Solana and Chainlink were among the largest gainers on Tuesday following a cooler-than-expected inflation print that gave traders further resolve to position for future Federal Reserve rate cuts while institutional money poured in.

Solana spiked 12.9% to $198.48 while Chainlink surged 12.5% to $24.21 over the past 24 hours, according to CoinGecko.

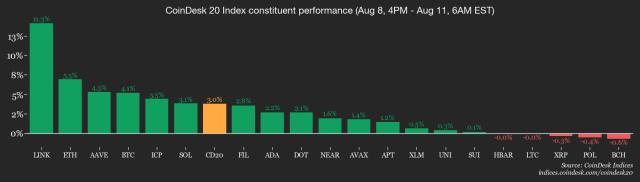

The broader altcoin market joined the advance, with major tokens displaying widespread strength across trading sessions.

Ethereum rose 8.6% to $4,670.42, while Cardano added 8.9% to reach $0.85. Dogecoin gained 6.2% to $0.23, Sui climbed 5.9% to $3.91, and XRP advanced 3.0% to $3.25.

The rally followed July's Consumer Price Index release, which showed headline annual inflation at 2.7%, below the 2.8% economist consensus, with markets responding by pricing in an 82.5% probability of a September rate cut, down slightly from Monday's 86% odds.

Min Jung, senior analyst at quantitative trading firm Presto, told Decrypt the current market dynamics are fundamentally different from previous crypto cycles, “being driven predominantly by institutional adoption, led by aggressive buying from digital asset treasury companies.”

"Yesterday's upswing, however, followed the CPI release, which reignited optimism for a September rate cut—a sentiment echoed in the latest FedWatch projections,” he added.

Jung pointed out that while macroeconomic conditions provide a supportive element, saying "the true engine of momentum remains deep-seated institutional conviction."

The analyst noted a departure from previous bull markets, which "have typically seen capital rotate from Bitcoin and Ethereum into altcoins," driven by retail speculation.

"It will be noteworthy to see if that pattern repeats this time, given that the current rally is being driven by institutional flows," Jung said.

Bitfinex analysts told Decrypt open interest in major tokens has jumped from $26 billion to $44 billion over the past month, reflecting a resurgence in speculative activity.

They cautioned, however, that the rise in leverage "introduces greater systemic fragility, as capital becomes more fragmented across volatile assets, potentially amplifying market-wide liquidation events."

In such conditions, markets become “more vulnerable to liquidation cascades, sharp reversals, and exaggerated volatility,” they said, noting that leveraged environments "tend to be reflexive, with price action amplifying sentiment and vice versa.”

Stalled momentum or surprise news could trigger a swift unwinding of leverage, deepening losses across altcoins, the analysts said.