Stripe's "Tempo" was exposed from stealth mode, while Circle officially announced "Arc" in its financial reporting rhythm.

On the surface, they are both public chains optimized for payment.

But the underlying logic is completely different: one is a payment service provider that controls merchant and developer distribution capabilities, and the other is the issuer of USDC, trying to upgrade a stablecoin into a network.

L1 and L2 Battle

First, answer the most straightforward question: Why not learn from Coinbase (Base), or plan their own L2 like Robinhood?

If your advantage lies in distribution, in "one-click migration" of massive existing users and merchants to the chain, then L2 is the most convenient solution.

Inheriting Ethereum's security and tool ecosystem, quickly launching, and incidentally gaining the sequencer economic bonus.

Base's rise is not technically impressive; the key is Coinbase's traffic portal and application integration. This methodology has been verified.

So why are Stripe and Circle talking about L1?

Because "payment chains" are becoming an independent track.

A group of L1 centered around Tether (Stable and Plasma) is driving a narrative: stablecoins need a native, payment-oriented underlying layer - stablecoins doing gas, predictable fees, sub-second settlement - rather than always being a "guest" residing on general public chains.

The pressure on Circle is obvious: if the opponent's USD stablecoin starts binding to its own settlement layer, USDC cannot forever remain just "a token", it must also become "that rail".

Decoding Circle

Zooming in, Circle's move is not a simple "defense".

Arc and Circle Payments Network (CPN) work in the same direction, more like bringing Visa's "network of networks" strategy to the chain.

Open, EVM compatible, USDC native, oriented towards payment and foreign exchange, and also preparing for capital market scenarios.

Its core is a strategic concession: if Circle chooses to give more front-end income to issuance/distribution partners, taking only a thin network-level fee rate, it gains stronger network externalities.

This was the winning strategy of card organizations back then: less commission, first popularization, win trust, lay endpoints.

From this perspective, "Arc vs Stable/Plasma" is more critical than "Circle vs Coinbase".

If the Tether-based payment chain makes "stablecoin native + low-friction payment experience" the industry standard, Circle cannot just be a bridge to others' rails; it must own a truly reliable rail that others can depend on.

At the same time, openness is not just a slogan: the distribution and threshold of notary nodes, the public nature of developer tools, and the ease of cross-chain and exit will determine whether Arc is a "public infrastructure" or just a rebranded brand-specific channel.

Otherwise, it will fall into the ghost wall cycle of "decentralization - expansion - re-centralization".

Decoding Stripe

Back to Stripe, whether Tempo is suitable as an L1 depends on whether it is "truly open".

If Tempo is fully public, minimally permissioned, EVM compatible, and natively interoperable, Stripe can turn its distribution power into a cold start engine for a public network.

Not building a "merchant garden", but lighting up a public road fair to all participants.

Conversely, if governance, validation, and bridging are tightly attached to Stripe itself, the ecosystem will quickly raise concerns about dependency risks: today you are a convenient "shortcut", tomorrow you might become an unavoidable "toll station".

Visa has long provided an industry textbook: to establish universal trust, first do interconnection, then have brand value.

Therefore, the judgment of "who should do L1, who is more suitable for L2" corresponds one-to-one with the business model.

For issuers like Circle, moving towards the network layer has intrinsic rationality.

USDC as gas, optional privacy, deterministic settlement, built-in FX, is attractive to cross-border B2B, platform merchants, and some capital market workflows; competitive pressure also urges it to quickly transform "scale" into "network power".

For PSPs like Stripe that already control the "last mile", Layer 2 is often a better solution.

Carrying one less L1 governance and security burden, enjoying an additional layer of composability and developer goodwill; unless Tempo writes "openness" into its system and technology from day one.

Offense vs Defense

There's a popular judgment in the industry about the L1 of these two companies: Stripe is on the offensive, Circle is on the defense.

This intuitive judgment is not bad, but not complete.

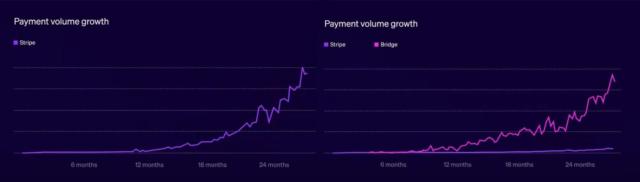

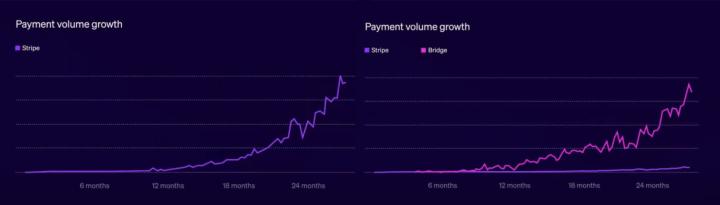

Stripe can indeed compress cold start costs with its distribution advantage, lighting up demand with a single command; Circle indeed does not control end-user terminals, with activities scattered across multiple chains and partners.

But if we view Arc + CPN as a chain-based version of the "Visa methodology", Circle is more like rewriting the game rules with a network strategy.

Commoditizing peripheral links, standardizing the core settlement layer.

Even if front-end major income is given to issuers, exchanges, or PSPs, it's to gain a larger network surface.

This way, it doesn't need to chase Base's volume, but can redefine its own chess game.

The real systemic risk is "fragmentation disguised as progress".

If every big company builds a "semi-open" payment chain, we'll return to the private network era before the internet.

Barely interconnected through adapters, with high costs and low resilience.

The judgment standard should not be TPS, but: whether it can be credibly open; whether it is easy to exit; whether it is equally friendly to "non-partner" entities.

The key to breaking free from the "decentralization - expansion - re-centralization" ghost wall cycle is whether it can scale without sacrificing protocol openness.

At the execution level, here are a few "hard indicators" recommended for both companies.

For Circle: Pull up the public test network according to the rhythm; polish the process of using "USDC as gas" for real merchants to the point of being easy to use without training; announce transparent, externally participable verification node standards; ensure that CPN clearly maintains a multi-chain principle, avoiding short-sighted incentives of "diverting traffic to one's own chain".

For Stripe: Either transform into a Layer 2 like Celo, or push Tempo's openness to the extreme: introduce external verifiers as early as possible, open-source the client and key modules, decouple chain-level governance from corporate organization, treat "network of networks" as fundamental law, rather than market rhetoric.

Distribution still determines speed, but not at the expense of protocol commons.

Conclusion

This is not a contest of speed and functionality, but a re-selection of "open protocol" versus "brand railway".

Circle's path is like an "attack" disguised in a "defensive" coat; if Stripe wants to do Layer 1, it must make openness a structural commitment, otherwise the smartest developers will vote with their feet.

What truly matters is not who shouts about higher TPS first, but who can establish cross-subject universal trust while maintaining composability.

This is the correct answer to "scaling without sacrificing protocol openness".