summary:

Financial market infrastructure is the "financial plumbing". Historically, Hong Kong has built financial infrastructure twice - the linked exchange rate system and RTGS, which ultimately shaped Hong Kong's status as an international financial center, once mentioned on par with New York and London. Now that digital finance based on stablecoins has arrived, it has provided a window for institutional and technological innovation. Stablecoins have become a standard feature of the infrastructure of international financial centers. Hong Kong should seize the opportunity to become a super financial center driven by the dual engines of the US dollar and the RMB.

Author: Lieutenant Colonel Wu¹, Li Yongfeng²

introduction

In May 2025, the global financial landscape ushered in an important turning point. The U.S. Senate and the Legislative Council of Hong Kong successively passed legislation on stablecoins, marking a key step for digital currencies to enter the mainstream financial system. These two legislative actions not only reflect the increasingly important position of stablecoins in the global financial system, but also reveal that the United States and Hong Kong are trying to shape the global digital financial landscape by regulating stablecoins.

In addition to the United States and Hong Kong, other countries and regions have also accelerated the legislation or amendment of stablecoins, including the European Union, Singapore, Japan, South Korea, Australia, India, Taiwan, Russia, Thailand, Argentina, etc. A global currency competition around the future of digital finance has begun. After several twists and turns, the United States finally took stablecoins seriously and tried to lead this change again. Financial companies and technology giants in various countries have already been gearing up.

Stablecoins are no longer just a "cryptocurrency tool", but have become a payment channel for the digital economy and a bridge between on-chain assets and legal tender. Former Federal Reserve Chairman Ben Bernanke believes that financial market infrastructure is "financial plumbing" to support transactions, payments, clearing and settlement, and to achieve interconnection and interaction between financial institutions.

We believe that since the 1970s and 1980s, Hong Kong has built financial infrastructure twice - the linked exchange rate system and RTGS, which ultimately shaped Hong Kong's status as an international financial center, once mentioned on par with New York and London. Now that digital finance based on stablecoins has arrived, it has provided a window for institutional and technological innovation. Hong Kong should seize the opportunity to become a super financial center driven by the dual engines of the US dollar and the RMB.

Note 1: Lieutenant Colonel Wang is the Director of Financial Research at Asia Weekly.

Note 2: Li Yongfeng is the founder of Jieshengjishi Company and a blockchain expert.

1. Paradigm shift in financial infrastructure

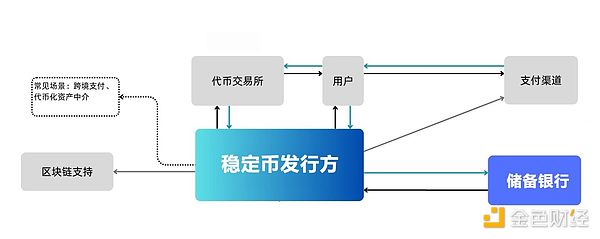

Stablecoins are cryptocurrencies that maintain stable value by being linked to legal tender, gold or other assets. Therefore, stablecoins reduce price fluctuations through an anchoring mechanism, combining the efficiency of blockchain with the stability of traditional assets. This design makes it a "safe haven" in the crypto market, retaining the convenience and decentralization advantages of cryptocurrencies while avoiding the risk of drastic fluctuations of mainstream cryptocurrencies such as Bitcoin.

Unlike volatile digital assets such as Bitcoin, stablecoins are widely used in cross-border payments, remittances, and decentralized finance (DeFi) due to their stability. According to market data, the total market value of the global stablecoin market has approached $250 billion, and the on-chain transaction volume in 2025 is expected to reach $10 trillion, demonstrating its core role in the digital economy.

When people talk about stablecoins, they often focus on their convenience as a payment tool - buying and selling assets in the crypto world, or making small cross-border transfers. In fact, the real challenge of stablecoins to the traditional financial system (TradFi) is not that it creates a new "money" or currency (stablecoins that are 1:1 tied to fiat assets are actually not issued), but that it brings a new and disruptive clearing system.

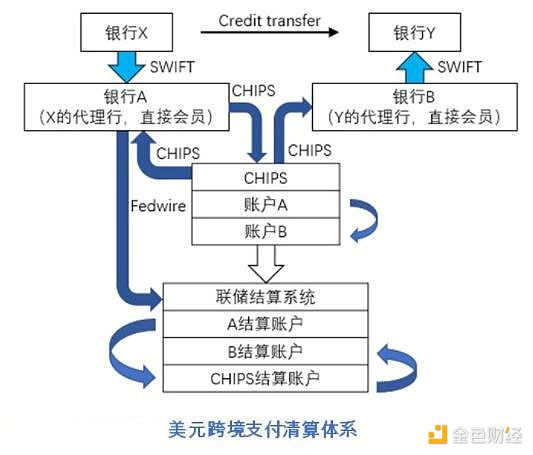

At present, the global financial trade system mainly relies on a network woven by bank accounts and SWIFT (Society for Worldwide Interbank Financial Telecommunication). Cross-border remittances send payment instructions through SWIFT, and funds jump between multiple correspondent banks. Each jump means time delay and cost accumulation. The core of this system is not efficiency, but the hierarchical trust based on national sovereignty and bank credit. And at the top of this pyramid, the US dollar and its clearing system CHIPS (Clearing House Interbank Payment System) are undoubtedly the top.

In this global payment system, when a transaction occurs, the information flow (such as SWIFT messages) and the capital flow are two independent tracks. The information flow promises that the funds will move, but the actual settlement of the capital flow depends on a trust chain consisting of multiple intermediaries. The inefficiency and high cost of this architecture are obvious, but its most fatal weakness lies in its systemic fragility: any problem in any intermediate link may lead to transaction failure and generate huge counterparty risk.

Stablecoins fundamentally solve this problem by combining the two actions of "bookkeeping" and "settlement" into one. In blockchain-based transactions, the transfer of tokens is itself a settlement. The flow of information and the flow of funds are no longer separated. They are encapsulated in the same operation. The transmission of information (transaction records on the chain) and the transfer of value (change of asset ownership) occur simultaneously, achieving atomic-level exchange , so it is called "Atomic Settlement". This means that value can flow around the world in near real time and point-to-point, just like information, without the need for approval and settlement by layers of intermediaries. It no longer requires a bank account as a prerequisite. A digital wallet is all the keys to this new world.

Stablecoin clearing system

This leads to the core advantage of stablecoins: the finality of transactions . The moment the stablecoin reaches the recipient's address, the transaction is irreversibly completed. This is not a "pending" or "pending settlement" state, but the final state of the transaction. The value has been transferred from one party to another, and the creditor-debtor relationship between the two parties has been settled. How to dispose of the assets in the future - whether to convert them into legal currency or use them for other investments - is entirely the decision of the recipient, but it has nothing to do with the finality of the original transaction. Finality is the solid foundation for the new generation of financial infrastructure to build trust and reduce risks. Obviously, this is not just an improvement in efficiency, it is a paradigm shift in financial infrastructure .

Stablecoins subvert the four core pillars of the traditional financial system

Instant settlement (T+0, significantly reducing working capital requirements)

Very low transaction costs (especially compared to the SWIFT system)

Global accessibility (24/7, only an internet connection required)

Programmability (money driven by extensible coded logic)

In the traditional financial system, the hegemonic status of the US dollar is inseparable from its role as the world's main settlement currency. Global trade, commodity pricing, and foreign exchange reserves are almost all denominated in US dollars. Any country that wants to participate in the global economy cannot bypass the US dollar's settlement channel. This gives the United States unparalleled economic influence and the ability to impose financial sanctions, which is the so-called "dollar hegemony."

However, the emergence of stablecoins has provided the world with a " Plan B ". Since its underlying technology is decentralized, any economy can theoretically issue stablecoins anchored to its own legal currency. If SWIFT and the banking system are the "national highways" and "provincial highways" of the financial world, then the stablecoin clearing system has laid countless "air routes" directly to the destination around the world. There are no traffic lights and no fear of road closures, which makes it possible to break the financial structure of the US dollar as the only world currency .

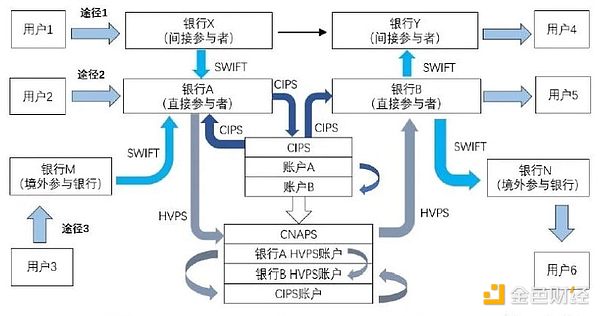

In order to deal with the risk of sanctions from the United States and the European Union against Russia, the Bank of Russia created the SPFS system (Russian Bank Financial Information System) to replace the SWIFT system. In addition, China has also launched the RMB cross-border payment system CIPS. These systems are as complex and inefficient as the US dollar cross-border payment and settlement system:

CIPS (Cross-Border Payment System)

In the digital financial era, the competition is no longer about who can print more trustworthy paper money, but who can take the lead in establishing an efficient, secure, and widely adopted digital currency clearing ecosystem. This is a competition to seize the "ecological niche" in the new financial era. If a country can successfully promote its own stablecoin, it can not only enhance the international influence of its own currency, but also become a rule maker for the new generation of digital financial infrastructure, attracting global capital, technology, and talents.

In essence, the core of this competition has never changed. It is still the battle for the right to mint coins that has lasted for hundreds of years. From shells to gold, from paper money to digital currency, the form of currency is changing, but the economic sovereignty and power behind it have never been lost.

Now, the technological revolution has opened Pandora's box, geopolitical games have ensued, and a new global currency war has begun, but the battlefield has shifted from the physical world to the invisible blockchain.

2. The “flywheel effect” and “scale effect” of stablecoins

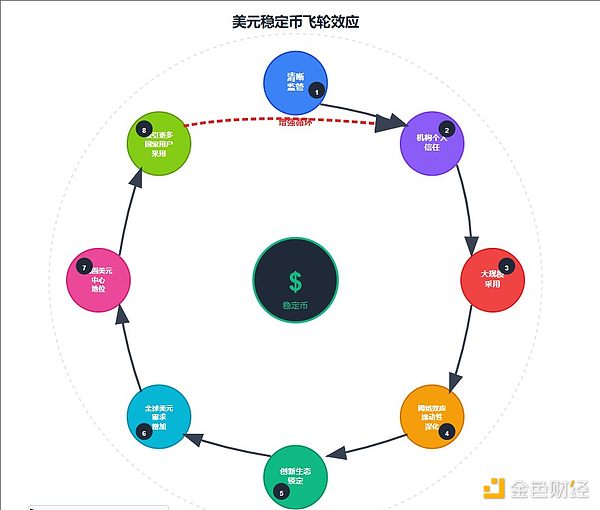

The stablecoin clearing system also has advantages such as being programmable, traceable, and verifiable. It is not only faster and cheaper, but also more open in theory - its entry threshold is no longer a bank license, but the ability to access the network. Obviously, as a new financial infrastructure, the pioneer of stablecoins has a flywheel effect, and the stablecoins of large economies such as the US dollar and the euro are more likely to achieve economies of scale.

2.1 Flywheel Effect

Flywheel Effect : refers to a system or business model that requires tremendous effort to start up, but once it is running, each link will promote each other and strengthen itself, forming a positive cycle, allowing the entire system to continue to grow with higher and higher efficiency and lower and lower costs. Taking the United States and the US dollar stablecoin as an example, the start-up and acceleration process of its flywheel can be broken down into the following interrelated links:

Step 1 : Start the flywheel - a clear regulatory framework

The US GENIUS Act clarifies the regulatory framework and eliminates legal gray areas. Issuers like Circle (USDC) and PayPal (PYUSD), as well as traditional financial giants such as JPMorgan Chase and Goldman Sachs, can safely invest resources because they know what the rules are and that their business is legal. Users (whether individuals or institutions) no longer need to worry about issues such as issuers running away and opaque reserves. Because of the regulatory endorsement of the US government (such as requiring 1:1 high-quality liquid asset reserves, regular audits, etc.), the US dollar stablecoin has transformed from a "risky asset" to a "cash-like" reliable tool.

Step 2 : Flywheel Acceleration - Adoption and Convergence

Once trust and legitimacy are established, the flywheel begins to gain initial momentum. Individual users will prefer to use USD stablecoins for payments, savings, and cross-border remittances because it is faster and cheaper than traditional bank wire transfers. Institutional users such as Wall Street funds, market makers, and enterprises will begin to adopt it on a large scale. They can use USD stablecoins for instant settlement (T+0 settlement) to replace the traditional clearing system, greatly improving capital efficiency. Then comes the integration of the ecosystem. Compliance-compliant USD stablecoins will become the "king of collateral" and "king of transaction medium" in the world of decentralized finance (DeFi). All mainstream lending protocols and decentralized exchanges (DEX) will be centered on it. Payment companies (Visa, Mastercard), technology giants (Apple, Google), and commercial banks will seamlessly integrate it into their payment systems and apps. Imagine using Apple Pay to pay USDC directly, and the experience is almost the same as using fiat currency.

Step 3 : The Self-Reinforcing Flywheel Cycle

This is the core of the flywheel effect, where each link starts to drive each other, forming a strong positive feedback. The more people and merchants accept the USD stablecoin, the greater its value to new users. This will attract more users and merchants to join, forming a classic "network effect", making it difficult for stablecoins of other currencies to compete with it. Huge trading volume and adoption rate will create unparalleled liquidity. Whether in centralized exchanges or DeFi protocols, USD stablecoins have the best trading pair depth and the lowest slippage. This will attract traders and capital from all over the world, further deepening its liquidity, forming a "liquidity black hole" and draining the liquidity of other competitors.

The world's smartest developers and entrepreneurs will build new applications (dApps), financial products and services around this most mainstream and trusted stablecoin standard. This will form a huge digital economic ecosystem based on the US dollar stablecoin. Once users and assets are locked in this ecosystem, the conversion cost will be very high. Traditionally, the influence of the US dollar has been mainly in international trade, foreign exchange reserves and the banking system. Now, through stablecoins, the influence of the US dollar will penetrate every corner of the digital world - from NFT transactions to the metaverse economy to micropayments between IoT devices.

According to regulatory requirements, for every $1 of stablecoin issued, the issuer needs to hold $1 in real reserves (usually cash and short-term U.S. Treasury bonds). This means that the larger the scale of the U.S. dollar stablecoin, the greater the demand for U.S. Treasury bonds. This indirectly helps the U.S. government to raise funds at a lower cost and strengthens the global financial system's dependence on U.S. Treasury bonds. Therefore, for the world's reserve currency, the U.S. dollar, once it seizes the opportunity of stablecoins, it can not only slow down the global trend of de-dollarization, but also provide support for the U.S. dollar.

2.2 Scale Effect

Scale Effect : Also known as economies of scale, it refers to the phenomenon that as output (here, the issuance and circulation of stablecoins) increases, unit costs gradually decrease. In the field of stablecoins, this includes not only technical costs, but also trust costs, compliance costs, and network construction costs.

For a stablecoin issuer, the compliance costs of operating in a country with clear and unified federal laws (such as the United States) are much lower than operating in dozens of countries or regions with different rules. Once a compliance exemption system that meets US standards is established, it can serve a large number of users around the world. This "one-time compliance, global service" model itself is a huge scale effect. In a small-scale, unregulated environment, users need to spend a lot of time and energy to study whether a stablecoin is trustworthy. But when the US government sets standards for the entire industry, the cost of trust is socialized. Users can "blindly trust" any stablecoin with a US license, which greatly reduces the transaction costs of the entire society.

As the user scale increases, the unit cost of building and maintaining infrastructure such as blockchain networks, wallets, exchange interfaces, APIs, etc. will drop sharply. The average cost of processing 100 million transactions is much lower than the average cost of processing 1,000 transactions. Scale brings deep liquidity. For institutions that need to make large transactions, this means lower market impact costs (slippage).

In a market with poor liquidity, a $10 million transaction may cause a large price fluctuation, but in a market with tens of billions of liquidity, this transaction will have little impact. This efficiency advantage is unmatched by small-scale stablecoins. When the US dollar stablecoin becomes the market leader by virtue of its scale, its technical standards, API interfaces, and compliance practices will become the de facto "global standards". Projects from other countries must be compatible with these standards if they want to interact with this huge US dollar digital economy. This gives the United States a strong voice in the formulation of future global digital financial rules. Just like the TCP/IP protocol of the Internet today, whoever first develops a widely adopted standard will have the initiative for subsequent development. This is an invisible but extremely powerful scale advantage.

2.3 First mover advantage

In summary, for a large economy like the United States, promoting compliant dollar stablecoins is by no means as simple as "embracing financial innovation." Through the "flywheel effect," the United States can use its existing monetary credibility and regulatory capabilities as an initial push to start a self-reinforcing cycle. This cycle will continue to expand the application scenarios of the U.S. dollar in the digital field, deepen the world's dependence on U.S. dollar liquidity, and ultimately "copy and paste" the dollar's hegemony from the traditional financial system to the future digital financial world. Through the "scale effect," the United States can build a solid moat for the ecosystem of the U.S. dollar stablecoin. By reducing compliance, technology, and trust costs, and establishing global standards, it makes the competition costs of latecomers (such as euro stablecoins and yen stablecoins) extremely high, making it difficult to shake its dominant position.

Therefore, this stablecoin legislative competition is essentially a battle for the future leadership of the digital currency world . Pioneers, especially those with a strong sovereign currency foundation, will gain huge and even insurmountable advantages through these two effects. This is why everyone thought that stablecoins were nothing after they were launched for many years, but after Trump began to develop stablecoins in his second term, all countries and economies suddenly became nervous, because the development of US dollar stablecoins in the US regulatory system will give full play to the flywheel effect and scale effect, which is unstoppable.

In this war on the blockchain, there is not much time left for the euro and the renminbi.

3. How Stablecoins Reshape International Financial Centers

Since ancient times, the rise of international financial centers has essentially become a "hub port" for global capital flows. Whether it is London, New York or Hong Kong, their core function is to gather, dispatch and increase the value of global capital by providing the most outstanding infrastructure, including legal systems, talent networks, and the most efficient transaction clearing system. However, when value itself begins to be digitized, the standard for measuring whether a "hub port" is advanced or not must also evolve accordingly.

We believe that stablecoins and cryptocurrencies are becoming key variables in the evolution of international financial centers with their efficiency, trust, and consensus on rules. It is not just a new asset, it also represents the cornerstone of the next generation of financial infrastructure and is the standard for financial centers in the digital financial era.

3.1 Trust and Credit

What is the core competitiveness of an international financial center? Solving the trust and credit issues of the financial system. Capital is profit-seeking and risk-averse. The reason why a place can become a financial center is that it has successfully established a set of mechanisms to minimize the uncertainty in transactions, so that strangers from all over the world are willing to entrust their lives and property to it.

The core competitiveness of a financial center is ultimately the ability to create, export and maintain "trust". Venice in the 14th to 16th centuries provided reliable clearing guarantees and a transparent contractual basis for cross-regional commercial trade through its strong national credit endorsement and the pioneering double-entry bookkeeping method. In the 17th century, Amsterdam standardized and assetized credit and enabled large-scale circulation by establishing the world's first central bank (Bank of Amsterdam) and the first freely tradable joint-stock company (Dutch East India Company). In the 18th and 19th centuries, London relied on the Bank of England's strong central bank function and the pound sterling, which was deeply tied to the strength of the "Empire on which the Sun Never Sets", to elevate national credit to a global currency anchor and to guarantee the sanctity of contracts with a mature common law system. New York from the 20th century to the present has built the ultimate bastion of contemporary financial credit with its unrivaled economic strength, the global reserve currency status of the US dollar established by the Bretton Woods system, and a capital market that is both deep and broad and strictly regulated.

From the state guarantee in Venice, to the corporatized and securitized credit in Amsterdam, to the central bank + global monetary credit in London, and finally to the hegemonic currency + strong regulation + deep market credit in New York, we can clearly see that the evolution of financial centers is a history of upgrading the "trust" manufacturing mechanism.

Stablecoins, on the other hand, take "trust" to a new level through institutional design and technical means. The traditional financial system mainly solves the risk problem of counterparties, while the stablecoin system uses blockchain technology to solve the risk of the transaction system itself.

On the other hand, compliant and reputable stablecoins build consensus and trust between new and old industries. For TradFi, stablecoins are the "official passport" for its assets to enter the digital world. When a dollar enters the blockchain through a compliant stablecoin (such as USDC), it has programmability and composability, and can participate in new financial activities such as DeFi lending and automated market making, greatly expanding the use and profit possibilities of assets.

For DeFi/Web3, stablecoins are the "value anchor" that connects them to the real world. They introduce the most core asset in the traditional world - the credit of sovereign currencies, providing a pricing benchmark and hedging tool for this emerging ecosystem. The future growth of a financial center depends on whether it can become the intersection of the old and new financial worlds. A financial center with a strong stablecoin ecosystem will become the gateway for global TradFi capital to enter Web3, and will also be the first choice for Web3 innovative projects to seek real-world liquidity.

3.2 Capital Efficiency

Capital is like water, always flowing to the lowest cost, highest efficiency and least resistance. Since the lifeline of a financial center is to attract and efficiently allocate capital, it must adopt infrastructure that maximizes capital efficiency. In a world where a stablecoin clearing system already exists, continuing to rely on traditional financial infrastructure is tantamount to insisting on using steam trains in the era of high-speed rail.

As mentioned above, the stablecoin clearing system can not only solve the counterparty risk problem, but also has extremely high efficiency. JD.com founder Liu Qiangdong said that the stablecoin license can realize the exchange between global companies, which can reduce the global cross-border payment costs by 90% and increase the efficiency to within 10 seconds.

Therefore, in order to maintain its basic positioning as a "high-efficiency place", the financial center must embrace stablecoins and use the efficiency of stablecoins' "atomic settlement" to achieve seamless and real-time flow of funds between global markets to capture any fleeting opportunities.

3.3 Rulemaking

Ultimately, the competition among international financial centers is a competition for the power to set global financial rules . In the field of technology, whoever has the most widely adopted infrastructure defines the industry standards. Windows defines the operating system for personal computers, and TCP/IP defines the communication protocol for the Internet.

Former Federal Reserve Chairman Ben Bernanke once likened financial market infrastructure to "financial plumbing" to support transactions, payments, clearing and settlement. As a new infrastructure, stablecoins may undermine this plumbing if not regulated. However, its rapid development also brings regulatory challenges, such as systemic risks, consumer protection and illegal activities. For example, insufficient reserves may trigger a "bank run" effect and affect financial stability. Regulation can ensure that stablecoin issuers provide transparent reports and regular audits to protect user interests. The cross-border nature of stablecoins requires international regulatory coordination. The EU's MiCA Act and the UK's FCA framework have begun to take action, but the regulation of decentralized stablecoins needs to be further unified to avoid regulatory arbitrage. Therefore, how to develop in a compliant and healthy manner is the focus of attention of all countries.

Li Yongfeng discussed the theory of legal personality of blockchain decentralized communities in "On the Legal Personality of Blockchain Decentralized Communities - Analysis Based on Corporate Community Theory", which provided important inspiration for the regulation of stablecoins. The legal personality theory helps to clarify the responsible parties, especially in decentralized stablecoins, where DAOs can be regarded as companies and subject to corporate law regulation.

Li Yongfeng believes that blockchain decentralized communities (such as DAOs) should be given independent legal personality, based on the communitarian theory. These communities have collective interests and organizational structures, similar to traditional companies, and should be regarded as legal entities to participate in civil and commercial legal relations. Stablecoins, especially decentralized stablecoins (such as Dai), are often managed by DAOs or similar structures. If DAOs are regarded as legal entities, their responsible parties in the issuance and governance of stablecoins can be clarified, solving the problem of unclear responsibilities in decentralized systems. Therefore, decentralized communities should have clear governance mechanisms, which can be applied to stablecoins, requiring open decision-making processes and member rights ; innovative legal frameworks are needed to adapt to blockchain technology, which is consistent with the need for stablecoin regulation, such as achieving transparency and compliance through smart contracts.

It can be seen that infrastructure is the standard , and this law is also applicable in the era of digital finance. A stablecoin ecosystem dominated by a specific financial center, its technical standards, compliance procedures (KYC/AML process), and API interface will subtly become the de facto global standard. For example, if the US dollar stablecoin regulated by New York dominates, then global digital asset project parties must comply with the rules of the New York Department of Financial Services (NYDFS) in order to access this largest liquidity pool.

By supporting and supervising the stablecoin ecosystem of its own country, a financial center is not only upgrading its "hardware", but also exporting its "software" - that is, regulatory concepts and financial rules. This is a higher-dimensional competitiveness, which enables financial centers to occupy the most core and advantageous position in the competition. From efficient clearing, new trust mechanisms, to leading future rules, stablecoins play an indispensable role in these three aspects. It is no longer a financial product that adds icing on the cake, but like electricity and the Internet, it is the core infrastructure that drives the operation of the next generation of financial centers.

4. The Hong Kong dollar is a stable currency of the US dollar

From the perspective of the linked exchange rate system, the Hong Kong dollar is a stable currency of the US dollar, but it is not implemented by blockchain technology. The core mechanism of the linked exchange rate is that Hong Kong's monetary base (cash in circulation and bank balances with the HKMA) must be supported by 100% or more of foreign exchange reserves (mainly US dollars). If the issuing banks (HSBC, Standard Chartered, Bank of China (Hong Kong)) want to issue more Hong Kong dollars, they must first pay the HKMA an equivalent amount of US dollars at a fixed rate of 7.80 Hong Kong dollars to 1 US dollar. Vice versa.

It is worth thinking about why the British Hong Kong authorities chose to link the Hong Kong dollar to the US dollar instead of the British pound. That is because the US dollar can provide the greatest trust basis for the Hong Kong dollar.

4.1 Credit of Hard Anchor USD

After the collapse of the Bretton Woods system, although the US dollar was decoupled from gold, its position as the world's first reserve currency, pricing currency and transaction medium has not been shaken, but has been strengthened by the "petrodollar" system. At that time, the British economy was in deep "stagflation" and the pound exchange rate fluctuated violently. Linking to the world's most stable and liquid currency can provide more credibility endorsement for Hong Kong than linking to the pound, which is in relative decline.

By the early 1980s, the United States had already replaced Britain as Hong Kong's largest trading partner and the main source of investment. Most of Hong Kong's imports and exports and financial assets are denominated in US dollars. Linking the Hong Kong dollar to major trading and settlement currencies is the most rational choice that meets commercial interests and can eliminate most of the trade exchange rate risks . In 1983, the Sino-British negotiations on the future of Hong Kong reached a deadlock, triggering an unprecedented crisis of confidence and a sharp drop in the Hong Kong dollar exchange rate. The Hong Kong government needed to take the most powerful and fastest measures to stabilize people's hearts . Choosing the US dollar, the most powerful dollar in the world at that time, as an anchor was the best "drastic medicine" to boost confidence.

The linked exchange rate system means that the Hong Kong government cannot print money at will to make up for the fiscal deficit or stimulate the economy. Behind every Hong Kong dollar issued is a real US dollar reserve. This institutionally eliminates the possibility of hyperinflation. This kind of monetary discipline, which is almost "self-binding", sends an extremely strong signal to global capital: Hong Kong is a place that respects rules, keeps promises, and has rigid property rights protection . This kind of credibility is priceless, especially in a region full of uncertainty.

4.2 Efficiency Improvement

Due to the stable exchange rate, companies and investors do not need to buy expensive financial derivatives (such as forwards and options) to hedge exchange rate risks, which directly reduces the cost of investing and trading in Hong Kong. In cross-border trade and financial transactions, if one party uses Hong Kong dollars and the other party uses US dollars, the settlement process becomes extremely simple because the exchange rate is almost fixed. This greatly improves the efficiency of clearing and settlement. Financial institutions do not need to reserve a large amount of capital buffer for exchange rate fluctuations when conducting large-scale asset allocation and fund scheduling, which improves capital efficiency. Investors can calculate the US dollar value of their Hong Kong dollar assets very accurately because they know that the exchange rate will only fluctuate within a very narrow range of 7.75-7.85. This certainty is the key to attracting long-term, large-scale capital. Therefore, the linked exchange rate system has become the "stabilizing force" for Hong Kong to attract international capital.

4.3 The first leap

As the Hong Kong dollar is pegged to the US dollar, Hong Kong naturally becomes one of the most important US dollar trading and settlement centers in the Asian time zone. Banks and companies around the world can easily exchange Hong Kong dollars for US dollars in Hong Kong, with excellent liquidity and extremely small spreads.

The linked exchange rate system is a strategic trade-off made by Hong Kong under specific historical conditions. It gives up monetary policy independence in exchange for extreme exchange rate stability and currency credibility. Facts have proved that for a small open economy like Hong Kong that is outward-oriented and relies on entrepot trade and international finance as its lifeblood, the benefits of exchange rate stability (attracting capital, reducing transaction costs, and building credibility) far outweigh the benefits of retaining monetary policy independence.

The linked exchange rate system is not just a technical exchange rate arrangement, but also a financial infrastructure for Hong Kong's status as an international financial center. Academically, financial market infrastructure can be defined as follows: the material and technical conditions required for the normal operation of financial markets, a series of activities that allow financial asset transactions to proceed smoothly, and a series of systems and organizational systems that allow financial markets to operate smoothly. The linked exchange rate system provides the most core and valuable promise to investors around the world, ensuring that financial transactions in Hong Kong are carried out stably and efficiently, and has profoundly shaped Hong Kong's economic structure, financial market ecology, and its unique role in the global financial system. Together with Hong Kong's common law system, it has promoted Hong Kong's leap from a re-export trade center to a regional international financial center in the 1970s and 1980s.

5. RTGS , a national important tool

Although Hong Kong has become an international financial center in Asia Pacific since the 1980s, compared with the old international financial centers London and New York, Hong Kong has not been an international financial center for long, and there are obvious gaps and deficiencies in the construction of the financial market system. New York and London are currently recognized as global international financial centers. These two financial centers are unmatched by other cities in terms of market size, degree of perfection and influence on global capital.

The second tier includes cities such as Hong Kong, Singapore, Tokyo, Frankfurt, Paris, Zurich, and Sydney, which play a financial role in their respective regions and are regional international financial centers. In addition, cities such as Shanghai, Toronto, Seoul, Madrid, Dublin, Kuala Lumpur, Mumbai in India, and Johannesburg in South Africa basically play a financial role in their own countries and are national or state financial centers.

5.1 Fierce Competition in Asia Pacific

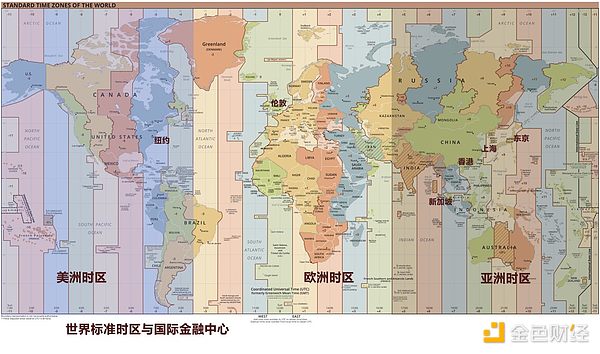

However, the booming development of Hong Kong's financial market in the 21st century represents the rise of a super economic power in the Asia-Pacific region. From the perspective of financial globalization, the Asia-Pacific region also needs a global international financial center that can cooperate with New York and London. In addition, from the perspective of the requirements of financial globalization on the efficiency of capital circulation, there should be at least three global financial centers, distributed in North America, Europe and East Asia, so that the global financial system can operate 24 hours a day. Only by mastering real-time information and product pricing power can a true international financial center be established.

The theory of financial time zones also believes that regional trading platforms should be established based on the human life cycle and habits in order to grasp the needs of local and product real-time information and pricing power in a more timely manner. At present, there are two global international financial centers in North America, New York (West Zone 5) and Europe, London (Zero Time Zone), while in East Asia, there is a lack of global centers, and it can only be replaced by three regional centers, Tokyo (East Zone 9), Hong Kong (East Zone 8) and Singapore (East Zone 7). Among them, Singapore sets its standard time in East Zone 8 to facilitate economic exchanges with Malaysia and China, which means that Singapore time is the same as Hong Kong and Beijing, with no time difference. From the perspective of the development needs of global international financial centers, Singapore and Hong Kong are the two most advantageous competitors, and the international community has a dispute between "New York and Hong Kong" and "New York and Boston".

5.2 Why Hong Kong stands out

At the beginning of the 21st century, although Singapore had a large foreign exchange trading volume, Hong Kong surpassed Singapore and became the world's third largest US dollar trading center. Foreign exchange trading is more in-depth, and its trading volume is more important and critical than the trading volume of other currencies. Because the US dollar, as the world's number one foreign exchange reserve currency, has the best liquidity and risk resistance. How can Hong Kong become the world's third largest US dollar trading center?

Lieutenant Colonel Li pointed out in "RTGS, the National Important Equipment - In-depth Exposing the Value of Hong Kong You Don't Know Part 2" that this is closely related to an important financial infrastructure before and after Hong Kong's return. The main part of this infrastructure is RTGS - Real Time Gross Settlement (also known as real-time gross settlement) system. This is also the core of Hong Kong's becoming an international financial center.

Norman Chan, former chief executive of the Hong Kong Monetary Authority who was responsible for the development and construction of RTGS, once pointed out: As an important component of financial market infrastructure, the interbank large-value payment and settlement system is an important cornerstone of any thriving financial center. Many people compare it to the "water pipes" in the financial system, but I prefer to think of it as blood vessels in the human body. Whether it is smooth or not directly affects physical health and even life.

This metaphor by Norman Chan vividly illustrates the harm of poor capital circulation, especially the risks in foreign exchange transactions, of which the most famous is the Herstatt Risk. Because there is a time difference in foreign exchange transactions, if the delivery is not timely, it will lead to a series of indirect defaults of banks, affecting a series of financial institutions. The larger the market size, the higher the financial risk. In order to eliminate the time difference, the key is to achieve synchronization between the two settlement systems, that is, to achieve real-time full settlement.

With advanced electronic technology, the United States took the lead in launching a complete RTGS system. In order to improve the financial system, the Hong Kong Monetary Authority began to develop the RTGS system after its establishment in 1993, and finally launched the Hong Kong dollar RTGS on December 9, 1996, becoming the fourth region in the world to launch the RTGS system, second only to the United States, Switzerland and the United Kingdom, and the United Kingdom was launched only a few months earlier than Hong Kong.

More importantly, after the Hong Kong dollar RTGS, the HKMA launched the US dollar RTGS system in 2000, with HSBC as the clearing bank, realizing the world's first ever simultaneous electronic foreign exchange transaction settlement , ending the Hearst risk that has plagued foreign exchange transactions.

Norman Chan said that since the launch of the RTGS system in Hong Kong on December 9, 1996, it has kept pace with the times and its functions have been continuously strengthened and upgraded. "What is particularly rare is that it has maintained 100% normal and continuous operation without any downtime." It has also laid the foundation for the future development of payment and settlement of Hong Kong banks and is an important cornerstone for Hong Kong to become Asia's leading international financial center.

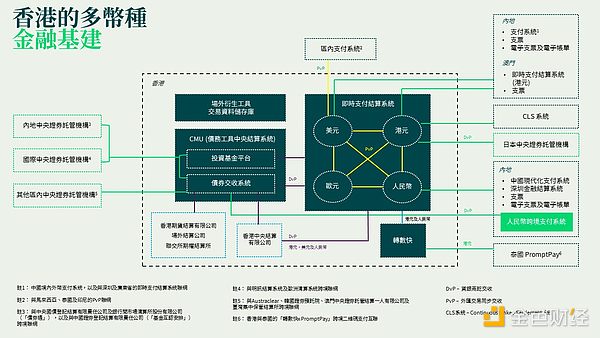

5.3 Seizing the Asian Time Zone

As Hong Kong's US dollar RTGS system has been operating smoothly and effectively, it has been highly recognized by the financial community. After multiple certifications, the Malaysian authorities connected the Malaysian ringgit RTGS system (RENTAS system) with Hong Kong's US dollar RTGS system in November 2006, allowing the simultaneous settlement of Malaysian ringgit and US dollar foreign exchange transactions during the business hours of Malaysia and Hong Kong, thereby eliminating settlement risks. In the same year, Singapore's RTGS system MEPS was just launched. After Malaysia, the Indonesian rupiah RTGS system and the Thai RTGS system were successively connected to the Hong Kong US dollar RTGS system. In addition, the Euro RTGS system was launched in 2003, with Standard Chartered Bank as the settlement bank. With the construction of the RMB offshore center, the HKMA launched the RMB RTGS system in 2007, with Bank of China as the settlement bank.

This internationally advanced, reliable, secure and efficient RTGS system handles a large amount of fund transactions within the Hong Kong banking system every day. The average daily RMB settlement alone exceeds 1 trillion yuan, which strongly supports Hong Kong as a global hub for offshore RMB business. According to statistics from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), about 70% of global RMB cross-border payments are processed through the Hong Kong payment system.

More importantly, this stable and efficient RTGS system also allows Hong Kong to seize the opportunity of US dollar transactions in the Asian time zone and become the world's third largest US dollar trading center. Becoming the US dollar trading center in the Asian time zone is a key step towards becoming the third global international financial center. Because financial globalization requires 24-hour uninterrupted foreign exchange transactions and settlements around the world, the Asian time zone outside of London and New York is crucial, and Hong Kong happened to quickly fill this gap with its own strength after the handover.

In other words, as the infrastructure of the global financial market, the US dollar settlement system of "New York, London and Hong Kong" has formed a stable pattern, jointly supporting the 24- hour operation of financial globalization. The three pillars of New York, London and Hong Kong are not in a competitive relationship, but a mutually dependent relationship. If any one of the three has problems, the impact on global finance is unimaginable.

5.4 The United States is cautious about using the right tools

The importance of Hong Kong as a US dollar trading center has been reflected in the confrontation between China and the United States in the past two years. At that time, it was reported that the United States wanted to restrict Hong Kong banks from using US dollar settlement, and even kicked Hong Kong banks out of the SWIFT system. In response, Hong Kong Monetary Authority Chief Executive Paul Chan said that Hong Kong is the third largest US dollar settlement center, serving a large number of multinational institutions in the Asian time zone, and financial centers are interconnected. Once there is any shock in the Hong Kong market, the United States will definitely be affected, and it will also shake the confidence of other investors who hold US dollars as foreign exchange reserves. The United States is naturally aware of the importance of Hong Kong's US dollar market and ultimately did not take any practical action. It can be seen that Hong Kong's financial infrastructure with RTGS as its core is not only China's "national heavy weapon", but also an important part of the global financial market.

In this sense, the financial infrastructure construction with the RTGS system as the core since Hong Kong's return to China is equivalent to recreating Hong Kong as an international financial center, thus forming a clear advantage over Singapore and also Hong Kong's trump card against Singapore in the competition for international financial centers. Coupled with the institutional arrangements such as the offshore RMB center and the listing of mainland enterprises in Hong Kong, Hong Kong has upgraded from a regional international financial center to a global financial center. This international financial center in transition can be regarded as one of the most significant achievements of Hong Kong in the 25 years since its return to China.

Of course, both Hong Kong and international financial professionals have a clear understanding of Hong Kong's actual status as a financial center. On the one hand, they believe that Hong Kong's current status as a financial center is not as high as that of New York and London. On the other hand, they believe that whether Hong Kong can achieve this key leap depends on the development in the next few years. For Hong Kong now, the top priority is to consolidate the advantageous position brought by financial infrastructure and common law, restore the confidence of all sectors of the market in Hong Kong as soon as possible, and retain financial institutions and talents. Singapore has also been strengthening its financial infrastructure, especially in recent years, focusing on the application of blockchain in the financial field, and has become the blockchain center of Asia. In the long run, Hong Kong also needs to innovate in the field of financial technology to maintain its competitiveness in the financial field. From the perspective of the development of Hong Kong's financial center, the construction of financial infrastructure is crucial.

Now that stablecoins, as a digital financial infrastructure, have become a reality, how can Hong Kong take advantage of this opportunity to achieve another leap forward as a financial center?

We believe that Hong Kong’s opportunity lies in the “dual-engine drive” - the two powerful digital engines of “Hong Kong dollar stablecoin” and “RMB stablecoin”.

6. Dual-engine drive

The core of Hong Kong's "dual-engine drive" is to allow the two digital engines, "Hong Kong dollar stablecoin" and "RMB stablecoin", to play different but complementary strategic roles on Hong Kong's unique platform.

6.1 HKD Stablecoin HKDS

The Hong Kong dollar stablecoin, due to its linked exchange rate system with the US dollar, is essentially a programmable US dollar proxy ( USD Proxy ) regulated by Hong Kong and operating in the Asian time zone. Nevertheless, it is critical to financial trade in the region: A large number of traditional financial institutions (banks, funds, family offices) around the world want to enter the digital asset field, but they are struggling with compliance and trust issues. A HKDS endorsed by the Hong Kong Monetary Authority is a reliable "onboard" tool for them. They can use HKDS to purchase tokenized assets (such as bonds, real estate) and participate in compliant DeFi protocols without directly holding stablecoins such as USDC/USDT that have been controversial in compliance in other jurisdictions.

Domestic e-commerce platforms need an efficient stablecoin clearing system to expand overseas, which can directly solve the cross-border payment problems that have plagued them for many years, especially the complicated exchange process and high bank fees when facing emerging markets. Through stablecoins, the settlement of funds between the platform and global suppliers, logistics companies and end consumers can be completed in near real time, greatly speeding up the cash flow turnover. More importantly, this system can uniformly handle payments from different countries and regions, aggregating them into a standard digital asset, thereby simplifying the complexity of financial reconciliation and risk management. This will not only significantly reduce the operating costs of overseas businesses and improve their price competitiveness in the global market, but will also trigger a supply chain revolution.

Hong Kong's RTGS system handles a huge amount of Asian dollar transactions. HKDS can upgrade this T+0 or T+1 settlement capability to 7x24 hours, instant, atomic on-chain settlement ( T-Now ) . This is a revolutionary efficiency improvement for foreign exchange transactions, securities settlement, derivatives clearing and other scenarios, and can consolidate Hong Kong's position as the Asian dollar clearing center.

It can be seen that HKDS is not intended to subvert the US dollar system, but to embrace and strengthen it . It uses Hong Kong's regulatory credibility to provide the US dollar world with a more efficient and secure digital interface to the future, consolidating Hong Kong's position in the existing international financial landscape.

6.2 Offshore RMB Stablecoin (CNHS)

Since HKDS will strengthen the US dollar system, what about the RMB? The most urgent task is that Hong Kong should launch a stable currency based on offshore RMB as soon as possible. Correspondingly, the RMB should accelerate its internationalization and adapt to the global financial digitalization trend as soon as possible.

Offshore RMB stablecoin is Hong Kong's most unique and disruptive trump card in this competition. Its strategic value lies in creating a brand new track. One of the biggest obstacles to the internationalization of RMB is the efficiency and cost of cross-border payment and settlement. CNHS can bypass the traditional SWIFT/CIPS system and provide a nearly zero-cost and zero-time-difference payment and settlement network for "Belt and Road" trade, commodity trading, cross-border e-commerce, etc. This is a "dimensionality reduction attack" on the existing system.

International investors who want to invest in Chinese assets face many inconveniences except for limited channels such as the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect. A CNHS with sufficient liquidity can become a "gateway" for global investors to enter offshore RMB bonds, funds and other financial products. They can use CNHS to purchase RMB-denominated tokenized assets anywhere in the world, greatly broadening the investor base of RMB assets.

The realistic strategy for Hong Kong is to launch the RMB stablecoin as soon as possible after the launch of the Hong Kong dollar stablecoin, so that Hong Kong will become the only place in the world where the "US dollar ↔ Hong Kong dollar stablecoin ↔ RMB stablecoin" can be legally, compliantly and on a large scale. It can be seen that for China, CNHS uses Hong Kong's unique advantage as the largest offshore RMB center to provide the most critical infrastructure for the globalization narrative of the RMB, and seizes an irreplaceable strategic high ground for Hong Kong in the new global financial landscape.

——Hong Kong will no longer be just a center for stocks or foreign exchange, but a global liquidity center for digital value**. Capital from the dollar world and capital from the RMB world will meet, collide, and merge here, creating unprecedented financial products and opportunities.

——Based on this dual-currency stablecoin infrastructure, Hong Kong can attract high-quality assets from around the world (from real estate to private equity, from art to carbon credits) to be tokenized and issued here. Issuers can freely choose to denominate in HKDS or CNHS to attract investors from different sources.

——Hong Kong will become a unique "regulatory sandbox" where the two different financial philosophies and technical paths of the East and the West can be tested and integrated. For example, the cross-border application test of e-CNY can be carried out in the interaction between Hong Kong and CNHS.

in conclusion

From a regional international financial center to a global international financial center, from a traditional financial system to a digital financial system, Hong Kong stands at a historical crossroads. Its institutional advantages of "one country, two systems", linked exchange rate system, Asian dollar center, the world's largest offshore RMB center, and the world's leading stablecoin regulatory framework have become the foundation for Hong Kong to move towards the digital financial era. By simultaneously developing the Hong Kong dollar stablecoin (connecting the world) and the RMB stablecoin (facing the future), Hong Kong has the opportunity to transform from a traditional international financial center into a "super financial hub" that connects the physical world and the digital world, and connects the US dollar system and the RMB system. Correspondingly, the RMB should accelerate its pace of internationalization and digitalization to adapt to the development trend of global digital finance.

This is not only a transformation and upgrading of Hong Kong itself, but also a key balance and intersection for the evolution of the global financial landscape in the next few decades. Whether Hong Kong can seize this opportunity will determine its global status in the second half of the 21st century.

References:

Marvin Barth: Stablecoins Are a Monetary Revolution in the Making, 2025, Thematic Markets

Rashad Ahmed Inaki Aldasoro: Stablecoins and safe asset prices, May 2025, BIS

Zhao Xiaobin: The Centennial Competition of Global Financial Centers: Factors Determining the Success or Failure of Financial Centers and the Rise of Chinese Financial Centers, World Geography Research, June 2010

Shen Jianguang: Opportunities and Challenges of Stablecoins to the International Status of the US Dollar, June 2025, Chief Economist Forum

Wang Yang, Bai Liang, Zhang Xueyi: Stablecoins are a double-edged sword for the US dollar hegemony, June 2025, FT Chinese

Liu Yu: Using compliant stablecoins to build a new generation of global payment network, 2024, Wanxiang Blockchain

Cai Xiaozhen: Analysis of the competitive situation of Hong Kong and Singapore as international financial centers, 1980-2005, Master's thesis of East China Normal University, May 2007

Li Yongfeng: On the Legal Personality of Blockchain Decentralized Communities - Analysis Based on Corporate Community Theory, 2021, Master's Thesis Collection of Renmin University of China

Lieutenant Colonel Wang: The little-known value of Hong Kong 2: New York or New York? 2022, Demonstration Finance