When market information pours in at an explosive rate, and projects continuously release news to encourage output and expand their influence, it's often difficult to discern truth from falsehood, and even more difficult to resist the onslaught of FOMO (fear of missing out). The media's hype, whether it's the hype surrounding "get-rich-quick" stories or the amplification of market panic, subtly irritates our nerves and keeps us on the brink of trading . And every promotional outreach and advertisement from those highly regarded influencers (KOLs) can be the final straw that breaks our rational defenses, pushing us into the abyss of emotional trading. These emotionally driven trading behaviors ultimately lead to phenomena like "chasing the market up and selling the market down," "frequent trading," and "excessive speculation."

This manual is based on everyone's general trading psychology, combined with traditional financial empirical data and encryption industry data, to help everyone avoid irrational decision-making and use strategies to restrain human weaknesses.

Please feel free to find your seat!

1. "I sold it again. Do you want to buy it back?"

"I sold out again!" This is a regretful sigh every trader has uttered at some point. When Bitcoin surged from $70,000 to an all-time high of $100,000, and when Ethereum soared from $3,000 to $4,500, how many traders sold early in the market's momentum? This was often followed by an even more dangerous thought: "Should I buy it back immediately?" This FOMO (fear of missing out) is the culprit behind ineffective trades and profit erosion.

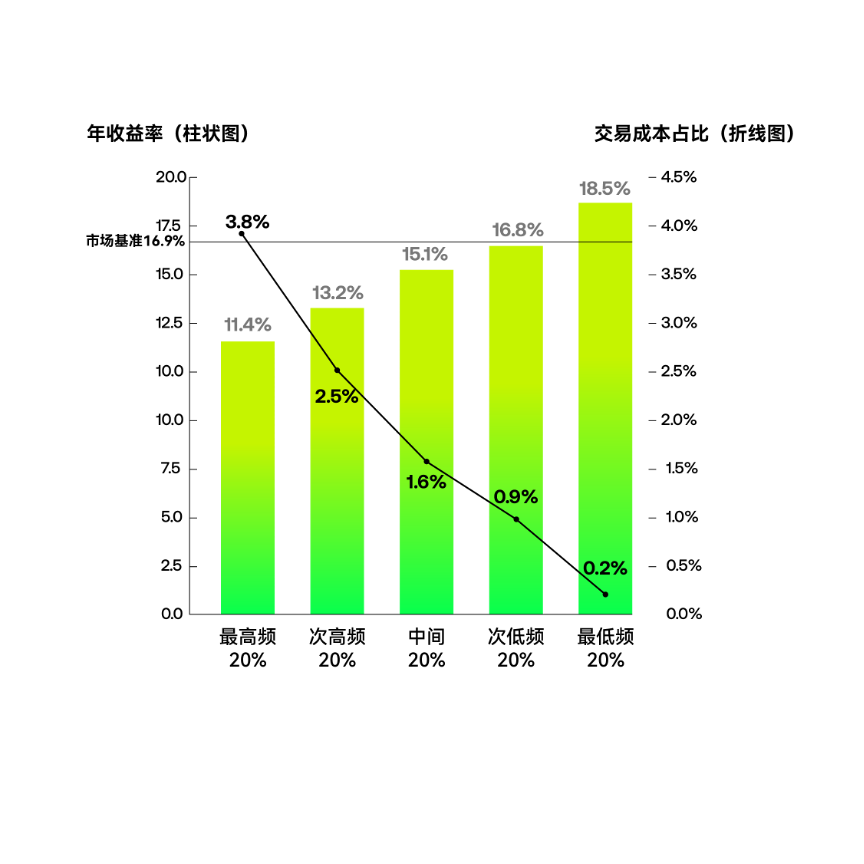

Data Insights: This data, based on a study of the trading frequency of individual investors in traditional finance, analyzes the differences in returns and transaction costs among users with different trading frequencies. The 20% user group with the lowest trading frequency achieved an annualized return of 18.5%, outperforming not only all other groups but also the market benchmark of 16.9%. In contrast, the highest-frequency trading group, after incurring a high transaction cost of 3.8%, ultimately achieved a return of only 11.4%, significantly underperforming the market.

Comparison of yield and cost ratio under different trading frequencies

In-depth Analysis: Excessive trading can significantly reduce overall returns, resulting from missing out on a few key up days. Over the long term, holding mainstream assets like Bitcoin for many years often yields strong returns, while frequent trading can actually undermine profits. This suggests that "fly-forward selling" is more often a strategic error driven by psychological factors.

In the long game of trading, less action is often better than more. We try to capture every tiny "wave" through frequent operations, but ultimately we miss the grand "tide" of asset value growth and ruthlessly "donate" the profits that should belong to us to the friction costs of the market.

Solution: Use discipline to overcome impulsiveness. If you're worried about missing out on the highs and the roller coaster ride, you can use tools like grid trading to set up batches of take-profit selling points.

Strategic recommendations:

1. When an asset is predicted to be in a volatile upward trend, a spot grid strategy automatically executes buy low and sell high within the preset "grid lines." This disciplined, automated trading allows for phased profit realization during an upward trend, continuously reducing holding costs. More importantly, it maintains a base position, ensuring you don't miss out on potential major uptrends. This fundamentally eliminates the regret of "selling too quickly" due to hesitation or errors in manual trading. The grid makes "passively harvesting swing profits" a reality.

2. Set a holding plan in advance. For example, define a strategy for responding to significant negative news, or reduce your position only when your target price is reached. Use data to drive your strategy and overcome emotional impulses.

2. “Should I go all in?”

"This opportunity is a once-in-a-lifetime opportunity. Others are fearful, but I'm greedy. It's time to go all in!" "Winning with a small investment is the key to success." "Investing heavily is the key to a comeback." This overconfidence, which infinitely magnifies a single opportunity, is the biggest source of risk that leads to a wiped-out account. The most important aspect of investment psychology is a fear of risk.

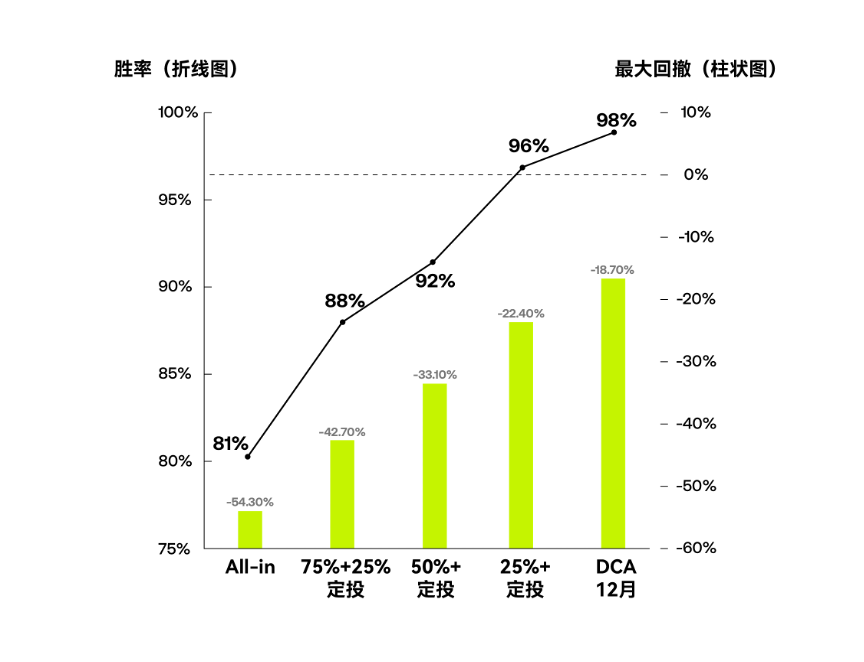

Data Insights: This data, based on comprehensive institutional simulations of long-term US stock data, analyzes the drawdown performance and trading win rates of different entry strategies in extreme market conditions. While the "All-in" strategy can achieve the highest returns in certain extreme situations, its corresponding "Maximum Drawdown" histogram also shows the highest value, reaching -54%, while its historical win rate curve is at a low point. Combining fixed investment with a DCA strategy maintains a more acceptable maximum drawdown and a more stable win rate.

Comparison of Position Building Strategy Performance: Maximum Drawdown and Win Rate

In-depth Analysis: The essence of going all-in is to risk a theoretically high return at the cost of an extremely low win rate, but this carries enormous risks that traders cannot afford. As Buffett said, the first principle of investing is "don't lose money." Any strategy that could result in a significant, permanent loss of principal should be out of the reach of any rational investment toolkit.

Solution: Use the art of “position management” to hedge the risk of “gambler’s mentality”.

Strategic recommendations:

1. The fixed investment tool compulsorily breaks down your trading plan. You invest a fixed amount at a fixed time. The OKX fixed investment feature allows you to set a price range for each fixed investment coin pair. Investments are executed only within this price range, continuously lowering your average cost during long market fluctuations. It compulsorily extends your trading behavior over a full timeframe, smoothing price fluctuations with the compounding effect of time. It's the most robust way to build a "core position" and mitigate the risk of All In.

2. Flexible use of mixed strategies: Strategies aren't necessarily one-or-the-other. You can divide your planned trading funds into two parts. For example, invest one portion all at once in assets currently priced reasonably, while the remaining portion is invested regularly on a weekly or monthly basis. When the market is bullish, you already have a certain position to benefit from the upside; if there's a short-term dip, you can continue to invest at lower prices, lowering your average cost.

3. Regardless of the method used, set a maximum drawdown ratio you can tolerate. For example, rather than investing all your tradable assets at once, reserve some funds as a backup. If a large loss occurs after a one-time investment, you can pause and switch to regular investments to cover your position and spread the cost, avoiding emotional increases in positions or stop-loss orders.

3. "I really can't help it, can you please come in?"

When a token goes viral in professional communities and spreads to your on-chain meme community, your go-to chat group, when group chats that have been dormant for three months become wildly active again, and when Google search indexes skyrocket, intense FOMO can easily swallow all rational thought. "Should I buy it?" the thought keeps popping up in your mind. However, historical data has repeatedly proven that the peak of enthusiasm is often the beginning of a crash.

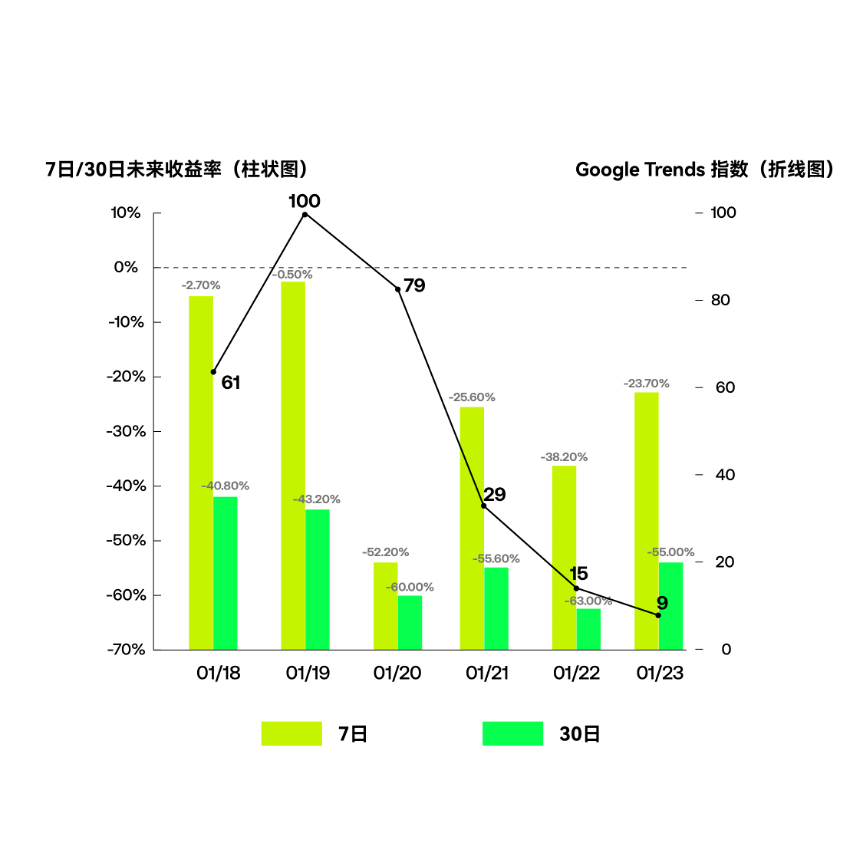

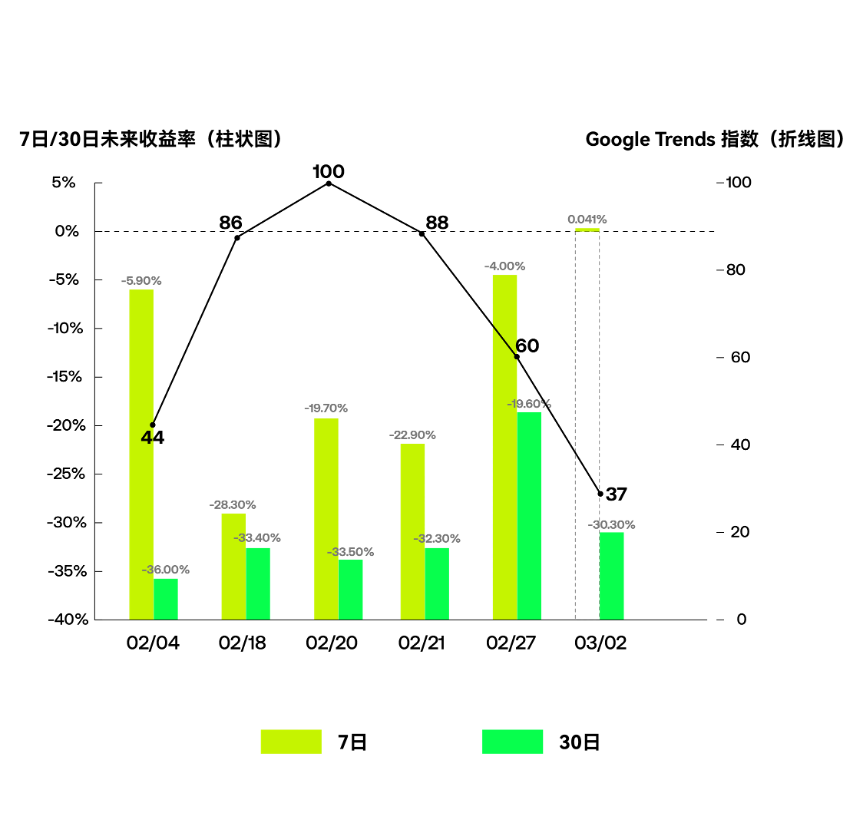

Data Insights: This data analysis examines the relationship between Google search interest in cryptocurrencies (using DOGE and TRUMP as examples) and the 7-day and 30-day returns following investor entry. A review of historical data for DOGE and TRUMP reveals that when their Google Trends popularity peaked at 100, their subsequent 7-day and 30-day forward returns were, without exception, significantly negative. Public sentiment fuels asset prices, but when it burns at its peak, it also signals its nearing exhaustion. When all potential buyers have entered the market, the market loses momentum, leaving only profit-taking and a stampede.

$DOGE Google Trends Index and 7-day/30-day Return Analysis

$TRUMP Google Trends Index and 7-day/30-day Return Analysis

Solution: Use strategies to mitigate the risk of chasing high prices

When it is judged that the market situation has not ended, how to enter the market is the key issue. It is necessary to prepare a set of scientific and risk-controlled follow-up operation plans.

Strategic recommendations:

1. Set objective warning levels for popularity indicators: Traders can monitor data such as Google Trends and Twitter discussion volume. When a coin's search index approaches a historical peak or social media sentiment is extremely optimistic, be cautious about chasing high prices.

2. Utilize a phased buy-in and take-profit/loss strategy: If you believe the market is surging but the trend may not yet have ended, employ a spot martingale strategy to control risk. The martingale strategy offers greater flexibility in cost management. Divide the funds you intend to buy into the rally into several portions, and buy back in each time the price drops by a fixed percentage. The core goal is to lower your holding costs. Also, set a stop-loss or take-profit level for each position you buy into. Once the appropriate sell point or expected profit ratio is reached, the martingale strategy automatically executes a sell.

3. If you're not interested in price per se, but rather the market opportunities created by hype, you can adopt a more robust "risk-neutral" strategy. When a coin is extremely popular, it typically signals strong bullish sentiment, leading to very attractive funding rates in the futures market. Using OKX's smart arbitrage, we can mitigate the risk of price fluctuations and earn the "rent" paid by market sentiment.

4. “Will this be another high point?”

The struggles of profit are no less painful than the pain of losses. There's the fear of "locking in profits" and the greed of "missing out on a billion." This balancing act of human nature often leads us to miss the best selling opportunities due to hesitation. In reality, human greed is often difficult to overcome, and manually liquidating all positions at the market's peak is nearly impossible.

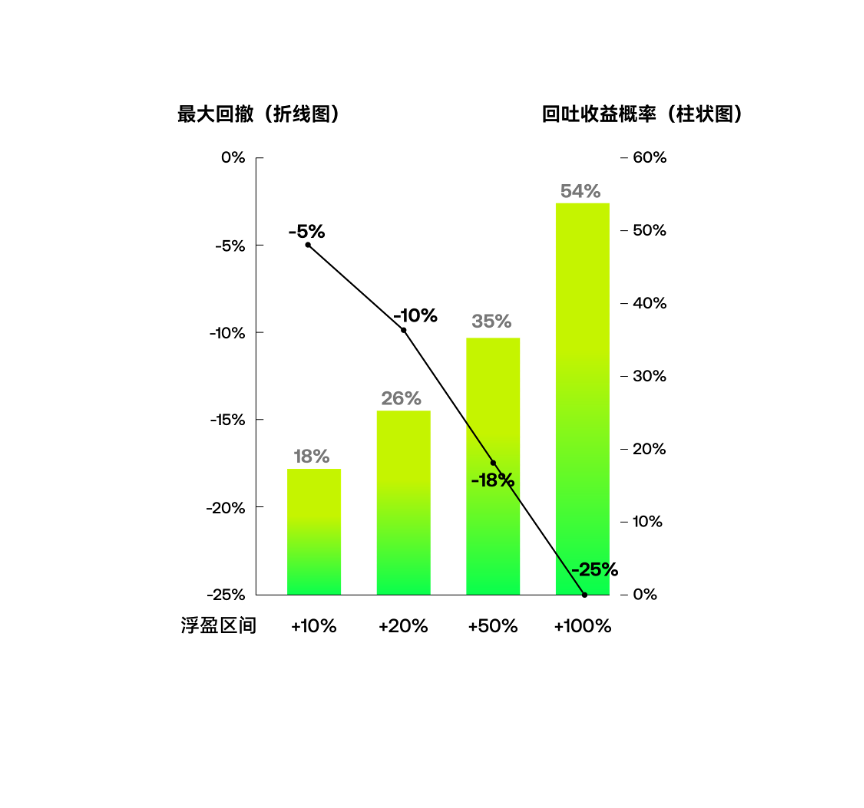

Data Insights: This data, based on behavioral finance research, analyzes and compares the relationship between average 30-day drawdowns and the probability of a profit drawdown exceeding 15% for various floating profit ranges. When a portfolio's floating profit exceeds +50%, the average maximum drawdown over the next 30 days reaches 25%, while the probability of a significant profit drawdown exceeding 15% rises sharply, reaching 54%. Classic behavioral finance research also points out that individual traders often sell too late due to greed, resulting in significant reductions in returns.

Future returns and drawdown risks in different floating profit ranges

In-depth analysis: When the risk-return ratio begins to become unfavorable, disciplined, phased profit-taking is the only way to transform "paper wealth" into real wealth.

The solution: Let a robot lock in profits for you. Manually taking profits is the ultimate test of human nature. Strategy tools perfectly enforce this discipline.

Strategic recommendations:

For the average trader, a more realistic and intelligent option is to abandon the obsession with selling at the peak and instead pursue selling at the relatively high end of a price range. Using automated strategies, you can gradually cash in profits. Instead of building a position, when prices enter a bubble or reach a profit target, you can employ an inverted pyramid selling strategy. This strategy involves selling larger portions each time as the price rises. For example, sell 10% at $100,000, 20% at $110,000, and 30% at $120,000. This approach ensures that the maximum position is sold at the peak.

5. “Wait until I get my money back before selling? Should I cut my losses?”

Loss aversion is a psychological bias ingrained in human nature. We prefer to endure the long-term pain of being stuck in a position to the short-term pain of admitting defeat by cutting our losses. However, data shows that for deeply trapped assets, time is often the poison, not the antidote. When facing losses, traders tend to hold onto their positions or increase their positions to spread the cost, rather than decisively cutting losses. This leads to a widespread phenomenon of holding on to losing assets. This behavior is known as the disposition effect: traders often sell profitable positions prematurely, but hold on to losing positions for a long time, hoping to recoup their losses.

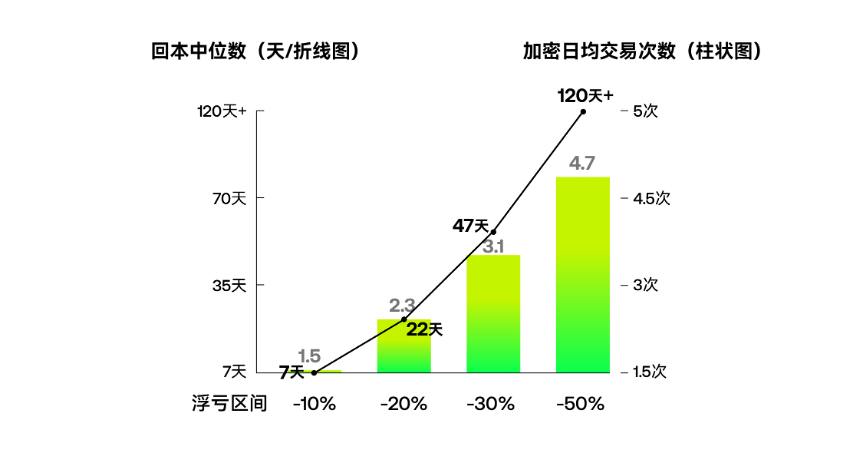

Data Insights: This data, based on data from the US stock and crypto markets, analyzes the correlation between trading behavior and days to breakeven under different loss regimes. The deeper the asset's unrealized losses, the lower its historical probability of successfully recovering its losses, and the time required to recover losses increases exponentially. When losses reach -50%, the asset price would need to rise by 100% to recoup losses, often over 120 days. In the crypto market, this means waiting for the next bull market cycle, which carries significant time and opportunity costs. Furthermore, during periods of loss, the number of trades increases significantly, and emotional trading can exacerbate losses.

Correlation between trading behavior in a losing state and days to breakeven

In-depth Analysis: Passive "holding on" is essentially a form of decision paralysis. It locks up valuable funds in inefficient or even "zero-cost" assets, causing us to miss out on other potential market opportunities. Proactive risk management and proactive position optimization are far more valuable than hopeless waiting.

Some traders become passive and reticent after losses, practically ceasing all trading, hoping for a miraculous rebound. Others become more impulsive, engaging in frequent short-term trading in an attempt to "spread costs" or quickly recoup losses. Both behaviors can be irrational. The former misses out on the opportunity cost of stop-loss orders or dynamic adjustments, while the latter can exacerbate losses due to emotional trading.

Solution: Scientific "self-rescue" rather than passive "carrying orders"

Strategic recommendations:

1. Set clear stop-loss and dynamic adjustment principles: When buying, plan for the worst-case scenario: if the price drops by a certain percentage or if there are negative fundamental changes, then unconditionally stop-loss and exit. Alternatively, adopt a phased stop-loss strategy: for example, sell a portion of your position after each rebound to a certain resistance level, or reduce your position after each breakout below a new support level to spread the risk. Quantifying your discipline can help avoid the temptation to procrastinate and wait for a return on your investment. Maintain a cool-down period after stopping a loss to prevent emotionally switching to other coins and repeating the same mistake.

2. Minimize losses, not just recover your investment: Shift your focus from "recovering your investment" to "minimizing losses and regaining profits." Sometimes, admitting losses and investing the remaining funds in assets with greater potential can offer a better chance of recovering losses. For example, rather than being stuck in a particular Altcoin for a long time, it's better to sell at a loss and buy a more promising coin on a dip, thereby more quickly recovering losses in the next market cycle.

This article is for reference only. It represents the author's views and does not necessarily reflect the position of OKX. It is not intended to provide (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of this information. Holding digital assets (including stablecoins and NFTs) carries a high level of risk and may fluctuate significantly. Past returns are not indicative of future returns, and past performance is not indicative of future results. You should carefully consider whether trading or holding digital assets is appropriate for you based on your financial circumstances. Please consult your legal, tax, or investment professionals regarding your specific circumstances. You are solely responsible for understanding and complying with applicable local laws and regulations.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush