Counterattack: The Comeback Journey of PUMP Token

After experiencing a deep callback lasting a month, the PUMP token strongly rebounded, breaking through the $0.004 public offering cost line, finally allowing investors who participated in the July 12th public offering to break even.

On August 13th, the PUMP token price broke through $0.00416, with a 24-hour increase of over 12%, completely recovering the ground lost from the 66.58% sharp drop since July 15th. This key breakthrough marks that users who participated in the public offering have finally escaped floating losses. Behind this rebound are a series of strategic adjustments by the Pump.fun platform:

- Whale's Early Layout:On August 5th, an anonymous address spent $3.3 million to purchase 1.06 billion PUMP tokens and opened a 3x leveraged long position, betting that the platform's upcoming new features will trigger a market reversal.

- Repurchase Plan's Stabilizing Effect:To address the 50% plunge after token listing, Pump.fun launched a repurchase plan worth hundreds of millions of dollars, continuously buying to stabilize market confidence. In early August, the team transferred SOL worth $5.6 million to a dedicated repurchase wallet, signaling protection.

- Technical Breakthrough Triggering Buying Pressure:On July 31st, PUMP broke through the $0.003 key resistance level, with on-balance volume (OBV) reaching a historical high, and relative strength index (RSI) stabilizing above 60, forming strong technical support.

Breaking even is just the beginning. The current price of $0.0039, while equal to the public offering price, is still 45% away from the historical high of $0.00689, and the market remains divided on whether Pump.fun can continue its upward momentum.

II. Arms Race Intensifies: The Life-or-Death Speed of Functions and Ecosystem

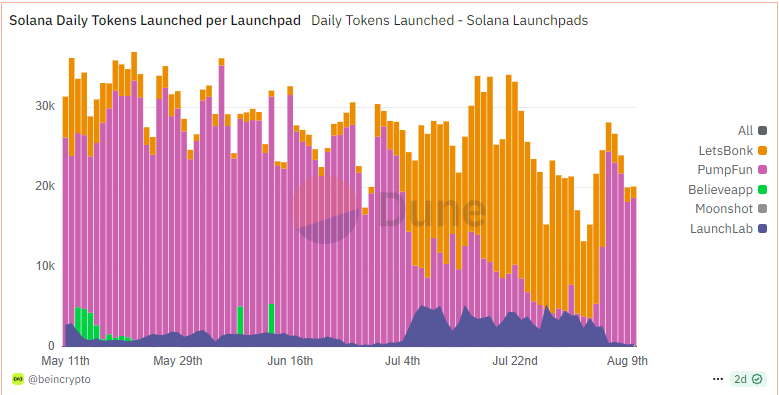

The battle of MEME token launch platforms in the Solana ecosystem has evolved into a three-dimensional war of technology, incentives, and community loyalty. LetsBonk.fun achieved comprehensive suppression in July through its "community-first" strategy:

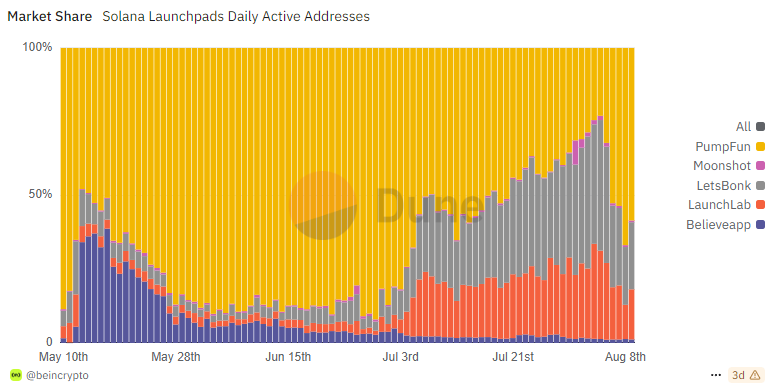

Dune data shows Pumpfun market share began rapidly rebounding from August 8th

- Data Dominance:In mid-July, LetsBonk.fun's daily token issuance reached 28,000, trading volume was $179 million, and 30-day fee income was $23.29 million, all more than double Pump.fun's metrics.

- Transparent Income Allocation as a Killer Move:The platform uses 50% of fees to repurchase and burn BONK tokens, 8% goes to reserve funds, and funds flow is publicly displayed through a real-time dashboard, in stark contrast to Pump.fun's criticized "greedy and closed" approach.

- Huge Creator Incentive Gap:LetsBonk.fun offers 1% of transaction fees to token creators, while Pump.fun only offers 0.05%, directly causing top projects to migrate. For example, the star MEME token USELESS (market cap $299 million) chose to launch on LetsBonk.fun, surging 2,400% in two weeks.

Pump.fun's counterattack began on August 8th. Its launched "Group Coins" feature attempts to fundamentally reshape the platform's trust system:

Multi-signature Team Issuance: Allowing multiple developers to create tokens through a joint wallet, preventing single-person "rug pull" scams.

Competitive Issuance Categories: Establishing a new token ranking and competition mechanism to promote long-term community building rather than short-term speculation.

Collaborative Tool Integration: Providing project management panels and fund locking tools for creators to reduce collaboration costs.

This update was seen by the community as a "pixel-level imitation" of LetsBonk.fun, but the effect was immediate: Within 24 hours of the feature launch, Pump.fun's token issuance surged to 15,000, reclaiming the market share lead after a month.

III. Rebuilding Trust: Repurchase, Cashing Out, and Ecosystem Fund Chain Negotiation

Pump.fun's comeback is accompanied by huge controversy. On August 13th, on-chain monitoring showed the team transferred 86,000 SOL (approximately $16.28 million) to Kraken, marking the first large-scale cash-out operation since PUMP token issuance. Despite triggering "selling out" suspicions, the team explained this as ecosystem development fund allocation:

Historical Income Support:Pump.fun accumulated revenue of $720 million from Q1 2024 to Q2 2025, reaching $264 million in the first half of 2025, with abundant fund reserves.

Fee Allocation Reform:After the August upgrade, the team promised to inject part of fee income into the PUMP token repurchase pool, forming an "income-repurchase-deflation" cycle.

However, compared to LetsBonk.fun's ecosystem binding, Pump.fun's trust rebuilding still appears thin:

BONK's Deep Binding:LetsBonk.fun has cumulatively burned BONK worth 34,000 SOL and staked 10,000 SOL to secure the network, creating a strong association between token value and platform growth.

PUMP Token Empowerment Lacking:Pump.fun has not yet clearly linked platform income with token holder rights, and community doubts about "pie in the sky" remain unresolved.

Life-and-Death Race: Three Key Decisive Points for Future Landscape

As both sides exchange offensive and defensive positions, the Solana MEME platform battle enters a new stage, with three key variables set to determine the final landscape:

Creator Migration Cost and Benefit Rebalancing

LetsBonk.fun's 1% fee sharing remains an insurmountable moat. Unless Pump.fun significantly increases the sharing ratio or introduces airdrops and staking rewards, top projects may only conduct "multi-platform launches" on Pump.fun rather than exclusive listings.

Effectiveness of "De-scamming" Team Tokens

Whether "Group Coins" can end Pump.fun's 98.7% token failure rate remains uncertain. On-chain KOL Byzantine General sharply pointed out: "Multi-signature teams only increase scam costs but cannot eliminate scam motives. Without third-party audits and mandatory liquidity locking, Group Rugs could become a new hidden danger."

Ultimate Showdown of Token Economic Models

Pump.fun's winning move lies in PUMP token empowerment:

- If introducing fee dividends: Allocating 0.05% platform income to token holders could replicate LetsBonk.fun's repurchase and deflation model.

- If opening governance voting: Allowing community decisions on new feature directions to reshape the decentralized image.

- LetsBonk.fun might counterattack with token airdrops. Its reserve fund pool has accumulated 52 million SOL, and airdropping governance tokens to active users could trigger a new traffic absorption wave.

Epilogue: Hidden Concerns and New Hope in the Reversal

On August 13th, when the PUMP token returned to $0.004, the Pump.fun team completed a $16.28 million SOL cash-out. Where will these funds be invested? The official has not yet specified, but the community expects them to be used for new feature development and creator incentives.

Short-term optimistic signals are already visible: PUMP's 30% monthly increase and token issuance rebound prove the market is willing to pay for reforms. If "Group Coins" can incubate the next USELESS-level project, Pump.fun might truly turn the tide.

Long-term challenges remain: LetsBonk.fun still holds 430,000 community die-hard fans and Solana ecosystem deep integration advantages. Its daily trading volume of $570 million and 75.1% token graduation rate require Pump.fun to break through with continuous innovation, not just a single update.

The ultimate outcome of this arms race may be determined by the most fundamental truth: whoever can bring higher earnings to creators and generate more wealth for traders will be the final winner of the Solana meme ecosystem. Regardless of the result, the transparency reforms, anti-fraud mechanisms, and community incentive upgrades brought by the dual competition have already reshaped the rules of the entire industry.