Against the backdrop of delayed interest rate cuts and geopolitical turmoil, almost all assets were trembling in the first half of 2025. However, BTC led the entire crypto world in a beautiful comeback, demonstrating strong resilience and growth potential. What key market forces are brewing for the second half of the year?

At the beginning of this year, the external world generally expected the US economy to take a steep dive, but currently, it appears to be experiencing a smooth "soft landing". The job market maintains certain resilience, with 139,000 new non-farm jobs in May, an unemployment rate of 4.2%, and wage growth of 3.9% year-on-year, indicating a slightly slowing but still stable labor market. Meanwhile, inflation data is below expectations, with core CPI rising 2.7% year-on-year in June, slightly lower than previous values, not yet significantly reflecting the impact of Trump's tariff increases. The market generally expects the Federal Reserve to start cutting rates in September rather than July.

[The rest of the translation follows the same professional and accurate approach, maintaining the specified translations for specific terms like BTC, Circle, USDC, etc.]Looking ahead to the second half of the year, if the 'GENIUS Act' passes the House of Representatives and is signed by Trump, it will officially usher in a new era of stablecoin regulation. Compliance will accelerate institutional capital inflow, and the boundaries between traditional stock markets and the cryptocurrency world will further converge, further strengthening the "crypto-stock linkage". Crypto stocks may continue their strong momentum and become the core driver of the structural market trend in US stocks.

In June, BTC price demonstrated resilience amid complex situations: when the Israel-Palestine conflict suddenly escalated in mid-June, BTC briefly dropped below $100,000 but quickly recovered and returned above $100,000, showing an independent trend and gradually decoupling from traditional risk assets. Recent research by Gemini exchange and on-chain analysis institution glassnode shows that institutional investors continue to increase holdings through channels like ETFs, and the market's structural changes are reshaping its volatility characteristics.

Reviewing the first half of 2025, although short-term price factors are still primarily driven by capital supply and geopolitical conflicts, at a more fundamental level, the crypto market may be experiencing the most profound paradigm shift since its inception. Its development trajectory can no longer be simply defined by market sentiment or technical indicators, but is emerging with new vitality through the combined forces of technology, capital, regulation, and ecosystem.

The institutionalization wave reached new heights in June, with global crypto ETF scale breaking through the $1.1 trillion milestone. BlackRock's Bitcoin ETF alone absorbed $4.9 billion in net inflows in a single month. More notably, traditional financial institutions' participation is qualitatively changing. For example, Goldman Sachs has begun offering Bitcoin-backed loan services with CoinBase, a participation depth far beyond Wall Street's exploratory layout during the 2021 bull market. Simultaneously, the expected monetary policy shift by the Federal Reserve has injected new variables into the market, with historical data indicating that Fed rate cut cycles are typically accompanied by significant Bitcoin appreciation.

In terms of regulation, as mentioned earlier, the passage of the US 'GENIUS Act' and the establishment of Hong Kong's stablecoin licensing system mark that major financial centers have built preliminary compliance frameworks for digital assets. This policy certainty is attracting more traditional capital.

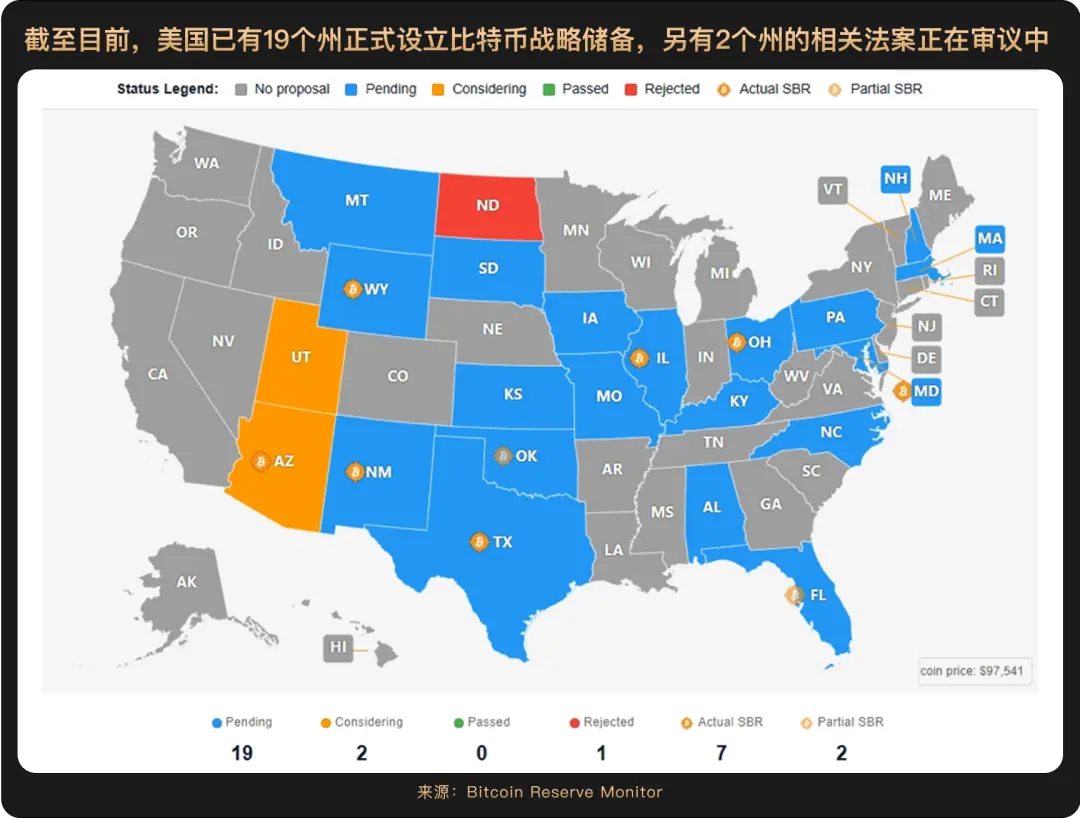

Additionally, the White House's digital asset policy advisor revealed that the US is working to construct a strategic Bitcoin reserve infrastructure. Trump's executive order in March did not mandate the Treasury to disclose the government's Bitcoin holdings, but we can expect proactive disclosure in the second half of the year. The advisor added that the US government is "highly inclined" to increase Bitcoin holdings in a budget-neutral manner, meaning it will fund Bitcoin purchases through internal fund reorganization or spending cuts without increasing fiscal deficit or taxpayer burden.

In essence, looking back from the midpoint of 2025, the crypto market's development trajectory has fundamentally differed from the early purely speculative-driven phase.

Standard Chartered Bank's Digital Assets Research Head Geoffrey Kendrick previously predicted a Bitcoin year-end target of $200,000 for 2025. The dominant narrative behind this trend has shifted from risk asset correlation to capital flow-driven, with capital surging in multiple forms. Bitcoin is becoming an asset allocation tool for capital fleeing US assets, indicating that this rise is not just a price fluctuation but a reflection of global capital allocation and macroeconomic trends. In this sense, the second half of 2025 may well be a historical turning point for deep coupling between traditional financial systems and the digital currency ecosystem.

Currently, BTC price remains in the high range of $100,000-$120,000. Looking ahead to the second half of the year, under multiple favorable conditions including a potential Federal Reserve rate cut, continued growth in corporate crypto adoption, and clarified regulatory policies, it is expected to usher in a new period of steady development.