Vietnam Has Over 17 Million Cryptocurrency Owners, Far Exceeding Stock Investors.

Vietnam is becoming a global hotspot for cryptocurrency market growth, with the number of digital asset owners far surpassing domestic stock accounts. According to the latest report by IVY Media in collaboration with data platforms like Chainalysis and Triple-A, by the end of 2024, approximately 17 million Vietnamese are holding cryptocurrencies – a number nearly double the active traditional stock accounts in Vietnam.

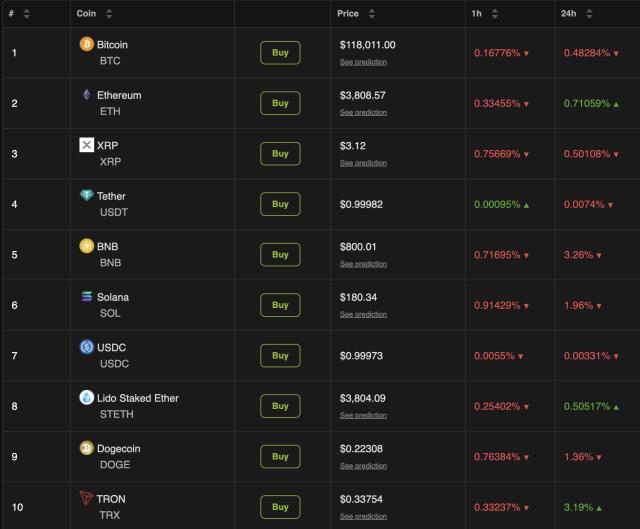

This sudden increase shows a clear shift in people's financial behavior. Instead of focusing on familiar investment channels like real estate or stocks, a large portion of investors – especially young people – are turning their attention to new financial products such as Bitcoin, Ethereum, DeFi, Non-Fungible Token, or GameFi.

The prevalence of cryptocurrencies in Vietnam is not only reflected in the number of participants but also demonstrated through online search behavior. In the first three months of 2025, the keyword "crypto" surpassed both "stocks" and "real estate" in Google search volume in Vietnam. This is a sign of rapidly increasing interest in this field nationwide.

Vietnam is currently ranked 7th globally in cryptocurrency ownership rate and 5th worldwide in the adoption of this asset type. With a young, tech-savvy population and dynamic investment mindset, Vietnam has all the necessary factors to become a strategic market in the global financial transformation wave.

Demographic analysis of the cryptocurrency investment community shows that the 18-24 age group dominates, with males being predominant. They tend to make long-term investments, with about 60% identifying themselves as "holders" – meaning they hold assets long-term instead of trading. The areas of most interest to young investors currently include blockchain infrastructure projects, artificial intelligence (AI), decentralized finance (DeFi), and trend-following meme coins.

However, investment effectiveness varies significantly between income groups. The survey shows that nearly half of those earning under 500 USD/month are experiencing losses, while investors with medium and high incomes (from 500 to 2,000 USD and above) have better profit rates. This highlights the crucial role of financial knowledge, risk assessment ability, and rational investment strategies in the volatile cryptocurrency market.

Additionally, community continues to play a significant role in information dissemination and investment decisions. Over 70% of surveyed individuals said they primarily receive information from online community groups or offline meetups. However, the credibility of cryptocurrency market KOLs is quite low due to concerns about "InfoFi" – sponsored content disguised as experience sharing. The lack of transparency in communication is eroding investor trust, especially for newcomers to the market.

The future prospects of the cryptocurrency market in Vietnam are becoming clearer as the legal framework is gradually being perfected. From January 1, 2026, the Digital Industry Law will officially take effect, which for the first time recognizes digital assets as a legal part of Vietnam's economy. This is expected to be a significant step in enhancing transparency, protecting investor interests, and expanding capital access opportunities for blockchain-related businesses.

However, to ensure healthy and sustainable development, experts believe Vietnam needs to focus more on financial education, disseminating correct knowledge about blockchain and Web3 technology, while strengthening information control and limiting speculative behaviors and financial fraud that exploit the market's rapid growth.

Source: Vietnamnet