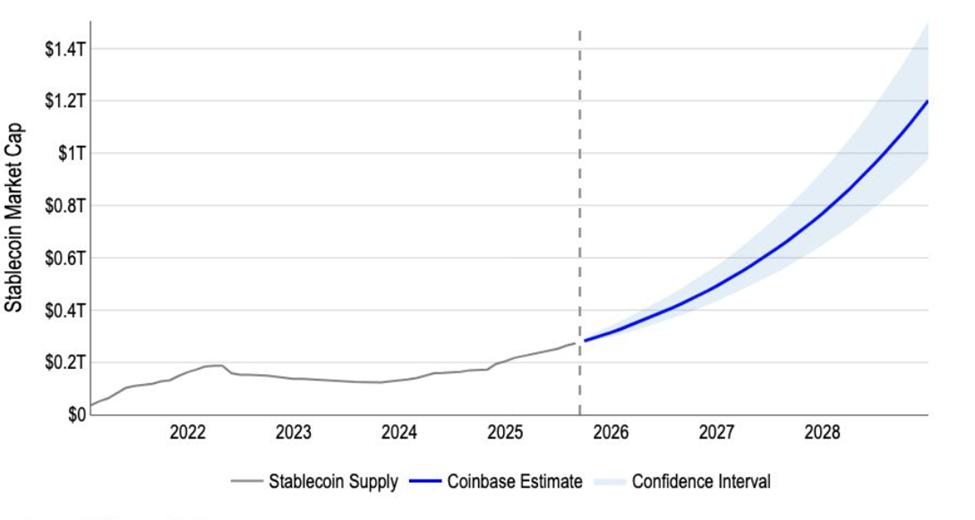

New forecast from Coinbase suggests the stablecoin sector could grow to $1.2 trillion by 2028.

However, this explosive growth raises questions about the spillover effects on US Treasury yields and global liquidation .

Coinbase Predicts $1.2 Trillion Stablecoin Market by 2028

The forecast comes as the stablecoin market increasingly becomes one of the most important battlegrounds in global finance.

David Duong, Head of Research at Coinbase, presented the company's methodology, which uses 20,000 Monte Carlo simulations based on autoregressive (AR(1)) processes to forecast growth.

Based on the group's findings, stablecoins could jump from their current market Capital of $275 billion to $1.2 trillion in just three years.

“This is not a ‘random’ forecast… An increase from $275 billion today to $1.2 trillion implies about $925 billion in net US Treasury issuance over about 175 weeks — or about $5.3 billion per week,” Duong explained .

Beyond underscoring the popularity of stablecoins, such a roadmap demonstrates their growing Vai in shaping global financial stability.

Coinbase Stablecoin Forecast. Source: David Duong on LinkedIn

Coinbase Stablecoin Forecast. Source: David Duong on LinkedInExperts react to expected pressure on Treasury yields

Coinbase's model shows that a $3.5 billion inflow into stablecoins could reduce three-month Treasury yields by two basis points (bps) within 10 business days and up to four bps within 20 business days.

This is because stablecoin issuers (like Circle and Tether) typically use a large portion of their reserves to purchase short-term US Treasury bonds like 3-month notes to earn yield while maintaining high liquidation and safety.

However, bond prices and yields move in opposite directions. As stablecoin issuers buy more bonds, prices rise, but yields fall.

While these effects may dissipate within weeks, the structural impacts are significant. However, Duong clarified that the response is not exponential.

“It’s important to note that the reaction is tapering — the effects don’t add up indefinitely. Trillions of dollars in money market funds could reallocate between bonds and the Fed’s overnight reverse repo facility, effectively setting a floor for overnight rates,” he added.

While Coinbase CEO sees stablecoins as a threat to US Treasury bonds, Treasury Secretary Scott Bessent has a different view.

According to Bessent, stablecoins could help increase demand for US Treasury bonds. He said the cryptocurrency industry will become a major buyer of bonds in the coming years. Bessent's prediction is based on Washington's efforts to bolster demand for new US government debt .

“Bessent has signaled to Wall Street that he expects stablecoins, digital Token backed by high-quality securities such as Treasury bonds, to become a significant source of demand for US government bonds,” the Financial Times reported , citing people familiar with the matter.

Market experts have weighed in on the forecast. Messari CEO Eric Turner pointed to current growth trends and noted that the $1.2 trillion estimate is reasonable.

“$1.2 trillion seems quite reasonable if not conservative, based on what we saw in 2025,” Turner wrote.

Similarly, Jordan Lawrence, CEO of Damisa, praised Coinbase’s use of simulation modeling and noted the importance of XEM the impact on yields alongside regulatory changes.

Meanwhile, RGG CEO Ben Lavi emphasized that stablecoin issuers must evolve beyond transaction utility to remain profitable. However, Lavi predicted that profit Chia with customers will become inevitable.

“For the Stablecoin market to reach $1 trillion, and even more, they will need to provide more than just trading capabilities. Ultimately, I predict that the ROI for Tether and Circle will be the same as it is today because they will need to Chia the ROI with their customers,” Lavi stated.

Between JPMorgan's Skepticism and the Treasury's Trillion-Dollar Optimism

Coinbase's forecast falls between more conservative and more aggressive forecasts. JPMorgan recently warned the market could only reach $500 billion by 2028 , due to limited adoption beyond crypto trading and DeFi.

Their report notes that 88% of stablecoin activity still takes place within crypto ecosystems, while only 6% involves real-world payments.

In contrast, the US Treasury and Standard Chartered are much more optimistic. The Treasury forecast sees a $2 trillion market by 2028 , driven by institutional adoption, Tokenize of financial assets , and commercial integration.

Standard Chartered also predicts the $2 trillion boom , fueled by new US legislation under the GENIUS and STABLE Acts , will impose stricter requirements on transparency and reserves.

Adding to the optimism, MEXC COO Tracy Jin predicts stablecoins could cross the $2 trillion mark as early as 2026.

In a statement to BeInCrypto, the crypto executive cited strong demand amid macroeconomic uncertainty and rapid growth in DeFi, cross-border payments, and digital asset trading.

Regardless of which forecast is correct, stablecoins are becoming a mainstay of modern finance. They have processed trillions of dollars in volume and dominate institutional crypto OTC trading , which now accounts for nearly 75% of activity.

Their expansion into payments, commerce networks, and Tokenize assets could further tie them into the global financial system.

However, even in the face of this growth, the road ahead is fraught with challenges. Italy’s economy minister has warned that US-backed stablecoins could challenge Europe’s monetary sovereignty.

“The current general attention is on the impact of trade tariffs. However, the new US policy on cryptocurrencies is even more dangerous, especially when it comes to dollar-denominated stablecoins,” Reuters reported , citing Giancarlo Giorgetti.

In this context, the accelerated push to launch a digital euro could hamper the development of US dollar-backed stablecoins.

The question is no longer whether stablecoins will scale, but how they will reshape financial markets. Coinbase’s $1.2 trillion roadmap is feasible and in line with the Treasury’s motivations.

However, policymakers say the challenge will be balancing innovation and stability as stablecoins evolve from niche cryptocurrency instruments to systemic financial instruments.

Will the market be closer to JPMorgan’s $500 billion, Coinbase’s $1.2 trillion, or the Treasury’s $2 trillion? Either way, the outcome will impact bond markets, banks, and regulators.