Foresight News brings you a quick overview of this week's hot topics and recommended content:

01 Ethereum

《Who Are the Top Players in Ethereum?》

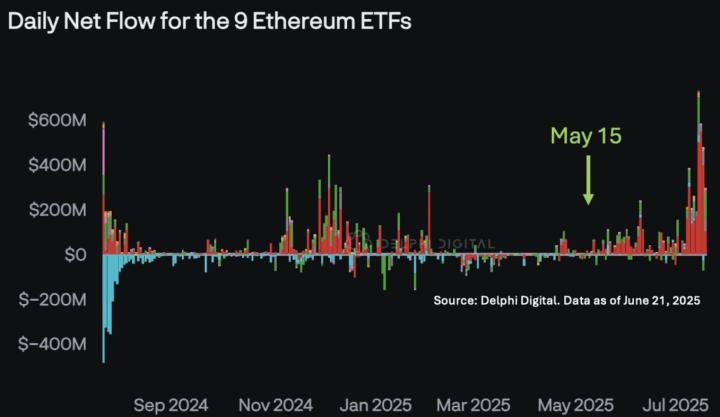

《Ethereum ETF One Year Anniversary: From Cold Reception to Explosion, Institutional Confidence Shift Behind Capital Flows》

《Why Will Ethereum Treasury Companies Outperform Strategy?》

02 Stablecoins and Regulatory Dynamics

《Is This Company the True Stablecoin Unicorn?》

《Tether's Cross-Industry Investment Matrix: What Future Tracks Are They Betting On?》

《Unveiling the Underlying Logic of South Korea's Stablecoin Wave》

《Pantera Partner: Three Heavy Blows from Washington's "Crypto Week", Is US Crypto Hegemony Secured?》

《a16z: Will the 'CLARITY Act' Usher in a "Golden Age" of Crypto Compliance Innovation?》

03 Solana Ecosystem

《SOL Returns to $200: A Quietly Successful Player》

《Metaplex: The Hidden Winner of Solana Launchpad Competition》

《Where Did SOL Tokens Go? The Hidden Landscape of 605 Million Supply》

04 Industry Insights

《From Facebook Smoke to Crypto Peak: The Winklevoss Brothers' Counterattack》

《MEME Confirmed, How to Participate in Polymarket Airdrop?》

《Metamask "Odyssey" Launched, Is It Worth Participating?》

(The rest of the translation follows the same approach, maintaining the specified translation rules for specific terms)Tether has five major sections on its official website: Finance, Power (renewable energy mining business), Data, Edu (education), and Evo (human evolution). From the layout of these five sections, it is not difficult to glimpse Tether's strategic betting direction.

-Tether Finance is committed to promoting financial inclusiveness and enhancing global financial accessibility in areas with poor or missing banking infrastructure. This is specifically reflected in stablecoins, Tether wallet development kit, asset tokenization, TradeFi, and investments.

-Tether Power focuses on the integration of renewable energy and Bitcoin mining;

-Tether Data develops artificial intelligence and P2P technologies. Tether's support for projects like Holepunch and Pears.com highlights its support for peer-to-peer technologies, and its investment in Northern Data will help AI research and projects.

-Tether Edu is dedicated to expanding access to educational tools and resources. Tether's investment in the Academy of Digital Industries in Georgia and support for PlanB.Network are breaking down educational barriers and driving the gig economy.

-Tether Evo is committed to empowering humans in their inevitable future evolution. Blackrock Neurotech, invested by Tether, is leading the development of neurotechnology, creating brain-machine interfaces, and opening up new areas of communication, rehabilitation, and cognitive enhancement.

This article will summarize and introduce the 25 investment portfolios disclosed by Tether CEO Paolo Ardoino.[Rest of the text translated similarly, maintaining the original formatting and structure]

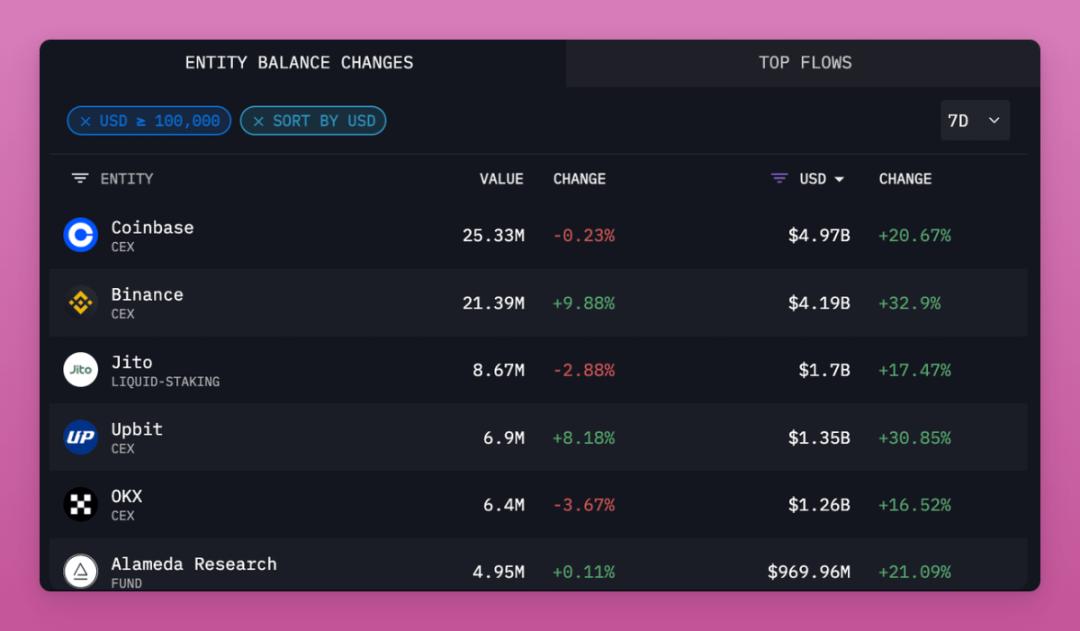

According to Arkham Intelligence data, Coinbase holds $5 billion worth of SOL, accounting for 4.7% of the total SOL supply.

Here are the other major holders sorted by circulating supply percentage:

Binance—3.97%; Jito—1.61%; Upbit—1.28%; OKX—1.19%; Alameda—0.92% (possibly locked tokens marked by Messari?); Marinade Finance—0.79%; Robinhood—0.74%; Kraken—0.53%; Bybit—0.49%; Jump Crypto—0.33%; Crypto.com—0.33%; Wintermute—0.14%; Bitstamp—0.13%.

04 Industry Insights

Stealing Facebook's creativity, the Winklevoss twins always saw opportunities others couldn't, from profiting in stocks to heavily investing in Bitcoin, from establishing a compliant exchange to promoting industry infrastructure, completing a reversal from disappointment to crypto giants. Recommended article:

《From Facebook's Smoke to Crypto Peak: The Winklevoss Twins' Reversal Path》

Forbes currently estimates that each brother is worth $4.4 billion, totaling about $9 billion, with Bitcoin holdings accounting for the largest portion of their wealth.

Their crypto assets include approximately 70,000 Bitcoins (worth $4.48 billion), as well as substantial Ethereum, Filecoin, and other digital assets.

Gemini remains one of the world's most trusted crypto exchanges, with institutional-level security and compliance credentials. Its upcoming IPO is an important step towards integrating with mainstream financial markets.

In February 2025, the brothers became partial shareholders of the English Real Bedford Football Club, investing $4.5 million. Currently in the eighth tier of the English league, they are collaborating with crypto podcast host Peter McCormack to potentially bring this semi-professional team to the Premier League.

Their father Howard donated $4 million in Bitcoin to Grove City College in 2024, the first Bitcoin donation the school has received, to fund the newly named Winklevoss Business School.

The brothers themselves donated $10 million to Greenwich Country Day School, setting a record for alumni donations.

They publicly stated that they would not sell their holdings even if Bitcoin's market value reaches gold levels, indicating their belief that Bitcoin is not just a store of value, but a fundamental reimagining of money itself.

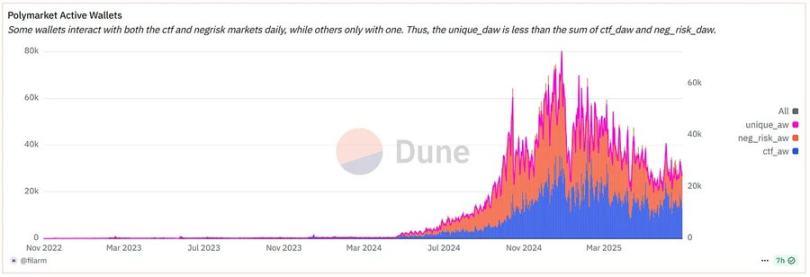

Polymarket airdrop may have a chance, with 10% of tokens potentially distributed to traders. This article analyzes key points for participation to help determine whether and how to get involved. Recommended article:

《Big Opportunity Scheduled, How to Participate in Polymarket Airdrop?》

If you want to participate in airdrop mining, you need to place bets in the market. Here are some reference data:

- Cumulative trading volume reached $15.7 billion.

- An average of 24,000 active wallets place bets on Polymarket daily.

- A total of 1.2 million wallets have interacted, with half placing bets more than 5 times.

- To be among the top 10% of traders, your average bet amount must exceed $500.

Before Linea's TGE arrives, Metamask's "Odyssey" activity is already here. How to participate? Is it worth it? Recommended article:

《Metamask Wallet "Odyssey" Begins, Is It Worth Participating?》

As mentioned earlier, the MetaMask Missions prize pool is only $5,000 per week, with a single reward of $500 and only 10 winners per week. The author's pass NFT minted around 15:25 had a number of 42,600. If the goal is merely to "win a lottery", the cost-effectiveness of participation is very limited. For users who only complete NFT pass minting (one lottery chance per week), the probability is close to zero. To get more lottery chances, each exchange or cross-chain transaction requires a platform fee of 0.875% and gas fees.

However, the community speculates that this activity may be related to a future MetaMask token airdrop. When ConsenSys founder Joseph Lubin responded to a user's question about whether MetaMask would launch a token in June, he stated that ConsenSys has short-term and medium-term strategic plans involving the protocolization of existing products and other projects, and that Web3 protocols typically require token support. Lubin emphasized that LINEA will be the first to launch a token, with more tokens to follow, and protocols will achieve synergy.