Crypto inflows reversed the trend in the week ending on 02/08/2024, reaching 578 million USD in the previous week. However, while Ethereum was the previous leader, Bitcoin is gradually catching up.

Trump's recent move to bring crypto into US 401(k) accounts was the main reason for this reversal during the week.

How Trump Activated Mid-Week Recovery for Crypto Inflows

In the week ending on 02/08/2024, crypto inflows reached 223 million USD, marking a significant contraction after reaching 2 billion USD in the previous week.

However, Trump's recent move to allow crypto into US 401(k) accounts created a psychological reversal, pushing inflows to 578 million USD.

"Very bullish for crypto!" crypto analyst Lark Davis said on X.

This indicates that interest surrounding the inclusion has overcome the negative sentiment from FOMC and macroeconomic concerns. The US is leading, accounting for the majority of crypto inflows last week.

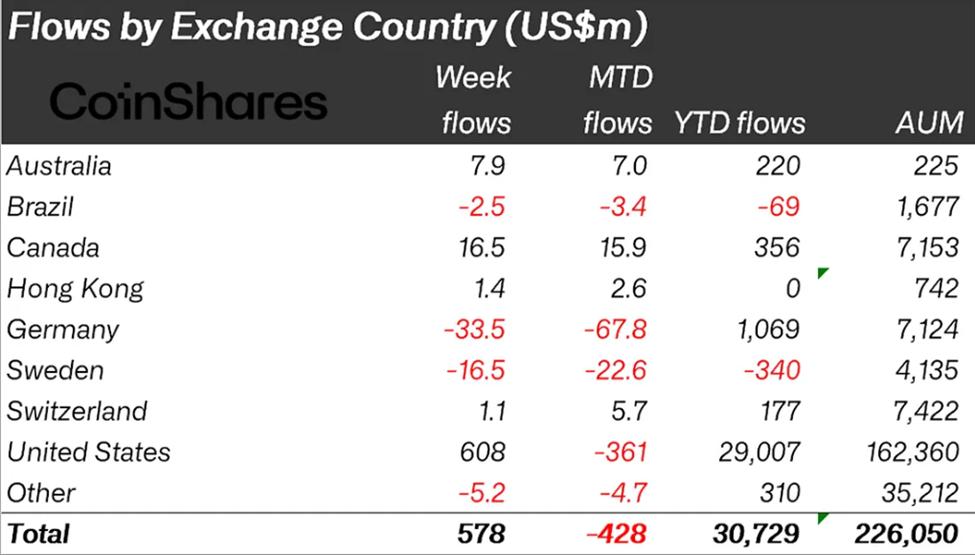

Crypto inflows by region. Source: CoinShares Report

Crypto inflows by region. Source: CoinShares Report"After early week outflows of 1 billion USD due to weak US employment data, inflows recovered to 1.57 billion USD after the government approved crypto for 401(k), bringing weekly inflows to 578 million USD," read a section in the latest CoinShares report.

Notably, Trump's directive reversed the outflows from crypto, which had reached 1 billion USD mid-week due to concerns from negative US economic indicators.

James Butterfill, CoinShares' head of research, explained that the crypto market recorded 1.57 billion USD of positive inflows in the second half of the week after the government's announcement allowing digital assets in 401(k) retirement plans.

However, Volume in crypto ETF funds remains 23% lower compared to the previous month, possibly due to quieter summer months.

Bitcoin Gradually Catching Up to Ethereum's Lead

Meanwhile, Ethereum has maintained its lead over Bitcoin in recent weeks amid an altcoin-led price surge. As BeInCrypto reported, Ethereum recently pushed crypto inflows to a record weekly high of 4.39 billion USD.

However, amid Trump's crypto promotion, Bitcoin is catching up. While Ethereum-related inflows reached 269.8 million USD, Bitcoin ranked second with 265 million USD.

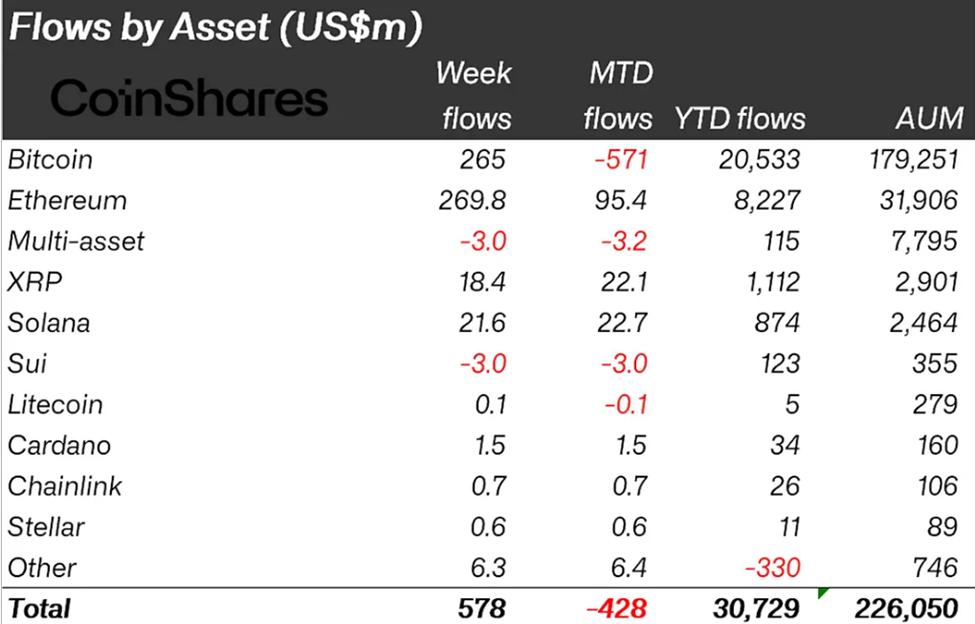

Crypto inflows by asset. Source: CoinShares Report

Crypto inflows by asset. Source: CoinShares ReportThis is a significant change from 133.9 million USD of positive inflows into Ethereum and 404 million USD of outflows from Bitcoin investment products the previous week.

"Bitcoin has seen a recovery after two consecutive weeks of outflows," Butterfill wrote.

In this context, Samson Mow, CEO of Jan3, said most ETH investors own many Bitcoins purchased during the initial coin offering (ICO) or through internal allocation.

Jan3's CEO said these ICO investors are converting to Ethereum to push prices up, following the story of Ethereum Treasury companies.

According to Mow, these investors will transfer their funds back to Bitcoin if Ethereum's price exceeds a certain level.

Agreeing with Mow, Bitcoin pioneer Davinci Jeremie, who advised his Watchers to just spend a dollar buying Bitcoin, encouraged investors not to sell their Bitcoin for Ethereum.