Ethereum dominance (ETH.D) hit 14.98% in August, marking its highest level since September 2024. The milestone coincided with the altcoin’s new record high of $4,946 yesterday.

Meanwhile, Bitcoin dominance (BTC.D) continues to decline. This difference in momentum has sparked notable predictions from analysts who predict major market changes ahead.

Bitcoin vs. Ethereum: Capital Movement Sparks Market Predictions

Data from BeInCrypto Markets shows that the second-largest cryptocurrency has outperformed the first over the past month. Bitcoin’s value has fallen by 5% over the past 30 days.

Meanwhile, Ethereum has increased by 23.4%. Moreover, Ethereum dominance has also increased since July, while BTC.D has gone in the opposite direction. In fact, yesterday, ETH.D reached a yearly high of 14.98%.

At the time of writing, it has corrected to 14.54%. Meanwhile, BTC.D is recorded at 58.2%, the lowest point since January 2025.

ETH.D vs. BTC.D Performance. Source: TradingView

ETH.D vs. BTC.D Performance. Source: TradingViewThis dynamic underscores the growing trend of Capital turnover. The buying trend of “whales” further proves this.

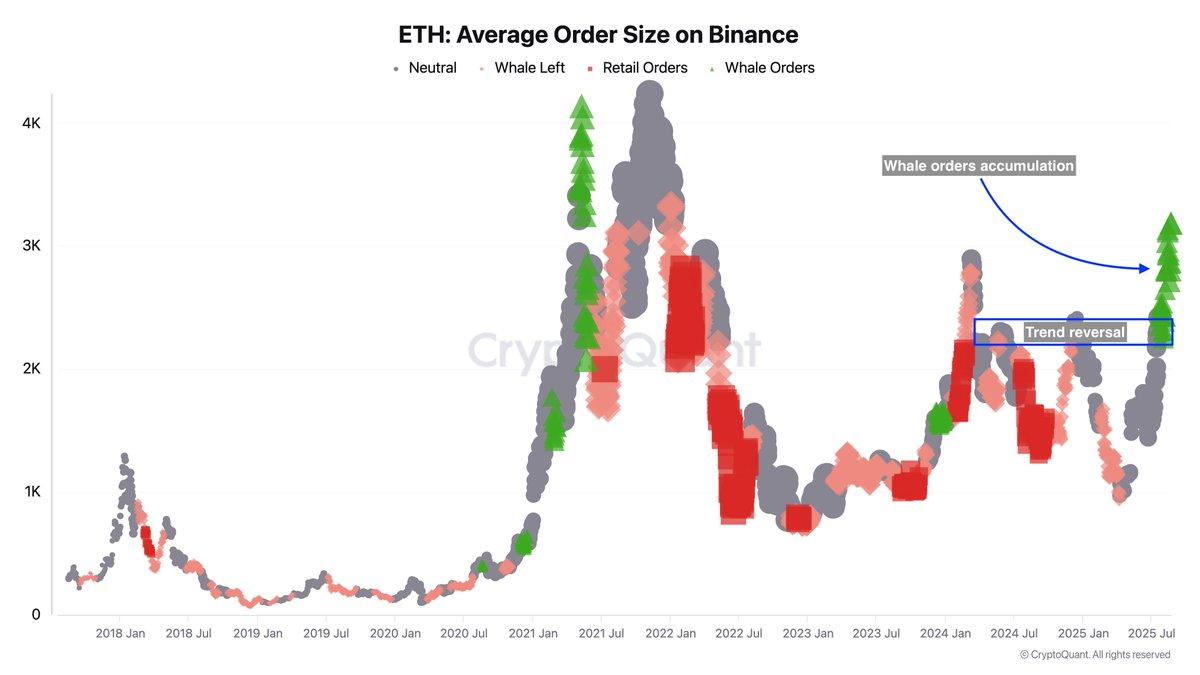

In a recent post on X (formerly Twitter), a crypto analyst highlighted that since July, whales on Binance have been consistently buying ETH through spot orders and Futures Contract.

“Whales act differently and usually like to enter positions after a positive trend has been clearly confirmed, which can be clearly seen here as these orders only started after the trend reversed. This strong accumulation is therefore bullish and could potentially provide enough momentum to push ETH to $5,000,” Darkfost said.

Whales are accumulating Ethereum. Source: X/Darkfost_Coc

Whales are accumulating Ethereum. Source: X/Darkfost_CocMeanwhile, BeInCrypto also reported that some old Bitcoin wallets are switching positions and selling their long-term BTC holdings in favor of Ethereum . And it's not just retail investors. Institutional preference for ETH is also quite noticeable.

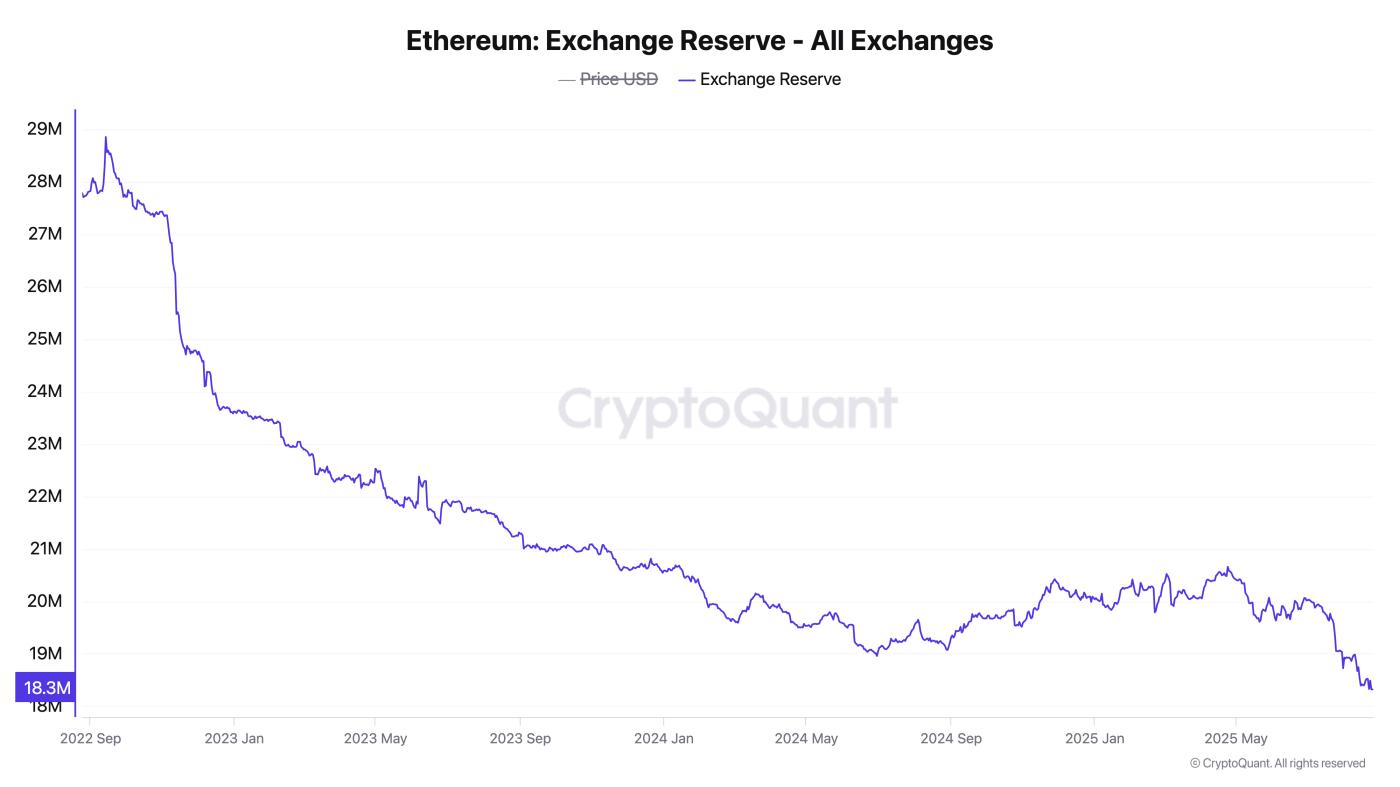

Public companies have increased their exposure to Ethereum, spending billions of dollars to buy ETH. Furthermore, ETH balances on exchanges have dropped to a new low of 18.3 million.

Ethereum supply on exchanges. Source: CryptoQuant

Ethereum supply on exchanges. Source: CryptoQuantThis decline suggests that investors are holding rather than selling, a behavior typically associated with confidence in future price increases.

“Ethereum supply shock loading,” said analyst Ted Pillows.

Amid these conditions, some analysts suggest that the rotation of Capital from Bitcoin to Ethereum could extend to altcoins, extending the market bull run .

“Every Alt cycle starts the same way: Bitcoin shows fatigue. Ethereum wakes up. Big rotation happens,” one analyst posted .

Meanwhile, Benjamin Cowen, CEO and founder of Into The Cryptoverse, previously predicted that after Ethereum hit record highs, Bitcoin could make a comeback.

“However, the rotation back to BTC will likely be initiated by a BTC correction in September and will continue in a BTC rally in October,” Cowen mentioned.

While Followin_X9nTd2’s predictions may differ, the outlook remains largely bullish. However, it remains to be XEM whether other altcoins or Bitcoin will be the main beneficiaries in the future.