New Highs Highlight Bitcoin's Dominance, While Altcoins Await Their Moment.

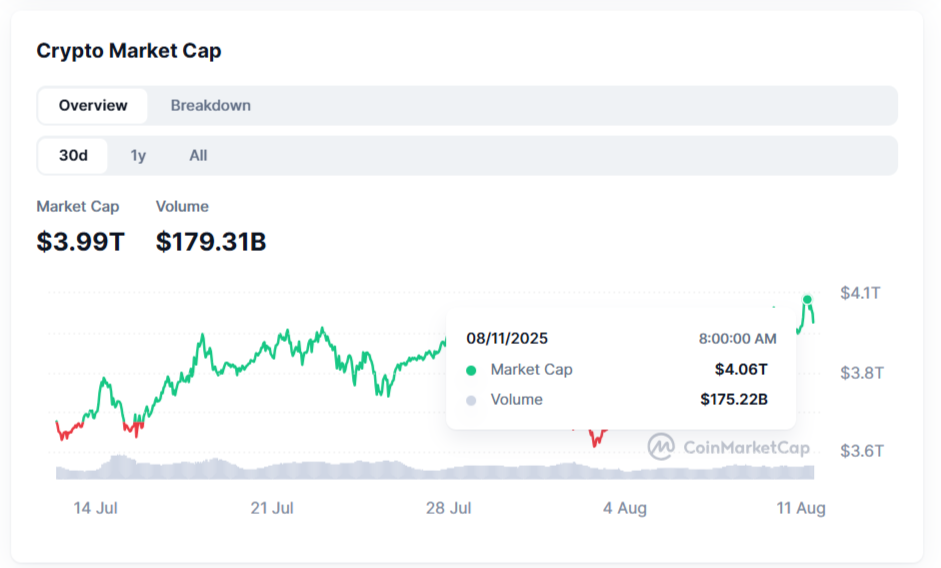

According to CoinMarketCap's data, the cryptocurrency market reached a new milestone, with its total market value climbing to an unprecedented $4.06 trillion. Driven by a 1.8% growth in total market value over the past 24 hours, the total market value exceeded the previous peak of $4.04 trillion. During the same period, trading volume surged to $180 billion, highlighting the reignited enthusiasm in the entire digital asset realm.

While this achievement marks a strong rebound from earlier lows, the much-anticipated "altcoin season" has yet to arrive.

Bitcoin's Dominance Remains Unshakeable

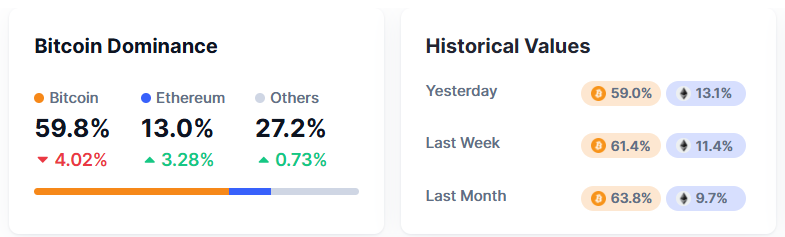

Bitcoin continues to lead the current uptrend, accounting for as much as 59.8%. On July 14, BTC reached a historic high of $123,000, subsequently trading in the range of $117k-$122k. The strong performance of cryptocurrencies has driven most of the market's upward momentum, consolidating its position as the primary driver of sentiment and liquidity.

Historically, altcoin seasons have followed periods of rapid Bitcoin appreciation. As Bitcoin stabilizes, investor focus often shifts to other digital assets, triggering a broad altcoin rally. However, this rotation has not yet occurred, indicating some changes in the current cycle.

Why Altcoin Season Has Not Yet Arrived

?

Altcoin season refers to a period when alternative cryptocurrencies outperform Bitcoin across multiple metrics. Typical characteristics include rising altcoin dominance, price gains outpacing Bitcoin, and heightened investor enthusiasm driving high trading volumes. In May 2021, the total market value of the top 100 altcoins reached 130% of Bitcoin's, significantly higher than the current level.

Several factors explain why altcoins have not yet synchronized with Bitcoin's rise. Key differences in this cycle include the introduction of ETFs, large purchases by listed companies (like Michael Saylor's Strategy), and even national accumulation, all of which have boosted Bitcoin.

These developments have attracted significant institutional and retail capital to Bitcoin, consolidating its dominance.

Meanwhile, most on-chain activity and retail excitement have been concentrated on meme coins, which have dominated headlines and trading volumes. Platforms like pump.fun and letsBONK.fun have helped divert attention and funds from traditional altcoins, slowing their momentum. Consequently, the broad-based altcoin rally seen in previous cycles has not yet materialized.

According to a recent CoinGecko analysis, the altcoin season may unfold in multiple phases. The current phase may reflect their described second stage, where Bitcoin's surge attracts significant capital, followed by increasing focus on selected high-market-cap altcoins rather than the entire altcoin market.

In this scenario, altcoins like Ethereum, Solana, and other large-cap Layer-1 tokens may lead the way, with momentum then cascading to smaller projects. The timing and breadth of this rotation depend on market sentiment, Bitcoin's price stability, and the emergence of notable industry catalysts.

Signals of Potential Shift

Despite the lack of an altcoin rally, there are indications that this might change. In recent days, Bitcoin's dominance has slightly decreased, historically a precursor to capital moving into altcoins. Increased network activity in networks like Solana, coupled with rising decentralized application usage, could catalyze the next market phase.

Investors often monitor Ethereum's price relative to Bitcoin as an early indicator. Ethereum's strong performance typically precedes broader market rallies for other coins. Similarly, increased trading volumes for top altcoins and strong performance of mid-cap assets might signal the beginning of an altcoin trading season.

Another possibility is that the altcoin season may never unfold in the same way as in past cycles. The current drivers of Bitcoin, such as ETF approvals, corporate finances, and national accumulations, have altered the market structure. With Bitcoin dominating speculative activity and investor attention, the conditions that once drove broad altcoin rallies may have been permanently changed.

Outlook for the Coming Months

The record-breaking total market value highlights the current uptrend's strength and Bitcoin's role as a market anchor. However, altcoin enthusiasts may need to be patient. If historical patterns repeat, capital might shift to alternative assets in the next cycle phase, triggering the long-awaited altcoin season.

Currently, Bitcoin remains the focus. Its continued performance may ultimately determine the timing and magnitude of any potential altcoin surge.