Meow fans, today we're discussing a hot topic - Ethereum firmly holds above 4000, returning to the familiar "4-prefix" price range. Don't forget, this is the ETH price from four years ago! Time flies, and seeing this number again after four years can't help but evoke some emotions.

So, what is everyone most concerned about now? I guess it's definitely these two questions:

- Will the Altcoin season arrive?

- I won't buy Bitcoin above 100,000, but would I dare to buy Ethereum above 4000 dollars?

Today, let's analyze these two questions together.

Breaking 4000: Ethereum's Key Breakthrough and Operational Approach

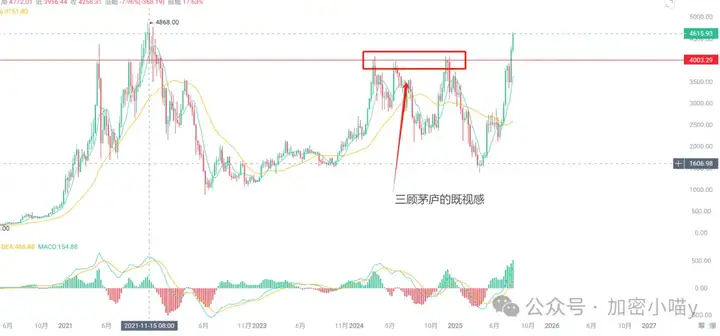

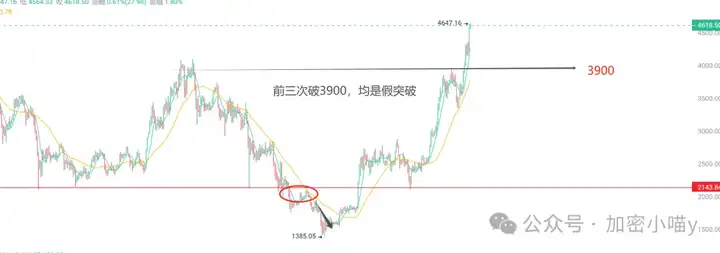

First, let's talk about the trend of #Ethereum. I previously mentioned that breaking the K-bar at 2140 was crucial for ETH. This K-bar's importance has two aspects:

- It broke through the hardest resistance level of this bull market.

- It also changed the trend pattern between ETH and BTC, presenting a clear reversal signal.

Without this key K-bar, the subsequent rise might not have happened.

I remember advising everyone not to rush to buy when ETH price pulled back to 3900, because the 4000 mark is a super hard resistance zone, and the on-chain data was a bit problematic. It's best to wait and chase after breaking through. In fact, ETH's price correction to 3350 and then breaking 4000 again confirms the upward trend. However, this doesn't mean I'll go all-in above 4000. After all, my position is already full. If I didn't have ETH on hand, I might make a small entry, but definitely not a heavy position.

Communication + Q: 3806326575

Why I Won't Buy ETH Above 4000?

For me, the price itself is not critical, what's truly important is the "price difference". For ETH above 4000, although it broke through strong resistance, it's not suitable for me. I already have low-position ETH, and I'll focus on ecosystem coins and Altcoins. If you don't have ETH, at this high point, it depends on whether you want to take a chance. Remember, safety is the most important.

Altcoins: How to Determine if the Altcoin Season is Coming?

#Altcoins are not just randomly rising coins, but depend on whether they can surpass Bitcoin within a specific time. To truly determine if the Altcoin season is arriving, we need to approach it from several aspects:

1. Bitcoin Market Dominance: If Bitcoin's market dominance is declining, it might be time to shift some Bitcoin positions to Altcoins. You need to ensure you've already profited from Bitcoin and sold some before considering a position change.

2. Market Sentiment and Capital Flow: Check Twitter, Telegram, and Discord for extensive discussions and "frenzy". These are signals that Altcoins are about to explode. However, don't be impulsive; understand that many of these discussions are just speculative.

Communication: V: c13298103401

3. Trading Volume: Pay attention to changes in Altcoin trading volume. If Altcoin trading volume significantly increases and market cap continuously reaches new highs, it means capital is flowing in faster, and you can follow along appropriately.

However, be wary of the "gambler's mentality". Many people are not investing in the coins themselves, but in a KOL's influence. We must always remain calm and not be swayed by short-term emotional fluctuations.

Summary: How to Allocate in This Bull Market?

The biggest difference in this bull market is that the driving force of capital has shifted from retail investors to institutional funds. Institutional funds are more inclined to flow towards top large-cap projects, especially those from the US with transparent regulation. Therefore, for ordinary retail investors, follow this trend and stop fantasizing about buying the dips on unnoticed small Altcoins.

If you already have Bitcoin and Ethereum and have made profits, you can consider converting part of your position to Altcoins, but premise is that you've already made money in the Altcoin market and have a higher risk tolerance. In a bull market, we must learn to judge market rhythm, never blindly chase highs, and don't easily give up on low-position layout opportunities.

📌 Safety Tip: In crypto, we must look not only at trends but also at capital flow. Understand market sentiment and master entry and exit timing. Don't blindly follow trends based on price fluctuations, but rely on rational analysis and long-term layout.

That's all for now! If you're still unsure in the crypto market, why not plan with me? Join the VX + Q group without barriers, get market analysis, Altcoin opportunities, and individual coin operations in the first time... waiting for you, or you might miss the next market wave. V: c13298103401 or Q: 3806326575