Written by AiYing Compliance

Everyone in the industry knows there are two types of compliance: those that are for regulators to see, and those that are truly effective. The former is called "Compliance Theater," while the latter is the real deal, real risk management. Sadly, the vast majority of institutions, especially those riding the wave of fintech, are unknowingly engaging in the former.

What is the essence of "compliance theater"? It's a stage meticulously constructed to navigate inspections, secure licenses, and reassure investors. On this stage, procedural accuracy trumps all else, and the polish of reports far outweighs the accuracy of risk identification. Actors (compliance officers) recite pre-written lines (the compliance manual), manipulate ornate props (expensive systems), and present a scene of prosperity and peace to the audience (regulators). As long as the play goes well, licenses are secured, and financing is secured, everyone is happy.

The most dazzling, expensive, and deceptive props in this drama are the "zombie systems" that appear to be running 24/7, but are in reality completely emasculated and useless. This is especially true of the Know Your Transaction (KYT) system, which should be the sharpest scout on the front lines of anti-money laundering (AML). Yet, it's often the first to "die," becoming a zombie that only consumes budgets and provides a false sense of security. It sits quietly on the server, green lights flashing, reports generated, everything working normally—until a real bomb explodes right under its nose.

This is the biggest compliance trap. You think you've purchased top-of-the-line equipment and built an impenetrable defense, but in reality, you're just feeding a zombie with money and resources. It won't protect you, but will only lead to your unexplained death when disaster strikes.

So, the question arises: Why do the KYT tools we invest so much money and manpower into sometimes become mere stalemates? Is this due to a fatal misjudgment of technology, a complete breakdown of process management, or perhaps a combination of both?

Today, we'll focus on the hottest arena of compliance in the fintech and payments industries, specifically the Southeast Asian market, where regulatory environments are complex and volatile and business growth is unbridled. Here, real dramas are unfolding, and our mission is to lift the curtain and uncover the truth behind the scenes.

Act 1: Analysis of a Zombie System - How did your KYT tool "die"?

The birth of a "zombie system" doesn't happen overnight. It doesn't die suddenly due to a devastating vulnerability or a catastrophic outage. Rather, like a frog in boiling water, it gradually loses its ability to perceive, analyze, and react during day-to-day "normal operation," ultimately leaving only a hollow shell that maintains vital signs. This process can be dissected from both technical and process perspectives, demonstrating how a once fully functional KYT system gradually dies.

Technical "brain death": single points of failure and data silos

Technology is the brain of the KYT system. When the brain's neuronal connections are broken, information input is blocked, and analytical models become rigid, the system enters a state of "brain death." It still processes data, but has lost the ability to understand and judge.

The cognitive blind spot of a single tool: seeing the world with one eye

Over-reliance on a single KYT tool is the primary and most common cause of system failure. This is common knowledge within the industry, but in the "Compliance Theater" script, in pursuit of so-called "authority" and "simplified management," this point is often selectively ignored.

Why is a single tool fatal? Because no single tool can cover all risks. It's like having a sentry simultaneously monitor enemies from all directions; there will always be blind spots. A recent research report released by MetaComp, a licensed digital asset service provider in Singapore, used test data to reveal this harsh reality. Analyzing over 7,000 real transactions, the study found that relying on just one or two KYT tools for screening can result in up to 25% of high-risk transactions being mistakenly approved. This means that a quarter of the risks are being directly ignored. This is no longer a blind spot, but a black hole.

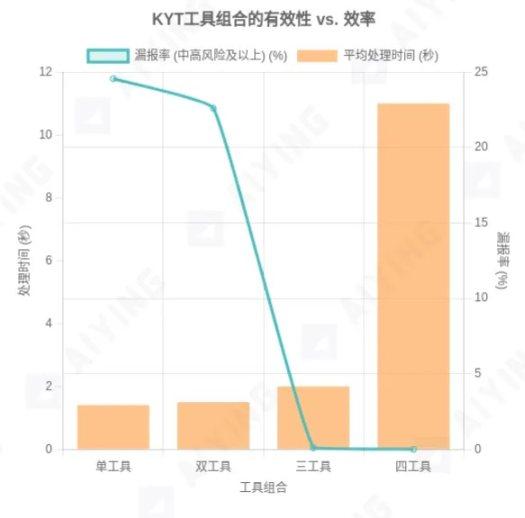

Figure 1: Comparison of False Clean Rates under different KYT tool combinations

Data source: MetaComp Research - Comparative Analysis of On-Chain KYT for AML&CFT, July 2025. The chart shows that when the risk threshold is set to "medium-high risk," the false negative rate for a single tool can reach as high as 24.55%, for a two-tool combination it can reach as high as 22.60%, and for a three-tool combination it drops sharply to 0.10%.

This significant risk exposure stems from inherent flaws in the KYT tool ecosystem. Each tool is built on its own proprietary datasets and intelligence gathering strategies, resulting in inherent differences and blind spots in the following areas:

- Differences in data sources: Some tools may have close ties with US law enforcement, providing stronger coverage of risky locations in North America; others may have deeper roots in the Asian market, providing more timely intelligence on localized fraud networks. No single tool can be the king of intelligence for all regions of the world simultaneously.

- Different tools focus on different types of risk: some are good at tracking addresses associated with OFAC sanctions lists, while others are better at identifying mixers or Dark Web markets. If the tool you choose doesn’t excel at identifying the primary types of risk your business faces, it’s essentially useless.

- Update delays and intelligence lags: Black market addresses can have a short lifespan. A risky address flagged by one tool today might not be synced with another tool for days or even weeks. This intelligence lag is long enough for money launderers to complete multiple rounds of operations.

Therefore, when an institution places all its hopes on a single KYT tool, it is actually gambling - gambling that all the risks it encounters are just within the "cognitive range" of this tool.

Malnutrition caused by data silos: How can water flow without a source?

If a single tool is narrow-minded, then data silos are utterly malnourished. A KYT system is never an isolated system; its effectiveness is built on a comprehensive understanding of counterparties and trading behavior. It requires continuous data nourishment from multiple sources, including KYC (Know Your Customer) systems, customer risk rating systems, and business systems. When these data channels are blocked or the data itself is of poor quality, KYT becomes a sourceless well, lacking a basis for judgment.

This scenario is common among many fast-growing payment companies:

The KYC team, responsible for customer onboarding, stores their data in System A; the risk control team, responsible for transaction monitoring, stores their data in System B; and the compliance team, responsible for AML reporting, uses System C. These three systems are managed by different departments and provided by different vendors, with little real-time data exchange between them. As a result, when the KYC system analyzes a live transaction, the customer risk rating it relies on might still be static information entered by the KYC team three months ago. This customer may have exhibited various high-risk behaviors over those three months, but this information is trapped in the risk control team's System B, leaving the KYC system unaware of it.

The direct consequence of this "malnutrition" is that the KYT system is unable to establish an accurate behavioral baseline. One of the core capabilities of an effective KYT system is to identify "anomalies"—transactions that deviate from a customer's normal behavior patterns. However, if the system doesn't even know what "normal" is for a customer, how can it identify "anomalies"? Ultimately, it will degenerate into relying on the most primitive and crude static rules, producing a large number of worthless "junk alerts," bringing it one step closer to becoming a "zombie."

Static rules: using old maps to find new lands

Criminals' methods are evolving rapidly, from traditional "smurfing" to cross-chain money laundering using DeFi protocols to fabricated transactions via NFT markets. Their sophistication and stealth are growing exponentially. However, the rule bases of many "zombie KYT systems" remain stuck in the past few years, like searching for a new world with an old nautical chart—a surefire way to find nothing.

Static rules, such as "alarm if a single transaction exceeds $10,000," are trivial to today's black market operators. They can easily use automated scripts to split large sums of money into hundreds or even thousands of smaller transactions, effectively bypassing these simple thresholds. The real threat lies in complex behavioral patterns:

- A newly registered account conducts small-amount, high-frequency transactions with a large number of unrelated counterparties within a short period of time.

- After the funds flow in quickly, they are immediately transferred out through multiple addresses without any pause, forming a typical "Peel Chain".

- The transaction path involves high-risk currency mixing services, unregistered exchanges, or addresses in sanctioned regions.

These complex patterns cannot be effectively described or captured by static rules. They require machine learning models that can understand transaction networks, analyze capital flows, and learn risk characteristics from massive amounts of data. A healthy KYT system's rules and models should be dynamic and self-evolving. However, "zombie systems" lack this ability. Once their rule bases are established, they are rarely updated. Ultimately, they are left far behind in the arms race with the black market, becoming completely "brain dead."

Heartbeat Stopping at the Process Level: From "Set and Forget" to "Alert Fatigue"

If technical flaws lead to a system's "brain death," then a breakdown in process management directly leads to its "heart arrest." Even the most technologically advanced system, without the right processes to drive and respond to it, is just a pile of expensive code. In the "compliance theater," process failures are often more subtle and devastating than technical failures.

The illusion of "going online is victory": treating the wedding as the end of love

Many companies, especially startups, approach compliance development with a project-based mindset. They believe that the procurement and launch of a KYT system is a project with a clear start and end point. Once the system is successfully launched and passes regulatory acceptance, the project is successfully concluded. This is a classic illusion of "compliance theater"—they view the wedding as the end of love, believing they can rest easy from then on.

However, the life cycle of a KYT system begins with its launch, which is only Day 1. It is not a tool that can be set and forget, but rather a living organism that requires ongoing care and optimization. This includes:

- Continuous parameter calibration: Markets change, customer behavior evolves, and money laundering methods evolve. The KYT system's monitoring thresholds and risk parameters must adjust accordingly. A reasonable $10,000 alert threshold a year ago may no longer be relevant after business volume has increased tenfold.

- Regular rule optimization: As new risks emerge, new monitoring rules need to be continuously developed and deployed. At the same time, the effectiveness of old rules should be regularly evaluated to eliminate "junk rules" that only generate false positives.

- Necessary model retraining: For systems that use machine learning models, the models must be retrained regularly with the latest data to ensure their ability to identify new risk patterns and prevent model decay.

When an organization falls into the illusion of "launch is victory," these crucial follow-up maintenance tasks are often neglected. Without accountability and budgetary support, a KYT system is like a sports car abandoned in a garage. No matter how good the engine is, it will slowly rust and eventually become a pile of scrap metal.

Alert fatigue: The final straw for compliance officers

The most immediate and catastrophic consequence of a poorly configured and poorly maintained "zombie system" is the generation of a massive number of false positive alerts. Industry observations show that at many financial institutions, 95% or even over 99% of the alerts generated by KYT systems are ultimately verified as false positives. This isn't just a problem of inefficiency; it can also lead to a deeper crisis: alert fatigue.

We can imagine the daily life of a compliance officer:

Every morning, he opened his case management system and saw hundreds of pending alerts. He clicked on the first one, and after a half-hour investigation, discovered it was normal client business behavior, so he closed it. The same thing happened with the second one. The same thing happened with the third one. Day after day, he was drowning in an endless sea of false alarms. His initial vigilance and seriousness gradually gave way to numbness and perfunctory responses. He began looking for "shortcuts" to quickly close the alarms, and his trust in the system plummeted to zero. Eventually, when a truly high-risk alert appeared among them, he might just glance at it, habitually mark it as a "false alarm," and then close it.

Alert fatigue is the final straw that breaks the compliance defense line. It psychologically destroys the compliance team's fighting spirit, transforming them from risk "hunters" into alert "cleaners." The entire compliance department's energy is consumed in a futile battle against a "zombie system," while the real criminals, sheltered by the cacophony of alerts, slither through defenses.

At this point, the KYT system had completely "heart-stopped." It still generated alerts, but these "heartbeats" were meaningless. No one responded, no one believed. It had become a complete zombie.

A friend's company, in an effort to secure a license and appease investors, staged a classic "compliance drama": They loudly announced the purchase of a top-tier KYT tool, using it as a publicity stunt to promote their commitment to the highest compliance standards. However, to save money, they only used the services of a single vendor. The management's logic was, "We're using the best, so don't blame us if anything goes wrong." They selectively forgot that any single tool has its own blind spots.

Furthermore, the compliance team was understaffed and lacked technical expertise, so they could only use the most basic static rule templates provided by the vendor. They considered their mission accomplished by monitoring large transactions and filtering out a few publicly blacklisted addresses.

Crucially, once business volume increased, system alerts began to pour in. Junior analysts quickly discovered that over 95% of these alerts were false positives. To meet their KPIs, their focus shifted from investigating risks to simply closing alerts. Over time, no one took the alerts seriously.

The professional money laundering ring quickly smelled rotting meat. Using a simple yet effective method, they transformed this "zombie system" into their own ATM: using the "Smurf" tactic of "breaking the whole into pieces," they split the funds from illegal online gambling into thousands of small transactions below the monitoring threshold, disguising them as e-commerce payments. Ultimately, it wasn't their own team members who raised the alarm, but their partner bank. When the regulatory investigation letter arrived on the CEO's desk, he was still bewildered. Later, it was reported that his license had been revoked.

Figure 2: Comparison of risk levels of different blockchain networks

Data source: MetaComp Research - Comparative Analysis of On-Chain KYT for AML&CFT, July 2025. The chart shows that, in the sampled data, the proportion of Tron transactions rated as "serious," "high," or "medium-high" risk is significantly higher than that of Ethereum.

The stories around us hold up a mirror, reflecting the countless fintech companies currently engaged in the "compliance drama." They may not have collapsed yet, but they've only been lucky enough not to be targeted by professional criminal gangs. But ultimately, it's only a matter of time.

Act 2: From “Zombie” to “Sentinel”—How to Wake Up Your Compliance System?

Having revealed the pathology of the "zombie system" and witnessed the tragedy of the "compliance theater," we must go beyond mere criticism and lamentation. As frontline practitioners, we are more concerned about: how to break the deadlock? How can we reawaken a dying "zombie" and transform it into a truly capable "frontline sentinel" capable of both fighting and defending?

The answer lies not in purchasing a single, more expensive, or more "authoritative" tool, but in a complete overhaul of both philosophy and tactics. This methodology has long been a tacit secret among true practitioners within the industry. MetaComp's research is the first to systematically quantify and publicly disclose it, providing us with a clear and actionable playbook.

Core Solution: Say goodbye to one-man shows and embrace a "multi-layered defense system"

First, we must fundamentally abandon the theatrical mindset of "just buy a tool and it's done." True compliance isn't a one-man show, but a battle of positions that requires a defense-in-depth system. You can't expect a single sentry to hold off a massive army; you need a multi-dimensional defense network comprised of sentries, patrols, radar stations, and intelligence centers.

Tactical core: multi-tool combination punch

The tactical core of this defense system is a multi-tool combination. Blind spots in a single tool are inevitable, but the blind spots of multiple tools are complementary. Through cross-validation, we can minimize the space for risks to hide.

So, the question is, how many tools do you need? Two? Four? Or more?

MetaComp's research provides a crucial answer: a three-tool combination is the golden rule for achieving the best balance between effectiveness, cost, and efficiency.

We can understand this "three-piece set" in a simple way:

- The first tool is your “front-line sentinel”: it likely has the broadest coverage and will detect most common risks.

- The second tool is your "special patrol": it may have unique reconnaissance capabilities in a specific area (such as DeFi risks, specific regional intelligence), and can detect hidden threats that the "sentinels" cannot see.

- The third tool is your "rear intelligence analyst": it may have the most powerful data correlation analysis capabilities, and can connect the scattered clues discovered by the first two to outline a complete risk portrait.

When these three tools work together, their power is far greater than simply the sum of their parts. Data shows that upgrading from a two-tool to a three-tool approach can lead to a qualitative leap in compliance effectiveness. MetaComp's report indicates that a well-designed three-tool screening model can reduce the "false clean rate" of high-risk transactions to below 0.10%. This means that 99.9% of known high-risk transactions will be caught. This is what we call "effective compliance."

In contrast, while upgrading from three to four tools can further reduce the underreporting rate, the marginal benefit is minimal, while the resulting costs and time delays are significant. Research shows that screening times with four tools can be as long as 11 seconds, while with three tools, they can be controlled to around 2 seconds. In payment scenarios requiring real-time decision-making, this 9-second difference can be the difference between life and death for the user experience.

Figure 3: Effectiveness and efficiency trade-offs of KYT tool combinations

Data source: MetaComp Research - Comparative Analysis of On-Chain KYT for AML&CFT, July 2025. The chart visually demonstrates the impact of increasing the number of tools on reducing false negative rates (effectiveness) and increasing processing time (efficiency), clearly demonstrating that a three-tool combination is the most cost-effective option.

Methodology implementation: Building your own "rule engine"

Choosing the right three-piece combination only completes the equipment upgrade. The more critical issue is how to command this multi-service force to operate in a coordinated manner. You can't have three tools working independently; you need to establish a unified command center—your own "rules engine" independent of any single tool.

Step 1: Standardize risk classification – speaking the same language

Don't let tools dictate your approach. Different tools might use different labels like "Coin Mixer," "Protocol Privacy," and "Shield" to describe the same risk. It would be disastrous if your compliance officer had to memorize each tool's dialect. The correct approach is to establish a unified, clear set of internal risk classification standards and then map all risk labels used by connected tools to your own standard system.

For example, you could create the following standardized categories:

Table 1: Example of a risk category mapping table

In this way, no matter which new tool you connect to, you can quickly "translate" it into a unified internal language, thereby achieving horizontal comparison and unified decision-making across platforms.

Step 2: Unify risk parameters and thresholds – draw clear red lines

With a unified language in place, the next step is to develop unified "rules of engagement." You need to set clear, quantifiable risk thresholds based on your risk appetite and regulatory requirements. This is a critical step in transforming subjective "risk appetite" into objective, machine-executable instructions.

This set of rules should not be just a simple monetary threshold, but a more complex, multi-dimensional combination of parameters, such as:

- Severity level definition: Clarify which risk categories are "serious" (such as sanctions, terrorist financing), which are "high risk" (such as theft, Dark Web), and which are "acceptable" (such as exchanges, DeFi).

- Transaction-Level Taint %: This defines the percentage of funds indirectly derived from high-risk sources in a transaction that triggers an alert. This threshold is scientifically determined through extensive data analysis, not arbitrary decisions.

- Wallet-level Cumulative Taint %: This defines the percentage of funds a wallet has transferred to or from high-risk addresses throughout its transaction history before being flagged as a high-risk wallet. This effectively identifies addresses that have long engaged in shady transactions.

These thresholds are the "red lines" you draw for your compliance system. Once they are reached, the system must respond according to the pre-set script. This makes the entire compliance decision-making process transparent, consistent, and defensible.

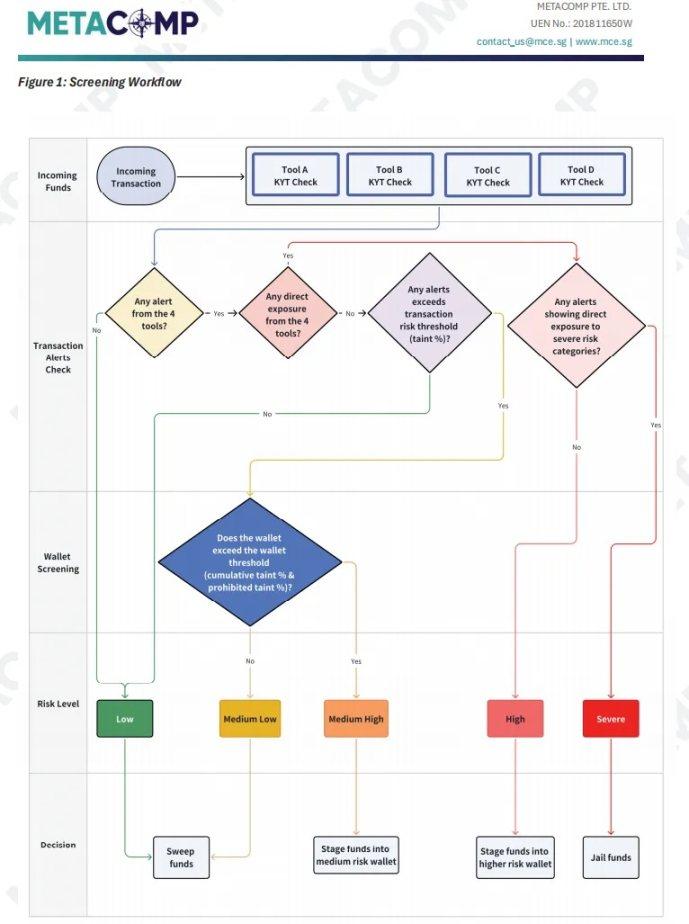

Step 3: Design a multi-layered screening workflow – a three-dimensional attack from point to surface

Finally, you need to integrate standardized classifications and unified parameters into an automated, multi-layered screening workflow. This process should act like a sophisticated funnel, filtering through layers and gradually focusing, precisely targeting risks while avoiding excessive disruption to a large number of low-risk transactions.

An effective workflow should include at least the following steps:

Figure 4: Example of an effective multi-layer screening workflow (adapted from the MetaComp KYT methodology)

- Initial Screening: All transaction hashes and counterparty addresses are first scanned in parallel using a suite of tools. If any of these tools raises an alert, the transaction proceeds to the next stage.

- Direct Exposure Assessment: The system determines whether the alert is a "direct exposure," meaning the counterparty address itself is a flagged "critical" or "high-risk" address. If so, this is the highest priority alert and should trigger an immediate freeze or manual review process.

- Transaction-Level Exposure Analysis: If there's no direct exposure, the system begins fund tracing, analyzing the percentage of funds involved in the transaction (the taint percentage) that can be indirectly traced back to the source of the risk. If this percentage exceeds the preset transaction-level threshold, the system proceeds to the next step.

- Wallet-Level Exposure Analysis: For transactions where risk exceeds the threshold, the system conducts a comprehensive health check on the counterparty's wallet, analyzing the overall risk profile (Cumulative Taint %) of their historical transactions. If the wallet's health falls below the preset wallet-level threshold, the transaction is ultimately deemed high-risk.

- Final Decision (Decision Outcome): Based on the final risk rating (critical, high, medium-high, medium-low, low), the system automatically or manually prompts the user to perform the corresponding action: release, intercept, return, or report.

The ingenuity of this process lies in transforming risk identification from a simple "yes/no" judgment into a multi-dimensional assessment process, from point (single transaction) to line (fund chain), and finally to surface (wallet profile). It effectively distinguishes between "direct hit" severe risks and "indirect contamination" potential risks, thereby optimizing resource allocation—responding quickly to the highest-risk transactions, conducting in-depth analysis of medium-risk transactions, and quickly approving the vast majority of low-risk transactions. This perfectly resolves the conflict between "alert fatigue" and "user experience."

Final Chapter: Dismantling the Stage and Returning to the Battlefield

We've spent considerable time dissecting the pathology of "zombie systems," revisiting the tragedy of "compliance theater," and exploring the "playbook" for awakening these systems. Now, it's time to return to square one.

The greatest danger of "Compliance Theater" isn't the budget and manpower it consumes, but the deadly, false sense of security it fosters. It lulls decision-makers into believing risks are under control, while numbing implementers to daily, ineffective labor. A silent "zombie system" is far more dangerous than a nonexistent system, as it leaves you defenseless and vulnerable.

In today's era of rapidly evolving black market technology and financial innovation, relying on a single tool for KYT monitoring is like running naked in a hail of bullets. Criminals possess an unprecedented arsenal of weapons—automated scripts, cross-chain bridges, privacy coins, and DeFi mixing protocols. If your defenses remain at the level of a few years ago, it's only a matter of time before they're breached.

True compliance is never a performance designed to please an audience or to circumvent inspections. It's a tough battle, a protracted one that requires sophisticated equipment (a multi-layered toolkit), rigorous tactics (a unified risk methodology), and exceptional personnel (a professional compliance team). It doesn't require a glamorous stage or false applause; it requires a reverent attitude toward risk, honesty with data, and continuous refinement of processes.

Therefore, I appeal to all practitioners in this industry, especially those with resources and decision-making power: Please abandon your illusions about "silver bullet" solutions. There is no magic tool that can solve all problems once and for all. Building a compliance system has no end point; it is a dynamic, lifecycle process that requires continuous iteration and improvement based on data feedback. The defense system you build today may reveal new vulnerabilities tomorrow. The only way to cope is to remain vigilant, continuously learn, and evolve.

It's time to dismantle the sham stage of "Compliance Theater." Let's return to the real battlefield, brimming with challenges but also with opportunities, armed with a truly effective "Sentinel System." Because only there can we truly protect the value we seek to create.

Report link: https://www.mce.sg/metacomp-kyt-report/

References

[1]Know-Your-Transaction (KYT) | New Standard in Crypto Compliance

https://www.chainup.com/blog/kyt-crypto-compliance-procedures/

[2]Understanding AML Tactics: Know Your Transaction (KYT) - Vespia

https://vespia.io/blog/know-your-transaction-kyt

[3]A Comprehensive Guide to Understanding Know Your Transaction ...

https://www.tookitaki.com/compliance-hub/a-comprehensive-guide-to-understanding-know-your-transaction-kyt

[4]1 in 4 Risky Transactions May Be Missed - MetaComp Study Finds ...

https://laotiantimes.com/2025/07/17/1-in-4-risky-transactions-may-be-missed-metacomp-study-finds-limited-kyt-tools-insufficient-for-blockchain-compliance/

[5]MetaComp Study Finds Limited KYT Tools Insufficient for Blockchain...

https://www.prnewswire.com/apac/news-releases/1-in-4-risky-transactions-may-be-missed--metacomp-study-finds-limited-kyt-tools-insufficient-for-blockchain-compliance-302507721.html