Sui has recovered from the hacker incident, and the listed company Lion has purchased over a million SUI tokens.

Written by: 1912212.eth, Foresight News

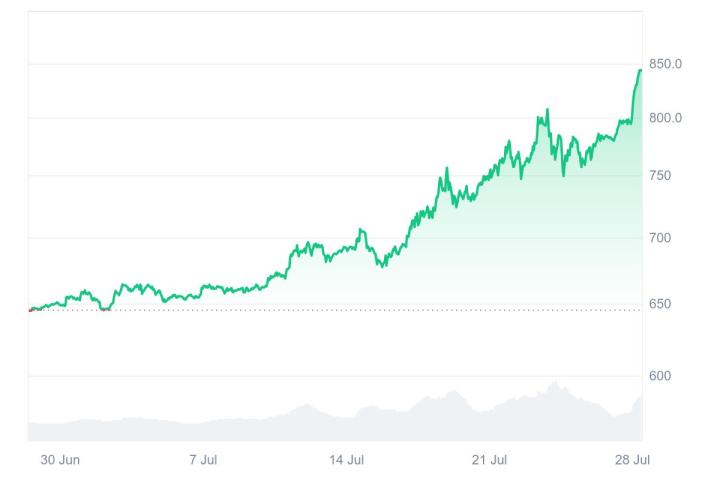

On July 28, SUI once broke through $4.44, creating a new high since January this year. The SUI token price increased by over 53% this month, achieving four consecutive daily rises since July 24, and four consecutive weekly rises since June 23. SUI's current total market value is $14.7 billion, ranking 11th, with its FDV rising to $43.048 billion, naturally attracting many investors' attention with such a rise for a large-cap protocol token.

How has the Sui ecosystem recovered since its setback in May? What are the reasons behind its strong price performance?

Sui Has Recovered from the Cetus Hacker Incident

On May 22, Cetus, the largest DEX aggregator on the Sui network, suffered a major security vulnerability attack, causing about $223 million in liquidity pools to be depleted. The attacker manipulated the pool using fake tokens, causing losses. However, the Sui community and development team's response turned the situation around. The Cetus team suspended trading and launched a recovery plan, ultimately recovering 85% to 99% of funds, with approximately $162 million in frozen assets released through community voting. However, the centralized approach due to frozen assets also sparked huge controversy in the community. The Cetus protocol was relaunched in June and plans to transition to a fully open-source model to enhance transparency and security.

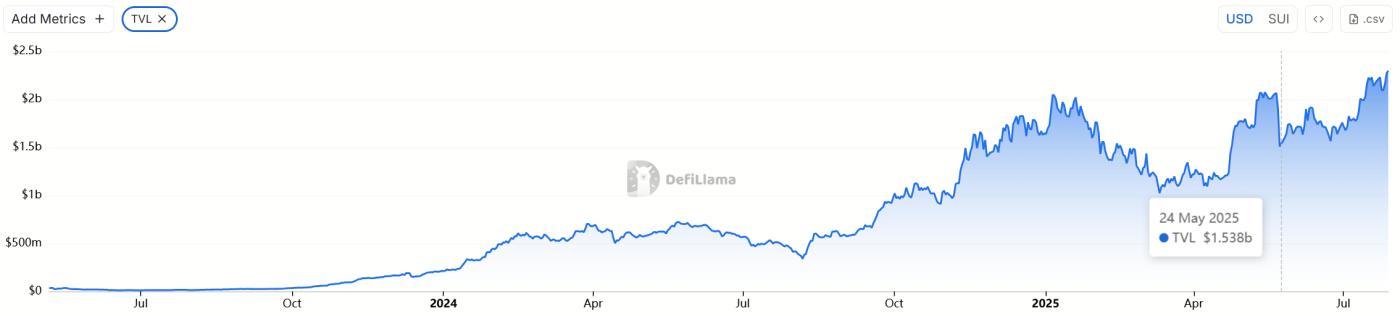

According to defillama data, after the hacker attack, Sui's total TVL once dropped to $1.538 billion. Currently, its total TVL has rebounded to $2.296 billion, reaching a historical high.

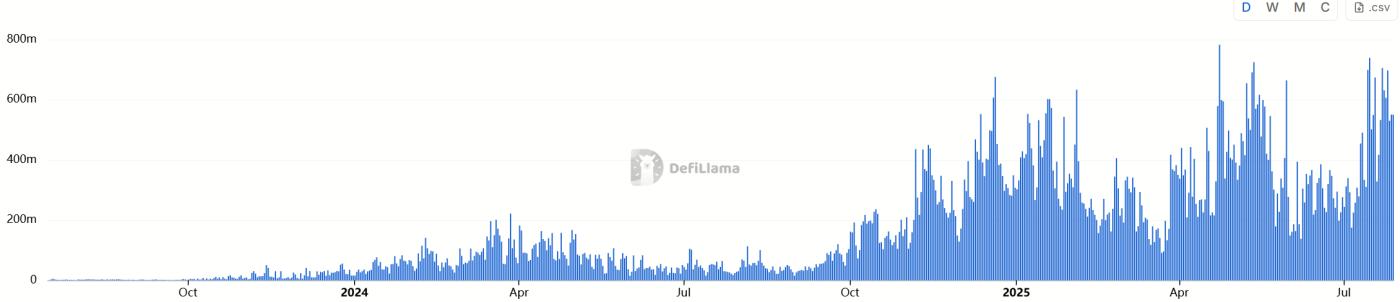

Its DEX trading volume has steadily recovered since June, with DEX trading volume exceeding $550 million in the past 24 hours, a weekly increase of over 8.79%.

Among this, its ecosystem protocol Cetus's trading volume in the past 24 hours reached $225.28 million, accounting for half of the entire Sui ecosystem's DEX trading volume, showing a remarkably rapid recovery.

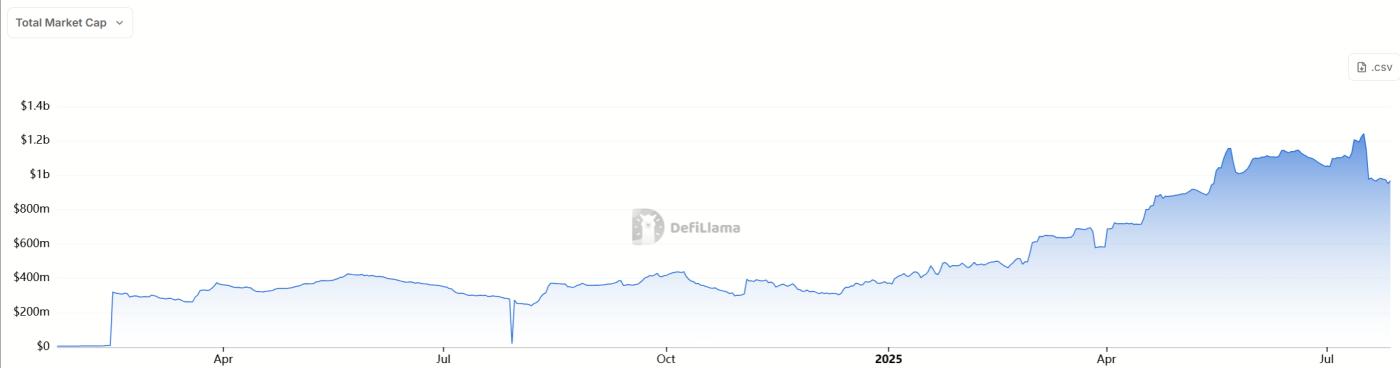

In terms of stablecoin data, the total market value is $968.38 million, slightly declining in the past 7 days but still at a historical high. Notably, USDT's inflow increased by 21% in the past day.

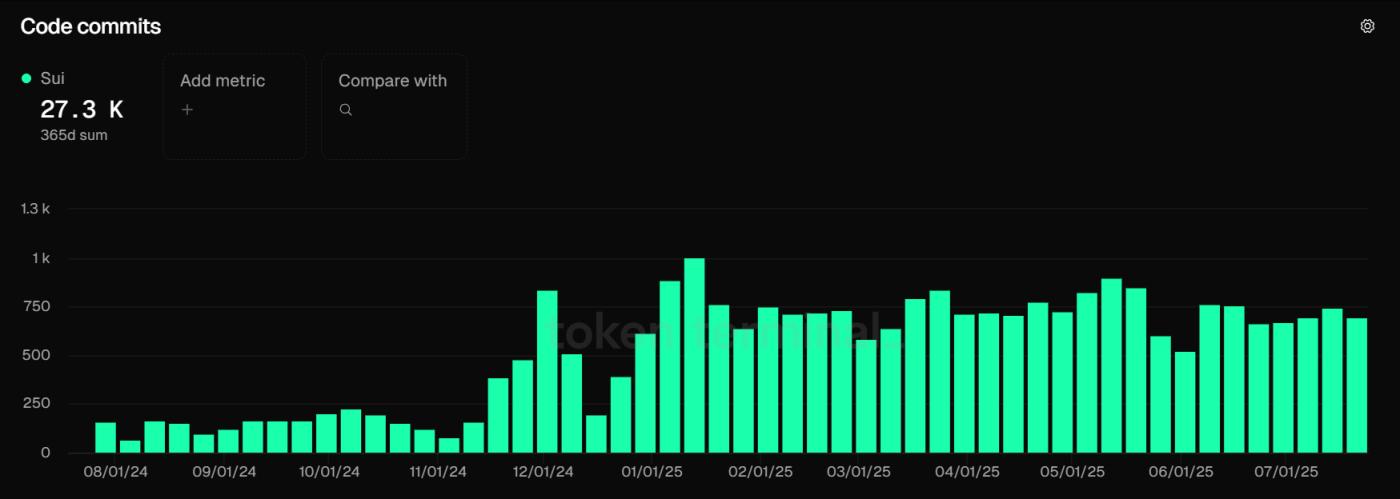

Code commits reflect the total number of submissions to the project's public GitHub repository, indicating the code library's update activity. Terminal data shows that after a brief negative impact in late May and early June, its code commit count quickly rebounded to a high level.

Data indicators prove that the Cetus incident not only did not destroy SUI but is accelerating its maturation.

Listed Company Lion Buys Over 100,000 SUI Tokens

It has become a trend for US listed companies to use fund reserves to purchase tokens. Previously, Strategy's BTC purchase gained huge profits and sparked imitation, followed by ETH/SOL/ENA reserve purchases.

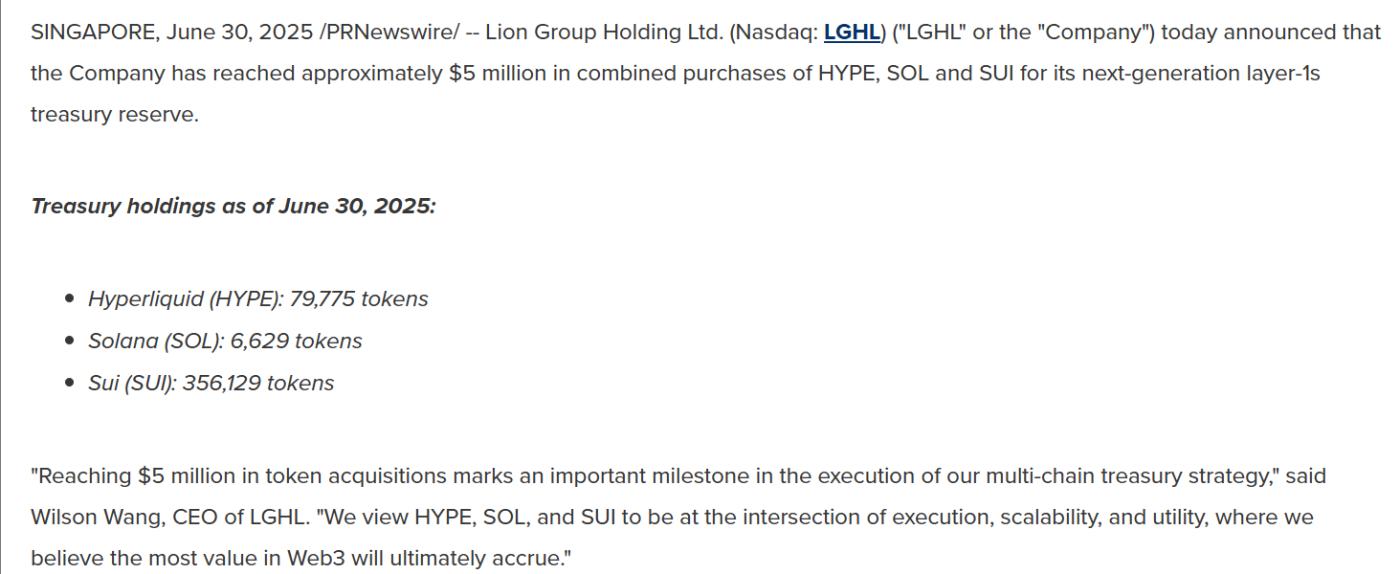

In June 2025, Nasdaq-listed Lion Group Holding Ltd. (LGHL) purchased SUI, SOL, and HYPE tokens, expanding its crypto asset reserves to $9.6 million. Data shows Lion Group bought 356,129 SUI tokens.

As a micro-cap company worth only millions, Lion's action, though limited in scale, carries significant symbolic meaning.

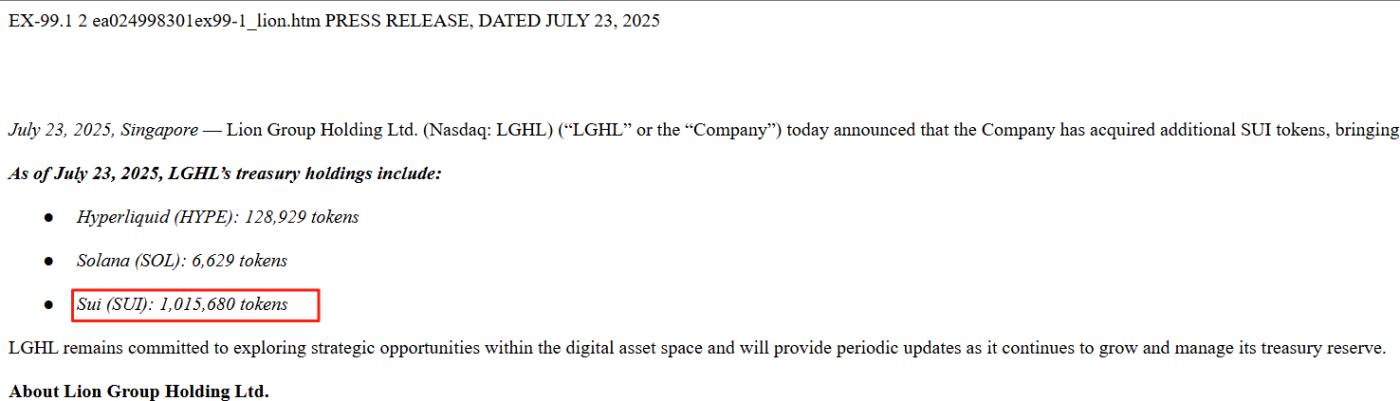

On July 24, according to SEC files, Nasdaq-listed Lion Group increased its SUI token holdings, reaching a total of 1,015,680 tokens. At the current price of $4.25 per token, this is worth approximately $4.316 million.

Previously, US listed company Everything Blockchain Inc. (EBZT) also planned to invest $10 million in five blockchain networks: Solana (SOL), XRP, Sui (SUI), Bittensor (TAO), and Hyperliquid (HYPE).

As crypto assets penetrate mainstream finance, SUI's Layer-1 positioning attracts listed companies seeking high growth. In the future, if more companies follow suit, SUI's liquidity and price stability will further improve.

SUI Spot ETF Likely to be Approved

The potential approval of a SUI ETF marks a key step in cryptocurrency mainstreaming. Currently, the US Securities and Exchange Commission (SEC) has officially initiated the review process for Canary Capital's SUI spot ETF application, which was submitted in March 2025 and announced delayed in June, with the review period extendable to 240 days. 21Shares' SUI ETF is also on a similar review track, with the Nasdaq-submitted 19b-4 form launched for evaluation in June.

Similar to Bitcoin and Ethereum spot ETF inflow data, if the SUI spot ETF is approved, it would undoubtedly boost market confidence and have a positive impact on token price.

In June this year, Bloomberg senior ETF analyst Eric Balchunas analyzed that the probability of SUI ETF approval is estimated at 60%.

At the beginning of this year, asset management company VanEck released a report predicting that SUI would occupy 5.5% market share, with a market value of about $61 billion. Calculating based on a circulating supply of 3 billion tokens, the price per token could reach $16. Yesterday, Twitter KOL 0x0xFeng tweeted, "SUI should be about to hit a new high."

In the altcoin bull market, SUI may continue to lead the market.