When Wall Street giants like Citigroup also start publicly discussing cryptocurrency custody and payment services, the market's reaction is almost unanimous: cheering and jubilation, as if endless financial liquidity is about to flood into this emerging digital continent. Media headlines shout "institutional adoption", and investors enthusiastically discuss how BlackRock's BTC ETF (IBIT) has absorbed an astonishing $88 billion in assets. All of this seems like a final victory declaration for cryptocurrency moving from the margins to the mainstream.

However, as an economics professional with over a decade of experience in capital waves, and a monetary theory practitioner, I see beneath the surface excitement potentially lies a structural bubble - a process of subtly "forging" original, free crypto assets into a financial product that claims to be exactly the same, but is actually limited and functionally different.

Analyzing the previous NFT boom through monetary banking theory reveals that when users exchange highly valuable, free, and liquid assets for NFTs with difficult-to-measure value and low liquidity, many traditional economists view this as a classic case of bad money driving out good money. We subsequently witnessed the NFT bubble, with most NFTs unable to recover even half their original value. The current reserve trend in the cryptocurrency field actually shows similar signs: institutions are buying BTC from the real market as reserves and repackaging it through regulation and compliance to create a supposedly identical "Bitcoin", which is essentially a "Wall Street Bitcoin NFT". This is not a positive development, but potentially the prelude to a perfect storm, especially for investors who mistakenly believe they're riding a wave of success.

When BTC Is No Longer BTC: How Wall Street Forges Gold into a Paper Cage

Let's start with a fundamental question: Are you really buying Bitcoin? When an investor clicks to purchase BlackRock's IBIT through a brokerage account, what they receive is not Bitcoin itself, but a certificate representing Bitcoin price exposure - an IOU. This certificate is entirely different from the native BTC in our wallets that can be sent to anyone, anywhere, 24/7, without permission.

This is the core concept of what I call a "Bitcoin NFT". A key characteristic of Non-Fungible Tokens (NFT) is their unique and non-interchangeable nature. Ironically, Wall Street is transforming the originally fungible Bitcoin into a de facto non-fungible asset through ETFs and custody services. A Bitcoin in your cold wallet represents financial sovereignty and censorship resistance; a Bitcoin ETF under institutional custody represents a financial instrument regulated by the SEC, tradable only during exchange hours, and potentially freezable due to geopolitical factors.

The souls of the two are worlds apart, much like owning a piece of physical gold that you can melt, carry, or bury in your backyard, versus holding a gold ETF certificate that can only be traded under specific rules and can never be exchanged for a bag of rice on a weekend night. Data shows that the "Non-Fungible Token-ization" of assets is happening on a large scale. According to Bitbo, by mid-2025, nearly 1.3 million BTCs, about 6.2% of the total circulating supply, will be locked in US spot ETF vaults. The situation with Ethereum is similar, with approximately 7.85% of the supply held by ETFs and various institutions. This is not simply a "supply reduction," but a transfer of power, concentrating asset control from dispersed individuals into the vaults of a few financial giants.

Market Fragility: Is the Shift from "On-Chain Activity" to "Macro Narrative" a Dangerous Signal?

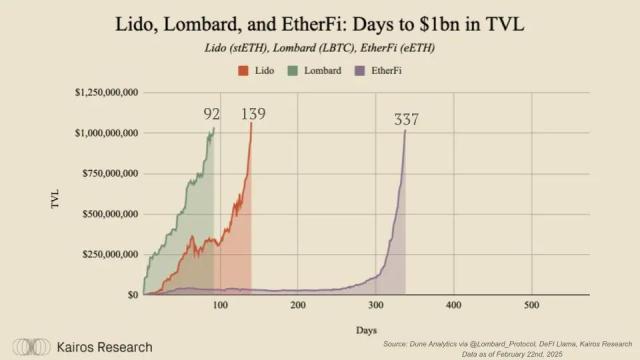

This structural change is fundamentally rewriting the risk model of the crypto market. In the past, the value of a crypto asset was largely supported by the health of its on-chain activity (for Bitcoin, possibly miner activity). Taking Ethereum as an example, its price is closely related to the total value locked (TVL) in DeFi, on-chain transaction activity, and gas fee consumption. We can describe its value function as `f(x, y)`, where `x` represents "on-chain utility" and `y` represents "market speculation". In past bull markets, the market state was `(+, +)`, with robust on-chain activity simultaneously attracting speculative hot money.

However, the market's driving forces are quietly changing. Institutional entry is shifting the core of the valuation model from "on-chain utility" to "macro narrative". The current market state is more like `(0, +)`, or even `(-, +)` in some aspects. On-chain utility may stagnate, but prices can be pushed up merely by macro narratives like "institutions are buying" and "BTC is digital gold".

This creates a seemingly powerful yet fundamentally fragile beast. Market stability is beginning to depend on the allocation decisions of a few large institutions. These are "low-frequency, massive" participants who won't trade as frequently as retail investors. Their buy decisions might be based on macro analyses spanning several quarters, and when they decide to sell, it will be an equally massive and decisive action. If future Federal Reserve policies change or global economic recession requires institutions to broadly reduce risk allocations, they will simultaneously and in the same direction sell their BTC ETFs. This could trigger a more destructive systemic collapse far beyond any previous panic-driven market crash, with a downward trend triggered by `(-, -)` potentially more severe than before.

Ethereum's Fatal Double Blow: When the "Reserve Narrative" Recedes and "Application Chains" Undermine the Foundation

If Bitcoin faces a structural risk, Ethereum might be facing an even more dangerous perfect storm. This is because the two pillars supporting its price are being eroded simultaneously.

The first pillar is its application value as a "world computer". Once, everyone believed Ethereum would be the underlying foundation for all decentralized applications. However, we see more and more applications, especially in payments and gaming, moving to their own dedicated chains (App-chains) or Layer 2 solutions. They replicate Ethereum's technology but may not necessarily contribute value to the Ethereum mainnet (by consuming ETH as gas). This means the `x` variable (on-chain utility) in the aforementioned value function is showing a slow downward trend.

The second pillar is the currently hot "reserve asset" narrative. Data shows over 50% of ETH is locked in staking contracts, with ETH exchange reserves dropping to historic lows. This significantly reduces market circulation, artificially creating scarcity and driving up prices. But this narrative is fragile. It entirely depends on the expectation of continued institutional buying. Once the macro environment reverses or institutional investors believe the "hold and wait" phase is over and decide to take profits, this pillar will quickly collapse.

This creates a fatal double blow: when the "reserve narrative" tide recedes, people will discover that Ethereum's foundation as the "king of applications" has long been undermined. At that point, prices will have no support, and the decline could far exceed anyone's imagination. Investors now entering to buy Non-Fungible Tokens due to "supply scarcity" are likely to become the biggest victims of this storm.

[The translation continues in the same manner for the remaining paragraphs.]Finally, it completely ignored the cost of "convenience". Investors give up the true ownership of assets and the ability to resist future uncertainties for the convenience of one-click buying and selling on broker Apps. What they own is various reasons such as App failures and connection interruptions when trading is prevalent. When you hold only Wall Street's "BTC Non-Fungible Token", you are essentially placing your assets under the roof of regulatory agencies, betting that they will never stab you in the back or cause you trouble for any reason (whether geopolitical, tax-related, or personal factors);

If you hold more native assets, your ownership and degree of freedom are undoubtedly higher.

Conclusion: Hold onto your private keys and see the truth before the storm arrives

Wall Street never creates revolutions; it only co-opts them. The influx of institutions is not a victory of the cryptocurrency spirit, but a process of being "co-opted" and repackaged by the traditional financial system. The market is cheering for this co-optation without realizing that its underlying structural fragility is rapidly increasing.

The BTC and ETH locked in ETFs have become tamed beasts. They have lost their free souls and gained the qualification to be viewed in Wall Street's zoo. When the next financial storm arrives, what will truly help you survive is not the certificate in your broker account, but the private key in your hand that leads to free assets.

Investors should rationally view this institution-led carnival. While chasing price increases, they should also understand the true nature of the assets they hold. Try to hold native tokens that truly belong to you and can be freely disposed of, because when the market's music stops, those who can find the exit fastest are the ultimate winners. Especially for ETH, be wary of the huge downside risks brought by the overlay of "reserve narrative" and "application emptiness". At this moment, the market needs a clear-headed approach more than ever, not blind optimism.