Source: PolkaWorld

Original link: https://mp.weixin.qq.com/s/i-21DJ_EZg0rGjet2WN1VQ

The term "multi-chain architecture" was once considered the golden narrative of Web3 for a long time: each chain could flexibly expand according to its own needs, collaborate with each other, share security, connect value, and build a truly open and interconnected network universe.

Ethereum L2 is such a narrative, as are Cosmos and Polkadot.

However, the ideal has not yet been realized, and the predicament has quietly arrived.

When we review the current development state of mainstream L1 and L2 networks, a common problem emerges:

Chains are increasing, but users cannot keep up;

Technology continues to break through, but product experience remains distant;

Capital rushes in, but it is difficult to precipitate sustainable value.

Public chains with multi-chain architecture have always been trapped in a dangerous "incentive cycle": issuing tokens, airdropping, pumping, selling, and crashing. Short-term heat can be easily manufactured, but long-term trust is increasingly scarce.

Cosmos's Crisis is Not an Exception, But a Microcosm

Taking Cosmos as an example, it was once considered one of the best practitioners of multi-chain architecture.

Through the path of Staking ATOM → Receiving Airdrops → Supporting Subsidiary Chain Projects, Cosmos once established the earliest and most active "ecosystem flywheel" in the Web3 world:

Projects like Osmosis, JUNO, Evmos, and Celestia were "incubated" under this mechanism;

Users actively participated in ATOM staking, received subsidiary chain token airdrops, and further participated in the governance or trading of these new projects;

Project parties quickly attracted traffic and attention through airdrops, completing the cold start task in the initial stage.

This "Stake-to-Earn + Airdrop" mechanism once activated the vitality of the Cosmos community in a short time and helped many projects obtain initial users and market.

But the problem is that this mechanism itself is not sustainable.

As more and more projects "take off through airdrops", airdrops gradually no longer represent long-term construction, but only one-time income:

Users participate in staking only for arbitrage;

Project parties dump tokens after airdropping, lacking long-term incentive mechanisms;

ATOM staking is diluted by high inflation, harming long-term holders' interests;

Subsidiary chain value cannot feed back to ATOM itself, leading to "ecosystem bustle, main chain decline".

Ultimately, when market heat fades and the airdrop economy bubble bursts, the ecosystem quickly collapses from its peak.

From Evmos, Stride to Celestia and Osmosis, the script of "airdrop takeoff → hyped trading → crash to zero" is repeatedly performed.

This is what we mean: Incentive cycle ≠ Business model. Airdrops bring one-time attention, not product retention; Staking cannot protect token value, nor can it support long-term project survival.

Today, Cosmos is paying a heavy price for this seemingly "value-binding" growth path:

Core asset $ATOM has dropped over 90% from its historical high;

Chain projects like Osmosis, JUNO, and INJ have fallen between 70% and 99%;

Multi-Chain Architecture Crisis

We cannot blame all problems on "speculators". The incentive mechanism itself is not wrong; what's wrong is the project parties' misuse of incentives and avoidance of business logic.

The problems Cosmos faces also exist in more multi-chain ecosystems:

Subsidiary chain value is fragmented, difficult to form a unified return mechanism;

Native tokens lack use cases, long-term inflation dilutes trust;

Governance systems are split, and communities lack stable consensus;

Airdrop economy destroys long-termism culture, hurting builders;

No income model supports user growth, unable to form a product closed loop.

This is not just a problem of Cosmos, nor of L1 or L2, but a deep challenge faced by most Web3 projects: most projects have only run through the incentive mechanism, not the business logic.

In any industry, healthy growth follows the same path:

Projects solve real problems for users;

Users are willing to pay for services;

Projects generate income and continuously optimize products;

Form a sustainable positive cycle.

This logic has been tried and tested in Web2 but has become rare in Web3. Most projects have not taken the first step before rushing to pursue the "market value" of the second step.

What About Polkadot? How to Break Out of Its Own "Vicious Cycle"?

Polkadot has also faced similar doubts in the past and continues to do so. Over the past few years, it has invested heavily in building infrastructure but is often criticized for "no users", "no traffic", and "slow growth".

However, precisely because of this, Polkadot has never been immersed in the illusion of "airdrop economy" but has continuously polished its infrastructure layer - only in the past two years has it gradually shifted towards exploring "productization" and "economic closed loop".

But this does not mean that Polkadot has no problems:

High-traffic parallel chains like Mythical and peaq cannot feed back DOT value

DOT token lacks use cases, and staking supported by high inflation continues to dilute token holders' value

A large proportion of inflation rewards are paid to stakers, causing the network's security costs to increase year by year

High staking returns have always limited Polkadot DeFi development, causing the ecosystem's total TVL to not even make the top ten

Voting rights calculated by DOT quantity make governance easily controlled by large holders

Core prices were once so cheap that Polkadot's core product value became unbalanced

High development threshold, relatively closed ecosystem, unable to attract Ethereum ecosystem developers, while Polkadot ecosystem developers can easily flee to other ecosystems

The entire Polkadot ecosystem lacks product thinking, with both developers and ordinary users lacking user-friendly products

However, I believe discovering these problems is a good thing. Only by precisely identifying problems can we solve them. Therefore, the Polkadot community has recently proposed a series of solutions to these issues.

DOT Supply Side: Inflation Governance, Limiting Total Supply

The community has initiated an off-chain vote to promote DOT towards a fixed total supply cap and step-by-step reduction of DOT inflation to protect long-term holders' interests and avoid uncontrolled incentives.

You can check more information and vote here 'The Proposal to Reduce DOT Inflation Has Finally Arrived! Cutting Inflation, Capping Total Supply, Can It Reverse the Decline? It Depends on This Vote!'

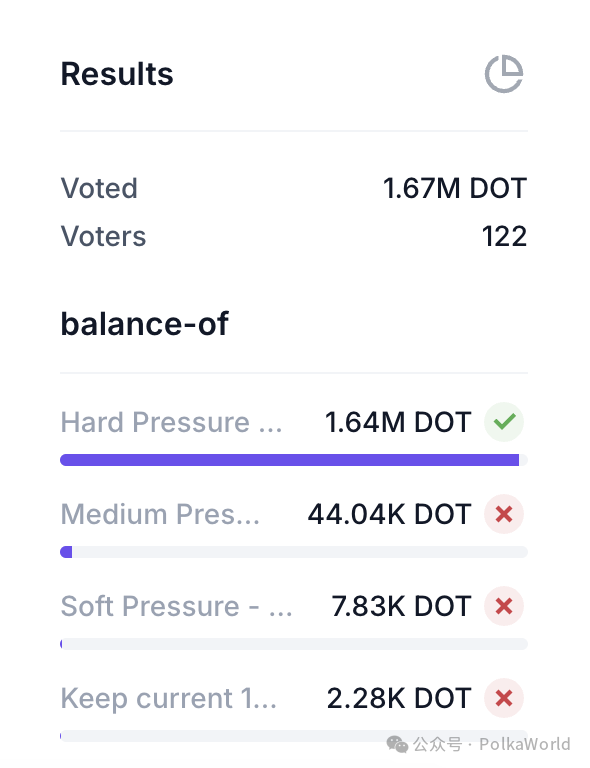

Currently, 122 addresses with a total of 1.67M DOT have participated in the vote! And the first proposal has the highest voting rate! That is, setting the DOT total supply at 2.1 billion and reducing inflation by 50% every two years currently has the highest number of votes!

DOT Demand Side: Creating Real Use Cases

Coretime Market Mechanism: Commodify computing resources, users buy Coretime with DOT to run services;

Polkadot Hub will go live in mid-December: As a smart contract platform supporting 100% EVM + PVM, DOT becomes the default payment token;

Liquidity incentive program stimulates DeFi recovery: vDOT, Hydration, and other protocols promote DOT's core position in on-chain finance; with staking returns declining, a significant portion of DOT is expected to flow into DeFi;

Polkadot APP: This is worth mentioning as a reflection of Parity's product thinking transformation. Through Polkadot Pay and a non-custodial VISA card, Polkadot APP can expand DOT's usage scenarios in real-world payments.

Base Protocol: Advancing JAM protocol development

JAM is positioned as a world supercomputer platform, providing users with more powerful computing capabilities and performance, bringing more imagination to application fields we haven't yet touched;

Developers can more easily deploy their products on JAM, with lower costs and a better experience.

Network Security Mechanism: PoP Model May Replace PoS, Reshaping Security Logic

Polkadot is exploring replacing the traditional staking model with "Proof of Personhood", aiming to reduce the annual security expenditure of $500 million to $90 million, and even achieve "self-sustaining security" through Coretime revenue.

Moreover, once the PoP mechanism is launched, it will help Polkadot OpenGov transition from "token governance" to "personality governance".

Currently, Polkadot's OpenGov governance system is mainly based on DOT weight, where those with more tokens have greater governance weight. The introduction of the PoP mechanism will add the dimension of "identity uniqueness" to governance, allowing each real user to have an independent voice.

Furthermore, governance without identity verification can easily be abused - such as creating multiple addresses to manipulate proposals, voting, opinions, and anonymously publishing false information. The core value of PoP is to provide unique identity verification, preventing governance from being maliciously controlled at the source, making each vote and proposal more authentic and credible.

Based on these changes, Polkadot may form a new main logic and value capture mechanism: DOT → Rent Coretime → Launch Service → Generate Income → Expand Resources → Use More DOT → Continuous Network Growth.

In this model, DOT is no longer an "incentive distributor", but the pricing unit and fuel for the entire ecosystem. Projects depend on DOT to launch businesses, users enjoy services through DOT, and DOT thus forms a positive economic value accumulation.

Growth comes from creating value, not hype and airdrops.

In conclusion: The way out for Web3 is not narrative changes, but usage.

The current state of Cosmos, Ethereum L2, and Polkadot are cases worth reflecting on.

Polkadot is not perfect, as we mentioned earlier, facing issues of slow promotion and high product understanding barriers. But we can at least see that it is actively exploring a more solid path:

Not relying on airdrops for momentum;

Not artificially inflating prices;

Building value through products, users, and real usage.

For Web3 to break out of the incentive loop, it must transcend narrative illusions and return to the essence of business.

Provide service → Users are willing to pay → Project generates income → Reinvest in product → Continuous growth.

If Web3 is to be implemented, will Polkadot's changes provide an economic paradigm that will be validated?