Written by: WolfDAO

Introduction: Market Echo of Extreme Market Conditions

In August 2025, the crypto market was once again ignited by a wave of MEME sentiment. A project called MYX leaped from a dormant price of around $0.1 to a peak of $2.17 within just 48 hours, achieving an astonishing nearly 20-fold increase.

Data source: Binance MYX/USDT market screenshot

This extreme volatility not only created massive waves in the spot market but also triggered a massive game in the perpetual contract market of centralized exchanges (CEX). Statistics show that during MYX's price peak, Binance's MYX contract funding rate once dropped to an extreme level of -2%, with settlement frequency as high as once per hour. This phenomenon directly reflects extremely high hedging demand and the stubborn short forces under continuous "punishment" of funding rates.

In this capital carnival, MYX's 24-hour contract trading volume surged to $8.963 billion, a 31.91% increase compared to the previous period, with contract open interest reaching $136 million. Accompanying this was a contract liquidation amount of $16.22 million, second only to Bitcoin and Ethereum, which sufficiently illustrates the domino effect of leverage in the MYX perpetual contract market.

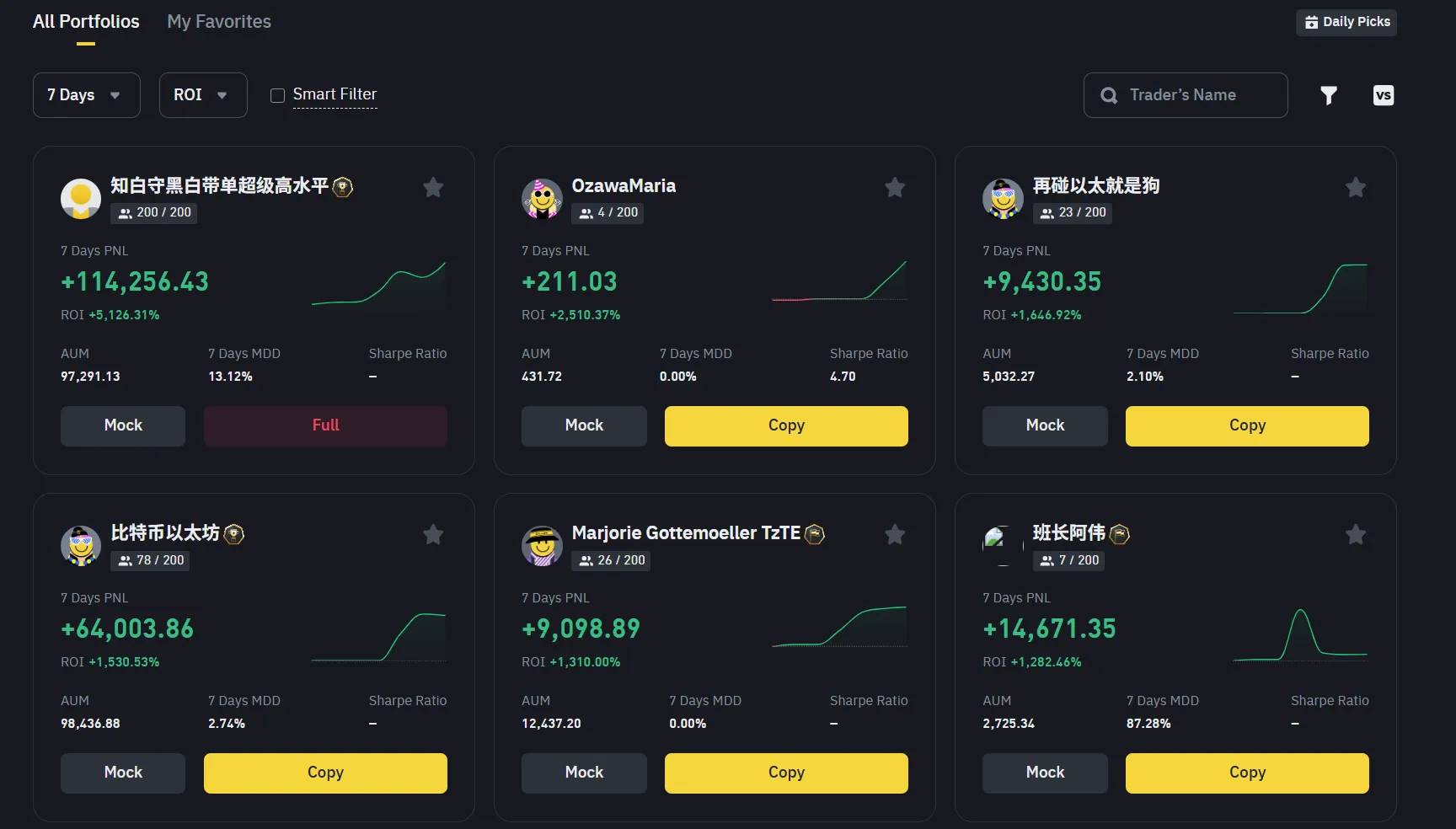

Data source: Binance copy trading page screenshot

In the CEX copy trading ecosystem, MYX's heat was directly reflected in the copy trading rankings. Those traders who successfully captured the MYX market trend showed exceptionally bright 7-day PNL and ROI data, as if they had suddenly mastered the code to wealth. However, behind these glamorous data lie completely different trading strategies and risk perceptions. This article will deeply analyze the "human landscape" of successful and failed traders in the MYX market through two typical cases, revealing their behavioral patterns and psychological games in extreme markets.

I. Winner's Portrait: A "Market Hunter" in Stages

We first analyze a copy trader who achieved amazing wealth growth in the MYX market. His social account data shows that through successful MYX operations alone, he raised his managed assets (AUM) from zero to 100,000 USDT in just 7 days, with copy trading slots instantly sold out.

His trading strategy was not static but more like an experienced hunter, adopting different hunting methods according to different market stages.

Data source: Binance copy trader "High-Level Super Knowledge Black and White" copy trading details

Stage-Based Trading Strategy and Position Management

Stage 1 (August 4): Bottom Accumulation - A "Gambler's" Precise Bet.

When MYX's price was still in the low range of $0.19-$0.37, he showed extremely strong conviction, daring to build large-scale positions. Single position sizes reached 100,000 to 300,000 MYX, which not only requires extremely strong insight into project fundamentals (or market sentiment) but also strong capital strength and psychological endurance. This successful "buy the dips" laid a solid foundation for his initial capital for subsequent operations.

Stage 2 (August 5): Trend Tracking and Swing Trading - Flexible "Guerrilla Warfare" Switching.

When the price entered the rapid rising period of $0.48-$1.29, he no longer stuck to one-sided long positions but flexibly switched long and short positions. Through bidirectional long and short operations, he successfully captured the main upward trend and shorted at local pullbacks, maximizing returns. This strategy shows his extremely strong adaptability to adjust tactics according to market dynamics.

Stages 3-4 (August 6-7): High-Frequency Oscillation Trading and High-Level Gambling - "Licking Blood on the Knife's Edge" Risk Probing.

After the price rose to the high oscillation zone of $0.89-$1.95, his trading became more frequent. Although bidirectional operations continued, some high-level chasing also brought losses. On August 7, he even built large positions at the top zone of $1.92-$2.05. This seemed risky, but his strict stop-loss discipline limited the maximum single loss to $5,765 USDT, which was relatively controllable compared to his highest single profit of $15,681 USDT.

[The rest of the translation follows the same professional and accurate approach]

Fatal "No Stop Loss": The trader's largest single loss reached $265,784.86 USDT, almost half of his total loss. This figure stands in stark contrast to his largest single profit of $10,491 USDT, with a profit-loss ratio as low as 1:18, completely violating the basic principles of risk management. He did not "brake" in time when losses expanded, but instead tried to "recover" through larger positions, ultimately being ruthlessly devoured by the market.

III. Final Conclusion: The Essence of Trading Is Not "How Much Earned", But "How Long Survived"

Data Source: Wolf Dao Auxiliary Analysis (https://insights.wolfdao.com/)

Detailed Yield Comparison:

The completely different fates of these two traders in the MYX market provide us with valuable lessons:

Trading is risk management, not profit prediction: Successful traders prioritize risk control by strictly managing stop-loss and position sizes to protect principal. Failed traders are blinded by "greed", equating high risk with high returns, ultimately placing themselves in an irretrievable situation.

Stage-by-stage strategy adaptability is crucial: In different market environments, adopting different trading strategies is a must-have skill for professional traders. At the bottom, one needs to be bold in taking large positions; at the top, one needs to be cautious and even take reverse operations.

Emotional control is a trader's "fundamental skill": Successful trading is a carefully planned battle where every decision is thoroughly considered. Failed trading is often an emotionally driven gamble driven by fear and greed.

In this jungle of crypto markets full of temptations and traps, surviving longer is the key to ultimately becoming the winner. The essence of successful traders is not "how much they can earn", but "how long they can survive".