The cryptocurrency market is experiencing strong volatility and potential to reach new peaks with quick profit opportunities.

Transactions from whales and large organizations, along with capital flowing into cryptocurrency financial products like ETFs, reflect the market's heat and increasingly strong corporate investment trends.

- SOL and ETH whales are actively trading, creating large fluctuations on CEX.

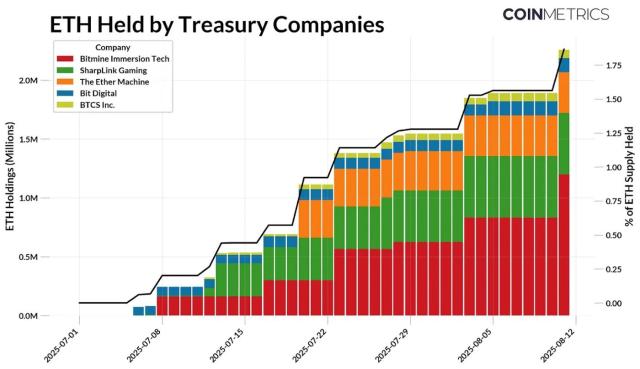

- Large organizations like BitMine and FG Nexus are strongly expanding their ETH funds with billions of dollars in value.

- Cryptocurrency ETFs are surging, driving global capital flow and elevating cryptocurrency's position in investments.

Is the cryptocurrency market preparing to enter a peak phase?

Trader Eugene notes that the market may be about to touch its peak with increased volatility and many quick investment opportunities.

After two consecutive months of strong growth, similar to the period after Trump's inauguration and the launch of the $TRUMP Token, the market currently shows high volatility and the potential for quick profits, but risks are also significant. Investors need to seize this moment but remain cautious about potential reversal.

How are Solana (SOL) whales operating on centralized exchanges?

According to Lookonchain, SOL whales have continuously deposited large amounts of SOL into major exchanges in the past 9 hours.

Specifically, address CMJiHu deposited 96,996 SOL (equivalent to $17.45 million), address 5PjMxa deposited 91,890 SOL ($15.98 million) into Kraken, and HiN7sS transferred 37,658 SOL ($6.73 million) to Binance, generating profits of around $1.63 million.

How much ETH has BitMine accumulated and what does this mean?

BitMine is recognized as holding a large amount of ETH, with a total of over 1.15 million ETH, equivalent to nearly $5 billion.

According to Ember, new wallets with ETH accumulation characteristics through BitGo are concentrating around 293,186 ETH ($1.24 billion) in the past 8 days. Previously, BitMine announced adding 317,000 ETH to its portfolio in just one week. This move reinforces BitMine's position as the world's largest ETH repository, backed by ARK, Founders Fund, and Pantera.

"BitMine aims to hold 5% of the total global ETH supply, becoming the world's leading corporate ETH reserve."

Statement from BitMine leadership, 2025

How are institutional investments and cryptocurrency ETFs growing?

Since the beginning of last year, over 1,300 ETFs have been launched globally, with more than 10 of the top 20 funds related to cryptocurrency.

According to Nate Geraci, President of The ETF Store, cryptocurrency ETFs dominate, including 5 Bitcoin spot ETFs, 2 Ethereum spot ETFs, and many other large-cap funds. This growth reflects increasingly positive trust and awareness about cryptocurrency in professional investment.

How are Ethereum futures contracts trading on the CME market?

Ethereum futures contract trading volume on CME in July reached a record $118 billion, an 82% increase from the previous month.

The Block reports that open interest also strongly increased from $2.97 billion to $5.21 billion, and global futures contract trading volume reached $2.12 trillion, surpassing the all-time peak from May 2021. Ethereum reached its highest price since late 2021, over $4,300 on 8/9/2025, driving a significant increase in Google search volume.

What are the benefits and impacts of large ETH investments from organizations like FG Nexus and SharpLink?

FG Nexus purchased 47,331 ETH worth $200 million, aimed at developing an ETH investment strategy through staking and re-staking.

SharpLink recently completed a private sale worth $400 million and now owns nearly 599,000 ETH with an expected value of over $3 billion upon investment completion. These funds promote ETH becoming an important corporate reserve asset, strengthening its position and application in tokenized financial models.

"Large-scale ETH accumulation by organizations helps promote cryptocurrency acceptance as a reserve asset and drives global Ethereum ecosystem development."

Eric Trump, ALT5 Sigma Director, 2025

Frequently Asked Questions

Is the cryptocurrency market at its peak?

Based on observations from professional traders, the market is currently highly volatile with many quick profit opportunities, but the risk of reversal is also very high.

What large transactions have Solana whales recently made?

In the past 9 hours, whales have transferred a total of over 225,000 SOL worth around $40 million to major exchanges like Kraken and Binance.

How much ETH does BitMine currently hold and why is it important?

BitMine owns over 1.15 million ETH equivalent to nearly $5 billion, making it the world's largest corporate ETH repository, shaping organizational cryptocurrency reserve trends.

What was notable about Ethereum futures contract trading volume on CME in July?

Trading reached $118 billion, an 82% increase from the previous month, showing significant attraction from institutional investors in the Ethereum futures market.

How have cryptocurrency ETFs developed since early 2024?

Over 1,300 ETFs launched globally, with 10 of the top 20 related to cryptocurrency, reflecting strong participation from institutional investors.