Tonight, global financial markets will be focused on a single piece of economic data that could determine their fate for the coming months: the US Non-Farm Payrolls (NFP) report. At a delicate juncture, with Bitcoin prices teetering on the brink of collapse and the broader historical cycle tipping towards a peak, this report hangs like a sword of Damocles over the market. The outcome of this report could be the straw that breaks the camel's back, or the spark that ignites a new uptrend.

The market is permeated by complex, even distorted, expectations. In normal economic logic, strong employment data signifies economic prosperity. However, in the current context dominated by central bank liquidity, this logic is reversed: a weak report, suggesting the risk of recession, is instead interpreted by the market as a clear signal that the Federal Reserve must accelerate interest rate cuts. "Bad news is good news"—this investment proverb has become a common prayer for investors in risky assets.

For Bitcoin, the significance of this macroeconomic drama, which will unfold at 8:30 PM Beijing time, is self-evident. It not only impacts short-term capital flows but also serves as a litmus test for a range of bearish theories. As veteran trader and Spectra Markets President Brent Donnelly has warned, the market may be heading for a longer-term correction. He has even placed buy orders at the distant $94,000 and $82,000 levels to hedge against a potential "panic sell-off."

The clock of cycles: the hands of history are pointing to the danger zone

To understand the caution of market veterans like Donnelly, we must shift our focus beyond tonight's short-term fluctuations and take a panoramic view of Bitcoin's macro-cycle. A time-tested pattern in the crypto world is the "halving cycle." Bitcoin production is halved approximately every four years. This supply-side deflationary event has historically triggered a spectacular bull market.

However, the feast must eventually come to an end. Historical data shows that the time span from the halving to the absolute peak of the bull market appears to be lengthening. An in-depth analysis report from Bitcoinsuisse reveals this trend:

- After the 2012 halving: The bull market peaked about 12 months later.

- After the 2016 halving: this process extended to approximately 17.5 months .

- After the 2020 halving: the market took about 18.2 months to reach its peak.

The most recent halving occurred in April 2024. By this calculation, we are now in the 17th month. This means that, regardless of historical cycle, Bitcoin has already entered the traditional "top zone." This isn't metaphysics, but rather sober observation based on historical patterns. Donnelly's core logic—that the craze for digital assets as a corporate treasury asset is waning, coupled with the fact that the seasonality of Bitcoin's halving cycle is turning bearish—is based on a deep understanding of this macroeconomic clock. Cyclical patterns remind us that while everyone is immersed in the frenzy, risks are quietly accumulating.

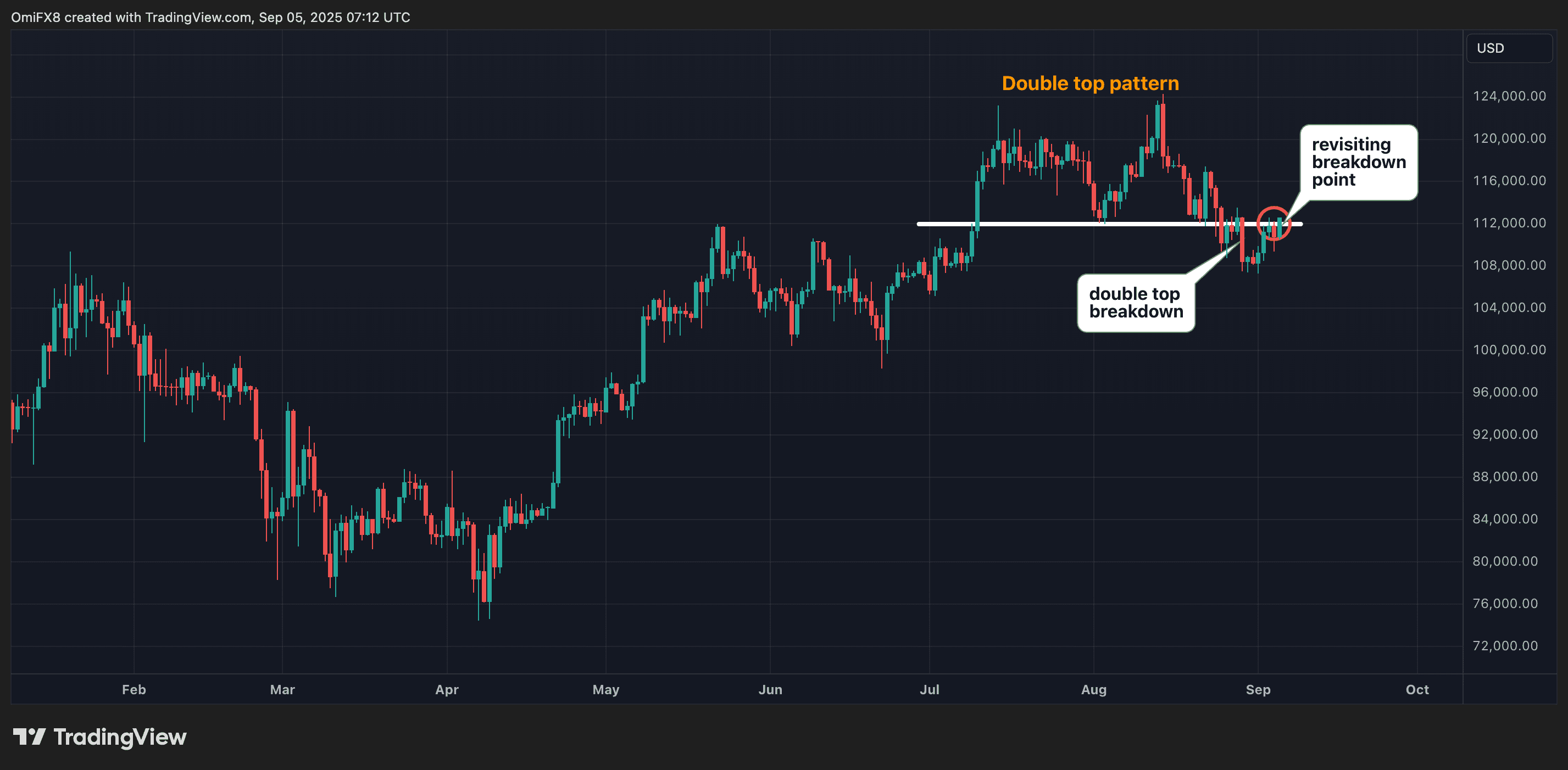

The Voice of the Chart: An Ominous "Double Top" Picture

If the macro cycle is the thunder in the distance, then the technical chart is the dark cloud in front of us. The current price trend of Bitcoin is painting a picture that makes many technical analysts uneasy: a textbook "Double Top" pattern.

This can be generally understood as a "failed peak." After the initial surge and retreat, bullish forces regrouped in an attempt to break through the previous high, but ultimately failed, resulting in a second peak of similar height. This is often seen as a sign of fading upward momentum and a shift in market sentiment from bullish to bearish.

The key to this pattern lies in its "neckline" support level. Currently, the market generally recognizes the neckline as being around $112,000 . This price level acts like a dam; if effectively broken, it could trigger a chain reaction of stop-loss orders, technically confirming the reversal pattern and ushering in a deeper decline. This aligns perfectly with the observation of a break below the key support level of $111,982 mentioned in the source material. Once broken, this level will transform from a former support level into a formidable resistance level.

The chart doesn't lie; it faithfully records the outcome of the market's bull-bear game. Currently, prices are hovering just above this life-or-death line, and tonight's non-farm payroll data may very well be the final external force that determines whether the dam holds or collapses.

Three scenarios: How non-farm payroll data could determine Bitcoin's fate

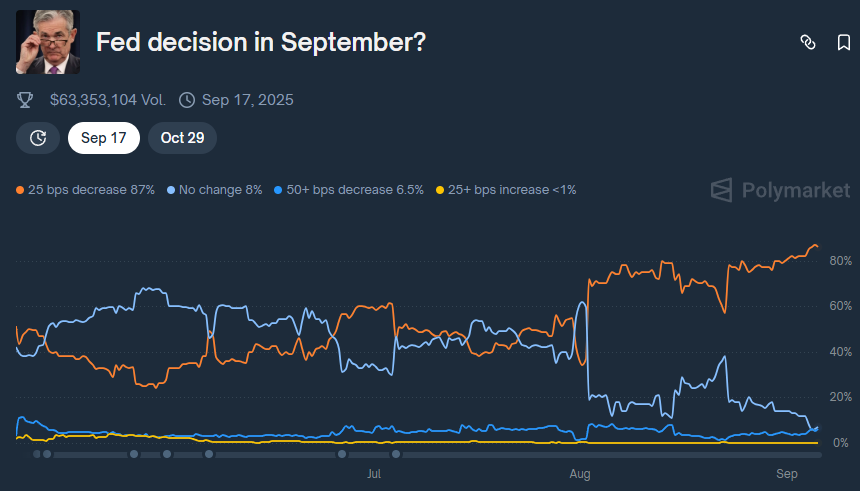

Before assessing the potential impact of different data outcomes, we must first understand the market's current "bottom line": expectations that the Federal Reserve will begin a cycle of rate cuts have reached an unprecedented level of certainty. On the eve of the data release, CME's "FedWatch" tool showed that traders believed the probability of a 25 basis point rate cut in September was as high as 99.3% , making it virtually certain. Although the prediction market, Polymarket, put this probability slightly more conservative at 87% , the overall market trend is undoubtedly dovish.

More profoundly, derivatives contracts used to bet on the Fed's policy moves have already mapped a clear long-term trajectory: by the end of next year, the market expects the Fed to have cut interest rates five times (by 25 basis points each time), guiding the federal funds rate from the current range of 4.25%-4.5% to around 3%. This means that tonight's non-farm payroll data will not only be a test of the September meeting, but also the first key verification of this grand easing expectation.

It is in this context of extremely certain expectations that any performance that deviates from the script will be magnified doubly by the market.

The ultimate variable: When economic data encounters political games

However, it would be too simplistic to think that the market will operate like a sophisticated machine, according to the above script. This year, an unprecedented variable has been thrown into this complex game - open political pressure.

US President Trump's recent attempt to remove Federal Reserve Board Governor Lisa Cook has escalated into a fierce conflict over central bank independence, placing Fed Chairman Jerome Powell in an extremely delicate position. Felipe Villarroe, a partner at TwentyFour Asset Management, pointedly noted that this data "will not only impact short-term interest rates but will also shape market perceptions of whether Fed officials' decisions are politically biased."

This presents a difficult question for Powell and his colleagues: If tonight's data is truly dismal (e.g., scenario three), should the Fed decisively send a strongly dovish signal to fulfill its mandate to stabilize the economy, or will it hold back to avoid appearing to be succumbing to White House pressure? Conversely, if the data is strong, will they openly acknowledge the economy's resilience, or will they seize the opportunity to highlight potential risks, preserving room for future rate cuts in a more politically correct manner?

This game of central bank independence casts a thick fog over pure economic data analysis, meaning that the market's ultimate reaction may no longer be linear, and investor confidence will be tested by both data and politics.

summary

Tonight, Bitcoin stands at a historic crossroads. The macro cycle clock is ticking, technical chart alarms are looming, and a jobs report released far away in Washington is about to become the catalyst for all of this.

Market participants, from institutional traders like Brent Donnelly on high alert to countless retail investors, are holding their breath. Will tonight's data serve as the needle that punctures the bubble, confirming predictions of a cyclical peak and sending Bitcoin plummeting towards deeper correction targets? Or will it unexpectedly provide a shot in the arm, adding the final flourish to this 17-month extravaganza?

The answer will be revealed in a few hours. But no matter what the result is, tonight is destined to be a page in the history of the crypto market.