OMG, family, I'm having trouble keeping up with this surge!

Looking back at what the little cat said about the turning point on 8.7, now it's about holding coins and waiting for the wind.

I won't list everything, today I'll follow up on the current heavy positions of several altcoins.

Contact +V: c13298103401

Recently, many people have been asking me if this wave of ETH can still be chased.

Yesterday morning, an article also detailed this issue: Ethereum steadily stands at 4000, will the altcoin season come? You dare to buy BTC above 100,000, but why hesitate above 4K for ETH?

Here's the comprehensive conclusion: Yes

But it's not the main character on stage this time. In past bull markets, the "second place" led the charge. This time, among the top ten coins, only ETH, ADA, and DOGE haven't broken their previous high points, while others have moved. So don't treat it as the leader. However, making money doesn't necessarily mean standing in the spotlight, it's about rhythm. This wave of ETH's rise is primarily due to traditional financial institutional funds pouring in, especially spot ETF, with an inflow speed that's dramatically 5 times that of BTC.

On August 11th, BlackRock alone bought 150,000 ETH, directly pushing the ETF to a historical high, but the coin price hasn't broken the top yet—that's the opportunity. Compared to BTC, ETH has more on-chain gameplay and a deeper ecosystem. This wave of institutional buying is about "stability", not chasing hot spots.

Looking at the ETH/BTC trend, there's not much resistance above. Those wanting to conservatively switch from BTC to ETH can wait for a breakthrough above 0.05. Just understand that the current rise is more about drawing funds from other coins. If ETH can subsequently drive on-chain activity, then fund spillover might ignite the altcoin season.

So, friends betting on altcoins should keep a close eye on on-chain data, especially the movements of veteran players and whales. Centralized exchanges are just ponds, while on-chain is the river. If you're empty-handed and want to get in, ETH is much safer than BTC—just don't complain about the price—like you can't have both fish and bear's paw.

As for my heavy positions, let's take a look now

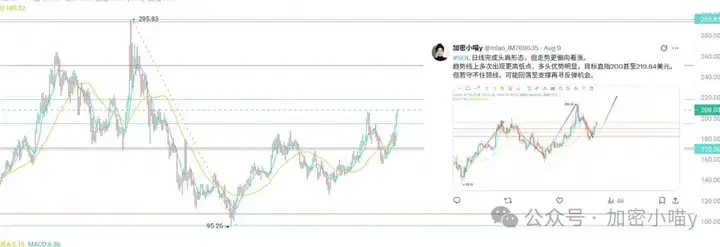

First, let's talk about the so-called "third place"—#SOL

Recently, besides BTC and ETH, SOL is what I've been talking about most. Look, another good news—Wall Street's "Hayes moment", BitMEX founder joins Apaxy, with momentum no less than Tom Lee's. Its market cap is much lighter than ETH. If the ETF passes in October, the speed of fund inflow might directly push it back to 300. Contact +Q: 3806326575

The second is the MEME sector's ancestor—#DOGE

In the past half year, it's been constantly washing out-breaking through-washing out, but still moving smoothly: low points gradually rising, high points layering new highs. It almost always has a chance in each cycle, now just continue holding and wait for the rhythm. Tip: Even in an upward trend, there are pullbacks, don't over-position and set good stop-loss.

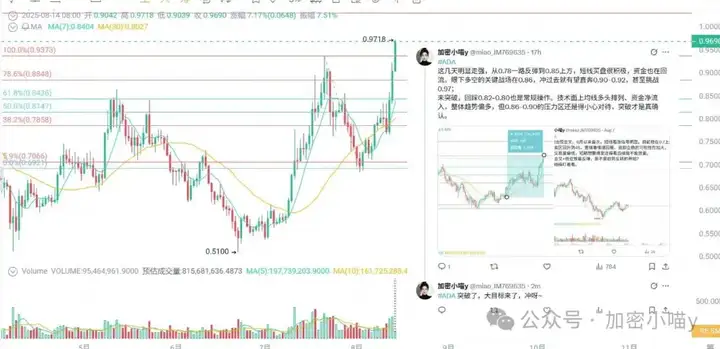

Lastly, let's discuss #ADA

Many people dislike ADA for lacking ecosystem and value, but it always follows its own rhythm in each market cycle, never absent. On-chain, large holders not only haven't sold but are adding positions. On the plate, there's always support below 0.6. This suggests they don't want the price to drop and definitely have something planned. So I'm in, and as long as it stays above 0.8, reaching 1 won't be a problem.

Now we'll wait for sector rotation: BTC rises → sideways → ETH rises → mainstream altcoins → small-cap → on-chain meme crazy, and finally the epilogue.

That's it for the article! If you're still unclear in the crypto world, why not layout with me? Join the VX + Q group with no threshold, get market analysis, altcoin opportunities, and individual coin operations in the first time... waiting for you, otherwise you might miss the next market wave. V: c13298103401 or Q: 3806326575