Ethereum’s recent surge toward its previous all-time high has created extraordinary opportunities for traders and long-term investors alike.

On August 17, blockchain analytics platform Lookonchain reported a remarkable story of one trader who transformed a $125,000 stake into $29.6 million in just four months.

Ethereum Rally Fuels Record Profit For Hyperliquid Trader

This impressive 236x return came from going long on ETH via Hyperliquid, a decentralized perpetual exchange. According to Lookonchain, the trader initially deposited $125,000 across two accounts when Ethereum traded below $2,000.

However, as ETH’s price climbed above $4,000, the trader compounded profits by rolling every gain back into their positions. This aggressive reinvestment strategy resulted in a massive 66,749 ETH holding valued at approximately $303 million.

As a result, Lookonchain reported that the combined equity of both accounts has skyrocketed from the original $125,000 to nearly $30 million.

This trader’s gains highlight how strategic leverage and market timing can produce outsized returns in volatile conditions. Meanwhile, not all gains in the Ethereum market come from trading activities.

Lookonchain also tracked an early ETH investor who recently moved a dormant wallet holding nearly $1.5 million worth of the digital asset.

According to the firm, the investor’s stash was untouched for over a decade, and the initial investment was just $104 during the ETH ICO in 2014. This represents a staggering return of roughly 14,269x at current prices.

These contrasting examples underscore the diverse paths to profit in the crypto ecosystem. Traders can leverage market swings for rapid growth, while patient holders continue to benefit from long-term price appreciation.

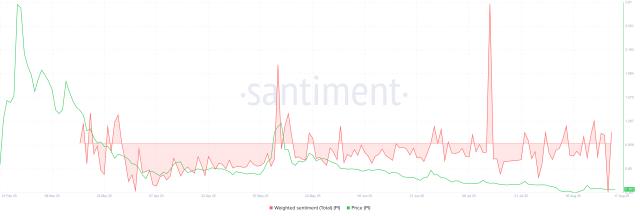

Still, BeInCrypto reported that Ethereum may have upside potential, with sentiment indicating a possible move toward $5,000. In fact, analysts at Standard Chartered believe ETH’s value could end the year at above $7,500.

Due to this, institutional interest is climbing, with major funds reportedly acquiring around $900 million in Ethereum to expand exposure and capitalize on potential gains.