This round of Bitcoin bull market feels "different". More accurately, each Bitcoin bull market has its unique characteristics, with each cycle bringing new narratives and fresh blood. However, in Bitcoin's history, one element remains unchanged: retail investors' enthusiasm for "free technology" and "financial freedom funds". At least during Bitcoin's price surge to moon-like levels.

Do you remember the silhouette of retail investors? Now, only silence remains...

It's simply quiet: no taxi drivers, no distant cousins, and no kindergarten teachers asking "Is it too late to buy Bitcoin now". Although analysts firmly believe the "Altcoin season" is about to start, I haven't even been asked about "Fartcoin", Dogecoin, or Ripple, and if needed, I have a ready-made answer for Ripple-related questions.

In essence, the core issue is: retail investors choose to be absent from this Bitcoin bull market, and the reason is certainly not lack of awareness. This time is indeed different: with Bitcoin ETF launch, presidential-level promotion, Larry Fink leading the World Economic Forum (WEF), retail investors have determined that this "game" is no longer suitable for them.

Frankly, Bitcoin might no longer be interesting, or possibly retail investors have lost too much in the previous bull market and finally learned not to play with fire. They aren't even casually searching for related news: Google Trends shows Bitcoin's search popularity is even lower than the weak peaks of "Japanese stroll" and "Labubu doll".

While "now no one searches on Google" might be one reason, the silence of distant relatives and service industry workers is also evident.

You'll barely realize that this top cryptocurrency has maintained the $100,000 mark for 100 consecutive days, which is both a psychological milestone and a historic turning point. Previously, whenever Bitcoin broke key round numbers ($100, $1,000, $10,000), it would trigger new adoption and investment waves, accompanied by a "hockey stick" price surge.

But this time, no one cares.

Bitcoin not only maintains its sky-high price and continues to set new historical highs, but its technical support is also continuously strengthening. Bitcoin's 200-day moving average has surpassed $100,000, which is a powerful signal for traders and long-term holders.

In each Bitcoin bull market, when price and moving average both break through and stabilize at historical resistance levels, a new wave of growth often follows. But this time, retail investors are nowhere to be seen.

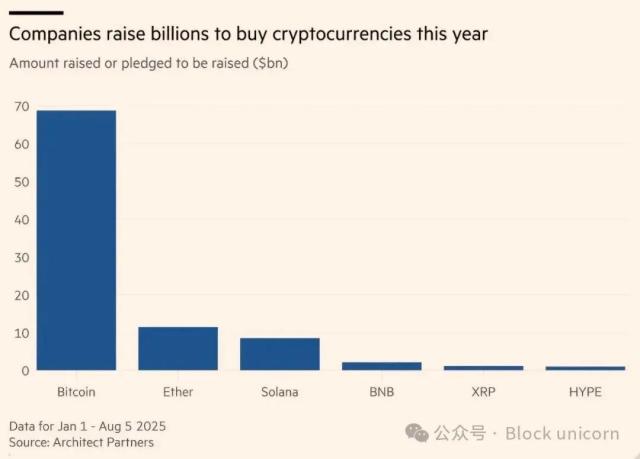

This cycle has even eliminated some long-term Bitcoin whales, making space for "institutions that Bitcoin was supposed to resist".

In 2025, major changes occurred in retirement planning: Bitcoin and other cryptocurrencies were legally incorporated into mainstream retirement accounts, allowing tens of millions of Americans to directly accumulate "hard currency" for the future.

But retail investors remain indifferent.

They seem to be "packing their bags for a virtual Bahamas", openly stating "we won't participate in this bull market". Although Bitcoin has gradually transformed from a speculative trade to a standard in retirement portfolios and an institutional diversification choice, the absence of retail investors feels particularly regrettable.