Quick Overview

- Multiple forces are driving ETH to its all-time high, including record spot ETF inflows, new US policy initiatives, and growing corporate fund diversification towards ETH.

- Analysts and industry leaders believe ETH has further room to rise, with Standard Chartered Bank raising its year-end target price to $7,500, and some predicting it will reach $6,000 in the short term—though profit-taking is possible when approaching historical highs.

Behind Ethereum's sprint towards its historical peak are not single catalytic factors, but multiple elements driving institutional fund inflows, regulatory clarity, and improved market sentiment, which are converting skeptics into buyers.

Spot Ethereum ETF demand has set records, with single-day fund inflows reaching $1 billion. Meanwhile, recent policy changes—from the White House allowing 401(k) retirement plans to invest in alternative assets to new stablecoin regulatory rules under the GENIUS Act—have provided clearer participation frameworks for institutional investors.

Ira Auerbach, Head of Tandem at Offchain Labs, stated, "The synchronization of policy, products, and infrastructure creates a rule system that can bring innovation back home and paves the runway for ETH to break through and maintain historical highs."

Corporate fund allocation is also driving buying pressure. Kevin Rusher, founder of RWA lending platform RAAC, noted that diversifying digital asset allocation from Bitcoin is becoming a growth trend. He calls it a "wise business decision" and a strong endorsement of the "world computer", while pointing out that 97% of Ethereum holders are already profitable. Such profit levels might trigger some profit-taking, but Rusher anticipates the long-term trend will continue upward.

He wrote in an email: "Will ETH reach $6,000? Of course. Those who didn't get on board at $300 will feel as disappointed as the person who used Bitcoin to buy pizza at Papa John's."

Earlier Wednesday, Standard Chartered Bank analysts raised Ethereum's year-end target price from $4,000 to $7,500.

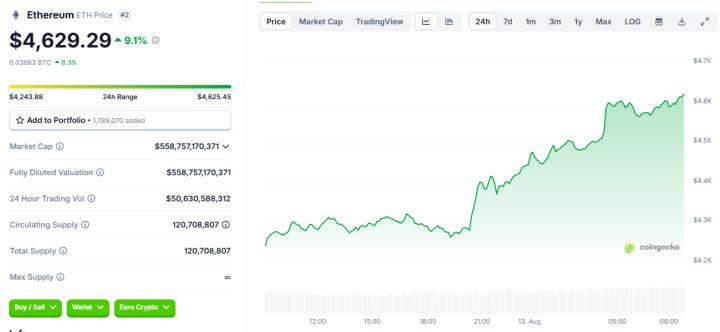

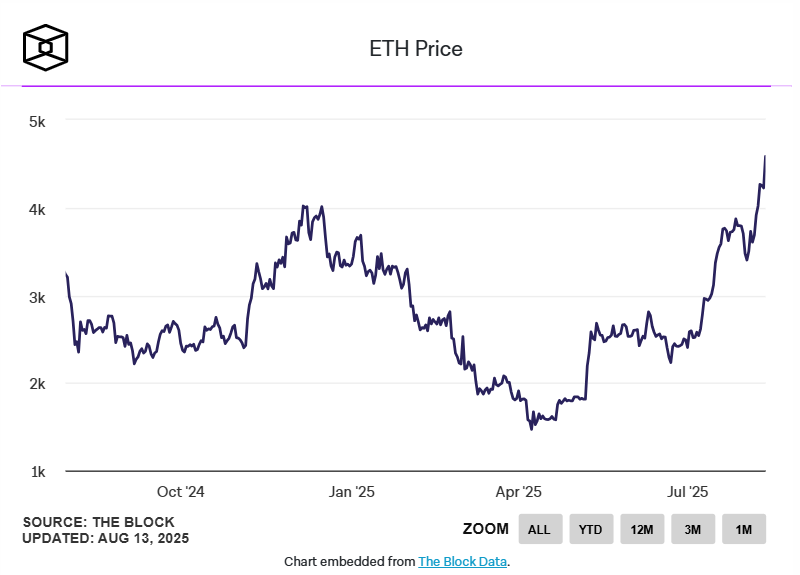

According to The Block's ETH price data, at the time of writing, Ethereum was trading at approximately $4,724, up 4.83% in the past 24 hours. The token previously reached an all-time high of $4,878 in November 2021.

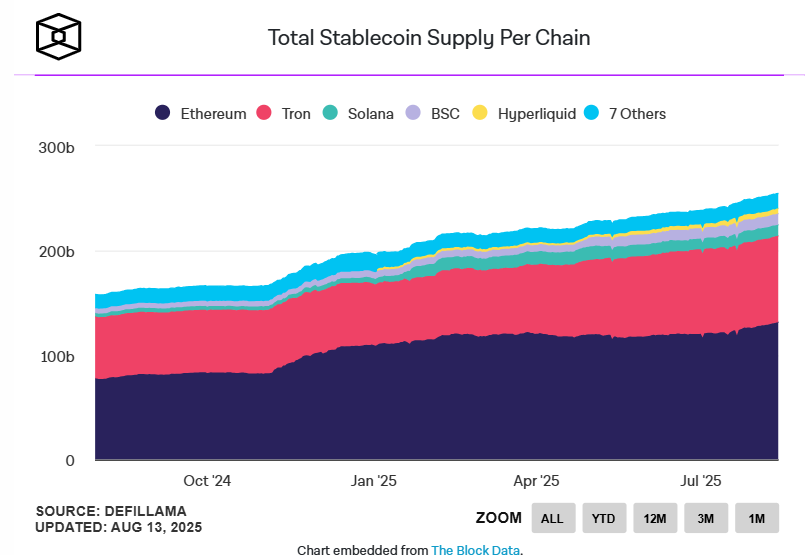

Not all upward momentum comes from fundamentals. Luke Nolan, Senior Researcher at CoinShares, noted that while the May Pectra upgrade did not directly impact ETH value, market sentiment was extremely low at the time, and "sometimes, just a little positive signal can trigger a change." The result was a wave of short covering, coinciding with the GENIUS Act's passage and renewed market interest in Ethereum's role in stablecoins and tokenized real-world assets—where Ethereum holds approximately 58% market share.

Nolan added: "A significant portion of market funds have insufficient Ethereum exposure, with many investors previously waiting and now just starting to enter, further driving price increases. Considering this crazy market, a pullback is possible when approaching or breaking historical highs, but I believe the larger upward trend is not over as long as the overall market remains stable."

Amid price fluctuations, industry professionals also emphasize that market cycle changes do not alter the actual work progress behind the scenes.

Charles Wayn, co-founder of Web3 growth platform Galxe, stated: "This reflects the hard work of numerous developers." He added that even during market downturns, the community and developers remain "loyal and committed".

As Ethereum's trading price approaches historical highs, with ETF fund inflows remaining strong, the market appears to be in a wait-and-see stage, anticipating new fund inflows and policy momentum to observe whether this second-largest cryptocurrency can break into uncharted new heights.