Written by: Umbrella, David

Just last night, Circle, the issuer of stablecoin USDC, released its Q2 financial report.

As its first financial report after the IPO, the data provides an important basis for the market to assess the true value of this "first stablecoin stock". By deeply analyzing key financial indicators, we can more clearly see Circle's growth momentum and potential challenges.

USDC Expands Strongly, but Revenue Structure is Single

Looking at the information disclosed in the financial report, the following data points need special attention.

Core Business Indicators: USDC Strong Expansion

First, the most notable aspect in the financial report is the simultaneous growth of USDC circulation and market share.

By the end of Q2, USDC circulation reached $61.3 billion, a year-on-year surge of 90%, and a growth of 49% year-to-date. As of August 10th, this figure has further risen to $65.2 billion, indicating its continued growth momentum. In terms of stablecoin market share, USDC solidly occupies about 28% of the market, consolidating its position as the second-largest stablecoin.

Secondly, USDC's trading activity has experienced an explosive growth.

USDC's on-chain transaction volume reached $5.9 trillion, a year-on-year surge of 540%. This explosive growth of indicators not only reflects the rapid expansion of USDC's usage scenarios but also reveals the important trend of the entire stablecoin ecosystem transforming from mere value storage to a payment settlement tool.

Financial Performance: Strong Revenue Growth but Structural Imbalance

The financial report shows that Q2 total revenue reached $658 million, a year-on-year increase of 53%, of which:

Reserve interest income: $634 million (96.4% share), year-on-year growth of 50%

Subscription and service income: $24 million (3.6% share), year-on-year growth of 252%

In this revenue structure, Circle's dependence on reserve interest income is still evident. Although subscription service income has grown by 252%, its absolute value remains tiny.

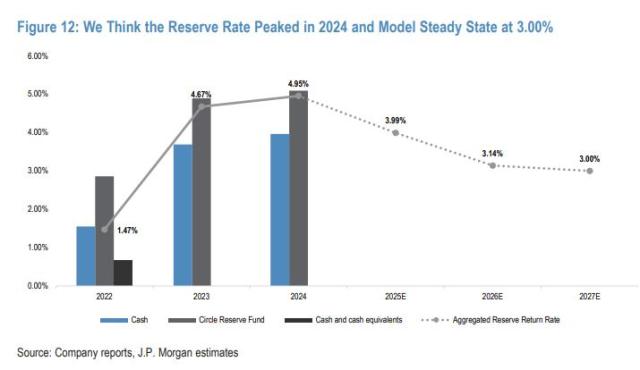

Circle highly depends on reserve earnings from the Federal Reserve's high-interest environment, and this dependence on a single income source constitutes its biggest operational risk. Once the Federal Reserve enters a rate-cutting cycle, Circle's profitability will face a severe test.

Additionally, a point easily overlooked is that the high IPO-related expenses mask the actual operating performance.

Looking at the overall picture, Circle's net loss in Q2 reached $482 million. Although this absolute value is large, if we break it down:

Total IPO-related non-cash expenses were $591 million

Equity incentive expenses: $424 million

Convertible debt fair value adjustment: $167 million

The adjusted EBITDA was $126 million, which also grew by 52% year-on-year.

In other words, after removing IPO-related expenses, Circle's actual operating performance remains robust. The adjusted profitability indicators show that the company's core business maintains healthy growth, which also explains why the stock price rose rather than fell after the financial report was released.

Selling Pressure under High Valuation

On the same day the financial report was released, Circle also announced a secondary offering of 10 million shares.

Calculated at the closing price of $163.21, this offering will raise $1.63 billion. Compared to the IPO price of $31, early investors' return rate exceeds 426%, with over $1 billion in cash from selling.

Among this, although Circle's CEO Allaire has sold 35,780 shares, he still maintains 23.9% voting rights.

From the comprehensive financial report data, we can see that USDC's network effect is accelerating. However, Circle's challenges are equally significant:

Overly dependent revenue structure on interest rates, emerging competitors (like PayPal's PYUSD), and uncertain regulatory policies are all issues that must be addressed.

The Q2 financial report provides a basis for assessing whether Circle is overvalued, but the final judgment still requires observing the performance in the next few quarters, especially Circle's adaptability when the interest rate environment changes.

Strategic Transformation: Circle's Path to Diversification

The strategic initiatives disclosed by Circle in the Q2 financial report and subsequent conference call also clearly outline the company's path from a stablecoin issuer to a comprehensive financial infrastructure provider.

This may also be a response to the single revenue structure revealed in the financial report.

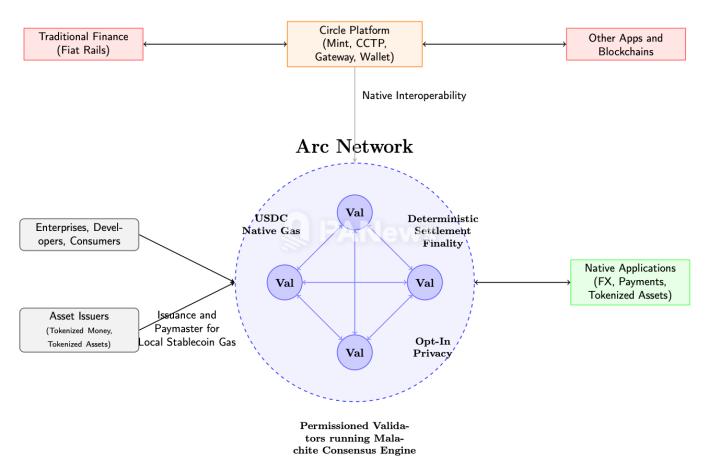

Circle announced the launch of its self-developed blockchain called Arc in the second half of 2025, which quickly became a market discussion focus. According to official disclosure, Arc is an open public chain designed specifically for stablecoin finance, using USDC as the native gas fee token, focusing on payment, foreign exchange, and other application scenarios.

Interestingly, stablecoin giants seem to have chosen the same path almost simultaneously.

USDT issuer Tether is developing Stable, payment giant Stripe is collaborating with top VC Paradigm to launch Tempo, and this race for stablecoin payment chains has already begun. Just today, OKX also announced an upgrade to X Layer to enter this track.

In this competition, Circle's advantages are obvious: compared to Tether facing regulatory pressure, Circle has inherent compliance advantages, with the Trump administration's "GENIUS Act" clearing policy obstacles; compared to payment-experienced Stripe, Circle possesses the network effect from USDC's 24% market share and the trust base of over 1,800 institutional clients.

The deeper business logic is that Arc directly addresses Circle's biggest weakness—over-reliance on interest income.

Currently, 96% of Circle's income comes from USDC reserve fund Treasury interest, and this dependence will become a fatal weakness when the rate-cutting cycle arrives. By controlling blockchain infrastructure, Circle can not only obtain on-chain transaction fees but also open new revenue modes like staking, while reducing dependence on third-party blockchains and increasingly growing distribution costs.

Besides launching the self-developed public chain Arc, Circle also mentioned deepening cooperation with Binance, FIS, Corpay, and other enterprises in the Q2 financial report and conference call.

This includes promoting Circle wallet technology with Binance and using the tokenized market fund USYC in Binance's institutional trading products as yield and over-the-counter collateral; collaborating with Corpay on global foreign exchange and USDC to provide 7x24 settlement services for enterprises worldwide; partnering with FIS to enable US financial institutions to provide domestic and cross-border USDC payments through FIS's Money Movement Hub, combining Circle's blockchain-native infrastructure with FIS's real-time payments to unlock faster, lower-cost compliant digital dollar transactions.

In addition to these three enterprises, Circle also mentioned cooperation directions with mainstream exchanges OKX and financial technology company Fiserv in the financial report.

Overall, Circle's Q2 financial report presents the portrait of a company in a critical transformation period. It is both a leader in the stablecoin track, enjoying growth dividends from the USDC network effect, and a financial technology company facing structural challenges that must reshape its business model before the interest rate downturn cycle arrives.

As a star company in the stock market this year, Circle is indeed worthy of its reputation. But beneath the halo of the first stablecoin stock, investors need to be clear-headed about its challenges. From a single stablecoin issuer to a global digital financial infrastructure provider, this transformation path is full of uncertainties. Whether Circle can continue to write the myth of its stock price rising tenfold after the IPO remains to be seen.