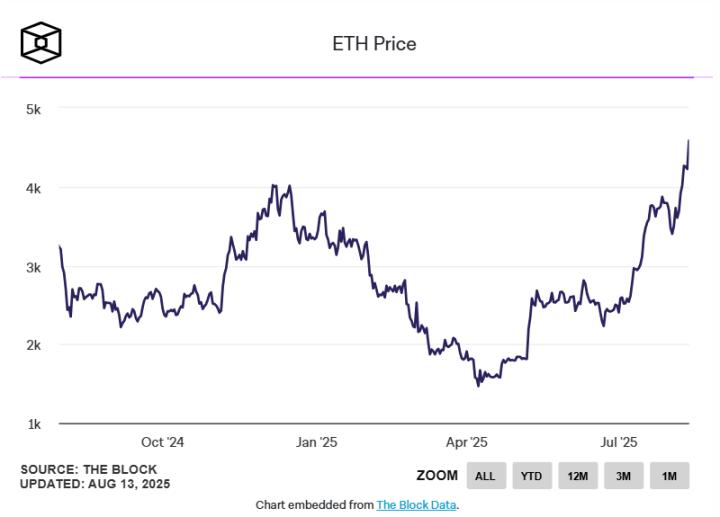

Standard Chartered Bank has raised its year-end target price for ETH from $4,000 to $7,500, citing improved industry environment and new demand from corporate treasuries. According to Reuters, the bank has also raised its 2028 forecast from $7,500 to $25,000. On Wednesday, ETH was trading at around $4,679, a level last seen in November 2021.

This adjustment is in stark contrast to the situation in March, when Standard Chartered Bank lowered its 2025 forecast from $10,000 to $4,000. At the time, the bank attributed the price reduction to structural pressures, including revenue diversion to Layer 2 networks like Coinbase's Base (estimated to potentially reduce ETH market cap by around $50 billion), and slowing on-chain economic activity.

Recent developments seem to have changed this assessment. Since June, corporate treasuries have accumulated significant ETH supply, with the bank expecting this proportion to potentially reach 10%. The bank noted that the rise of corporate treasuries holding ETH and increased industry participation are catalysts for the target price increase. This trend is similar to Bitcoin's early adoption pattern, where corporate balance sheet allocations influenced market perception and liquidity.

The current price environment reflects ETH regaining momentum after being long below previous historical highs. Returning to late 2021 levels, widespread institutional activity in staking, DeFi participation, and infrastructure development may enhance demand stability.

Although Standard Chartered Bank's adjusted target is forward-looking and subject to market volatility, the narrative suggests long-term holders and treasury managers may play a more core role in price support.

ETH's market position continues to be shaped by its dual role: both as a settlement layer and foundation for the Layer 2 ecosystem. Previous concerns about capacity expansion solutions causing fee leakage have not dissipated, but the bank's latest forecast suggests new demand sources might offset some pressure.

Corporate positions may lock up a larger supply proportion, intertwined with staking yields and ETH's attractiveness as an interest-bearing asset, adding a dimension to investment logic beyond speculative trading.

Standard Chartered Bank's latest forecast adjustment captures the evolving interaction between ETH's technological landscape and its macro adoption trends. Based on assumptions of continued corporate engagement and ecosystem activity, raising the 2025 target from $4,000 to $7,500 and the 2028 target from $7,500 to $25,000 places ETH in a higher valuation range.

Whether these trends can be sustained will depend on regulatory clarity, competitive pressures from other smart contract platforms, ETH's development roadmap, and future protocol upgrades. For now, the bank's forecast reflects a renewed confidence in the asset's medium to long-term trajectory.