In the article from the day before yesterday, I shared the history of Evergrande's ultimate collapse due to debt risks. Some readers associated this history with potential similar risks in some listed crypto treasury companies.

A few days ago, Vitalik also mentioned this risk in his Twitter message. This risk is indeed worth paying attention to. Even though it is not an explicit risk at present, I am somewhat worried that these companies' increasingly aggressive operations might trigger such a risk in the future.

The book "Classic Value Investment Cases: China Evergrande" was published at the time to demonstrate the author's firm belief in Evergrande.

To prove this "firmness," the author meticulously listed the debt risks of Evergrande at various stages from different investment banks and institutions, and used this to strongly affirm his continued optimism about the company.

Today, when I look at this book, I am not focusing on its conclusion, but on the series of risks listed in it - these risks are actually more valuable historical clues.

All these risks can be summarized as follows:

Evergrande's approach was to raise funds by going public, issuing new stocks, issuing perpetual bonds, and mortgaging assets, while trying to extend payment cycles and repeatedly divide payments to delay payment.

Why do this? To pursue scale. The result? It became deeply trapped in a debt trap.

To conceal this situation, Evergrande aggressively borrowed money to buy back stocks and boost stock prices to stabilize investor confidence on one hand, and aggressively diversified and created a company image on the other hand to demonstrate the company's strength.

This series of actions seemed to repeatedly "burst" short sellers and "strike back" at pessimists, and ultimately misled many domestic investment banks, securities firms, and investors.

In contrast, overseas renowned investment banks (such as Goldman Sachs) always remained exceptionally clear-headed, completely dismissing these tactics and consistently focusing on its deteriorating debt and cash flow.

Looking back at this history now, the method to expose the facade of such enterprises and penetrate their core is actually very simple:

Use common sense to judge.

What common sense?

Is every action weakening its core business? Is it increasing debt? Is it reducing free cash flow? Is it making the enterprise's operations increasingly tight? Is it making the enterprise increasingly unable to cope with external environmental changes?

Any other superficial things (soaring stock prices, massive advertisements, ubiquitous celebrity endorsements...) are all temporary and do not play a decisive role.

We can also use this standard to assess the situation of listed crypto treasury companies.

Their current approach is to use financing to purchase crypto assets. Their current financing methods are basically three: issuing stocks, issuing convertible bonds, or directly issuing bonds.

Among these three financing methods, stock financing risks are relatively controllable, while direct debt financing risks are worth paying close attention to.

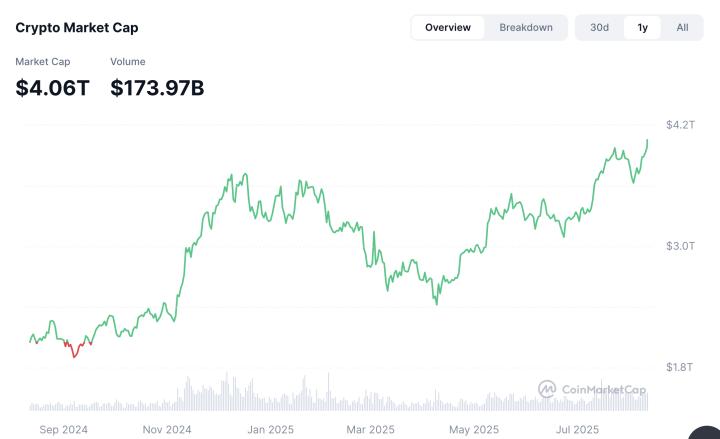

Because once the company cannot cover its debt, it will be forced to sell its held crypto assets to repay debt. And once such selling occurs, crypto assets might trigger a chain reaction.

So to assess whether these companies have risks, I look at whether their free cash flow can support enterprise operations and cover enterprise debt risks.

For companies buying Bitcoin, since Bitcoin does not generate interest, this part of the business does not generate cash flow. For companies buying Ethereum, Ethereum's current staking can provide approximately 3-4% staking yield, so held Ethereum can generate some cash flow through staking.

Compared, companies holding Ethereum seem to have cash flow and smaller risks. But I actually think its hidden risks might be larger.

Because Ethereum's price will have a leverage effect on staking yield: when Ethereum rises, holders enjoy both fixed staking income and the appreciation of the "native currency".

This effect can easily trigger the operator's greed and complacency. If the operator is not honest and is very aggressive, it becomes very dangerous.

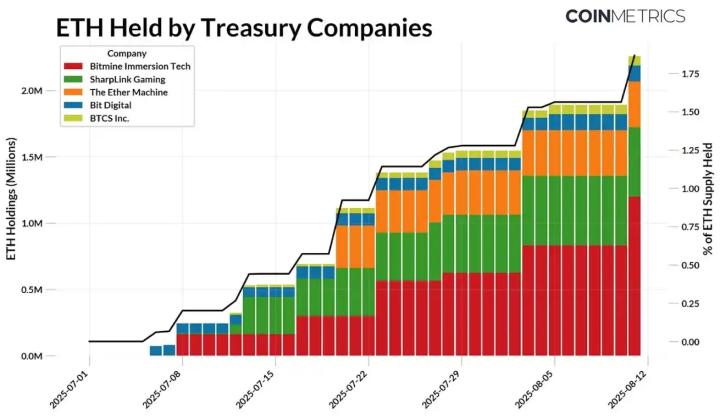

MicroStrategy currently has some debt and indeed has certain risks. But among current Ethereum treasury companies, there is one more worth being wary of. That company loudly proclaims its goal is to "hold 5% of Ethereum".

Seeing this goal, I recall a statement by Duan Yongping (roughly meaning):

For companies that set goals like "becoming a Fortune 500 company" or "achieving revenue of XXX", he would avoid them.

Because a company's goal is not numbers, but serving customers and end consumers. "Becoming a Fortune 500 company" or "achieving revenue of XXX" are naturally achieved in the process of serving customers and consumers. If it can be done, do it; if not, it's okay. In his view, any company not aimed at serving customers and consumers is an dishonest company.

I very much agree with this view.

For that Ethereum treasury company, I cannot currently judge whether that goal serves customers, but I always feel that the goal sounds strange.

For that goal, the company's recent actions are very significant. For instance, its next move is to issue stocks, with planned fundraising amounts exceeding several times its current market value.

If it were just issuing stocks to finance Ethereum purchases, the risk would be relatively controllable. But I'm worried that under the stimulation of such "exciting" slogans, it might become overheated, further pursue scale, thus heading down the path of debt and continuously leveraging up.

And when it is crushed by debt and forced to sell its assets to repay debt, that would be a disaster for the entire crypto ecosystem.