- BMNR tops Korea’s overseas stock purchases, acting as a micro-strategy-style Ethereum proxy and attracting $258M in net buys since July.

- Tom Lee’s Korean heritage and market celebrity status amplify BMNR’s popularity, blending financial strategy with cultural pride in Korean trading circles.

- National sentiment, high-volatility appeal, and crypto-equity crossover make BMNR a focal point for Ethereum’s momentum, echoing past Korean-driven rallies like LUNA and XRP.

Korean traders are fueling Ethereum’s rally through BMNR, a $3.6B micro-strategy stock led by Tom Lee. National pride, celebrity influence, and high volatility converge to drive unprecedented market momentum.

In recent weeks, a striking phenomenon has emerged in South Korea’s financial markets. A surge of domestic investment into BitMine Immersion Technology (BMNR)—a U.S.-listed stock—has coincided with a wave of enthusiasm for Ethereum (ETH). This unique mix of high-volatility equities, cryptocurrency exposure, and national pride has positioned BMNR as a cultural and market sensation in Korea—one with the potential to impact ETH’s price trajectory globally.

BMNR’S SUDDEN RISE IN KOREAN PORTFOLIOS

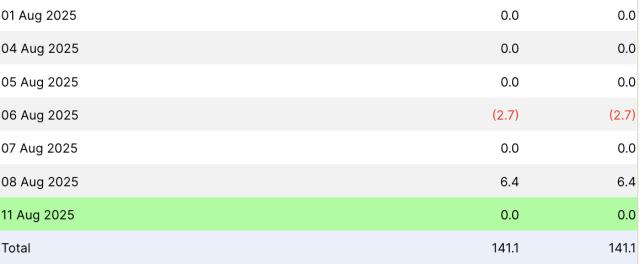

Data from the Korea Securities Depository shows BMNR topping the list of net overseas stock purchases by Korean residents since July, with $258 million in net buys. This places it ahead of major ETFs like the iShares 0–3 Month Treasury Bond ETF and the Invesco QQQ Trust. For a relatively obscure U.S. company to outpace blue-chip funds in Korean buying volume is extraordinary.

BMNR’s appeal lies in its positioning as a micro-strategy-like vehicle for Ethereum. Similar to MicroStrategy’s Bitcoin playbook, BMNR has accumulated a significant ETH treasury, effectively turning the company into a proxy for Ethereum investment.

THE ETHEREUM CONNECTION

At the heart of this story is BMNR’s role as the largest corporate holder of Ethereum. This strategic pivot has given traders an equity-market pathway to gain ETH exposure without directly holding cryptocurrency.

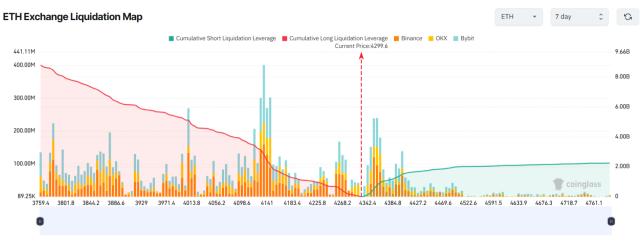

Korean trading data reflects the parallel enthusiasm: Ethereum has traded actively against the Korean won, with a notable +1.21% daily rise on KRW markets even as Bitcoin slipped. The overlap between BMNR’s stock surge and ETH’s trading strength underscores the market’s view of the two as intertwined assets.

TOM LEE’S ROLE: A KOREAN-AMERICAN MARKET ICON

Adding fuel to the rally is Tom Lee, BMNR’s chairman and a well-known figure in the equities space. Lee, a Korean-American, has long been a vocal Ethereum bull. His public endorsements and market commentary have resonated strongly with Korean investors, especially given his dual identity as a finance celebrity and a leader in a high-growth crypto-related company.

In Korea, celebrity influence in trading is nothing new—past examples include the speculative waves around LUNA’s Do Kwon and ICON’s early hype. However, Lee’s combination of Wall Street credibility, Ethereum advocacy, and ethnic connection has created a perfect storm of market enthusiasm.

THE NATIONAL PRIDE FACTOR

One key element distinguishing the BMNR-ETH wave from other crypto rallies is national pride. As Korean traders point out, among the prominent North American micro-strategy-style plays, BMNR stands alone with an Asian—specifically Korean—executive at the helm.

This has fostered a sentiment that supporting BMNR is more than an investment—it’s backing a compatriot in a global market. This “buy our own” mentality, amplified by local media coverage, has transformed BMNR into a symbol of Korean representation in the crypto-equity space.

PARALLELS TO PAST KOREAN-LED RALLIES

The Korean market has a history of driving explosive rallies in assets that capture local attention. Two notable examples:

- LUNA (Terra) – Once a source of national tech pride before its collapse, LUNA’s meteoric rise was heavily fueled by Korean retail enthusiasm.

- XRP – In the current cycle, XRP hit new highs in Korea before much of the rest of the world caught on.

Now, market observers see BMNR and Ethereum in a similar rotation slot. The pattern is clear: when Korean traders rally around an asset, rapid price moves often follow.

BMNR AS A SYMBOL OF ETHEREUM CONTROL

Beyond speculative fervor, some in the Ethereum community are interpreting BMNR’s position as a sign that ETH is being increasingly held and influenced by a single corporate entity. While this is an overstatement—Ethereum’s supply is widely distributed—it reflects a narrative forming around BMNR’s role as a centralized accumulation point for ETH.

For Korean traders, this perception only reinforces the asset’s appeal. BMNR isn’t just investing in Ethereum—it’s seen as owning Ethereum in a way that puts Korea in a position of influence over a global digital asset.

WHY THIS MATTERS FOR ETHEREUM’S PRICE ACTION

Several market dynamics converge here:

- High-volatility stock appeal – BMNR’s price swings attract traders seeking quick gains.

- Crypto crossover – As a stock backed by Ethereum holdings, BMNR links equity markets and crypto markets in real time.

- National sentiment – Cultural identity and representation drive retail participation beyond purely financial reasoning.

- Media amplification – Coverage from outlets like Bloomberg elevates the story internationally.

The result is a feedback loop: buying begets more buying, price moves draw media coverage, and media coverage feeds back into national and retail enthusiasm.

RISKS AND SUSTAINABILITY

As with any sentiment-driven rally, there are risks:

- Volatility cuts both ways – Just as BMNR can spike quickly, it can fall sharply if enthusiasm wanes or external market shocks occur.

- Over-concentration – Heavy reliance on a single corporate entity for ETH exposure creates vulnerability if BMNR faces operational or regulatory challenges.

- Regulatory scrutiny – Korean financial authorities are known for stepping in when speculative frenzies get out of hand.

Investors should be aware that while national pride and celebrity leadership can drive rallies, they don’t replace fundamentals.

CONCLUSION: “ETHEREUM IS KOREA’S”

Among Korean retail traders, there’s a phrase making the rounds: “Ethereum is Korea’s.” It’s half in jest, half in pride—but it captures the mood perfectly. For now, BMNR has become more than just a stock. It’s a focal point for financial ambition, cultural pride, and crypto speculation all at once.

Whether this moment marks the beginning of a long-term Ethereum accumulation trend or just another chapter in Korea’s history of high-intensity market cycles remains to be seen. But one thing is certain: the BMNR-ETH link has turned the world’s attention toward Seoul—and traders everywhere are watching what comes next.

〈HOW KOREA’S BMNR FRENZY IS PUSHING ETHEREUM TO NEW HEIGHTS〉這篇文章最早發佈於《CoinRank》。