Federal Reserve has officially canceled the notification requirements and management guidelines related to banks' cryptocurrency activities.

This decision means that banks no longer have to comply with specific regulations on reporting cryptocurrency-related activities, opening up a significant change in the United States' financial management policy.

- Federal Reserve withdraws notification requirements for banks' cryptocurrency activities.

- This policy directly impacts the supervision and management regulations of cryptocurrency in the banking sector.

- The decision provides banks with more flexibility in deploying cryptocurrency-related services.

How has Federal Reserve changed cryptocurrency management regulations?

Federal Reserve has officially canceled previous notification requirements and management guidelines for banks' cryptocurrency activities.

This move reflects a policy adjustment to facilitate financial institutions' deployment of cryptocurrency-related services, while also reflecting innovation trends in the US financial industry.

Removing previous rules may help reduce administrative burdens for banks and promote the development of cryptocurrency products and services in the banking ecosystem.

How does this regulation cancellation affect banks and the cryptocurrency market?

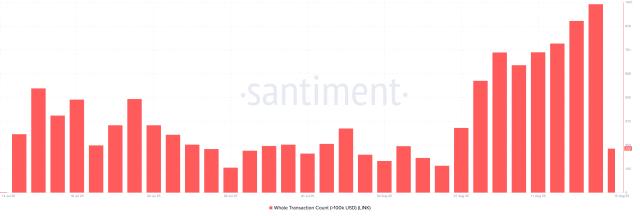

The Federal Reserve's action helps banks increase their autonomy in supporting cryptocurrency transactions and storage.

This means banks can expand their cryptocurrency service scope without facing previous reporting pressures or management restrictions, thereby enhancing competitiveness and innovation to attract customers.

In reality, this relaxation is expected to create favorable conditions for more sustainable cryptocurrency market development in the United States, reflecting the global trend of integrating cryptocurrency with traditional financial services.

Federal Reserve's removal of prior crypto-related bank notice requirements marks a significant step in adapting regulatory frameworks to evolving financial technologies.

Financial Expert Solid Intel, August 2024

Next steps and long-term impacts of policy changes?

Removing notification requirements is a signal of a more open approach to new financial technology, though banks must still comply with general safety and security regulations.

According to experts, this move will promote innovation in banking operations and may lead to developing more legal and safer cryptocurrency-related products, contributing to expanding the digital financial ecosystem.

Federal Reserve will continue to monitor market developments to adjust policies appropriately, balancing support for development and consumer protection.

Frequently Asked Questions

What notification requirements has Federal Reserve canceled for cryptocurrency-related banking?

Banks no longer need to perform specific reports and monitoring for cryptocurrency activities according to previous Federal Reserve guidelines.

How does this decision affect bank operations?

It helps banks become more flexible in providing cryptocurrency-related services without being limited by old reporting regulations.

Will this increase risks for customers?

Despite looser regulations, banks must still comply with general financial safety standards to protect customers.

What is the impact of this decision on the cryptocurrency market?

How might Federal Reserve adjust policies in the future?

Federal Reserve will monitor market developments and adjust to balance innovation and consumer protection.