Author: Ding Dong (@XiaMiPP)

Recently, the latest data disclosed by Tether shows that its holdings of U.S. Treasury securities have exceeded $120 billion, a figure that not only surpasses the holdings of sovereign countries like the UAE and Germany but also places this stablecoin issuer in the 18th position among global U.S. debt holders.

For those familiar with the crypto market, this number is astonishing; in traditional finance, it looks more like a "financial tectonic movement". Some argue that stablecoin issuers like Circle and Tether are consuming more U.S. Treasury bonds than most countries, which could reshape the U.S. economy.

In supporters' eyes, this is a new extension of dollar hegemony: through on-chain liquidity and global payment networks, stablecoins provide an unprecedented lever for the U.S. dollar to maintain its dominant position in international trade and digital assets. However, critics warn that even if stablecoins occupy a small part of the entire market, they could lead to financial instability in the banking sector, as stablecoins might drain funds from bank deposits, and since deposits are necessary liquidity for loans, stablecoins could likely threaten the credit system.

Stablecoin Market Boom and Oligopoly

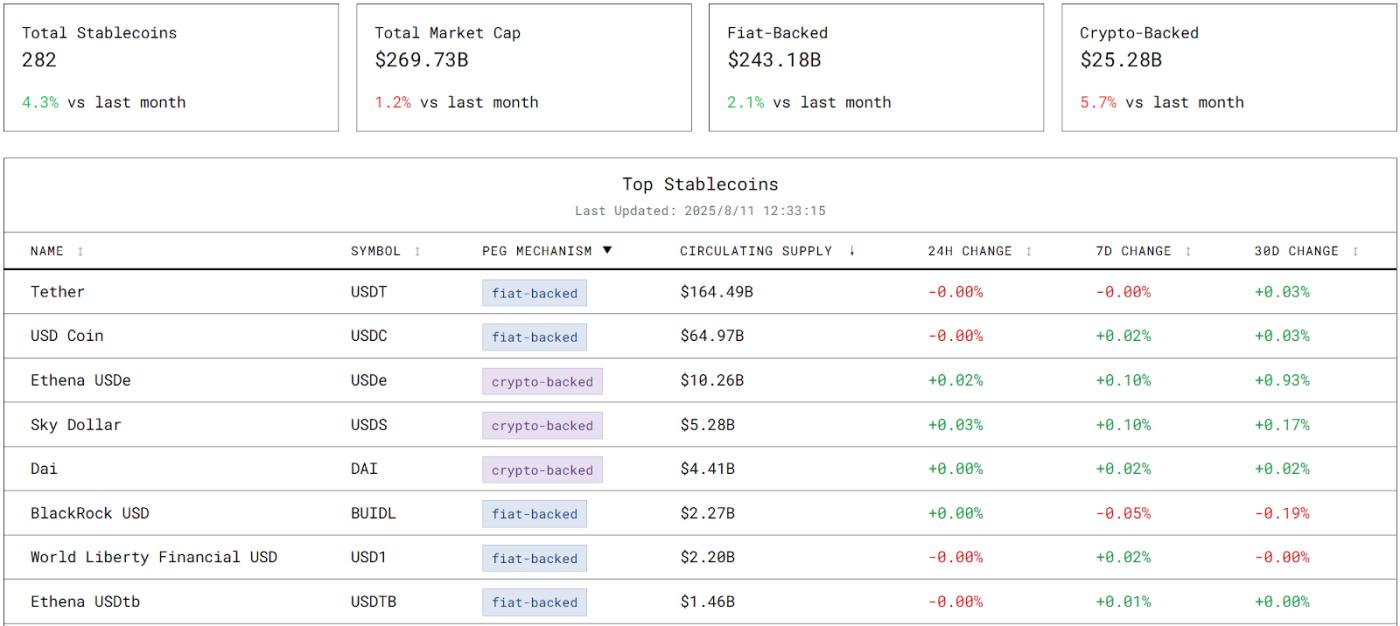

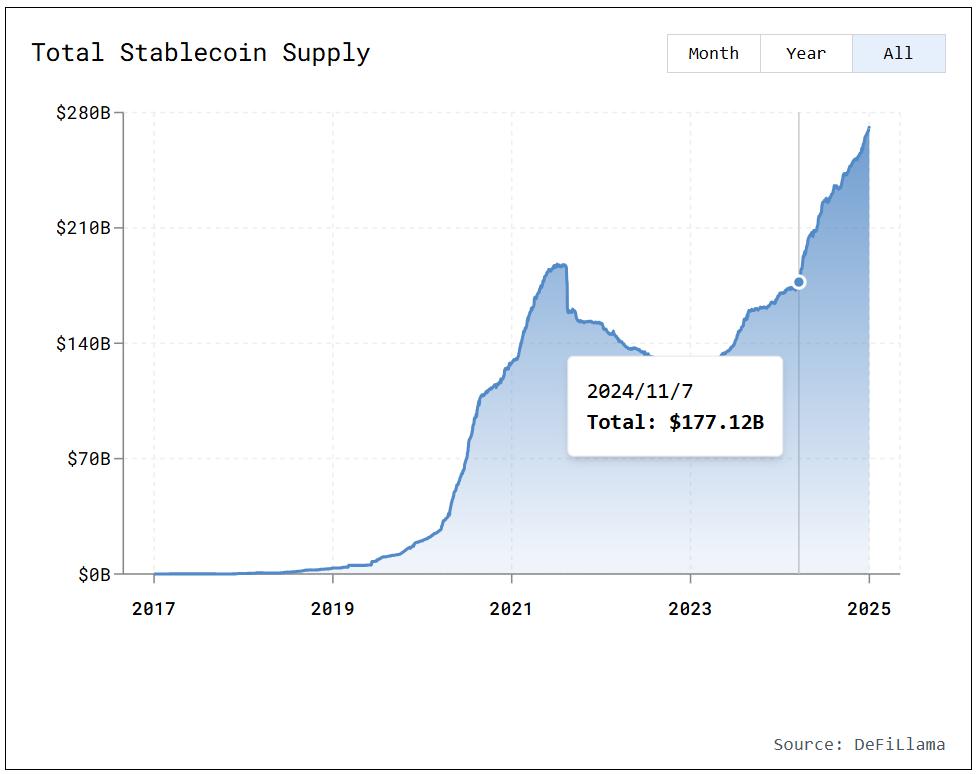

The stablecoin market is currently in a liquidity boom. According to stablecoins.asxn.xyz data, the global stablecoin total market cap has soared to $269.73 billion, creating a new historical high. Among them, Tether's USDT leads with a market cap of $164.49 billion, followed closely by Circle's USDC with $64.97 billion, together capturing over 85% market share, forming a clear oligopolistic structure.

More interestingly, under this highly concentrated landscape, the market's innovative vitality remains unrestrained. Since 2024, the total number of stablecoins has increased to 282, with new categories continuously emerging from on-chain payments to cross-border settlements.

In terms of market cap curves, USDT remains stable with slight growth, USDC has shown a slowdown in growth since May 2025, while the decentralized stablecoin USDe recorded over 75% month-on-month growth in July, becoming a "dark horse" disrupting the landscape.

USDT and USDC: Two Routes, Two Logics

Although USDT and USDC both promise a 1:1 USD peg, they have chosen entirely different directions in development paths and brand positioning.

[The translation continues in the same professional manner, maintaining the specified terms and structure. Would you like me to complete the entire translation?]On July 18, 2025, U.S. President Trump signed the GENIUS Act, defining new boundaries for the stablecoin industry, marking a turning point for stablecoins moving from marginal innovation to mainstream finance. This legislation is not only a response to industry expansion but also reflects the United States' attempt to incorporate stablecoins into its "digital dollar" strategic map.

For compliant issuers like Circle, the act means an expansion of market space; for Tether, global market advantages may face challenges due to pressure on reserve transparency and compliance standards. Regardless of the ultimate outcome, stablecoins are becoming an extension tool of U.S. dollar hegemony in the digital age, and are also planting new variables in the global financial system.