Key Points:

The combination of gold and stablecoins has advantages, but future development requires overcoming some obstacles. If the mechanism improves, gold stablecoins can serve the function of value storage, as well as payment and settlement functions under specific conditions.

Gold Stablecoins: The Quietly Rising "Crypto Darling"

After USD stablecoins became the "star coin" in the stablecoin market, gold stablecoins are also quietly rising. As the name suggests, gold stablecoins are cryptocurrencies pegged to gold, with the same characteristics as other types of stablecoins: stable value and decentralization.

The gold stablecoin market currently presents a "dual dominance" situation, with Tether's XAUT and Paxos' PAXG each occupying nearly half of the market share. As of June 2025, the market capitalization of gold stablecoins reached $1.6 billion, accounting for approximately 0.67% of the total stablecoin market value, making it the third-largest type of stablecoin after USD stablecoins and crypto-collateralized stablecoins.

Combination Advantages: Stablecoins Empowering Gold Trading

Compared to other gold investment products like gold ETFs and futures, the decentralized characteristics of stablecoins enhance the convenience of gold trading:

Reducing Time and Space Limitations:Gold stablecoins operate on the blockchain, enabling global instant trading at any time;

Lowering Investment Thresholds:Gold stablecoins correspond to gold bar ownership, allowing fragmentation during trading, with the highest divisibility up to six decimal places (about 0.02 yuan);

Reducing Transaction Fees:Gold stablecoins only charge low transaction fees (e.g., PAXG charges two ten-thousandths).

Gold Stablecoins Development: Three Challenges to Overcome

First, the natural conflict between the monetary functions of gold and stablecoins.Stablecoins primarily enhance the payment and settlement functions of money, while gold more often serves the value storage function. The combination of gold and stablecoins appears somewhat forced.

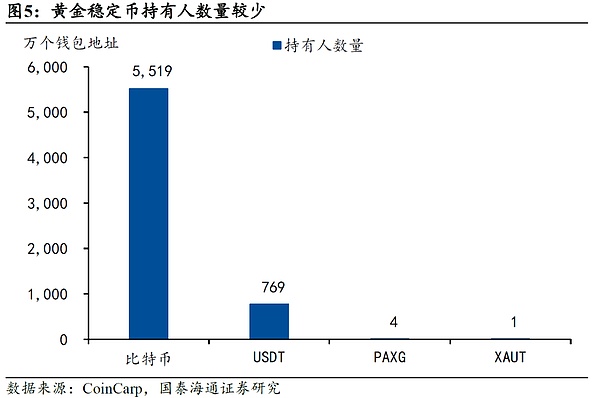

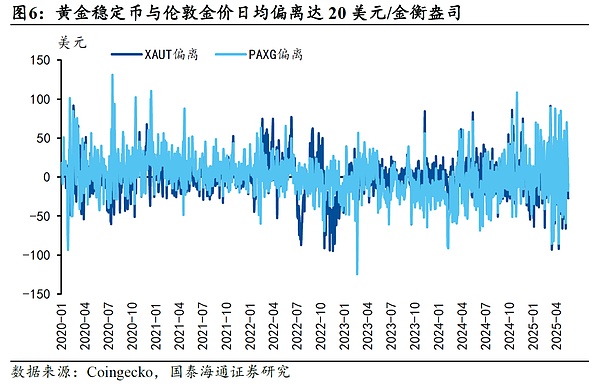

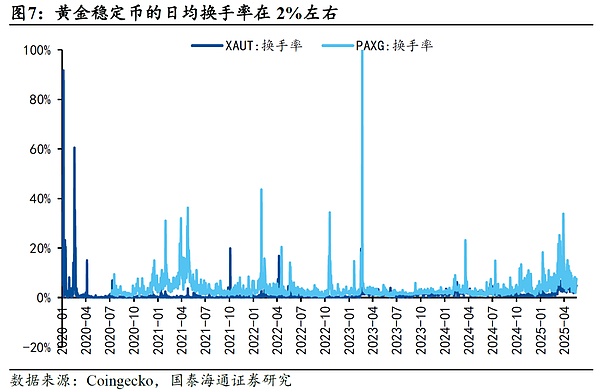

Second, gold stablecoins have not demonstrated their expected value stability attribute.The extremely low number of gold stablecoin holders has resulted in low trading turnover, shallow market depth, and high deviation from London gold prices.

Third, the credit verification issue of gold stablecoins contradicts the blockchain's pursuit of decentralization and trustlessness.Regulatory frameworks for asset-backed stablecoins remain lagging, with US and Hong Kong stablecoin laws only covering fiat stablecoins, leaving gold stablecoins facing regulatory uncertainty, which is a key reason for investors' cautious attitude.

However, if the mechanism improves, gold stablecoins can still serve the function of value storage and payment and settlement functions under specific conditions.

Risk Warning:Significant deviation of gold stablecoins from current gold prices poses legal compliance risks for investors and issuers.

[The rest of the translation follows the same pattern, maintaining the structure and translating all text while preserving the <> tags.]Third, there are credit verification issues with gold stablecoins.The gold reserves owned by the issuer are the value guarantee of gold stablecoins, which requires centralized custody institutions and audit agencies for storage and verification. For example, in 2022, PAXG was questioned about its token issuance far exceeding the gold reserves owned by the issuer, triggering a redemption wave. Currently, the regulatory framework for physical-backed stablecoins is still lagging, with stablecoin laws passed in the United States and Hong Kong only covering fiat stablecoins, leaving gold stablecoins facing uncertain compliance, which is also an important reason for investors' cautious attitude.

However, if the mechanism is improved, gold stablecoins can still perform the function of value storage and payment and settlement functions under specific conditions.

IV. Risk Warning

Gold stablecoins significantly deviating from the current gold price pose legal compliance risks for investors and issuers.