In the third quarter of 2025, the digital asset market was caught in a tug-of-war between the macroeconomic environment and capital flows. Fluctuations in inflation and interest rate policies, massive capital inflows and short-term profit-taking, and risk-averse signals from the derivatives market all shaped the price trajectory of BTC and ETH.

Macroeconomic environment: a tug-of-war between easing expectations and uncertainty

Recent US inflation data has become a market focus. July's CPI remained steady at 2.7% year-on-year, below the expected 2.8%. The core CPI rose to 3.1% year-on-year, up 0.3% month-on-month, indicating that inflationary pressures are gradually easing. This trend reinforces expectations of a September Federal Reserve rate cut, with federal funds futures implying a probability exceeding 80%. Meanwhile, the growth rate of broad money (M2) in major economies worldwide has continued to rebound. An indicator tracking eight countries has risen 5% since April and maintains a high correlation of 0.9 with the Bitcoin price. Ample liquidity and potential monetary easing support the medium- to long-term performance of risky assets.

However, some data points have also prompted market caution. The PPI surged 0.9% month-over-month in July (far exceeding expectations of a 0.2% increase), bringing the year-over-year increase to 3.3%. The core PPI also rose beyond expectations, suggesting significant wholesale inflationary pressures. This has fueled market concerns that the Federal Reserve may maintain high interest rates for longer, a sentiment reinforced by strong employment data (initial jobless claims were only 224,000). The coexistence of both positive and negative macroeconomic factors has ultimately led to increased short-term market volatility.

Capital flows: Institutional buying and profit-taking intertwined

Funding dynamics are a key factor supporting the rise of digital assets. CoinShares data shows that digital asset investment products saw a record-breaking $4.39 billion in net inflows in mid-July, bringing the industry's total assets under management to $220 billion. Ethereum, in particular, has seen record-breaking inflows of $2.12 billion in recent months, bringing the cumulative inflow to $6.2 billion in 2025 to over $1.2 billion, already exceeding last year's total.

Driving capital inflows is not only the expectation of easing, but also favorable policies and institutional factors. US President Trump signed an executive order allowing 401(k) retirement plans to invest in digital assets, potentially unlocking $8.7 trillion in capital. Wall Street giants like BlackRock are actively increasing their investments, with the iShares BTC Trust now holding $10 billion. The spot ETH ETF saw net subscriptions for eight consecutive days in early August, with daily inflows exceeding $1 billion, driving ETH prices to a new high for the year. Meanwhile, the number of BTC held by listed companies worldwide is rapidly increasing, with Japan's Metaplanet purchasing 775 BTC in one go being a prime example.

However, the market is also showing signs of short-term profit-taking after its strong gains. Since mid-August, ETH ETFs have seen net outflows of approximately $197 million, and BTC has also experienced a slight pullback. Despite this, large inflows of stablecoins into exchanges (as high as $1.8 billion in a single day) suggest that institutions and whales are still buying on dips. Overall, the main theme of the funding cycle remains "continued influx of incremental funds."

Derivatives market: a differentiated pattern of short-term bearish and long-term bullish trends

The options and futures markets reveal mixed investor sentiment. BTC's 30-day implied volatility rose to 35%, significantly higher than the historical volatility of 25%, indicating investors are willing to pay a premium to hedge future risk. The 25-Delta skew indicator for options jumped to +11%, indicating significant downside protection buying, reflecting concerns about a short-term correction.

Sentiment on ETH is more volatile. In early August, driven by positive ETF activity, short-term options briefly exhibited a strong bullish bias, with risk reversals rapidly turning positive from -11% to +4.8%. However, with a rapid price correction, short-term sentiment reverted to bearishness, reflecting a retreat in speculative buying. However, the bullish bias in long-term maturities persists, demonstrating investor confidence in ETH's long-term prospects.

In the futures market, BTC perpetual contract funding rates turned negative after hitting a record high, indicating a cooling of bullish sentiment. However, the annualized premium for three-month futures contracts remained in the 6%-7% range. ETH even experienced an inverted premium, demonstrating strong bullish momentum. The overall trend is "short-short, long-term bullish": short-term safe-haven demand is strong, but long-term optimism persists.

On-chain data: Long-term funds continue to flow in

On-chain indicators show that the concentration of chips is increasing among long-term holders. Over 92% of new BTC has been absorbed by wallets that have held it for more than 155 days. The BTC balance on exchanges has dropped to 2.903 million, representing 14.6% of the total, a multi-year low. In other words, the available chips for sale are decreasing, and selling pressure is declining.

On-chain activity on ETH also reached new highs, with average daily transactions exceeding 1.5 million and active addresses approaching 600,000. Importantly, gas fees remain moderate, indicating that the increased activity stems from robust demand rather than speculation. Institutional capital is rapidly entering the market, pushing ETH's TVL to $97 billion, a 2021 high. ETH's low inflation, even deflationary, supply chain, coupled with continued capital inflows, has significantly improved its supply and demand structure.

Stablecoin flows also provide sentiment signals. Before BTC hit $124,000 in August, exchanges recorded large inflows of stablecoins, a key precursor to rising prices. This logic has been validated again, suggesting that stablecoin movements should continue to be monitored as a forward-looking indicator in the future.

Investment strategy: using structured products to smooth returns

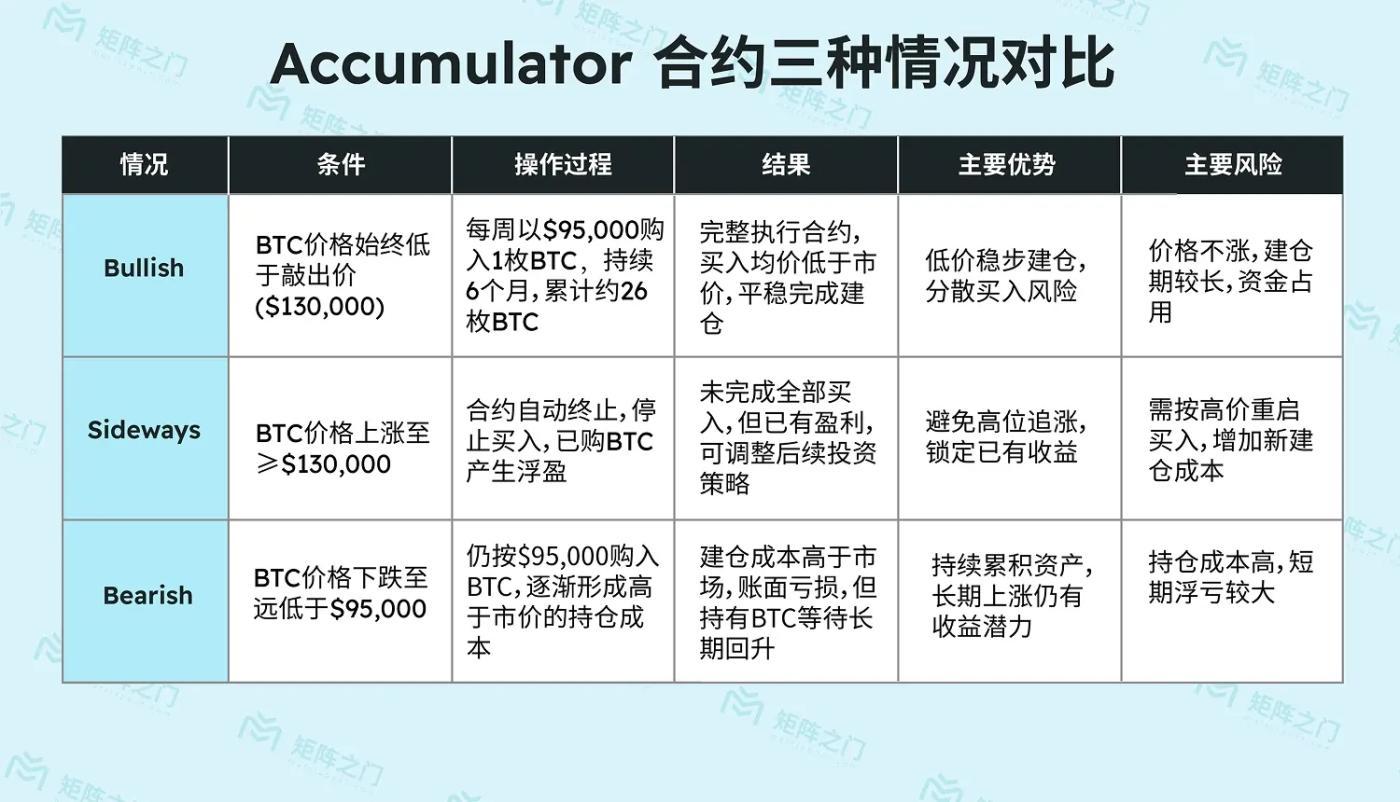

Driven by multiple factors, including the macro environment, liquidity, derivatives markets, and on-chain data, BTC and ETH prices are likely to remain within a wide range of fluctuations. We believe investors should avoid relying solely on a single directional bias and instead flexibly utilize structured products to optimize their strategies, combining their own market perspectives and risk appetite. The Matrixport platform offers a variety of tools (such as the Accumulator, Decumulator, and Daily Dual Currency) to achieve a balanced approach in various market conditions.

In an era of both volatility and opportunity, only those who effectively utilize tools can seize opportunities. Amidst the current macroeconomic environment and market sentiment, crypto assets are experiencing high volatility, requiring investors to strike a balance between opportunity and risk. A robust approach is to hedge against volatility and optimize capital utilization through structured products. For Matrixport clients, these structured tools are not a single option, but rather a suite of strategic modules that can be applied in combination. By judiciously combining different products, investors can achieve both excess returns during market upturns and steady income growth during periods of volatility or corrections, achieving a balanced portfolio. Risk management is crucial throughout this process: controlling individual exposures, clarifying asset allocation targets, and operating under the guidance of a professional team ensure a balanced balance between returns and security.

By Daniel Yu, Head of Asset Management (This article represents the author's personal views only)