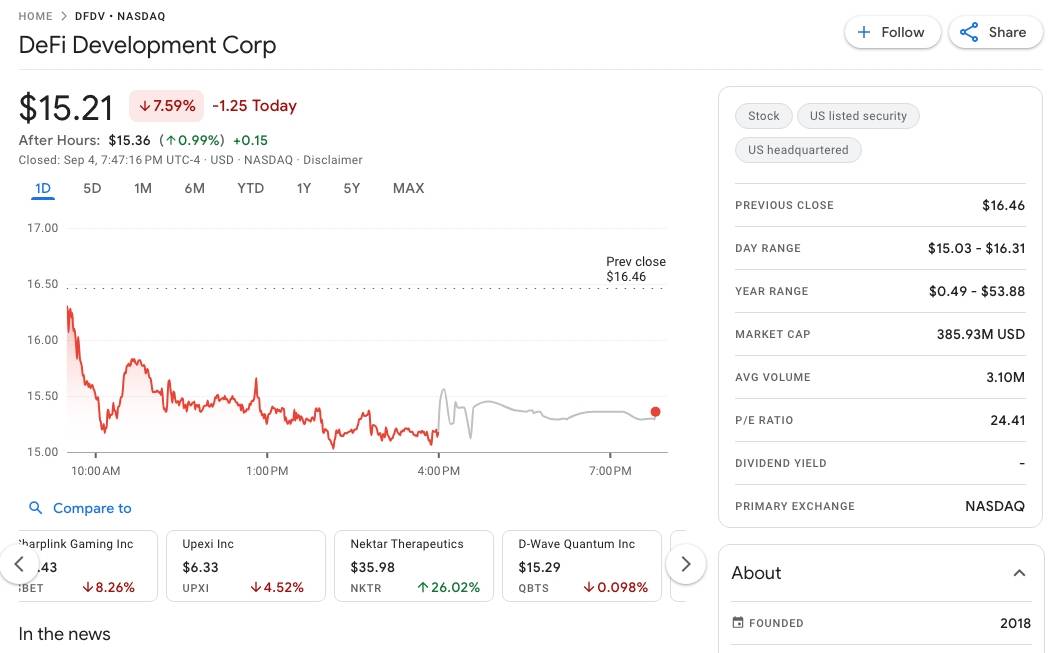

Statistics of the largest Solana treasuries today. Source: CoinGecko (09/05/2025)

Statistics of the largest Solana treasuries today. Source: CoinGecko (09/05/2025)

Coin68 synthesis