Author: Azuma, Odaily

The cryptocurrency market seems to have entered an accelerated upward phase. After a significant surge the night before, the market experienced an even more violent rally last night.

OKX data shows that BTC briefly surged to 117,548.2 USDT last night, currently reporting at 115,408 USDT as of 8:30 this morning, with a 24-hour increase of 3.75%. Even more surprisingly, the Altcoin bellwether ETH, stimulated by multiple positive factors, broke through the 3000 mark last night, reaching a high of 3002.99 USDT, currently reporting at 2972.21 USDT as of 8:30 this morning, with a 24-hour increase of 5.77%; another Altcoin leader SOL is currently reporting at 162.7 USDT, with a 24-hour increase of 4%.

Influenced by the overall market uptrend (especially ETH's revival), the Altcoin market has also seen a strong recovery. As of 8:30 this morning, multiple coins in the top 100 Altcoins recorded double-digit gains, with SUI reporting at 3.42 USDT, a 24-hour increase of 11.7%; ARB at 0.3915 USDT, a 24-hour increase of 11.1%; PEPE at 0.00001218 USD, a 24-hour increase of 11.2%; PENGU at 0.0194 USDT, a 24-hour increase of 26.18%...

CoinGecko data shows that the total crypto market value has now exceeded $3.669 trillion. In terms of market sentiment, crypto users' trading enthusiasm has also significantly increased, with today's fear and greed index reaching 71, currently rated as "greedy".

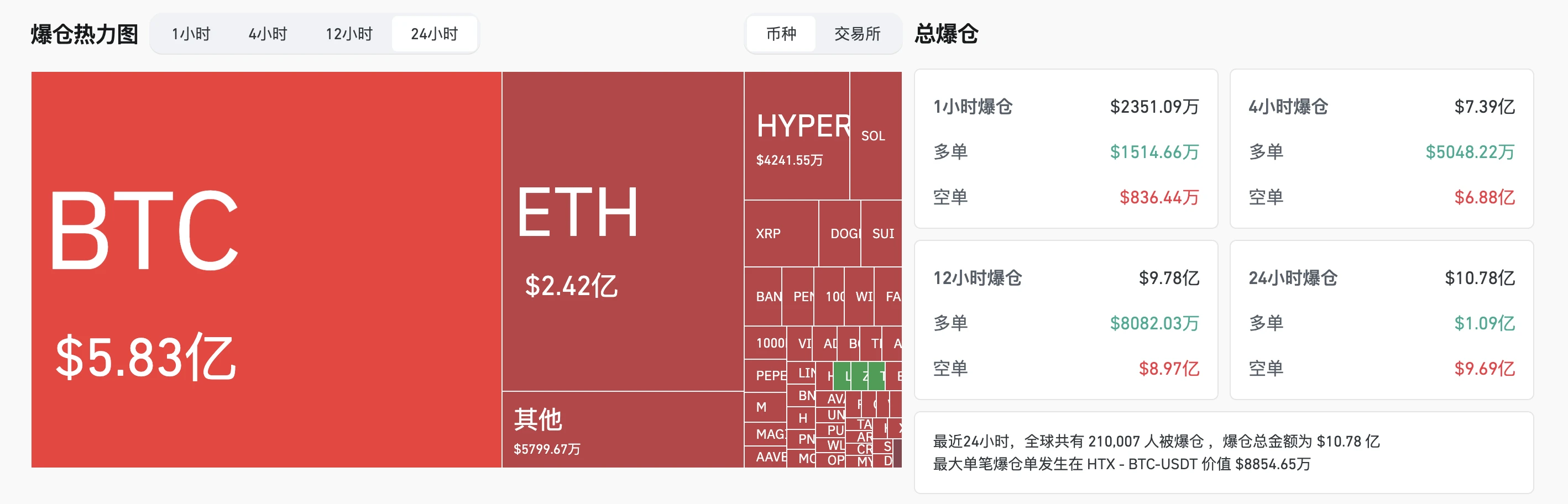

In derivatives trading, Coinglass data shows that over the past 24 hours, total liquidations reached $1.078 billion, with the majority being short liquidations amounting to $969 million. By cryptocurrency, BTC liquidations were $583 million, and ETH liquidations were $242 million.

Reasons for the rise: Tariff "desensitization", institutional involvement, rate cut expectations

We have already analyzed the reasons for this market upturn in yesterday's market trend article.

On one hand, the market has gradually realized that the collective psychological impact of the recent tariff dispute has significantly weakened. On the other hand, institutional buying power, including ETF inflows, continues to expand.

Additionally, statements from Federal Reserve officials last night about potential rate cuts somewhat boosted market sentiment.

San Francisco Fed President Daly stated last night that she believes two rate cuts are possible, considering implementation in the fall.

Fed Governor Waller suggested that the Fed should consider a rate cut at the July meeting, despite strong June employment data.

ETH's strong rebound - can it continue?

ETH is undoubtedly the "brightest star" in this market rally. Since the market low in April, ETH has surprisingly outperformed BTC and SOL, completing a double-digit rebound.

LD Capital founder Jack Yi also posted on X this morning that ETH breaking $3000 marks the start of the crypto bull market, believing ETH is severely undervalued.

However, short-term analysis shows that ETH still faces significant selling pressure around $3000, meaning it may need further consolidation to effectively break through this level.

Will the "Altcoin season" return?

Some analysts believe that the gradually increasing short positions might ultimately become the fuel for Altcoin growth, potentially triggering an "Altcoin season".

Currently, an unprecedented phenomenon is occurring: multiple Altcoins have open interest (OI) exceeding their market cap, indicating unsustainable short positions.

However, different perspectives exist. DWF Labs partner Andrei Grachev believes most Altcoins will likely underperform Bitcoin.

Will this time be different? The market seems to have lost the courage to imagine another Altcoin season.