From Dogecoin's Joke to the Myth of a "Fair Launch": The Genesis Code of the Meme - In 2013, programmers Jackson Palmer and Billy Markus created Dogecoin based on a Japanese Shiba Inu meme to mock the frenzy of cryptocurrency speculation. No one could have predicted that this "joke coin" would go viral on Reddit. Netizens used it to reward outstanding creators, crowdfund for the Jamaican bobsleigh team's Olympics, and launch the absurd "Send Dogecoin to the Moon" campaign. This completely spontaneous community behavior unexpectedly gave birth to the purest fairness model in the history of cryptocurrencies: no white paper, no team allocation, 100 billion tokens were produced entirely by mining, and everyone started from the same starting line. Ten years later, Dogecoin's market capitalization stabilized at tens of billions of dollars. People then realized that the "equality" of meme coins was never in the code, but in the hands of netizens who stayed up late to read posts and actively spread memes.

But capital soon rewrote this idealistic experiment. In 2021, Elon Musk, the "Godfather of Dogecoin", jokingly called himself the "Father of Dogecoin" on the SNL show. The price of the coin plummeted 34% that day, and countless retail investors who chased high prices were trapped at high levels. This black humor turn revealed the fatal contradiction of Meme coins. They survive on community sentiment, but are easily manipulated by celebrity effects and capital. Take the 2023 Bonk coin as an example. It claimed to distribute half of the 50 trillion tokens to Solana ecosystem contributors, and wanted to replicate the decentralized gene of Dogecoin. However, the definition of "contributors" was vague, and a large number of tokens eventually flowed into early institutional wallets, and fluctuated sharply by 70% on the first day of listing.

Bonding Curves and Liquidity Traps: Inequality Packaged by Algorithms

Code-free platforms like pump.fun simplify token creation to "three minutes and done," seemingly democratizing meme coin issuance. However, the "bonding curve pricing model" prompt that pops up before clicking the "Create" button hides a mathematical trap that most people don't understand. This algorithm links price to circulation, ostensibly creating a fair mechanism where "buying drives prices naturally higher," but in reality it creates new inequalities. Data from the 2023 "fair launch" of a certain cat-themed meme coin showed that the top 100 traders made an average profit of 300% through front-running, while subsequent participants suffered losses as high as 82%.

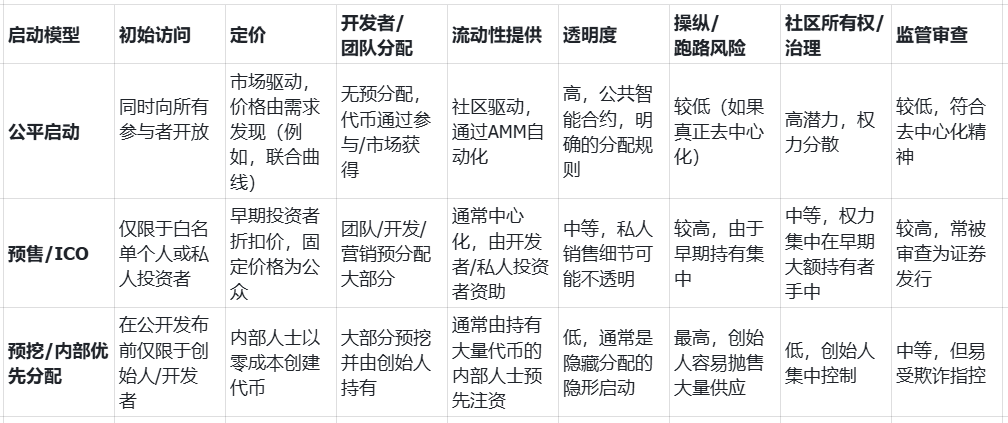

Comparison of memecoin launch models and their impact on equality

More covert manipulation is taking place in the liquidity pool. Everyone still remembers the Squid Game token crash in 2022. After the developers paired the token with Ethereum, they withdrew all the liquidity at once when the price soared, and the tokens in the hands of retail investors became worthless code. This "rug pull" scam has a standard procedure in the meme coin field. First, use the promise of "100% liquidity lock" to attract funds, then use false social media popularity to raise prices, and then delete the social account late at night and run away with the funds. Data from CertiK blockchain security company shows that in 2023, more than 1,200 meme coin projects "ran away", with an average life cycle of 4.7 days, and the amount involved reached US$4.3 billion.

The Ideals and Realities of DAO Governance: When Community Voting Becomes a "Whale Game"

Faced with numerous scams, DAOs (decentralized autonomous organizations) were once seen as a path to salvation for meme coins. The NeoPepe project white paper promised that "every decision would be determined by community vote, with no developer privileges." However, when the community voted on whether to destroy 50% of the tokens, early "whale" holding 30% of the tokens united to veto the proposal, rendering the 12,000 votes of ordinary holders useless. This governance dilemma of "seemingly decentralized, but actually centralized" is ubiquitous in the meme coin sector. Shiba Inu Coin's (SHIB) "community destruction plan" appears democratic, but in practice, 90% of the destruction came from ordinary retail investors, while the wallets of early holders, the whale, remained untouched.

The irreconcilable contradictions within the meme coin community have led to this governance failure. On the one hand, they rely on the "decentralized" label to attract believers, but on the other hand, without a core team to guide the project, it is easy for chaos to occur. In 2023, the community of a famous frog-themed meme coin disagreed on whether to list on a centralized exchange. Supporters and opponents exchanged insults on Discord, resulting in the resignation of seven core developers, bringing the project to a standstill. Cryptocurrency researcher Laura Shin once said, "Meme coin communities are like rave parties. When the music stops, no one knows who will clean up the mess."

Regulatory Gray Area: When "Non-Securities" Identity Becomes a Shield for Fraud

The US SEC classified Meme Coin as "non-securities" in an attempt to make room for innovation, but it ended up being used as a talisman by scammers. In 2023, Trump Coin took advantage of political heat to drive up the price of the coin and sold it. The SEC was unable to classify it as a security and had difficulty intervening. 12,000 investors lost more than $80 million as a result. Regulatory loopholes gave rise to more covert manipulation methods. A team first created 10 similar Meme coins, deliberately let 9 of them run away, and when investors trusted the 10th one, they took the money away in the name of "cross-chain migration" and "contract upgrade".

Even more ironically, some projects are exploiting regulatory loopholes for aggressive marketing. For example, a so-called "compliant meme coin" launched in early 2024 prominently stated in its white paper that "this project does not meet the U.S. Securities and Exchange Commission (SEC) definition of a security." Yet, the disclaimer secretly included the small print "no guarantee of returns." It's difficult for ordinary investors to discern the true risks behind this "compliant packaging combined with high-risk implications" rhetoric. Former SEC Commissioner Hester Peirce warned, "Saying that meme coins are not securities doesn't mean they are safe investments. They can be a hundred times more dangerous than securities."

A Survival Guide for Adventurers: How to Survive the Meme Coin Rush

Despite the numerous risks, Meme coin has attracted countless people to join this carnival. If you must participate, you must remember these bloody lessons: Don't trust the promises of "anonymous teams", 92% of the runaway projects hide their identities, carefully check the liquidity lock proof, and the fund pool must be hosted by a third-party platform and cannot be controlled by the project party. You must also be wary of "dark horses" that suddenly soar. After all, 87% of the Meme coins that rose by more than 1000% in 2023 were exposed within 72 hours.

Real opportunities often hide in less bustling corners. Dogecoin has demonstrated over the past decade that the value of meme coins lies not in price but in the cultural significance continuously created by the community. Pepe traders exchange memes on Twitter, and the SHIB community spontaneously organizes charitable events. These seemingly meaningless actions may be when meme coins are closest to the ideal of "equality." The equality here isn't the absolute fairness of code, but rather a group of people sharing a common joke and a shared faith, temporarily forgetting the greed and fraud of the crypto world and simply enjoying this digital revelry.

Please always remember: when the music stops, you are never the first to leave.

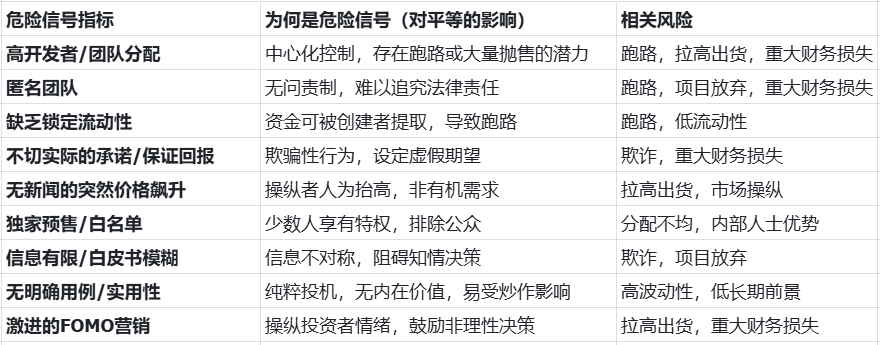

Common Red Flags of Unfair Memecoin Launches

The Democratization Revolution in the Memecoin 2.0 Era: Reconstructing the Creative Ecosystem

While PEPE's liquidity destruction mechanism is still held up as a model of fairness, the crypto market has quietly evolved. In 2025, HashKey-incubated the DJ.DOG project, transforming Memecoin from a speculative tool for a few into a creative platform for the many. This team, which won the Solana Hackathon in Hangzhou, leveraged a combination of "top institution endorsement, community management expertise, and technical competition validation" to perfectly address the democratization of creative work that has plagued the industry for years.

Transition from Trader to Creator

The traditional Memecoin market has an invisible glass ceiling, limiting 99% of participants to passive trading. Creative rights are tightly controlled by a small number of individuals with Cabal membership, technical expertise, and knowledge of regulatory gray areas. The DJ.DOG team, with experience operating a community of 3 million users, has identified three primary fears of coin issuance: the psychological burden of being labeled a scammer, the technical barriers of lacking smart contract development capabilities, and the social barrier of being two to three hours behind in terms of information access.

The business logic behind technological equality

DJ.DOG's full-stack tool matrix supports this democratized creation. Its self-developed aggregation engine at the transaction layer can achieve a transaction speed of 0.5 seconds, which is three times faster than the industry average. This speed is due to the high-performance public chain optimization solution carefully polished by the team in the Solana Hackathon. After connecting to the real-time tweet stream of Musk's Grok at the data layer, the narrative recognition speed is 2 minutes faster than traditional tools. When Musk posted content related to "Dogecoin Landing on the Moon", DJ.DOG users were able to complete the entire process from token minting, liquidity injection to social dissemination within 120 seconds, and the speed advantage directly turned into a creative advantage.

Its regulatory compliance strategy is even more noteworthy. The team clearly positions its product as an "on-chain entertainment tool," embedding a "no investment commitment" disclaimer in the smart contract. Developer addresses are also hidden through a trustless teaming mechanism. This design not only complies with the SEC's 2025 guidance on Memecoin's non-security status, but also alleviates users' legal concerns. In their acceptance speech at the hackathon, the team emphasized, "We're not building a financial product, but a digital creative field that allows ordinary people to participate."

Essential differences from the traditional paradigm

Dogecoin is a community-driven model, and PEPE is a fair launch mechanism. DJ.DOG is innovative in that it extends "fairness" from the issuance stage to the entire life cycle. Traditional Meme coins lose fairness after token distribution, while DJ.DOG relies on three mechanisms to continuously achieve fairness.

Creation stage : Data feature cloning technology eliminates technical barriers, allowing non-technical users to replicate the on-chain genes of successful tokens

Dissemination stage : Decentralization of early dissemination is ensured by mandatory social tasks (such as Twitter retweets and community discussions).

Trading stage : 15,000+ The smart money tracking system can make the information transparency of retail investors and institutions equal.

The core definition of Memecoin 2.0 is the transformation from a "pure speculative target" to a "creation tool + social platform" and this evolution echoes this. Beta users have reported that issuing coins used to be like walking a tightrope, but now it's like playing a sandbox game.

Potential challenges and critical thinking

However, the democratization of tools does not necessarily lead to creative equality. While DJ.DOG's AI narrative analysis function has lowered the technical threshold, priority access to the Grok API is controlled by paying institutions, which may create a new "data privileged class." Randomly assembled creative teams have conflicts in terms of profit distribution and decision-making consensus, which remains an unverified uncertainty. These contradictions just illustrate the essence of Memecoin's evolution, that is, fairness is not a static endpoint, but a dynamic process of constant game between technology and human nature.

If ordinary users can create their own Meme coins on their phones within 5 minutes, and the profits from their creations are automatically distributed to each dissemination node through smart contracts, then Memecoin may truly be undergoing a paradigm shift, from "a bubble created by a few people" to "a digital cultural experiment participated in by the majority." Moreover, the example of DJ.DOG shows that technological innovation not only changes the issuance method of Meme coins, but also reshapes their social value foundation.

Final Thoughts

The Memecoin market is a highly dynamic and rapidly evolving area of the cryptocurrency ecosystem, characterized by ongoing innovation in launch mechanisms and governance models. The inherent tension between the ideals of decentralization and fairness, and the practical needs of ensuring initial funding and long-term sustainability, will likely drive the development of more complex hybrid models in the future.

As the market matures, even if it doesn't lead to all memecoins being classified as securities, increased regulatory scrutiny could drive greater transparency, accountability, and a reduction in fraudulent activity, which could indirectly help create a more level playing field for participants. The journey toward true equality in the memecoin space remains an ongoing evolution, shaped by technological advancements, community dynamics, and regulatory developments.