Written by: angelilu, Foresight News

On August 1st, global financial markets experienced a violent turmoil, and the cryptocurrency market was no exception. BTC dropped to 112,751 USDT in the early morning, erasing nearly three weeks of gains, creating a new low since July 10th, with BTC price at 113,639 USDT at the time of writing. ETH also fell to a recent low of 3,431 USDT in the early morning.

According to Coinglass data, over the past 24 hours, network liquidations totaled $726 million, with long liquidations at $640 million and short liquidations at $86.85 million. Moreover, ETH liquidations in the past 24 hours were $270 million, exceeding BTC's $165 million.

Crypto-related stocks in the US performed poorly, with Coinbase dropping 16.7%, Riot Platforms falling 17.75%, and Circle down 8.4% at market close yesterday. This indicates that investors' risk appetite for crypto assets is declining.

The market's significant volatility was triggered by weak US employment data, Trump's intense political reaction, and rising geopolitical risks.

Macro Environment: US Employment Data Collapse Shakes the Market

On the evening of August 1st Beijing time, the US Bureau of Labor Statistics released the July non-farm employment report, showing that US non-farm employment increased by only 73,000 in July, significantly below the expected 104,000, marking the smallest increase since October last year. Even more shocking to the market was that the Bureau of Labor Statistics significantly revised down previous data, reducing the employment data for the past two months by 258,000.

Trump's Strong Response: Immediately Dismiss the Bureau of Labor Statistics Director

US President Trump reacted strongly to the weak employment data, posting on social media to accuse Erika McEntarfer, the Bureau of Labor Statistics director appointed by Biden, of fabricating employment data before the election, stating "non-farm employment data has been manipulated to embarrass me" and ordering the immediate dismissal of Erika McEntarfer hours after the non-farm employment report was released. William Wiatrowski will serve as the acting director of the US Bureau of Labor.

Trump stated: "We need accurate employment data. Such important data must be fair and accurate, and not manipulated for political purposes." He also criticized the Federal Reserve for "playing tricks" by significantly cutting rates twice before the presidential election, suggesting that Powell should also "retire".

Additionally, Federal Reserve Board member Kugler announced early resignation next week, providing Trump an opportunity to appoint his preferred candidate, which could have a significant impact on the Federal Reserve's future monetary policy.

Rising Geopolitical Risks

Besides economic data, geopolitical risks are also heating up. Trump announced on social media that based on "provocative remarks" by Russian former President Medvedev, he has ordered the deployment of two nuclear submarines near the Russian region.

These events directly triggered a massive sell-off across US three major stock indices, with the US stock market losing over $1 trillion in market value on August 1st Eastern Time. Simultaneously, risk aversion sentiment rose, with gold prices surging straight up, breaking through the $3,350 per ounce mark, at $3,362 per ounce at the time of writing.

BTC Enters the "Downward Devil Month" in August

The crypto market has historically performed poorly in August. According to Lookonchain's statistics, August and September have been the worst months for Bitcoin (BTC). Data shows that in the past 12 years, Bitcoin prices have fallen in 8 years during August and September, with a decline probability of 67%.

Market Faces a Critical Turning Point: Short-term Correction or Long-term Consolidation?

Currently, the market faces a key question: Is this pullback a healthy short-term correction or the beginning of a prolonged consolidation period?

After this data event, market expectations for a Fed rate cut in September continue to rise. CME "Fed Watch" data shows the probability of a 25 basis point rate cut in September has risen to 89.8%, with the probability of maintaining current rates dropping to 10.2%. The probability of a cumulative 50 basis point rate cut in October has reached 51.8%. From a macro perspective, weak US employment data may accelerate the Fed's rate-cutting pace, which should theoretically be positive for risk assets, including cryptocurrencies.

ARK Invest Increases Holdings Against the Trend

Notably, amid increasing downward market pressure, investment firm ARK Invest counter-cyclically increased holdings on August 1st. Multiple ARK funds simultaneously increased Coinbase (COIN) stock holdings, with ARKK, ARKW, and ARKF collectively buying 94,678 Coinbase shares, totaling approximately $33 million. Additionally, Ark Invest purchased about $18.7 million of BMNR stock (a listed company using ETH as a financial strategy).

Whale Game: Selling vs Buying the Dips

Among whale movements, some quickly sold while others bought the dips: Arthur Hayes sold 2,373 ETH (worth about $8.32 million), 7.76 million ENA (worth about $4.62 million), and 3.886 billion PEPE (worth about $414,700) in the past 6 hours. Meanwhile, according to @ai_9684xtpa monitoring, an address seemingly belonging to Anchorage Digital appears to be buying 14,933 ETH (worth about $52.07 million) through Galaxy Digital OTC. The address received these tokens 4 hours ago (almost at ETH's rebound starting point) at an average price of $3,487.

Trader Perspectives: Technical Analysis Opinions Diverge

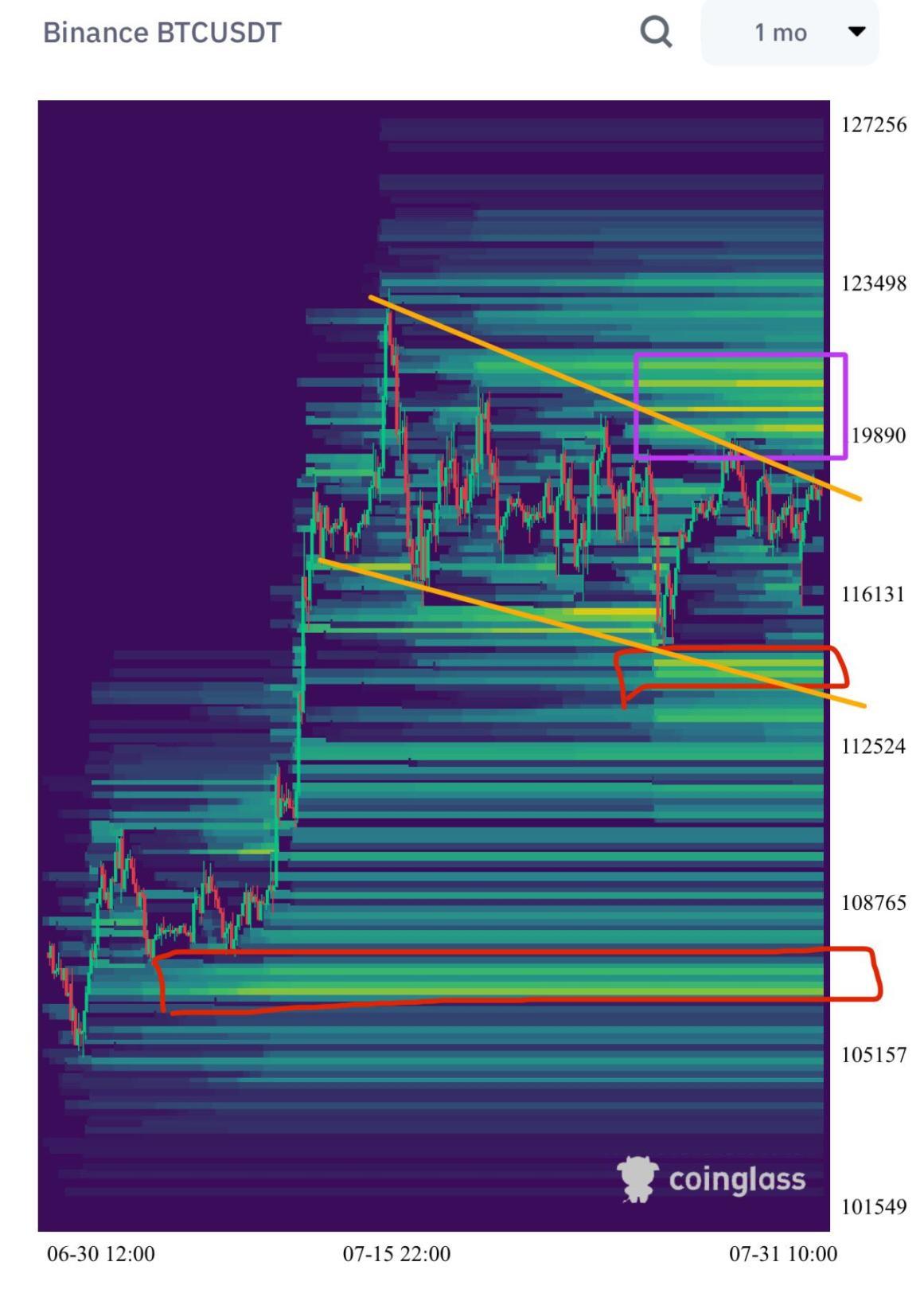

Investment firm DragonFly pointed out that they have marked Bitcoin's key accumulation liquidation zone, believing the market might first test upper liquidity before exploring lower liquidity zones. Notably, due to Bitcoin forming a flag technical pattern, there's a possibility of direct upward movement without touching the bottom liquidity. Although the current trend is unclear, they emphasized that closely monitoring BTC liquidity distribution is crucial for grasping future market movements.

Bitcoin trader Crypto Bully noted that BTC finally broke through the interval's low point and fell below the Volume Weighted Average Price (VWAP) bands, stating he will maintain a short-term trading mode when Bitcoin price rises to $115,000 or falls to $110,000, attempting to catch short-term long opportunities before the Asian trading session.

Another analyst, Crypto Fella, offered a more cautious view, "Bitcoin breaking below $114,700 support could further test the support area around $112,000 on the 4-hour chart."

Data analyst and quantitative trader Crypto Painter stated that BTC's descending wedge has been broken, and price can only be treated as a descending channel before returning above the wedge.

Crypto investor Sensei, however, remained optimistic, believing the Bear Trap has ended and preparations can be made for an upward movement. Foresight News notes that Bear Trap is an important stage in the market psychology cycle, referring to a situation where the market briefly drops and then quickly reverses upward, trapping short sellers into losses.

Recommended Reading:

Solana and Base Founders Start Debate: Does Content on Zora Have "Basic Value"?