Bitcoin reaches a record high of over 123,600 USD but quickly adjusts due to high US inflation data.

Ethereum rises strongly, nearly reaching its 2021 peak, drawing capital into risky assets and reducing Bitcoin's market dominance.

- Bitcoin reaches 123,640 USD before dropping 5.4% due to increased market risks from US inflation.

- Ethereum rises from 1,386 USD to nearly 4,783 USD in 4 months, close to its 2021 peak.

- Core inflation and PPI exceed expectations, creating pressure on Fed policy in September.

How did Bitcoin reach its record price peak and what happened afterward?

Bitcoin touched a record high of 123,640 USD and then dropped approximately 5.4% due to investors' cautious sentiment triggered by negative US inflation data.

This price adjustment shows that the cryptocurrency market remains sensitive to macroeconomic factors, especially US economic information. Currently, Bitcoin's price remains within a range between its historical peak and a lower support zone, with no strong factor to break this trend.

Experts suggest the market will continue to consolidate until significant stimuli emerge, such as Fed rate cuts or strong ETF capital inflows.

How did Ethereum rise and what was its impact on the cryptocurrency market?

Ethereum performed remarkably, increasing from 1,386 USD in April to nearly 4,783 USD last week, close to its historical peak of 4,864 USD reached in 2021.

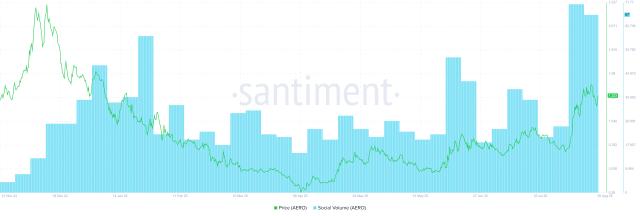

Ethereum's breakthrough drew capital into risky assets, reducing Bitcoin's market dominance from 65% to 59% within two months. However, due to a lack of sustainable structural investment capital, the altcoin market became highly volatile.

The cryptocurrency market is currently at a critical threshold, where short-term growth can be strongly adjusted without stable capital flow and solid fundamental indicators.

Ethereum's strong growth is not only a positive signal for DeFi but also changes the market capitalization and capital flow landscape, demonstrating the future development potential of its ecosystem.

Cryptocurrency Market Analysis, August 2023

How did US inflation data from July impact monetary policy and the cryptocurrency market?

July's US inflation data showed continued increases in service and taxable goods costs, with the core inflation index reaching a 6-month peak and PPI exceeding expectations, causing corporate profits to shrink.

These figures indicate persistent inflation pressure, creating significant challenges for the US Federal Reserve in determining September's policy path. This reduces market expectations of rapid interest rate cuts.

From a cryptocurrency perspective, tighter policies could negatively impact investment capital, presenting more challenges for risky assets currently in a consolidation trend.

Monetary policy will not be quickly loosened while inflation pressure remains, presenting numerous challenges for the global financial market, including cryptocurrencies.

Economist John Smith, 2023

Frequently Asked Questions

Can Bitcoin exceed the 123,640 USD peak in the near future?

The potential for a breakthrough depends on macroeconomic factors like Fed policy and ETF capital inflows into the cryptocurrency market.

Why has Ethereum been rising faster than Bitcoin recently?

Ethereum attracts more capital due to its application development potential and DeFi, drawing risk investors away from Bitcoin.

How do US inflation data affect the cryptocurrency market?

High inflation increases the likelihood of the Fed maintaining a tight policy, restricting investment capital into risky assets like cryptocurrencies.

Is the altcoin market experiencing significant volatility?

Lack of stable capital makes altcoins highly volatile, making this a time to be cautious with altcoin investments.

What factors could significantly drive Bitcoin and Ethereum price growth?

Fed interest rate loosening or strong ETF capital inflows would be price growth stimulants.