Cryptocurrency markets are gearing up for a potential altcoin resurgence, driven by institutional capital inflows into Ethereum and a decline in Bitcoin's market dominance. According to Coinbase Institutional's August 2025 analysis, the altcoin market cap has surged by 50% since July, reaching $1.4 trillion, with Ethereum (ETH) leading the charge. Smart money is positioning for Q3 liquidity events, signaling a bullish outlook for altcoins. While the Altcoin Season Index remains neutral at 53, key indicators suggest an impending rally. This shift in market dynamics highlights growing investor confidence in altcoins, particularly ETH, as the crypto market enters a new phase of growth and diversification.

Coinbase Foresees September Altcoin Surge Amid Shifting Market Dynamics

Cryptocurrency markets are poised for a potential altcoin renaissance as institutional capital flows into ethereum and Bitcoin's dominance wanes. Coinbase Institutional's August 2025 analysis reveals a 50% altcoin market cap surge to $1.4 trillion since July, with ETH leading the charge as smart money positions for Q3 liquidity events.

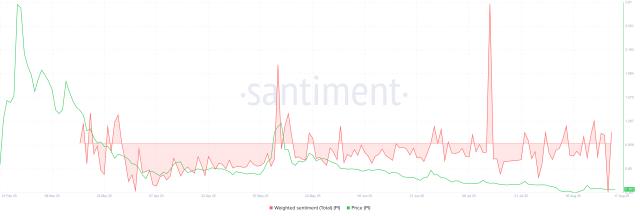

The Altcoin Season Index remains neutral at 53, but telltale signals abound: Bitcoin's market share has eroded from 65% to 59% since May, while anticipatory buying builds ahead of expected Federal Reserve rate cuts. 'When the tide of global liquidity turns, altcoins historically outperform,' the report suggests, noting September's dual catalysts of monetary policy shifts and regulatory clarity.

Coinbase Flags Early Signs of Altcoin Season as Institutional Interest Grows

Market analysts at Coinbase Institutional are detecting early signals of a potential altcoin surge, with September poised as a pivotal month. Ethereum has emerged as the primary beneficiary of institutional allocations, with corporate treasuries rapidly accumulating over two million ETH since June. Entities like Bitmine, SharpLink, and Bit Digital are leading this charge, driven by narratives around stablecoins and digital asset treasury management.

Liquidity conditions are rebounding after six months of decline, with Coinbase data showing improved trading volumes, order book depth, and stablecoin issuance. The shift follows a more favorable regulatory environment, encouraging market makers and long-term participants to re-engage. This liquidity recovery could serve as a catalyst for sharper altcoin rallies if current momentum holds.

Derivatives markets are flashing signs of an impending altcoin rotation, with open interest dominance shifting away from Bitcoin. The convergence of macro trends, regulatory clarity, and institutional positioning suggests the next few months may see decisive capital flows into alternative cryptocurrencies.

Altcoins Poised to Outperform Bitcoin as Market Dynamics Shift

Coinbase Institutional's latest report signals an impending altcoin season, with 75% of altcoins expected to eclipse Bitcoin's performance. The analysis comes as Bitcoin's market dominance slips to 59.39%, marking a 10.21% decline since June. Ethereum's ETH/BTC pair surged to 0.039 on August 14, underscoring altcoins' growing momentum.

Market sentiment appears tied to macroeconomic expectations. Polymarket traders price a 75% probability of a 25-basis-point Fed rate cut in September—a MOVE historically correlated with risk-asset rallies. This potential liquidity injection coincides with capital rotation into altcoins, particularly Ethereum, which is leading the charge against Bitcoin's hegemony.

XRP’s DeFi Lag: What’s Holding It Back From Matching Ethereum, Solana

The XRP Ledger has rolled out automated market makers and stablecoins to bolster its DeFi ecosystem, yet its progress pales in comparison to Ethereum and Solana. With a total value locked (TVL) of just $87.85 million and daily decentralized exchange volume under $70,000, XRP struggles to compete. Ethereum dominates with $96.9 billion in TVL, while solana commands $11.27 billion—highlighting the vast gap in adoption.

Adam Kagy, an NFT marketplace co-founder, underscores the challenge: "Enterprises won’t build on networks with minimal retail participation or on-chain activity." The XRP community is now pushing for builder-led initiatives to spur growth, but the ledger’s decade-long presence in blockchain has yet to translate into meaningful DeFi traction.

Even newer networks like Coinbase’s Base, launched in 2023, have eclipsed XRP with a $4.90 billion TVL. The disparity raises questions about XRP’s ability to attract both institutional and retail interest in a crowded market.