Coinbase May Become the Biggest Winner.

Written by: 1912212.eth, Foresight News

On July 29, the U.S. Securities and Exchange Commission (SEC) announced the approval of physical creation and redemption mechanisms for crypto asset exchange-traded products (ETPs), previously relying on cash creation and redemption models. This change significantly reduces trading costs and improves efficiency. Additionally, the SEC published listing standards for spot ETFs, with the new standards expected to take effect in September or October 2025, aimed at simplifying the ETF listing process and opening mainstream financial doors for more crypto assets.

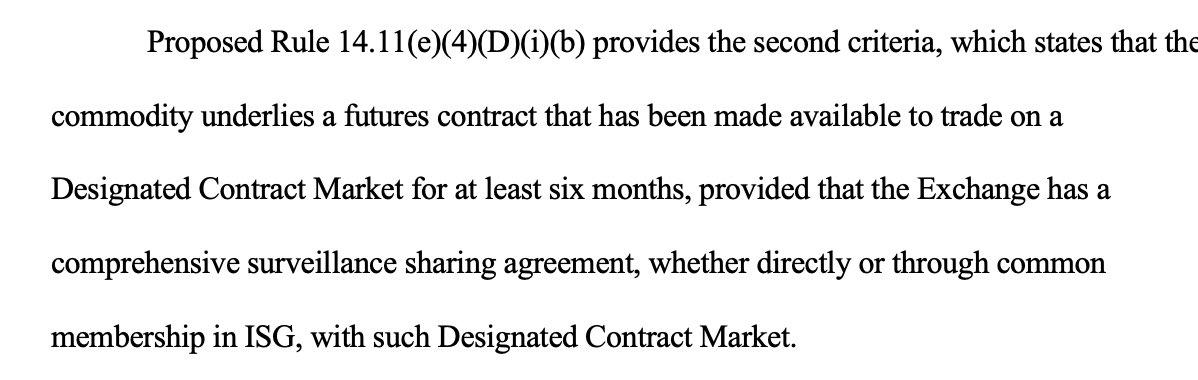

Must Be Listed on Futures for at Least 6 Months on Coinbase and Other Major Exchanges

The SEC's new listing standards primarily focus on the qualification requirements and operational mechanisms of crypto ETPs. First, physical creation and redemption are officially allowed, meaning authorized participants can exchange ETP shares with actual crypto assets instead of cash. This model can reduce tax burdens, minimize transaction friction, and enhance ETF liquidity. The SEC Chairman emphasized that this decision aims to provide crypto ETPs with treatment similar to traditional ETFs while maintaining market integrity. Previously, crypto ETPs were forced to use cash models, leading to higher operational costs and potential manipulation risks.

Moreover, the SEC established "universal listing standards" requiring crypto assets to be listed on futures for at least 6 months on major exchanges like Coinbase. This regulation aims to ensure sufficient asset liquidity and market depth, avoiding manipulation. According to Phyrex's document reference, for tokens without futures or newer altcoins like MEME coins (such as Bonk and Trump coins), ETF conversion would require going through 40 Act.

Which Projects Might Get ETF Approval

Bitcoin and Ethereum spot ETFs have been approved in 2024 and 2025 respectively, and these products will continue to benefit from optimized physical mechanisms.

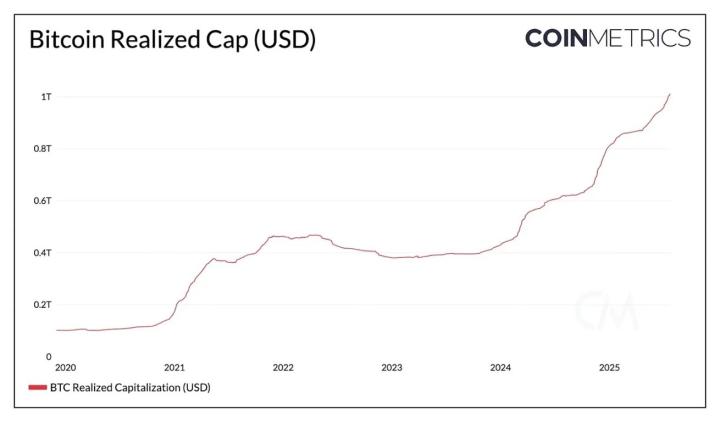

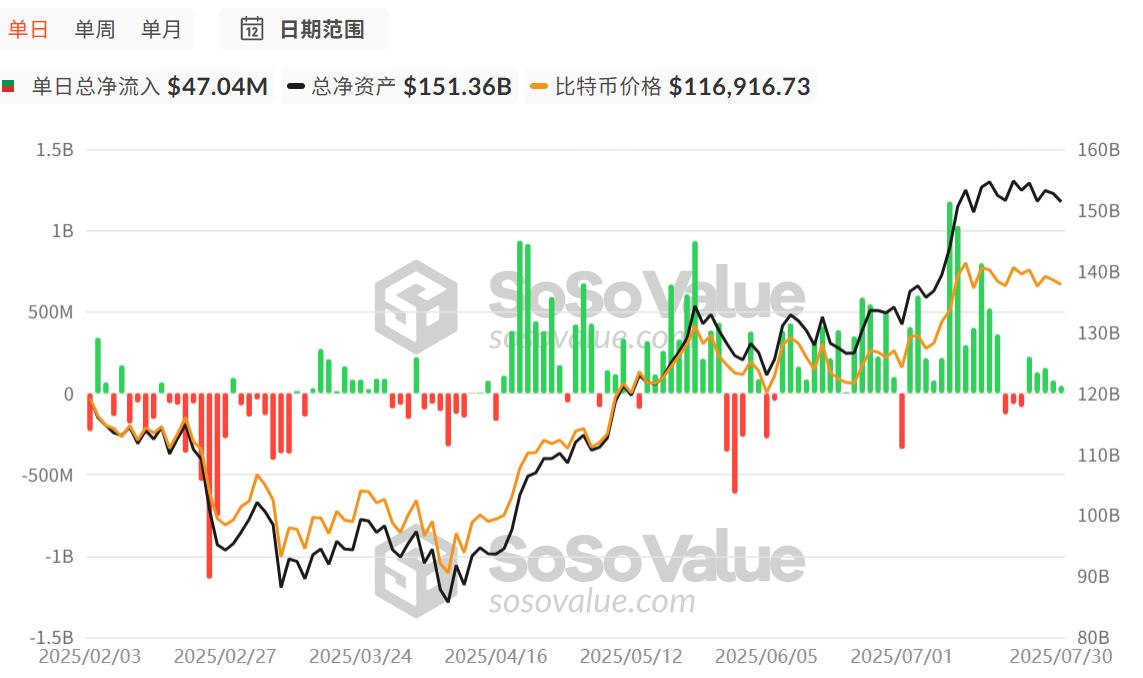

According to SoSoValue data, by July 31, 2025, U.S. Bitcoin spot ETFs have accumulated a total net inflow of $55.11 billion. Ethereum spot ETFs have achieved a cumulative total net inflow of $9.62 billion, with rapid growth after breaking out of a sluggish period. The approval of spot ETFs undoubtedly provides good support for their coin prices.

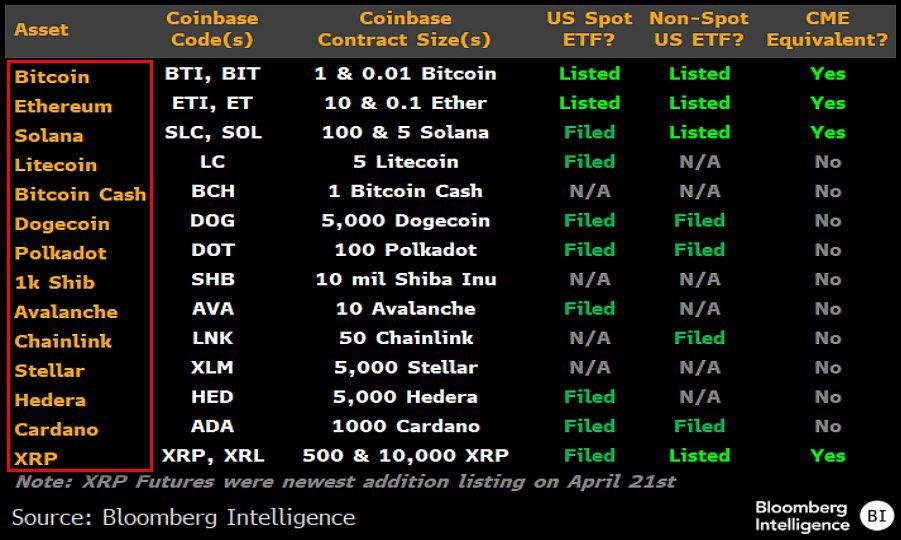

The new standards open doors for altcoins. Solana (SOL) and Ripple (XRP) are considered the first beneficiaries. Cboe's proposal explicitly mentions that SOL and XRP ETPs are expected to be launched in Q4 2025, with active futures markets. XRP's futures contracts were officially launched on Coinbase on April 22 this year, and its cross-border payment applications have attracted institutional interest. Analysts predict that the approval probability of these ETFs is high, potentially realized by the end of 2025.

Other potential projects include Chainlink, Polkadot, and Cardano, which meet listing duration requirements and have emerging futures contracts. However, not all projects will pass: Doge might be excluded due to lack of futures history unless its market maturity improves. Overall, the new standards are expected to approve 10-15 new ETFs, covering the top 20 crypto assets by market cap, driving the industry from speculation towards investment.

Coinbase May Become the Biggest Beneficiary

On May 9, Coinbase's subsidiary Coinbase Derivatives launched the first U.S. CFTC-regulated Bitcoin and Ethereum 24/7 leveraged futures trading service, covering retail and institutional users. This marks the first all-day trading in the U.S. derivatives market, allowing users to hedge risks and capture market opportunities at any time. Coinbase also plans to introduce perpetual contracts, offering more compliant derivatives in the future.

As the largest U.S. crypto exchange, Coinbase will significantly benefit from the SEC's new standards. First, the standards directly reference Coinbase as a qualification benchmark: assets traded on the platform for over 6 months are eligible to apply for ETPs, strengthening Coinbase's regulatory influence. This means assets listed on Coinbase can more easily be converted into ETF products, attracting more issuers to collaborate. For example, Coinbase has served as the custodian for multiple Bitcoin and Ethereum ETFs, with its custody business revenue growing 30% in Q1 2025.

Secondly, the new standards will increase Coinbase's trading volume and revenue. The physical redemption mechanism requires ETP issuers to hold actual crypto assets, driving institutions to conduct large transactions through Coinbase. Bloomberg analysts estimate this could bring Coinbase an additional $1 billion in annual fee income. Moreover, as more ETFs are approved, retail investors will turn to Coinbase to purchase underlying assets, creating a positive feedback loop.

On February 21 this year, the SEC withdrew its lawsuit against Coinbase without any fines. In terms of policy, Coinbase now faces no major obstacles. The new standards enhance Coinbase's legitimacy, transforming it from a regulatory opponent to a partner.

CFTC's Approval Rights for Spot ETFs May Be Prioritized

The U.S. Commodity Futures Trading Commission (CFTC), as a commodity regulatory body, is increasingly important in the spot ETF domain. Crypto assets like Bitcoin are considered commodities, so spot ETF regulation involves coordination between SEC and CFTC. In 2025, a White House policy report called for stronger cooperation, including establishing a "safe harbor" mechanism to avoid regulatory overlap. The CFTC's leadership vacuum (with the chairman position vacant) has caused decision-making delays, but this also provides opportunities for the crypto industry: CFTC tends to have a more lenient commodity framework and may accelerate derivative innovations for spot ETFs. If CFTC further classifies more crypto as commodities, spot ETF approvals could be faster, reducing SEC's securities review burden.

Currently, regulatory bodies seem to have found a balance. Twitter KOL qianbafrank commented that the SEC's new listing standards mean "SEC's approval rights for crypto asset spot ETFs are now prioritized to CFTC (Commodity and Futures Commission), as CFTC is the primary decision-making and regulatory body for which assets can have futures contracts."

However, CFTC's influence also brings challenges: if crypto futures market manipulation incidents increase, CFTC might intensify scrutiny, indirectly impacting spot ETFs. Reports show that CFTC has handled multiple crypto fraud cases in 2025, which might require ETF issuers to comply with stricter reporting standards.