Author: Coingecko

Translated by: Felix, PANews

Liquidity has become a key indicator for crypto assets, affecting not only trading convenience but also volatility, slippage, and institutional attractiveness. As exchanges raise listing standards and market makers provide foundational depth, liquidity signifies an asset's maturity and readiness for large capital inflows.

This report explores the trading depth of major centralized crypto exchanges, focusing on narrow price ranges to reveal the capital scale needed to drive market fluctuations. The report aims to provide a clearer and more intuitive liquidity view for ordinary traders in today's rapidly evolving crypto field.

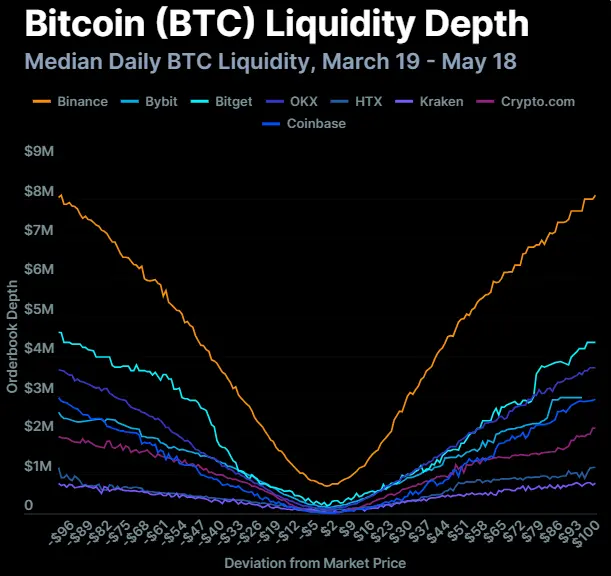

1. Binance leads in BTC liquidity at all depth levels, with bilateral (buy and sell) depth of around $8 million within a +/- $100 price range, ahead of Bitget and OKX.

During the research period, the median bilateral depth of eight selected exchanges in the BTC market price +/- $100 range was between $20 million and $25 million. Almost all exchanges showed a steady upward trend in liquidity, indicating liquidity at various depth levels.

Binance accounts for about 32% of this liquidity, with buy and sell depths of around $8 million. Following are Bitget at about $4.6 million and OKX at about $3.7 million. Meanwhile, HTX and Kraken are typically the exchanges with the worst BTC liquidity.

Within a +/- $10 range, only Binance has bilateral liquidity exceeding $1 million. Bybit, Bitget, OKX, HTX, and Crypto.com have liquidity between $100,000 and $500,000, while Kraken and Coinbase have liquidity of around $100,000 or lower.

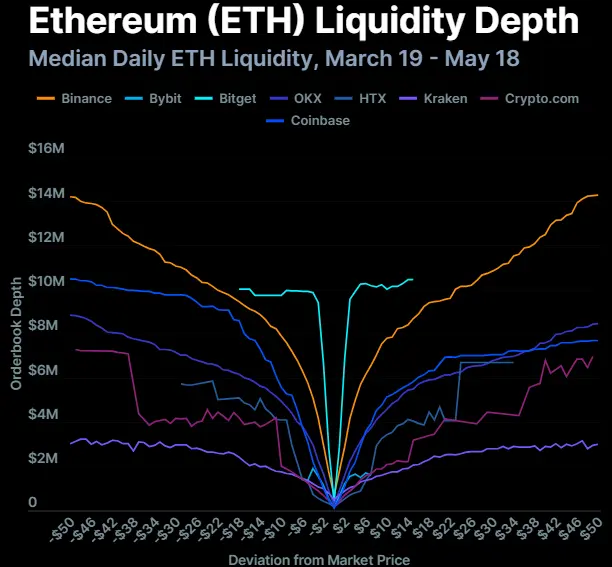

2. Within a +/- $15 range, Bitget surpasses Binance to become the leading ETH liquidity provider, though Binance dominates in broader price ranges.

ETH's liquidity depth median is $15 million to $16 million, with depth range around +/- $2 in the 0.1% liquidity interval. In the same 0.1% range (BTC at +/- $100), its liquidity is about 60% to 70% of BTC's.

Within a +/- $2 range, Bitget is the strongest ETH liquidity exchange, followed by Binance and OKX. However, Bitget's ETH liquidity gradually weakens beyond this range. The liquidity of eight exchanges is quite healthy within the +/- $2 range. Six platforms have liquidity of around $1 million or more, with even the smallest platform (HTX) reaching $430,000.

In a larger range of +/- $50 (about 2%) from the market price, Binance still provides more liquidity, though its ETH advantage is smaller compared to BTC. Binance's ETH liquidity share is 25%, compared to 32% for BTC.

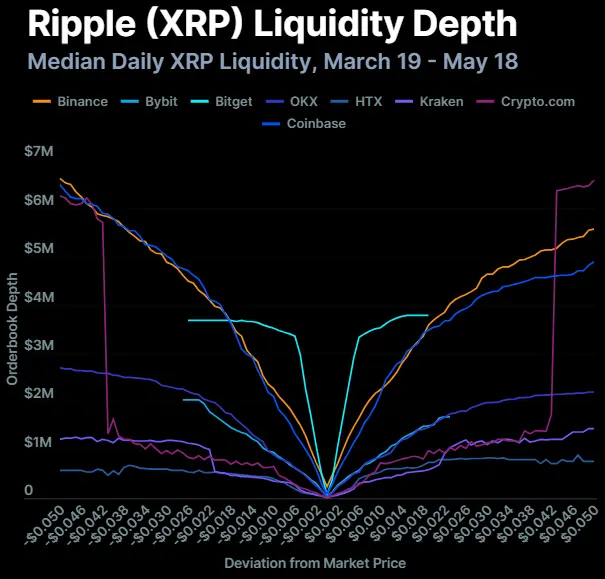

3. XRP liquidity is concentrated in Bitget, Binance, and Coinbase, controlling about 67% of the share; lagging behind SOL in both liquidity and trading volume.

Within a +/- $0.02 depth range (about 1.0%), XRP's unilateral liquidity across eight exchanges is about $15 million.

Bitget dominates within a +/- $0.006 range (about 0.3%) but quickly loses its advantage. Within a +/- $0.02 range (about 1.0%), Binance and Coinbase have caught up in liquidity. These three exchanges occupy nearly two-thirds (about 67%) of the liquidity in this range.

Despite XRP's much higher market cap, its cumulative liquidity across eight exchanges within a +/- 2% depth range is lower than SOL's. This is also reflected in trading volume statistics, with SOL's trading volume being almost twice that of XRP during the research period.

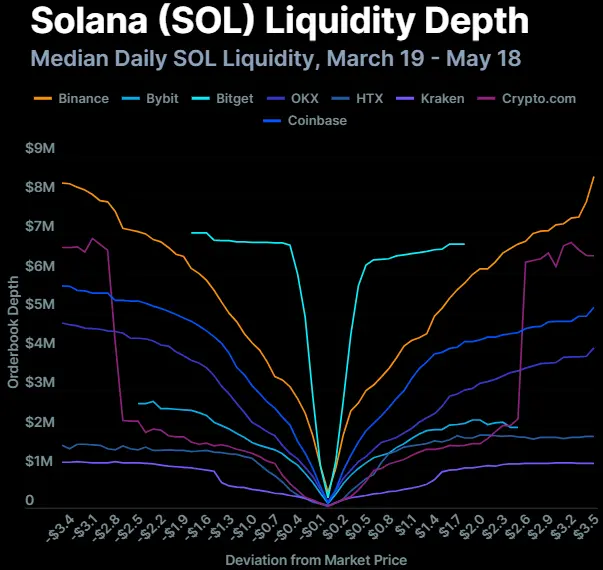

4. SOL's order book holds about 60% of ETH liquidity within a +/- 2% depth range, showing significant depth in a narrow +/- $1 range.

Within a +/- $1 range (about 0.6%), SOL has about $20 million liquidity on each side across eight exchanges, indicating overall good liquidity.

In this interval, Bitget occupies about 32% of liquidity share, followed by Binance at about 20%. Only Kraken has unilateral depth below $1 million, with unilateral liquidity of about $480,000.

Beyond the +/- $1 range, Binance again demonstrates its liquidity advantage, continuing to rise steadily with increasing distance from the market price. At the +/- $2.5 range (about 1.6%), Crypto.com's depth shows a significant leap. However, for smaller coins like SOL, liquidity so far from the market price is less meaningful for ordinary traders. Additionally, liquidity for six other exchanges gradually decreases after the +/- $1.5 level.

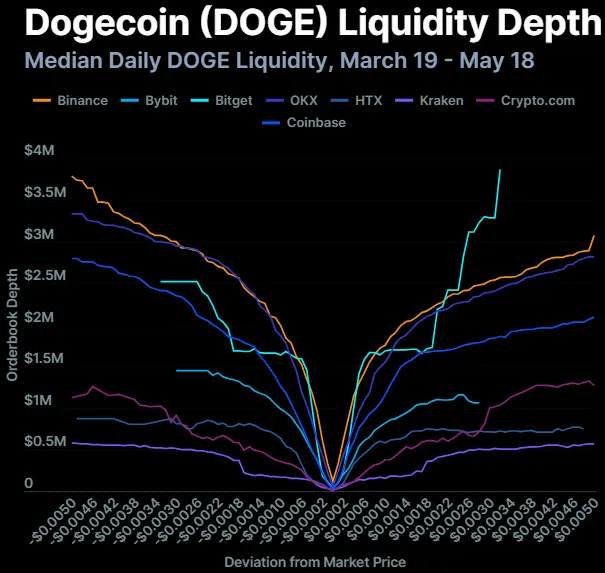

5. DOGE liquidity remains balanced within a +/- 2% range, closely surrounding the market price.

DOGE's liquidity situation is distinctly different from other tokens, perhaps because it is a meme token.

In more exchanges, liquidity closer to the market price is notably deeper. Bitget, Binance, OKX, and Coinbase have roughly equivalent liquidity within a +/- $0.001 range (about 0.5%), with unilateral liquidity between $1 million and $1.7 million.

Dogecoin's liquidity curves on Binance, Coinbase, Bitget, and Crypto.com are relatively steep, indicating consistent liquidity across depth levels. This may suggest the presence of market makers but also indicates more speculative limit/stop-loss orders from traders.

At the +/- 2% depth level, Dogecoin's cumulative unilateral liquidity across all eight exchanges is about $10 million to $12 million, approximately half the liquidity of XRP at the same depth level. Considering the relative market cap of XRP and Dogecoin, this situation is particularly healthy.