The term "Internet Capital Market" encompasses many meanings. In today's context, it refers to the "alchemy" results purely driven by blockchain technology advantages: financial technology that disregards geographical boundaries. You can use "magic internet currency" for lending, tokenize treasury bonds and private credits, issue stablecoins - in today's world where traditional finance and digital assets converge, people call all this the "Internet Capital Market".

But for veterans who have lived and breathed in the on-chain trading realm, the meaning of Internet Capital Market is more than just "on-chain treasury bonds" - it refers to Non-Fungible Tokens, DeFi, ICO, and various speculative tools invented in the past decade, as well as tokens tradable since the first smart contract was deployed on Ethereum in 2015.

This article aims to focus on the original logic behind currencies, narratives, ten-fold, hundred-fold gains, and airdrops, analyzing this aspect of the Internet Capital Market. We are about to enter a "new metaverse" in the words of OG crypto players. To analyze this, we must first observe these capital formation mechanisms and the differences they bring.

Evolution of Market Financing Mechanisms

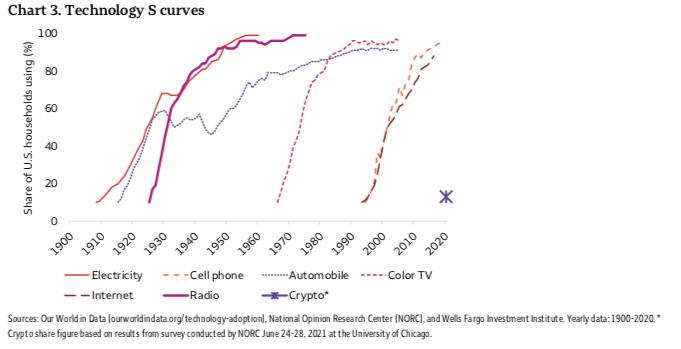

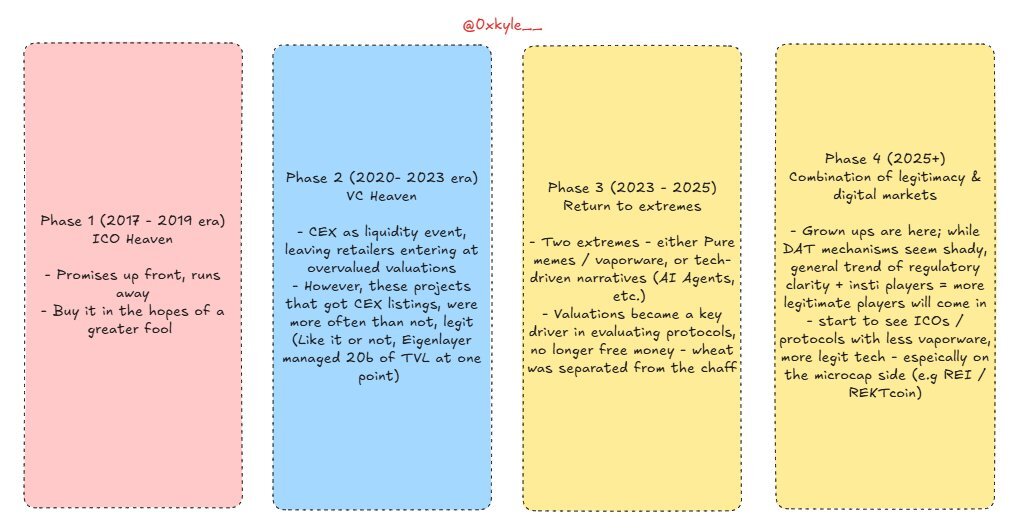

Looking back at past cycles, we see market financing mechanisms constantly changing. From ICO to centralized exchange Altcoins (CEX Alts), to meme coins... the chart has already summarized this, which can be briefly summarized as:

Original ICO (2017 Era)

In this mechanism, funding was based on project "promises", with the purpose of selling to a bigger "fool". The technology was hardly truly usable or valuable. Most of the time, it was a game of "pass the parcel". Typical cases: Bitconnect, Dentacoin, etc.

VC Paradise (2021 Bubble Period)

This wave attracted institutional capital, but looking back, it caused great harm to the industry - absurdly high valuations, poor incentive design (who would work with a hundred million dollars?). However, this wave also brought more reliable products - so it cannot be completely dismissed. Although inflation valuation was severe, many protocols you love today were born. Take Ethena as an example: I like it, but the mechanism of "giving too much too early" indeed damaged its early token performance; however, it is undeniably one of the best crypto products currently. This was also the era of projects like Solana and Uniswap rising. Even if one has objections to their governance or operations, it was not entirely bad.

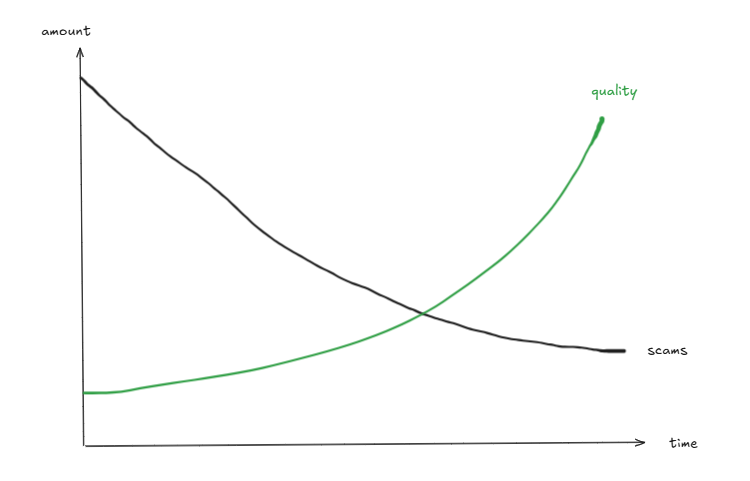

(Translation continues in the same manner for the rest of the text)Think about that diagram: it will never go to zero, but it doesn't have to. Look at Hyperliquid, Ethena, Aave - they all have $1 billion in annualized revenue, stablecoin TVL of $10 billion, and net deposits of $6 billion. Look at Pengu, Rekt - with a total of 197 trillion plays, 2 million peripheral items sold globally, even stocked in 7-11 convenience stores across the US. They all have on-chain token support.

S/A level projects / The more founders, the less focus on C-level and below founders - less attention to air coins and other short projects, more focus on projects that can truly achieve compound growth

S/A level projects / The more founders, the less focus on C-level and below founders - less attention to air coins and other short projects, more focus on projects that can truly achieve compound growth

We can argue whether they are overvalued or undervalued, but I would rather discuss this than return to an era of "empty promises". The era of being forced to buy corporate assets that sell promises but yield no results. I would rather own something tangible, rather than pretending to play a game of musical chairs.

If you always treat every coin as a "meme", you're wasting opportunities. Tokens issued by projects like Hyperliquid are no longer a fantasy. The next Steve Jobs will likely issue tokens on-chain. Some of these assets will ultimately become on-chain giants controlling the financial future. And we all have a chance to buy them. Simplifying them as "just a meme" is an excellent way to miss thousand-fold returns.

This is the evolution of speculation: we've moved from trading worthless air to finally being able to truly own solid, durable, and most importantly, on-chain assets that will determine the future world.

It's time to regain belief, forget past constraints, and reshape dreams. The future is bright, don't let the shadows of the past obscure your optimism about the future.

This - is the future I see: Internet. Capital. Markets.