Translated by: Block Unicorn

The stock market for companies primarily holding cryptocurrencies like Bitcoin, such as Michael Saylor's Strategy, is showing cracks. These stocks have become a very popular way for investors to speculate on Bitcoin and some more exotic cryptocurrencies recently.

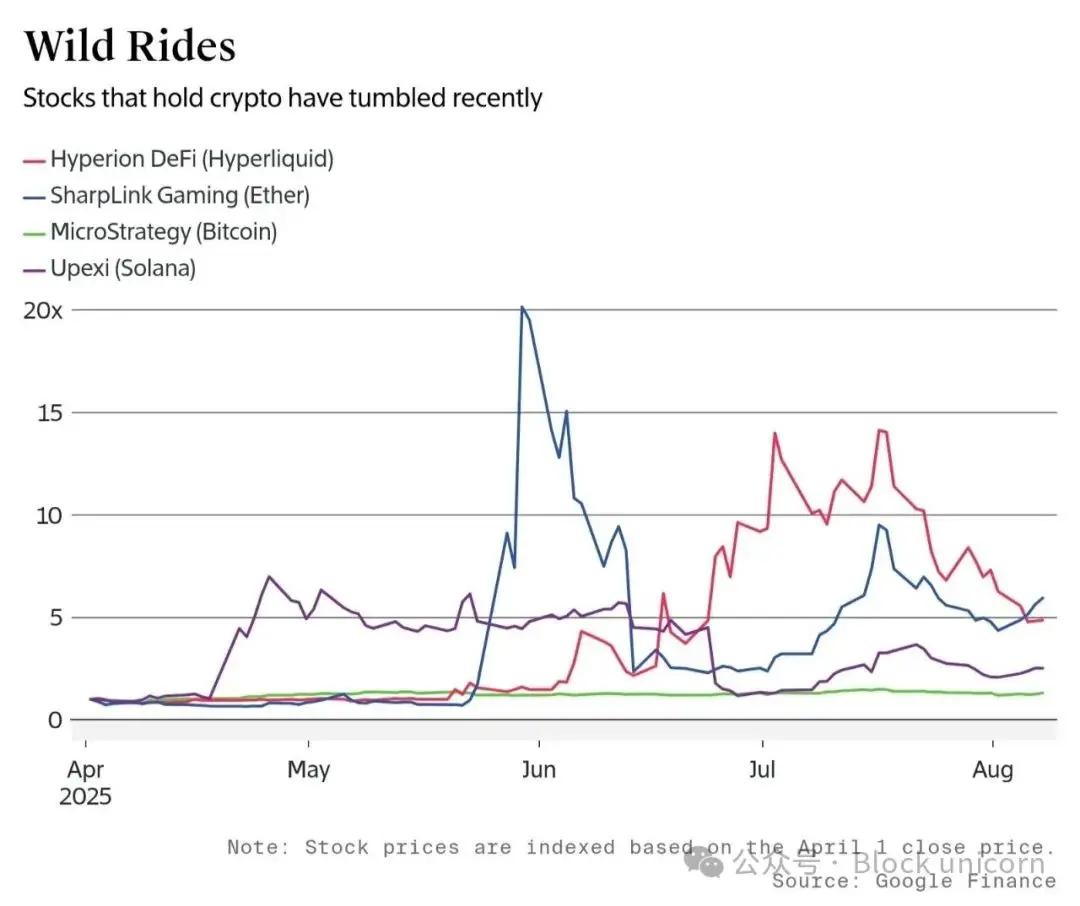

The valuations of Strategy and other companies (including Semler Scientific, a Bitcoin holder, and Upexi, a Solana holder) have declined, with companies holding more speculative tokens experiencing significant drops, some even falling below the value of their held cryptocurrencies. The structure of these companies and the leverage used by some of them suggest that selling could quickly accelerate.

Steve Kurtz, Global Head of Asset Management at Galaxy Digital, said: "There are signs of market fatigue. I don't think it has lost momentum. In the future, there will be differentiation, and winner-takes-all scenarios will emerge in different vertical fields."

Over 160 such global stocks, like Strategy, are now called crypto inventory stocks, allowing investors to gain cryptocurrency exposure without directly purchasing tokens. In this regard, they are similar to cryptocurrency ETFs that have become popular since their launch in the US in early 2024.

Although Strategy has been buying Bitcoin for years, the soaring cryptocurrency prices have triggered a wave of new products. According to crypto consulting firm Architect Partners, US-listed companies have announced plans to raise over $91 billion for purchasing Bitcoin and other cryptocurrencies so far this year.

Dealogic data shows this far exceeds the $38 billion raised by US companies through IPOs this year. Meanwhile, private equity and private credit fundraising activities have slowed down.

Cosmo Jiang, a general partner at crypto fund Pantera, said: "These digital asset tools have stolen the spotlight from all other areas. It's almost the only thing people are discussing." Pantera has invested hundreds of millions of dollars in over 10 crypto inventory stocks this year.

Large investors are still injecting funds into these tools. According to sources, Citadel, the hedge fund founded by Ken Griffin, is among the companies actively considering investing in select crypto inventory stocks. Billionaire investors Stanley Druckenmiller and Ark Invest, led by Cathie Wood, recently invested in the Ethereum inventory stock BitMine, as reflected in a document and announcement.

A Citadel representative declined to comment.

Signs of slowdown are evident when observing Strategy (formerly MicroStrategy)'s stock. As a pioneer in the crypto inventory market, Strategy now holds $73 billion worth of Bitcoin. In May, its stock traded at twice the value of its held Bitcoin. Now, it trades at 1.75 times its Bitcoin holdings.

According to Blockworks data, Strategy's imitators have also generally declined in the past two weeks, in some cases erasing premiums or driving stock prices below the value of their held cryptocurrencies.

Josh Saulsbury, Vice President at ParaFi, said the stock premium has decreased due to reduced summer trading volume and increased product numbers.

Hyperion DeFi (formerly a biopharmaceutical stock Eyenovia) began purchasing Hyperliquid tokens in June. Hyperliquid is the token of one of the fastest-growing cryptocurrency exchanges. Hyperion currently has a market cap of $30.5 million, although its held Hyperliquid tokens are worth nearly $60 million at current token prices. Since renaming to HYPD and changing its ticker on July 2, Hyperion's stock has fallen 62%.

When these companies trade at a premium above their assets, raising funds is easy—but the opposite is true when they trade at a discount. This makes it difficult for them to raise funds to buy more cryptocurrencies. In this scenario, a decline in the value of underlying tokens like Hyperliquid could further suppress company stock prices.

Companies holding popular tokens like Bitcoin perform far better than those holding smaller tokens. According to Architect Partners, crypto inventory stocks holding Bitcoin, Ethereum, or Solana tokens have a median return of 92.8% since their respective announcements.

In contrast, the median return for the group of crypto inventory stocks investing in less popular tokens is negative 24%.

Market weakness could reduce earnings for crypto asset management companies like Pantera, Hivemind, ParaFi, and Galaxy Digital. These companies invest in enterprises planning to buy cryptocurrencies through private placements before stock announcements. These trades almost always generate profits, as stocks typically rise after the announcement.

The rise of crypto inventory stocks increases the connection between traditional markets and cryptocurrencies, potentially adding volatility to stocks. Matt Zhang, founder of Hivemind, said: "As this integration deepens, traditional stock investors will face more risks they haven't seen before. They may not be accustomed to tokens dropping 15% in a day, which is common in the cryptocurrency realm."

Nic Carter, founding partner of crypto venture capital firm Castle Island Ventures, stated that the company has avoided investing in crypto inventory stocks. "We believe these enterprises, which are essentially zero-sum games, carry reputational risks, with returns primarily derived from leverage or retail shareholders buying at unfavorable prices."