Mega Matrix files with SEC to deploy $2 billion stablecoin Governance Token (DAT) treasury strategy, with the goal of pooling ENA and expanding the ecosystem.

Mega Matrix raises $2 billion for stablecoin treasury strategy, prioritizes ENA

Mega Matrix raises $2 billion for stablecoin treasury strategy, prioritizes ENA

On September 4, 2025, Mega Matrix announced that it had filed a registration document for a $2 billion securities offering (Form F-3) with the US Securities and Exchange Commission ( SEC ).

The funds will be used to deploy the DAT stablecoin Governance Token treasury strategy , with a focus on pooling Ethena (ENA) and other stablecoin Governance Token .

Mega Matrix Inc. (NYSE: MPU) filed a $2 billion universal shelf registration statement (Form F-3) to support its stablecoin governance Token DAT strategy, aimed at accumulating tokens such as Ethena's ENA. https://t.co/IJTPBfAFXE

— Wu Blockchain (@WuBlockchain) September 4, 2025

Why this news is important

Mega Matrix joins the Digital Asset Treasury (DAT ) race, following many other major players.

This is a plan to create a multi-billion dollar DAT fund, allowing Mega Matrix to become one of the first publicly listed companies on Nasdaq to implement this model.

Ethena ’s ENA Token is targeted as the core asset, indicating growing interest in the stablecoin project.

Once approved by the SEC, Mega Matrix can issue various types of securities (stocks, bonds, options, warrants, etc.) to flexibly raise Capital .

Related context

In July 2025 , Ethena announced that StablecoinX Inc. will establish a $360 million fund to invest in ENA . Of which, $100 million comes from the Ethena Foundation, the rest is raised from large funds such as Dragonfly, Pantera, Animoca Brands, Galaxy Digital, Wintermute...

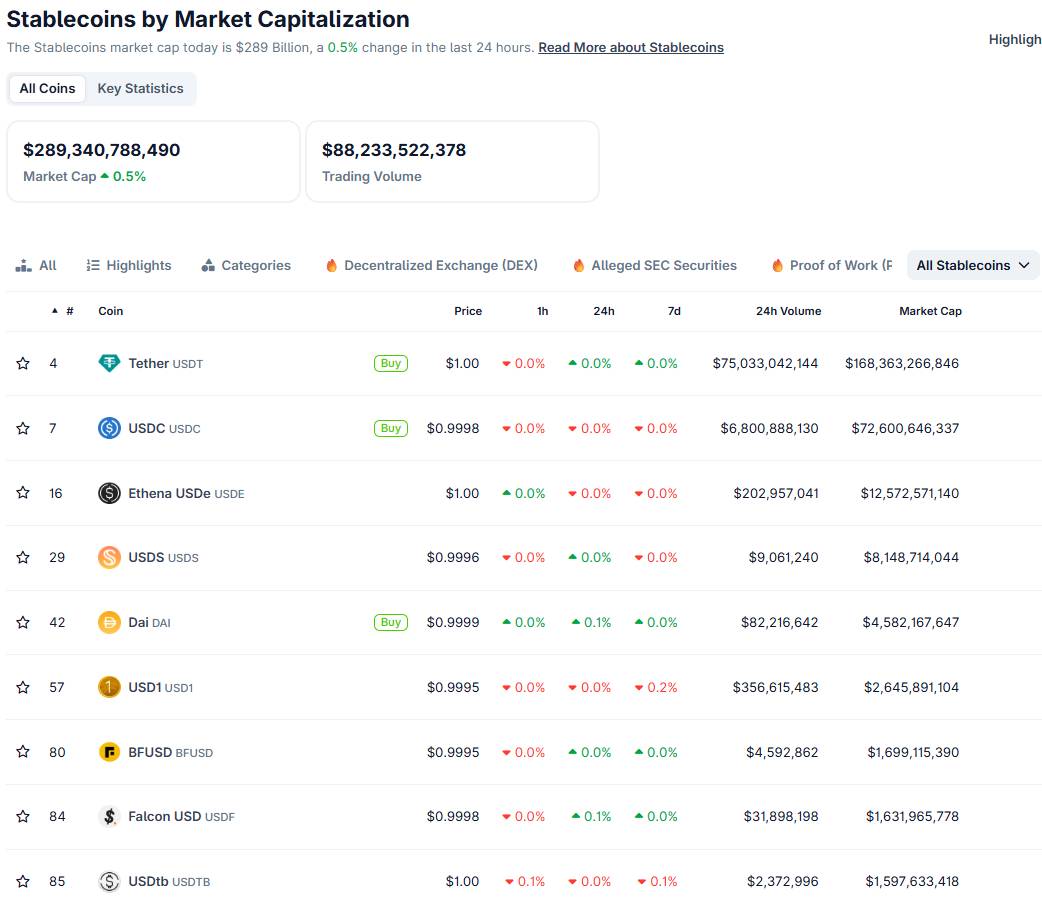

Ethena has also partnered with Anchorage Digital to issue the USDtb stablecoin in the US, in compliance with the new stablecoin regulatory framework GENIUS Act .

USDtb is backed byBlackRock's BUILD fund , which currently has a circulating supply of $1.59 billion after more than half a year of operation. This is an important step to bring the new generation stablecoin closer to legal status in the US market.

Expert opinion

Mega Matrix's board of directors commented:

Stablecoin Governance Token are the “stakes” of stablecoin ecosystems.

Accumulating Token like ENA will give companies both financial benefits and a say in shaping the future of digital currencies.

“The combination of large-scale social platforms and blockchain is the biggest market opportunity since Bitcoin,” said Enzo Villani, founder of Alpha Transform Holdings. “We are at the cusp of an inevitable transition in global finance.”

Conclude

Mega Matrix is positioning itself to become the first publicly listed stablecoin treasury business with a billion-dollar scale.

This move could give a fresh boost to ENA and the entire Decentralized Stablecoin space.

Along with the GENIUS legal framework in the US, this is XEM an important turning point in the process of legalizing stablecoins.

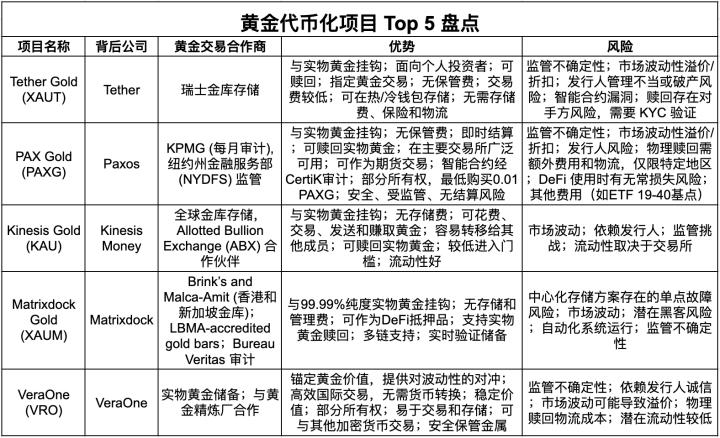

ENA Token price did not fluctuate much after the news, on the contrary, it recorded a decrease of 3.6% in the past 24 hours.

Ethena's ENA Token price movement captured at 08:40 PM on 04/09/2025 on CoinGecko

Ethena's ENA Token price movement captured at 08:40 PM on 04/09/2025 on CoinGecko

TVL statistics of USDtb products issued by Ethena. Source: defillama (04/09/2025)

TVL statistics of USDtb products issued by Ethena. Source: defillama (04/09/2025)

List of stablecoins ranked by market Capital as of September 4, 2025. Source: CoinGecko

List of stablecoins ranked by market Capital as of September 4, 2025. Source: CoinGecko

Coin68 synthesis