A 200% surge in five minutes! Just around six this morning (27th), the decentralized perpetual contract platform Hyperliquid staged a short squeeze on the XPL token. This "flash harvest" once again highlights how the market is precisely manipulated by capital when high leverage and thin liquidity are combined.

How whale ignited the market: A single $16 million transaction triggered a rally

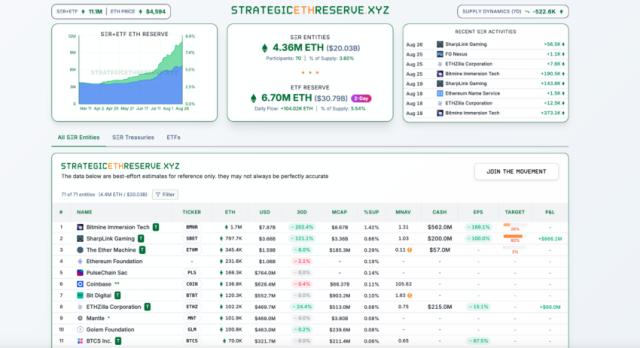

It's understood that wallet address 0xb9c0 first deposited $16 million in USDC into Hyperliquid, then used 3x leverage to open a long position on millions of XPL. Due to the platform's limited liquidity, the continuous influx of large market orders immediately drained away sell orders, driving the XPL price from around $0.60 to $1.80. The whale actions were fully documented by on-chain data, and one analyst described them as follows:

This trader wants to "clear out the entire order book and squeeze out all the short orders"

High leverage + thin liquidity: a structural gap that leads to short-term bank runs

While Hyperliquid only offers up to 3x leverage for small-cap tokens, it can still trigger exponential fluctuations in trading pairs with thin liquidity. When whale increase their positions, their buy orders far exceed the platform's order book, passively driving up prices and rapidly eroding short margins. Automatic liquidation by the system creates secondary buying pressure, leading to a short squeeze.

According to ChainCatcher statistics, in just over ten minutes, XPL short positions exceeded US$38 million, which also gave the whale a second boost.

The Pros and Cons of Liquidation Cascades: Whale Profit, Retail Investors Bear the Expense

The dominant whale(0xb9c0) liquidated its positions in batches at the peak, locking in approximately $14 million in profits. On-chain data also revealed that several other wallets copied the operation, bringing their combined profits to nearly $38 million within an hour.

In contrast, most short or hedging users suffered heavy losses. One user revealed that he only used 1x leverage to hedge 10% of his position, but was still forced to close his position within minutes, losing $2.5 million on his account.

Decentralized derivatives are still a high-pressure testing ground

This incident raises a familiar question for Hyperliquid and similar platforms: how to maintain high efficiency and leverage while preventing malicious price manipulation? Market participants are calling for stronger incentive mechanisms, adjustments to margin call thresholds, and the introduction of dynamic transaction fees to reduce the possibility of a single wallet hoarding liquidity.

For investors seeking to capture volatility, the XPL market's endgame leaves support at $1.20-$1.40 and resistance at $1.80, serving as a reminder that at the intersection of high leverage and low liquidity, risk always precedes reward. While no one can accurately predict when the next short-term run will occur, the event once again demonstrates that adequate risk assessment and strict position management are the keys to survival.