Bitcoin is facing volatile market conditions as its price struggles to recover from the $112,500 level. At the time of writing, BTC is trading at $112,425, just above the key support level.

Despite the continued volatility, investor sentiment remains quite bullish. What drives this optimism is not price growth, but market behavior.

Bitcoin Profits Fall

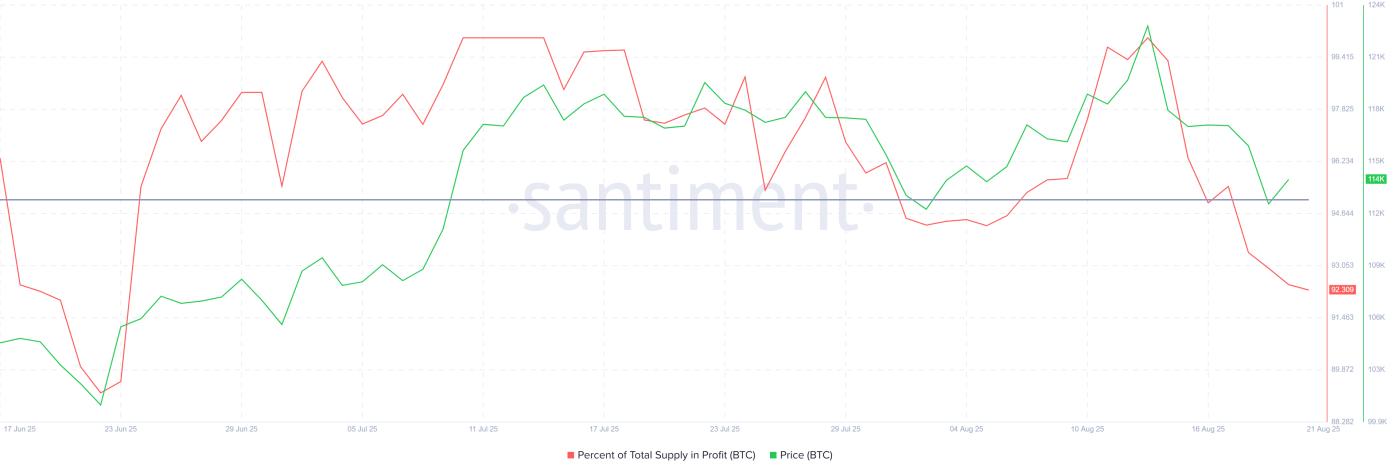

Bitcoin’s profit margins have plummeted in the past week, hitting a two-month low. The price drop has pushed many addresses out of profit, reducing their total realized profits. Such price drops typically occur after a market overheats, which may have marked the recent market top.

History shows that when 95% of supply is in profit, a market top is formed, making the possibility of a reversal high. Investors tend to take profits at these levels, leading to short-term corrections. This behavior, while predictable, is challenging for those expecting prices to continue rising.

Want more information about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Bitcoin Supply in Profit. Source: Santiment

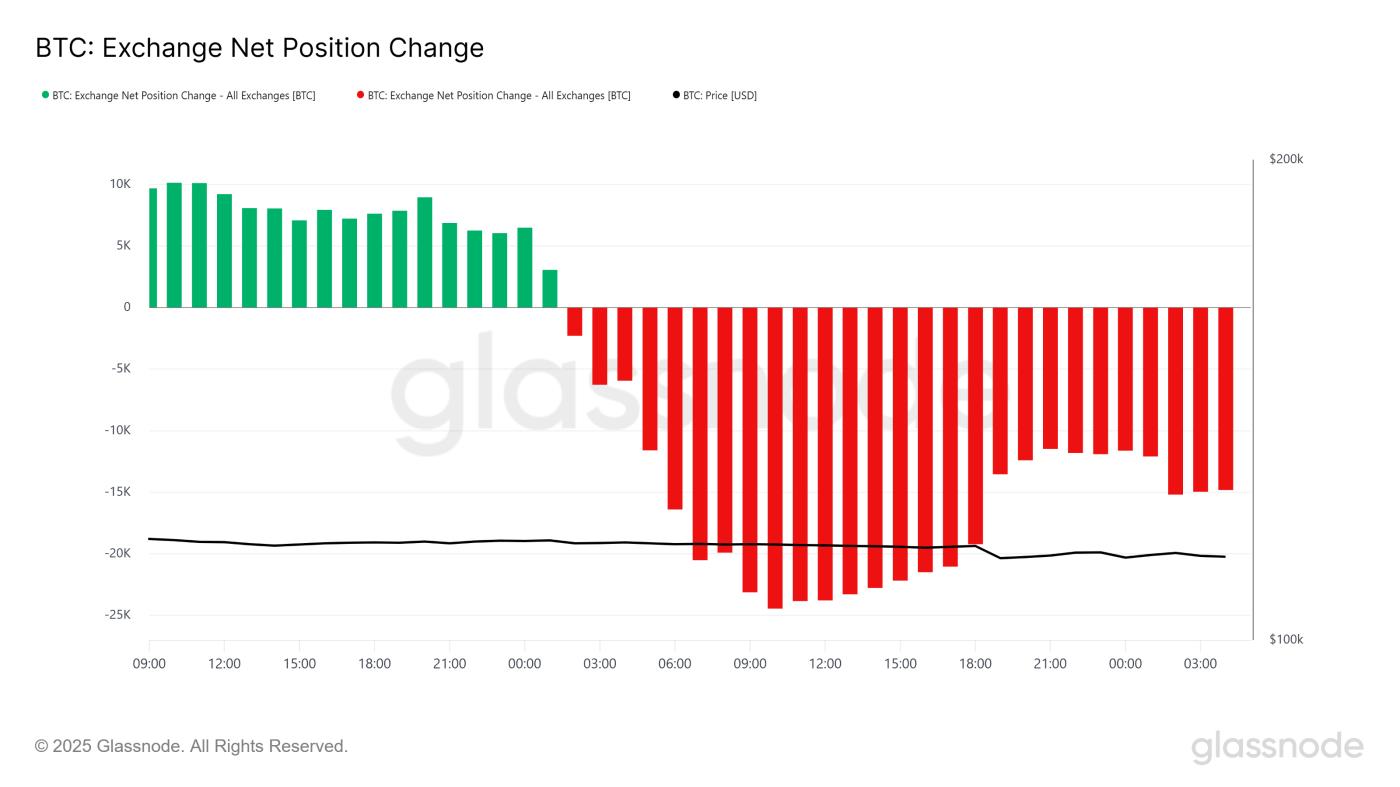

Bitcoin Supply in Profit. Source: SantimentDespite the drop in profits, investor behavior shows resilience. According to on-chain data, over 11,890 BTC were withdrawn from exchanges in the past 24 hours. This trend suggests accumulation, with holders expecting a recovery.

The change in net position on exchanges shows a steady outflow, even as prices fall. Former sellers are now turning into buyers, indicating a change in strategy. These moves indicate confidence in the long-term value of Bitcoin , despite short-term headwinds to profits.

Bitcoin exchange net position data. Source: Glassnode

Bitcoin exchange net position data. Source: GlassnodeBTC price maintains support

Bitcoin's current price is $112,425, closely following the $112,500 support level. This area has held since early August 2025, providing an important cushion against deeper losses. Currently, the price action suggests consolidation rather than a breakdown.

Based on current sentiment and net accumulation, Bitcoin could see a rally to $115,000. If buying pressure increases and macro support builds, BTC could stabilize above this resistance. Otherwise, it could continue to trade sideways between $112,500 and $115,000 until clarity returns.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewHowever, if accumulation slows and selling continues, Bitcoin could fall to $110,000. Such a deep move would mark a near two-month Dip and could expose BTC to increased downside risk.