- LayerZero proposes acquiring Stargate for $110M, converting STG tokens to ZRO at a fixed rate, dissolving Stargate DAO to merge ecosystems under one governance.

- Both ZRO and STG tokens have surged (ZRO by 23–26%, STG by ~16–20%) following the announcement—yet many STG holders criticize the swap ratio and loss of staking

- rewards.Critics argue the fixed 1 STG → 0.08634 ZRO rate undervalues Stargate’s ongoing revenue and staker contributions, calling for fairer compensation or revised terms.

LayerZero has proposed a $110M acquisition of Stargate Finance: retiring STG via a token swap into ZRO, consolidating ecosystems under unified governance—and sparking both market optimism and community backlash.

At 1:00 a.m. on August 11, 2025, cross-chain messaging protocol LayerZero dropped a bombshell proposal: a $110 million plan to acquire all circulating STG tokens of cross-chain bridge Stargate and fully fold the project into the LayerZero ecosystem.

The market reaction was immediate — LayerZero ZRO surged more than 30% in a single day. And Stargate’s native token STG surged nearly 29%.

If approved, this deal would mark one of the most high-profile “parent–subsidiary mergers” in the cross-chain space. But beneath the polished narrative of “ecosystem synergy,” the proposal has sparked intense backlash within the Stargate community, with some holders calling it nothing less than a “cut-price land grab” and “governance hostage-taking.”

According to LayerZero’s published plan:

- Acquisition price: $0.1675 per STG, via a swap ratio of 1 STG : 0.08634 ZRO (based on ZRO’s current price of $1.94).

- Stargate DAO will be dissolved, with all protocol surplus used for ZRO buybacks and burns.

- Long-term locked veSTG and liquid STG will be redeemed at the same rate — no extra premium for lockups.

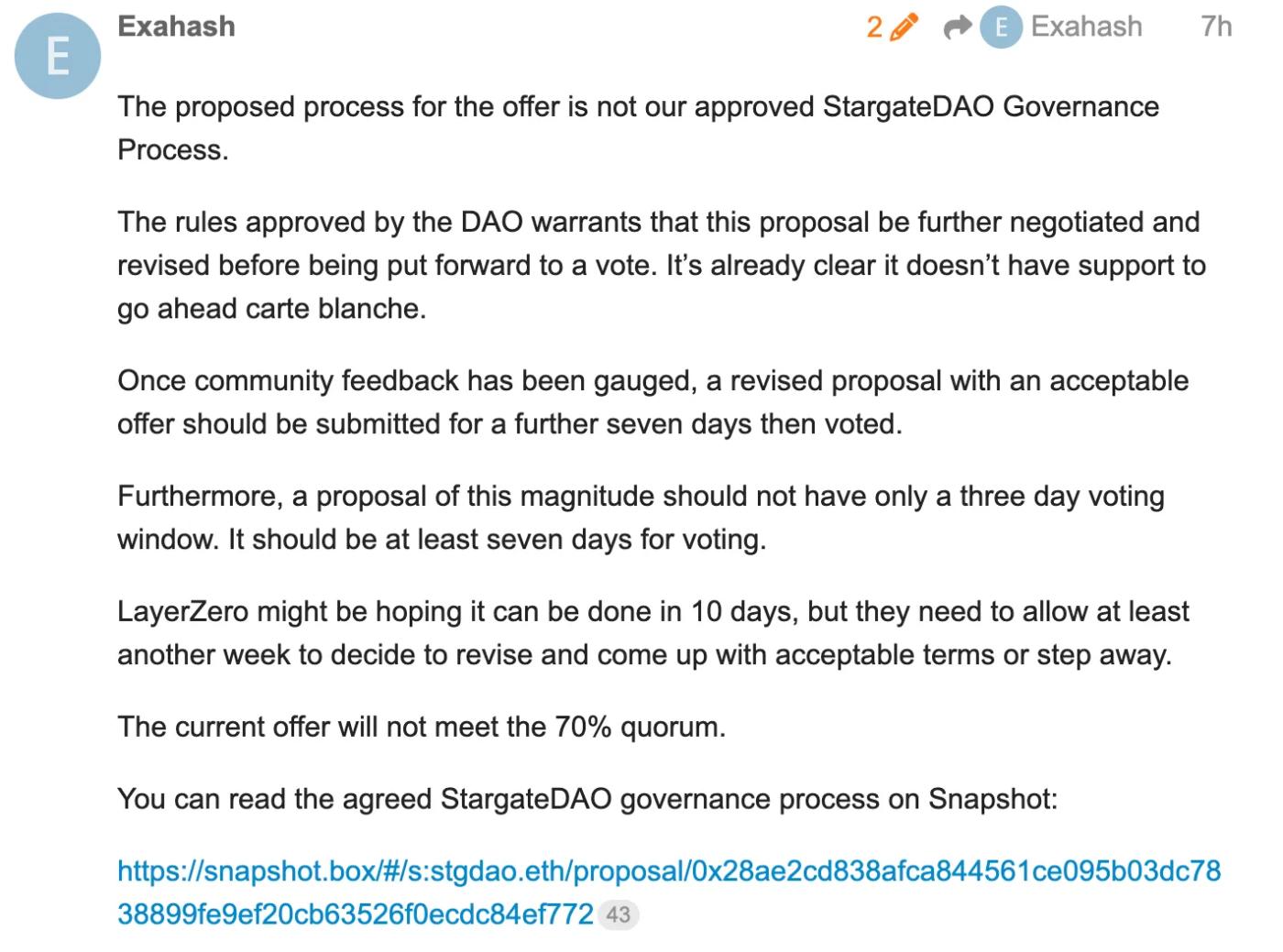

- Timeline: 7-day discussion period, followed by a 3-day Snapshot vote. Approval requires 70% “Yes” votes with at least 1.2M veSTG participating.

The integration play

Structurally, this is a one-and-done acquisition: LayerZero buys out all STG at a fixed price, takes full control of the protocol and its revenue streams, and absorbs Stargate’s governance rights, tokenomics, and revenue-sharing model into the ZRO framework.

Stargate is currently the most-used cross-chain bridge, with over $70 billion in cumulative transaction volume, and its Hydra mechanism accelerates liquidity onboarding for new chains.

Post-acquisition, LayerZero could bind its underlying messaging protocol directly to the largest cross-chain liquidity gateway — effectively creating a “base-layer comms + application-layer bridge” closed loop.

Phasing out STG and funneling Stargate’s revenue into ZRO buybacks would sharpen ZRO’s value capture, reduce market distraction from multi-token systems, and potentially boost both secondary market performance and long-term fundraising valuations.

Why the opposition is pushing back

Critics argue the deal undervalues Stargate’s long-term potential and may be linked to LayerZero’s rumored U.S. IPO plans, aiming to consolidate assets and simplify governance before going public.

The $110M total valuation is seen as a bear-market anchor price. Just months ago, Stargate Foundation’s internal bull-case model priced STG at $0.60 — and that was before the U.S. GENIUS Act passed.

U.S. Treasury Secretary Bessent has since projected the stablecoin market will jump from $250B to $3.7T following the Act’s implementation, with transaction velocity — the key driver of Stargate fee revenue — growing even faster.

In the same period, Stargate has expanded integrations, boosted transaction volume, and increased yields for long-term lockers. The team even waived OFT routing fees to fuel ecosystem adoption. With entry into the Intents market on the horizon, profitability could rise further. Analysts like Tom Lee have also raised Ethereum’s potential price target to $10,000+, suggesting a parallel lift in the value of protocol treasury assets.

From the opposition’s perspective, the proposed buyout price ignores this upside, offers no acquisition premium, and is curiously timed before a potential altcoin bull run (ALTSZN).

There’s also the governance fairness angle: veSTG holders — who currently enjoy a 50/50 revenue split and can lock up to 4 years — would lose their income rights and receive no lockup premium.

The 7-day discussion + 3-day vote has been branded a “blitzkrieg”, denying the community time to negotiate better terms or solicit competing bids. Some warn it’s a classic anchoring strategy — start with a lowball offer, then slightly improve it to make the final terms appear generous.

Strategic alignment or value extraction?

From a pure strategy lens, merging Stargate into LayerZero could indeed concentrate technology, users, and token value — a near risk-free win for ZRO holders: more revenue, a clearer buyback narrative, and a stronger brand story.

But for STG holders — especially long-term lockers — it looks more like value extraction: income streams removed, no premium paid, governance rights erased.

Opponents argue the DAO should delay the deal until after the GENIUS Act’s market effects fully unfold, invite competing bids from potential buyers such as Coinbase, Robinhood, Circle, or Tether, and consider hiring an investment bank to secure a higher valuation.

〈LayerZero Proposes $110M Acquisition of Stargate: Strategic Integration or a Cut-Price Land Grab? A DAO vs. Capital Showdown〉這篇文章最早發佈於《CoinRank》。