Written by: imToken

Stock tokenization is becoming the best narrative for TradFi and Web3 integration in 2025.

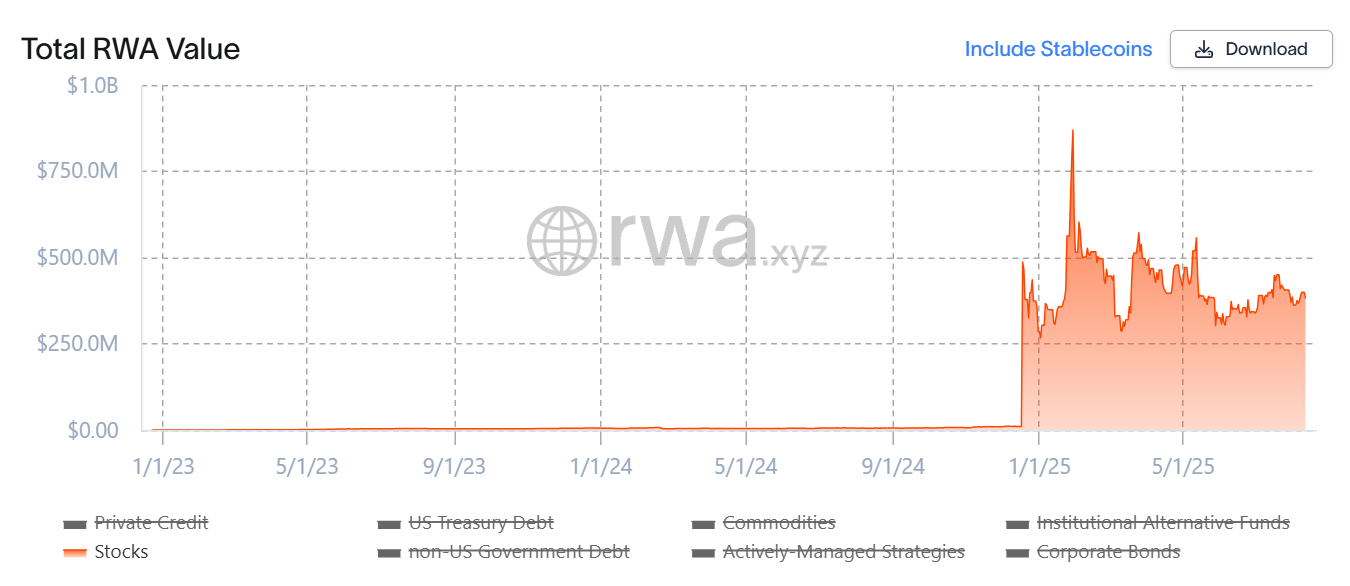

Data from rwa.xyz shows that since the beginning of this year, the scale of stock tokenized assets has leaped from almost zero to hundreds of millions of dollars, driven by stock tokenization accelerating from concept to implementation - experiencing a model evolution from synthetic assets to actual stock custody, and extending towards more advanced forms like derivatives.

This article will provide a simple review of the stock tokenization model evolution, inventory core projects, and look forward to potential development trends and landscape changes.

Source: rwa.xyz

I. The Past and Present of US Stock Tokenization

What is stock tokenization?

Simply put, it is mapping traditional stocks into digital tokens through blockchain technology, where each token represents a part of the underlying asset's ownership. These tokens can be traded on-chain 24/7, breaking through traditional stock market time and geographical restrictions, allowing global investors to participate seamlessly.

From a Tokenization perspective, US stock tokenization is not a new concept. In the previous cycle, representative projects like Synthetix and Mirror had already explored a complete on-chain synthetic asset mechanism:

This model not only allows users to mint and trade "US stock tokens" like TSLA and AAPL through over-collateralization (such as SNX, UST), but can even cover fiat currencies, indices, gold, and crude oil, almost encompassing all tradable assets, because the synthetic asset model tracks the underlying asset through over-collateralization.

For example, users can pledge $500 worth of crypto assets (like SNX, UST) to mint synthetic assets (like mTSLA, sAAPL) anchored to asset prices and trade them. The entire operating mechanism uses oracle pricing + on-chain contract matching, with no real counterparty, theoretically achieving unlimited depth and zero slippage liquidity experience.

However, this model does not truly own the corresponding stock, but is merely "betting" on the price. This means that once the oracle fails or the collateral asset collapses (Mirror fell during the UST crash), the entire system would face risks of liquidation imbalance, price de-anchoring, and user confidence collapse.

Source: Mirror

The biggest difference in this wave of "US stock tokenization" is the adoption of an "actual stock custody + mapped issuance" underlying model, which currently has two main paths, with the core difference being whether they have compliant issuance qualifications:

One type, represented by Backed Finance (xStocks) and MyStonks, is a "third-party compliant issuance + multi-platform access" model, where MyStonks collaborates with Fidelity for 1:1 anchoring of real stocks, and xStocks purchases and custodies stocks through Alpaca Securities LLC;

The other type is the Robinhood-style licensed broker self-operated closed loop, relying on its own broker license to complete the entire process from stock purchase to token issuance;

From this perspective, the key advantage of this round of stock tokenization is that the underlying assets are truly verifiable, with higher security and compliance, making it easier for traditional financial institutions to recognize.

It is worth mentioning that MyStonks has not limited itself to on-chain spot trading, but is actively expanding into diversified financial services such as derivatives, lending, and staking. In the future, users can not only conduct leveraged trading of US stock tokens but also use their positions as collateral to obtain stablecoin liquidity and even participate in portfolio investment and yield optimization strategies.

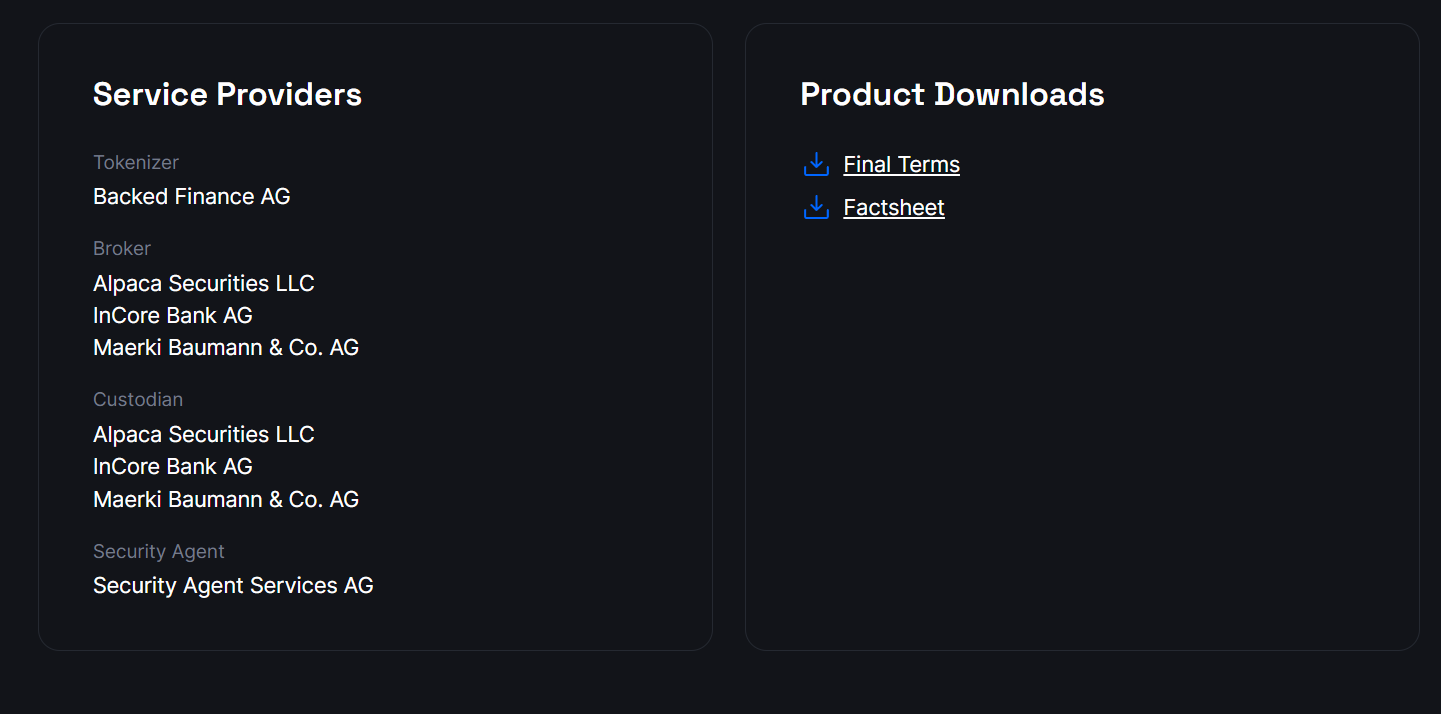

Backed Finance: A Compliant Cross-Market Expander

Unlike MyStonks' focus on US stocks, Backed Finance's layout has been more cross-market and multi-asset from the beginning, with a key highlight being its compliance model that highly aligns with the European MiCA regulatory route.

The team operates its business based on the Swiss legal framework, strictly adhering to local financial regulatory requirements. They issue fully anchored tokenized securities on-chain and have established a stock purchase and custody system with partners like Alpaca Securities LLC, ensuring a 1:1 mapping between on-chain tokens and off-chain assets.

In terms of asset range, Backed Finance supports not only US stock tokenization but also covers ETFs, European securities, and specific international index products. This provides global investors with multi-market, multi-currency, and multi-target investment options, meaning investors can simultaneously allocate US tech stocks, European blue-chip stocks, and global commodity ETFs on a single chain platform, thus breaking through traditional market geographical and time constraints.

Block Street: A Liquidity Releaser for Tokenized Stocks

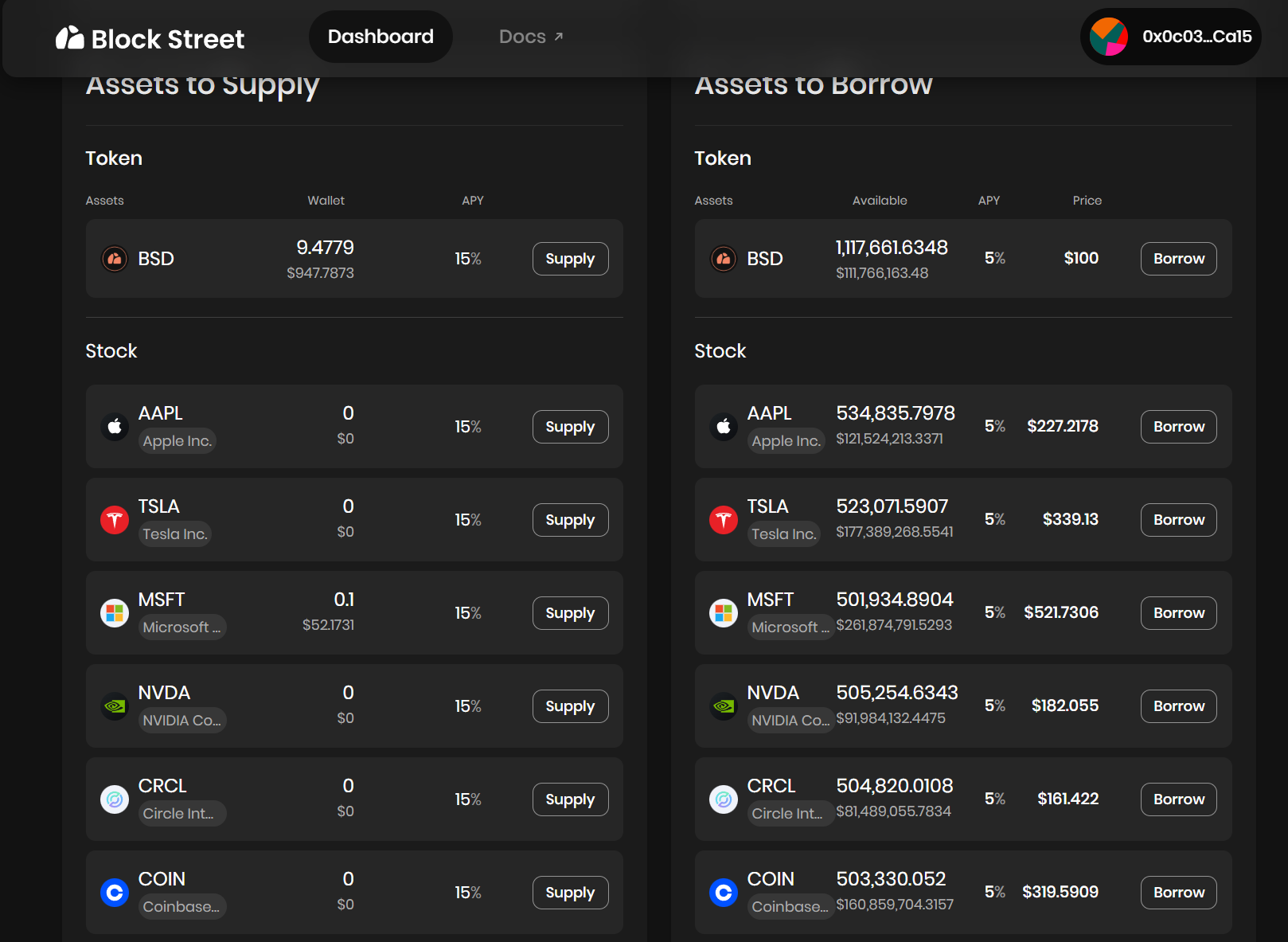

Block Street, one of the few DeFi protocols focusing on tokenized stock lending, targets the downstream and potentially more explosive direction of liquidity release.

This is a blank segment in the current "trading layer" of tokenized stocks. Taking Block Street as an example, it directly provides on-chain collateral and lending services to token holders—users can directly deposit tokenized US stocks like TSLA.M and CRCL.M as collateral on the platform, obtaining stablecoins or other on-chain liquid assets based on the collateral rate, achieving a funding utilization model of "keeping assets, getting liquidity".

Block Street just launched its test version last week, allowing users to convert tokenized stocks into liquid capital, enabling holders to release funds without selling assets. This fills the gap in DeFi lending for tokenized stocks and is worth observing whether subsequent lending, futures, and other derivative directions will build a "second curve" for the tokenized stock market.

Source: Block Street

III. How to Further Break Down the Walls?

Objectively, the biggest progress in this wave of US stock tokenization is the "actual stock custody" model + lowering entry barriers:

Any user only needs to download a crypto wallet and hold stablecoins to buy US stock assets directly through DEX anytime, anywhere—bypassing account opening, identity verification, without a US stock account, time zone, geographical, or identity restrictions.

However, the problem is that most products are still focused on the first step of issuance and trading layer, essentially still in the initial stage of digital certificates, and have not truly transformed them into on-chain financial assets that can be widely used for trading, hedging, and fund management, which means they significantly lack in attracting professional traders, high-frequency funds, and institutional participation.

This is somewhat like ETH before DeFi Summer—at that time, it couldn't be lent, used as collateral, or participate in DeFi until protocols like Aave gave it "collateral lending" functions, releasing billions in liquidity. For tokenized US stocks to break through, they must replicate this logic, turning deposited tokens into "pledgeable, tradable, and composable active assets".

Therefore, if the first curve of the tokenized US stock market is trading scale growth, the second curve will be improving the capital utilization rate and on-chain activity of tokenized stocks through financial tool expansion. Only such a product form can attract broader on-chain capital flow and form a complete capital market cycle.

Under this logic, beyond instant buying and selling of tokenized stocks, a richer "trading layer" of derivative trading becomes crucial—whether DeFi lending protocols like Block Street or future short-selling tools, options, and structured products that support reverse positions and risk hedging.

The core is who can first create highly composable and liquid products, who can provide an integrated on-chain experience of "spot + short + leverage + hedging", such as using tokenized US stocks as collateral for fund lending on Block Street, constructing new hedging targets in options protocols, or forming a composable asset basket in stablecoin protocols.

Overall, the significance of stock tokenization is not just about moving US stocks and ETFs on-chain, but opening the "last mile" between real-world capital markets and blockchain:

From the issuance layer of Ondo to the trading and cross-market access of MyStonks and Backed Finance, and then to liquidity release by Block Street, this track is gradually building its underlying infrastructure and ecosystem closed loop.

Previously, the main battlefield of RWA was dominated by US Treasury-stablecoin. As institutional funds accelerate entry and on-chain trading infrastructure continuously improves, tokenized US stocks become composable, tradable, and pledgeable active assets, stock tokenization is likely to become the most scalable and incremental asset category in the RWA track.