Ethereum Price Surged 26% This Week, Causing Significant Losses for Short Sellers.

Ethereum reached $4,500 for the first time since 2021, creating the largest liquidation in the cryptocurrency market. This second-largest Capital market currency recorded a 26% increase in just one week, raising its 30-day total increase to over 50%, far exceeding Bitcoin's 6% performance during the same period.

Data from CoinGlass shows over $104 million in ETH Short positions were liquidated in the past 24 hours, accounting for most of the $154 million ETH positions wiped out. This number leads the entire crypto market in liquidation scale, contributing to a total liquidation of $403 million across the entire cryptocurrency market.

This sharp increase was primarily driven by record Ethereum ETF Capital flows. Last Monday, ETH recorded over $1 billion in net Capital, far exceeding the previous record of $726 million. BlackRock's iShares Ethereum Trust contributed 63% of this Capital flow, almost single-handedly reestablishing the old record, while the Bitcoin ETF only attracted $170 million on the same day.

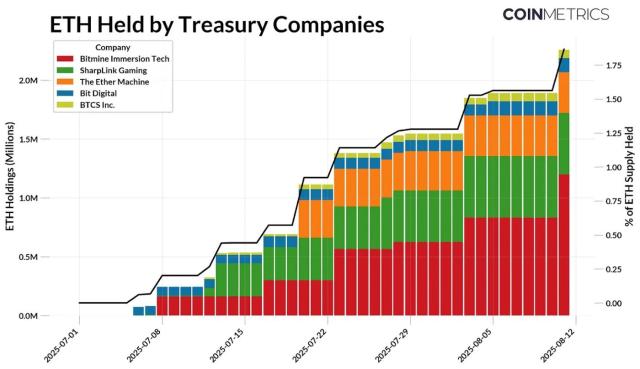

Large-Scale Ethereum Corporate Accumulation

Besides ETF, publicly listed companies are buying ETH at an unprecedented scale. SharpLink Gaming and BitMine Immersion Technologies currently hold an Ethereum portfolio valued at nearly $8 billion, leading globally. BitMine recently increased its Capital raise by $20 billion to continue purchasing ETH for its balance sheet, while SharpLink raised nearly $900 million just in the past week.

In total, approximately 8% of circulating ETH supply has been purchased as of Tuesday, significantly increasing from 3% in April when no public company had established an "strategic reserve" of Ethereum. This trend reflects a fundamental change in how organizations approach ETH as a reserve asset.

At the price of $4,502, ETH remains about 8% below its historical peak of $4,878 reached in November 2021. However, the Myriad prediction platform estimates a 77.7% chance of ETH surpassing $5,000 before the end of 2025, an increase of over 30% compared to the previous week.

ETH's superiority over Bitcoin recently, especially through ETF products, indicates a shift in institutional investment preferences. Since July, ETH has only had 3 days of net outflows, while ETH ETFs have consistently outperformed Bitcoin ETFs in Capital inflows over the past month. This signals a new phase in the mainstream adoption of Ethereum as an investment asset.